Global Compact Agricultural Tractors Market

Global Compact Agricultural Tractors Market Size, Share, and COVID-19 Impact Analysis, By Engine Power (Below 30HP, 31 HP To 40 HP), By Driveline (2WD, 4WD), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Compact Agricultural Tractors Market Summary

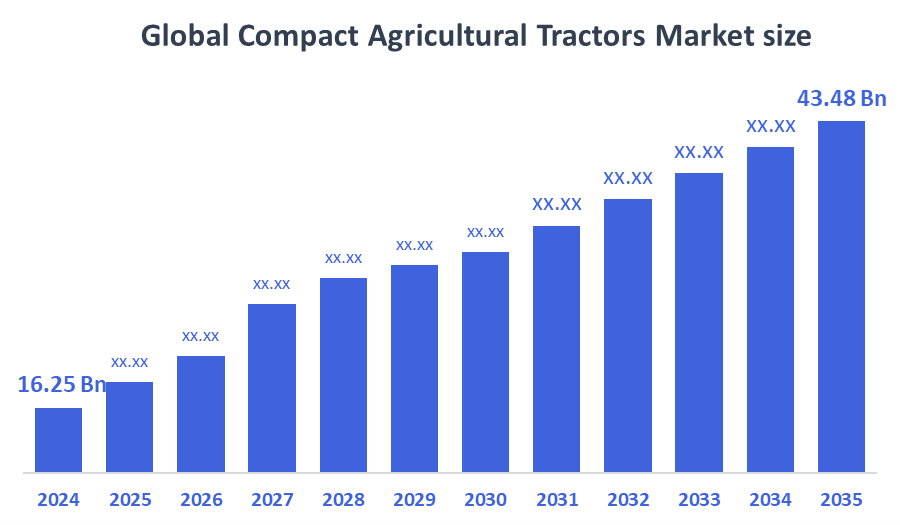

The Global Compact Agricultural Tractors Market Size Was Estimated at USD 16.25 Billion in 2024 and is Anticipated to Reach USD 43.48 Billion by 2035, Growing at a CAGR of 9.36% from 2025 to 2035. The market for compact agricultural tractors is expanding as a result of the growing need for precision and small-scale farming, the growing mechanization in emerging nations, the affordability of small farms, the convenience of use in confined locations, and government backing for the modernization of agricultural methods.

Key Regional and Segment-Wise Insights

- With a 52.6% revenue share in 2024, the Asia Pacific led the market for compact agricultural tractors market.

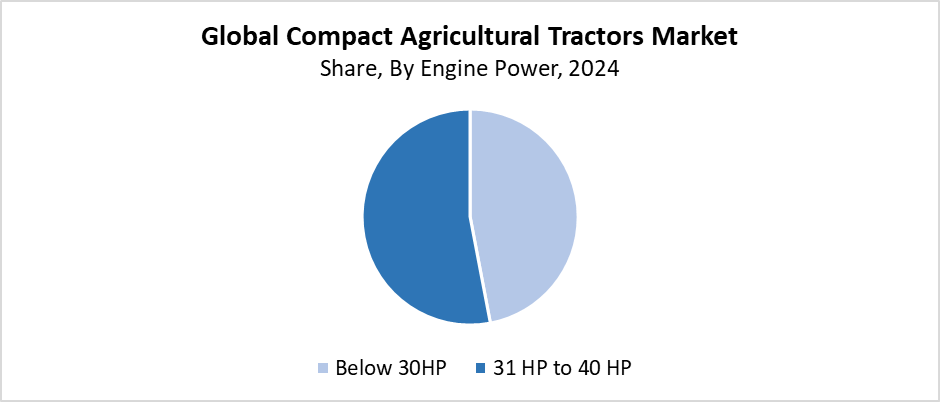

- With a revenue share of 53.72% in 2024, the 31–40 HP segment dominated the market by engine power.

- The 2WD segment led the market by driveline in 2024, with the biggest revenue share of 87.26%.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 16.25 Billion

- 2035 Projected Market Size: USD 43.48 Billion

- CAGR (2025-2035): 9.36%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

The compact agricultural tractor market targets customers who need agricultural equipment for farms that are both small and medium in size, along with landscaping operations and grounds maintenance activities. The power ratings of these tractors remain below 50 HP, which makes them suitable for small farms, along with vineyards, orchards, and restricted field sections. The main market expansion drivers include the growing number of small and hobby farms worldwide and precision farming adoption, and agricultural mechanization development. The small size, combined with fuel efficiency and user-friendly design, makes these tractors suitable for multiple agricultural tasks. Smallholder farmers in developing nations select smaller tractors instead of full-sized models because they cost less.

The market for compact agricultural tractors continues to grow due to technological advancements. Modern tractors feature telematics systems together with automated steering and GPS navigation, and electric or hybrid engines to improve both productivity and sustainability. Manufacturers dedicate their attention to creating ergonomic designs and simple controls that work with different attachments to fulfill end-user requirements. The adoption of modern agricultural equipment receives support from worldwide governments through their finance programs, combined with subsidies and rural mechanization initiatives. The market growth continues because these initiatives aim to enhance farm productivity while reducing manual work and promoting sustainable agricultural practices.

Engine Power Insights

Why Did the 31–40 HP Segment Lead the Compact Agricultural Tractor Market in 2024 by Capturing a 53.72% Revenue Share?

The 31–40 HP segment led the compact agricultural tractor market in 2024 by generating the largest revenue share of 53.72%. The segment's supremacy stems from its adaptable nature that enables it to perform various agricultural tasks, including plowing, tilling, transporting, and spraying. The 31–40 HP tractors attract medium-sized and small farm owners who seek optimal power and fuel efficiency in their equipment. Their compact design enables easy operation inside small fields and orchards, but their compatibility with various attachments enhances their operational capabilities. The global market has seen an increasing trend in popularity for tractors with this power range because they fulfill the rising requirement for cost-effective and productive agricultural equipment.

The below 30 HP segment of the compact agricultural tractor market is expected to grow at a significant rate throughout the forecast period because of rising market interest from small-scale farmers, along with horticulturists and landscapers. The tractors operate perfectly to complete light-duty assignments such as mowing and soil preparation, as well as spraying and transportation in small farms and orchards, and gardens. Their low-cost operation, combined with fuel-efficient design and operational simplicity, makes them most attractive to developing regions that have smaller land plots and limited financial resources. The growing interest in urban farming and hobby farming, together with government subsidies and funding for smallholder mechanization, are supporting adoption. Manufacturers deliver advanced functionalities through compact designs, which makes this market segment more attractive and accessible to customers worldwide.

Driveline Insights

What Factors Enabled the 2WD Segment to Capture an 87.26% Revenue Share in the Compact Agricultural Tractor Market in 2024?

The 2WD segment held the largest revenue share of 87.26% and dominated the compact agricultural tractor market in 2024. The strong market share of 2WD tractors stems from their widespread use across flat landscapes and light agricultural work, such as mowing and tilling, and transporting. Small and medium-sized farmers choose these tractors because they cost less and require simpler maintenance, and need fewer fuel resources than 4WD models, especially in fields with moderate conditions. Their straightforward design and operational characteristics boost their popularity among developing nations because both price points and user-friendliness matter most. Their ongoing market dominance stems from the solid market need for straightforward and reliable industrial mechanization.

The 4WD segment of the compact agricultural tractors market is projected to grow at the fastest CAGR during the forecast period because of increased demand for enhanced traction performance on muddy, hilly, and uneven terrain. The increasing popularity of 4WD tractors among farmers who undertake extensive or diverse agricultural operations stems from their enhanced power distribution capabilities and ability to handle heavy equipment. These tractors prove most valuable in locations with challenging soil conditions and for farmers who engage in year-round farming. The rising interest in 4WD systems stems from increased productivity requirements together with an expanding understanding of their benefits. The segment experiences rapid growth because manufacturers now offer different horsepower options and implement new technological advancements.

Regional Insights

The market for compact agricultural tractors in North America is projected to experience the fastest CAGR throughout the forecast period because of increasing interest in landscaping and hobby farming, and small-scale farming equipment. The expanding rural lifestyle trends across Canada and the United States have made compact tractors popular because they offer versatile operation and user-friendly controls, and cost-effective maintenance. The rising demand for grape and orchard cultivation, together with government initiatives supporting sustainable agriculture and precision farming techniques, drives market growth. Low-emission and technologically advanced tractors match the needs of farmers and comply with environmental laws. The region's quick expansion in this market sector is supported by the presence of important manufacturers and rising investments in rural mechanization.

Asia Pacific Compact Agricultural Tractors Market Trends

The Asia Pacific region led the compact agricultural tractor market by generating the largest revenue share of 52.6% in 2024. The suitability of compact tractors for small, dispersed farm plots makes them extremely popular among small and marginal farming operations in nations such as China and Vietnam, and India. Smallholder farmers now use tractors more because of increasing government financial help, together with rural mechanization programs and subsidy systems. Compact tractors serve multiple agricultural tasks at an affordable price and operate fuel-efficiently while providing flexibility for tilling and spraying, and transporting. The region solidified its position as a global leader through successful domestic tractor manufacturers and the growing understanding of farm production.

Europe Compact Agricultural Tractors Market Trends

The European market for compact agricultural tractors will experience substantial growth during the forecast period because small and medium-sized farm owners need adaptable, effective farming equipment. The use of compact tractors continues to rise in Germany and France, along with Italy and the United Kingdom, for horticulture and vineyard management and municipal applications, and landscaping. The increasing popularity of compact tractors with fuel-efficient and electric power systems stems from both sustainable and precision farming initiatives and rising emission control standards. The market demand increases through the development of rural property management activities and hobby farming operations. The market continues to grow at a steady pace throughout the region due to supportive government regulations, combined with farm mechanization subsidies and leading European tractor manufacturers operating within the area.

Key Compact Agricultural Tractors Companies:

The following are the leading companies in the compact agricultural tractors market. These companies collectively hold the largest market share and dictate industry trends.

- AGCO Corporation

- TYM Corporation

- Deere & Company

- CLAAS KGaA mbH

- Kubota Corporation

- Mahindra & Mahindra Ltd.

- Daedong Corporation

- CNH Industrial N.V.

- International Tractors Limited

- YANMAR HOLDINGS CO., LTD.

- Others

Recent Developments

- In September 2024, Bloomfield Robotics, Inc. was purchased by Kubota Corporation through its subsidiary, Kubota North America Corporation. Through the acquisition, the company hoped to address actual difficulties in agricultural applications and incorporate AI-driven technology into its history of high-quality products. The acquisition marked a critical turning point in the business's strategic plan to provide all-encompassing smart agriculture solutions.

- In August 2024, the SM series tractors were introduced to the North American market by Yanmar Holdings Co., Ltd., a division of Yanmar America Corporation. Three new models—the SM240, SM475, and SM240H—were introduced. The SM240's fuel-efficient Yanmar TNV engine, which produces 36.9 horsepower, makes it perfect for tough jobs and big loads. The SM240, which included a foldable ROPS, a joystick-operated front loader, and an ergonomic operator station for comfort and style, prioritized safety and convenience of operation while boasting a front-end loader that could lift over 2,000 pounds.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the compact agricultural tractors market based on the below-mentioned segments:

Global Compact Agricultural Tractors Market, By Engine Power

- Below 30HP

- 31 HP to 40 HP

Global Compact Agricultural Tractors Market, By Driveline

- 2WD

- 4WD

Global Compact Agricultural Tractors Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 213 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |