Global Companion Animal Genetics Market

Global Companion Animal Genetics Market Size, Share, and COVID-19 Impact Analysis, By Animal (Dogs, Cats, Horses, Companion animals), By Type (Genetic Disease Testing, Genomics, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Companion Animal Genetics Market Summary

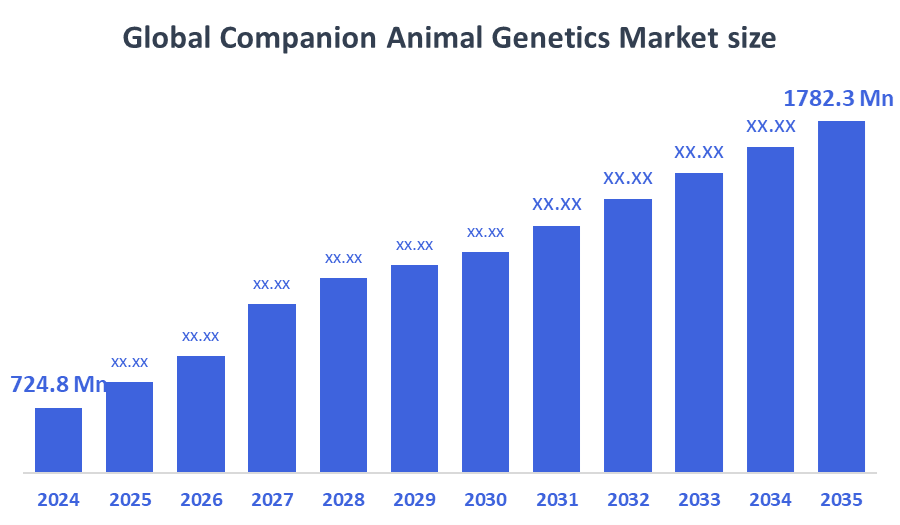

The Global Companion Animal Genetics Market Size Was Estimated at USD 724.8 Million in 2024 and is Projected to Reach USD 1782.3 Million by 2035, Growing at a CAGR of 8.52% from 2025 to 2035. The market for companion animal genetics is expanding due to factors like growing pet ownership, rising healthcare costs, improved genetic testing methods, knowledge of inherited disorders, and the need for preventive veterinarian diagnostics, breeding programs, and customized pet care.

Key Regional and Segment-Wise Insights

- In 2024, the companion animal genetics market in North America had the biggest revenue share of 30.62% and led the market globally.

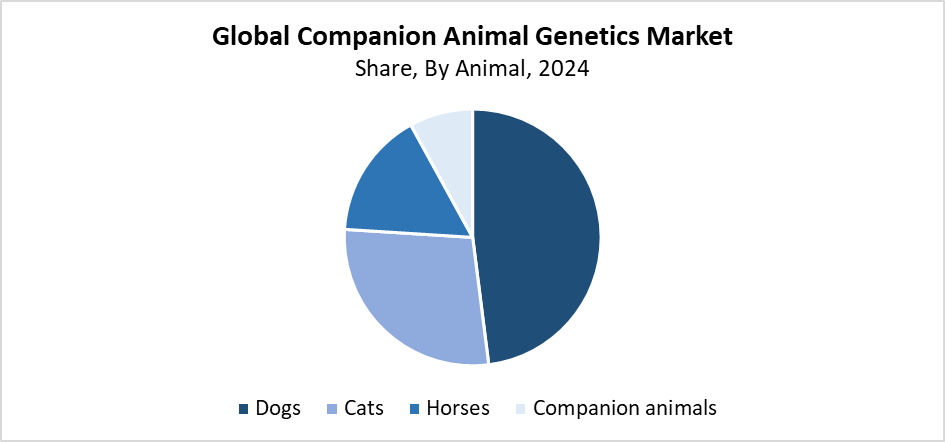

- In 2024, the dogs segment had the highest revenue share of 48.72% and led the market by animals.

- In 2024, the genetic disease testing segment had the biggest market share by type, accounting for 55.26%.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 724.8 Million

- 2035 Projected Market Size: USD 1782.3 Million

- CAGR (2025-2035): 8.52%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The companion animal genetics market represents the veterinary medicine sector that conducts genetic testing and analysis for horses, together with dogs and cats. The tests evaluate inherited diseases alongside traits and breed ancestry and health predispositions to support better decisions about pet care and breeding, and treatment. The veterinary market shows substantial growth because of increasing pet ownership worldwide, together with better animal health understanding and rising focus on preventative veterinary care. Modern diagnostic technologies have attracted growing numbers of pet owners who now choose to invest in their animals' health protection. The industry grows because customers want designer and pedigreed breeds, while animal healthcare expenses increase.

Modern technological advancements serve as a fundamental necessity to boost both the range and accuracy of companion animal genetic testing. The speed, precision, and cost-effectiveness of testing have improved through DNA microarrays, PCR, and NGS technologies. Genetic data interpretation becomes more effective because artificial intelligence operates as an additional tool for diagnosis. Several nations support veterinary genetics research along with animal genetic disease studies by providing financial backing through their governmental institutions and animal health organizations.

Animal Insights

The dogs segment dominated the companion animal genetics market by holding the largest revenue share of 48.72% in 2024. The large market share exists because people across the world own many dogs, and pet owners now understand their breed-specific genetic disease risks. The demand for genetic testing of dogs continues to grow as owners seek to detect hereditary diseases and enhance breeding practices while creating personalized medical approaches. The growth of purebred and designer dog breeds has led to increased demand for ancestry and trait identification testing. The market growth received additional support from advances in canine-specific genetic testing panels, together with easier access to direct-to-consumer testing kits. Veterinary clinics, together with breeders, now frequently use genetic technologies to enhance both animal health and breeding methods and effectiveness.

The cat segment of the companion animal genetics market is expected to grow at the fastest CAGR throughout the forecast period. The fast market growth stems from the rising number of cats being adopted as household pets, particularly by city dwellers. The demand for genetic testing to detect inherited diseases and determine breed composition, and develop preventive healthcare approaches continues to increase because pet owners want to understand their feline companion's health better. The expanding popularity of exotic and pedigree cat breeds makes precise genetic screening essential. Veterinary professionals, alongside pet owners, now find these services easier to access because of advancements in feline genetic testing technologies and increased availability of affordable, user-friendly test kits.

Type Insights

The genetic disease testing segment led the companion animal genetics market by holding the largest revenue share, of 55.26% in 2024. The high market share of genetic disease testing stems from growing hereditary illness rates in pets, together with rising awareness of early disease identification among veterinary professionals and pet owners. Genetic disease testing enables early detection of hip dysplasia and cardiomyopathies, along with retinal atrophy, which helps veterinarians develop specific treatment plans for each case. The rise of preventive healthcare and ethical breeding practices has driven increased demand for dependable diagnostic tools. The widespread application of genetic disease testing across companion animal healthcare became possible due to advancements in testing technologies and the availability of complete disease panels.

The genomic segment of the companion animal genetics market is expected to experience substantial growth during the forecast period. The detailed genetic insights, which include breed identification, ancestry tracking, trait analysis, and behavioral genetics, exceed disease diagnosis in their growing market demand. Pet owners and breeders now require complete genetic information for better healthcare decisions and dietary and breeding choices. The combination of Next-generation sequencing (NGS) with bioinformatics improvements has enhanced genetic testing accuracy and affordability, thus expanding its application to broader markets. Genomic services in companion animal care have gained momentum because veterinary treatment now integrates genomic data, which enables personalized preventive care.

Regional Insights

The worldwide companion animal genetics market is dominated by the North America region with the largest revenue share of 30.62% in 2024. High pet ownership rates in this region, together with rising pet healthcare spending and rising veterinarian and pet owner knowledge of genetic testing advantages, mainly drive North America's dominant position in this market. The market growth stems from advanced diagnostic labs, together with developed veterinary systems and major industry players present in the region. Personalized pet care through breed identification and genetic screening for illness prevention is gaining increasing popularity among pet owners in the United States and Canada. The market in this region continues to grow because of ongoing veterinary genetics development alongside government initiatives supporting animal health.

Europe Companion Animal Genetics Market Trends

The continuous expansion of the companion animal genetics market in Europe stems from increasing pet ownership, together with rising animal health understanding and advanced veterinary diagnostic needs. European pet owners increasingly turn to genetic testing for breed characteristics, hereditary condition identification, and overall health assessment as they pursue preventive care approaches. The existence of premier biotechnology enterprises and veterinary research facilities drives innovation in genetic testing technology development. Pro-animal welfare government policies, together with supportive programs, play a vital role in expanding the business operations. The companion animal genetics industry in the region receives its main driving force from advanced veterinary healthcare systems combined with increasing interest in personalized pet care, which has established Germany, the UK, and France as leading nations.

Asia Pacific Companion Animal Genetics Market Trends

The companion animal genetics market in the Asia Pacific is expected to grow at the fastest CAGR throughout the projected period. The rapid growth of this industry stems from increasing pet ownership and improving financial situations, together with advanced veterinary treatment knowledge spreading across China, India, Japan, and Australia. The increasing number of dog adoptions in urban zones creates a demand for genetic testing to maintain proper breed management and optimal health status. The region shows rising availability of genetic testing services together with improved veterinary infrastructure. The Asia Pacific region will lead market growth in the upcoming years because foreign players will enter the market, and biotechnology and animal health investments will boost innovation and market development across the region.

Key Companion Animal Genetics Companies:

The following are the leading companies in the companion animal genetics market. These companies collectively hold the largest market share and dictate industry trends.

- Neogen Corporation

- Generatio GmbH

- UC Davis Veterinary Genetics Laboratory (VGL)

- Antech Diagnostics, Inc.

- Orivet Genetic Pet Care

- Animal Genetics Inc.

- Basepaws

- ZOOGEN

- Embark Veterinary, Inc.

- Zoetis Services LLC

- Others

Recent Developments

- In August 2025, together with Innovative Pet Lab and Embark Veterinary, POP initiated a 90-day canine health study that provided insights into DNA, biomarkers, and diet. To promote preventative pet wellbeing, participants receive $600 worth of tools and customized reports.

- In June 2025, Scientists from the Wisdom Panel discovered a SLAMF1 gene mutation that is highly associated with canine atopic dermatitis in French Bulldogs and Boxers. This discovery advances breeding knowledge and makes it possible to control skin health in more focused ways.

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisiors has segmented the companion animal genetics market based on the below-mentioned segments:

Global Companion Animal Genetics Market, By Animal

- Dogs

- Cats

- Horses

- Companion animals

Global Companion Animal Genetics Market, By Type

- Genetic Disease Testing

- Genomic

- Others

Global Companion Animal Genetics Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 123 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |