Global Construction Equipment Finance Market

Global Construction Equipment Finance Market Size, Share, and COVID-19 Impact Analysis, By Financing (Loans/Term Loans, Finance Leases/Capital Leases, Operating Leases/Rental Financing, Vendor/Dealer Financing, Others), By Equipment (Earthmoving Equipment, Material Handling Equipment, Compaction Equipment, Specialized Equipment, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Construction Equipment Finance Market Summary

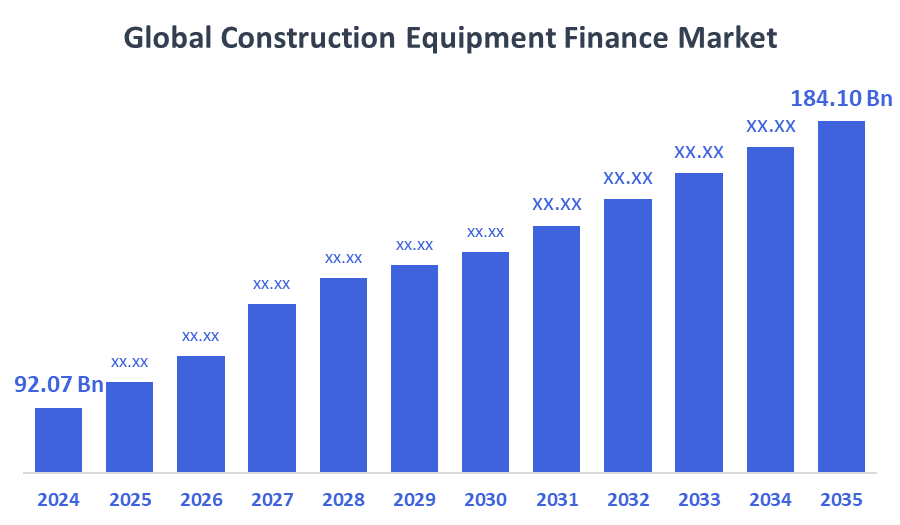

The Global Construction Equipment Finance Market Size Was Estimated at USD 92.07 Billion in 2024, and is Projected to Reach USD 184.10 Billion by 2035, Growing at a CAGR of 6.5% from 2025 to 2035. The market for construction equipment finance is expanding due to several factors, including increased infrastructure development, high equipment costs, a growing need for rental and leasing options, and government programs that make it possible for contractors to obtain modern machinery without having to make significant upfront investments.

Key Regional and Segment-Wise Insights

- In 2024, the Asia Pacific construction equipment finance market held the largest revenue share of 39.6% and dominated the global market.

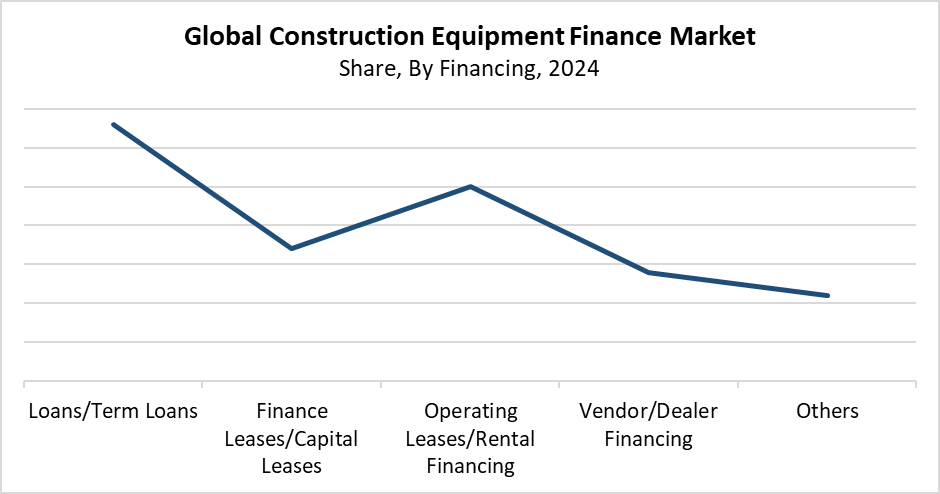

- In 2024, the loans/term loans segment held the highest revenue share of 33.3% and dominated the global market by financing.

- With the biggest revenue share of 37.6% in 2024, the earthmoving equipment segment led the worldwide construction equipment finance market by equipment.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 92.07 Billion

- 2035 Projected Market Size: USD 184.10 Billion

- CAGR (2025-2035): 6.5%

- Asia Pacific: Largest market in 2024

The construction equipment finance market operates to provide financial solutions, which include loans, leases, and rental agreements for purchasing construction machinery and equipment. The market functions as a vital resource which enables builders, contractors, and construction companies to obtain costly equipment through financing options. This, instead of requiring them to pay the entire amount at once. Emerging nations need infrastructure development at increasing rates to achieve their developmental goals. Large-scale government projects in transportation, energy, and housing sectors, combined with urban growth and industrial expansion, create rising needs for construction equipment. The market expansion has experienced strong support from the increasing necessity for adaptable financing solutions, together with the rising costs of complex machinery.

The finance industry experiences impacts from equipment technological advancements, which include automated systems, telematics, and fuel efficiency improvements, because companies need modern machinery to enhance their production while cutting operational costs. Financial institutions speed up approval processes and deliver customised funding through digital platforms that combine AI-based credit evaluation systems. The government backs equipment acquisition through programs which provide low-interest loans and subsidies, and infrastructure development plans. The positive regulations have led to increased confidence among small and mid-sized contractors. This drives up worldwide construction equipment financing requirements.

Financing Insights

The loans/term loans segment held the largest revenue share of 33.3% and led the construction equipment finance market in 2024. The broad preference among contractors and construction companies for long-term equipment ownership, while efficiently managing cash flow, is what drives this supremacy. Term loans function as an appropriate financing solution for acquiring costly equipment because they offer adaptable repayment options, together with affordable interest rates and fixed repayment plans. The acquisition of essential equipment for extended infrastructure projects requires financing through loans. Both major construction companies and small-to-medium enterprises (SMEs) obtain this financing. The segment achieves higher growth and market share because lending rules operate in its favour, and banks and NBFCs provide financial support through government-backed credit programs.

The operating leases/rental financing segment of the construction equipment finance market is expected to grow at the fastest CAGR during the forecast period. The market expansion results from customers who want adaptable, affordable equipment solutions which do not require them to buy the equipment. Through operating leases and rental agreements, construction businesses, including small and medium-sized companies, can obtain contemporary equipment with affordable initial payments, reduced maintenance needs, and flexible usage for their short-term projects. The trend continues to grow because short-term infrastructure projects keep increasing. Organisations need to replace their equipment because of technological upgrades. The rental financing market has experienced rapid growth because contractors now understand the operational and financial benefits that leasing provides compared to buying equipment.

Equipment Insights

The earthmoving equipment segment led the construction equipment finance market by holding the largest revenue share of 37.6% in 2024. Heavy earthmoving equipment operates as the primary driver of this industry because it supports mining operations and infrastructure development, and real estate construction projects through its use of loaders, excavators, and bulldozers. The machines need financial backing because they perform essential operations, which include material handling, grading, excavation, and land clearance. Heavy equipment financing drives construction companies to acquire earthmoving equipment because it enables them to manage capital expenses while keeping their projects on schedule. The company maintains its market leadership position because the financing of earthmoving equipment sales continues to grow. This is through increased spending on urban development, transportation infrastructure, and smart city projects in emerging markets.

The specialized equipment segment of the construction equipment finance market is expected to grow at the fastest CAGR during the forecasted period. Large industrial projects together with complex infrastructure operations need specialised equipment, which includes pile drivers, concrete pumps, and tunnelling machines. The equipment cost reduction becomes a possible option for contractors who need to lower their expenses because these machines cost a lot and serve specific operational needs. Businesses need to find funding sources because they require it to stay competitive in the market. They must do so because automated machinery advances at such a fast pace. The fast development of this area continues because people are adopting technology integration, equipment modification, renewable energy expansion, urban infrastructure development, and big construction projects.

Regional Insights

The North American construction equipment finance market achieved a significant market share in 2024 through its robust backing of large commercial projects, urban renewal programs, and infrastructure construction. The high cost of new construction equipment, along with the rising popularity of rental and leasing options, creates a growing demand for financing solutions throughout the U.S. and Canada. The procurement of equipment becomes simpler through the customised financing options that established financial institutions, non-banking financial companies (NBFCs), and OEM-backed finance arms provide. The U.S. Infrastructure Investment and Jobs Act, along with other government programs, has created higher demand for adaptable financial solutions because of the increased construction projects. The market growth in this region occurs because of its dedication to fleet modernisation and technological progress.

Europe Construction Equipment Finance Market Trends

The European construction equipment finance market experiences significant growth in 2024 because of expanding investments in renewable energy projects, urban development, and infrastructure improvements across Europe. The increasing need for advanced construction equipment in Germany, the UK, and France has led contractors to choose financing solutions which help them handle high equipment costs. The market experiences effects from the growing adoption of sustainable technologies. The European Union aims to achieve its green building and emission reduction targets. Leasing firms, together with financial institutions, offer personalised solutions which help both major contractors and small to medium-sized businesses (SMEs). The construction industry experiences digitalisation and automation, which leads to rising equipment financing requirements that support fleet modernisation.

Asia Pacific Construction Equipment Finance Market Trends

The Asia Pacific construction equipment finance market leads the worldwide market with the largest revenue share of 39.6% in 2024. The region maintains its leading position because urban areas grow rapidly while major economies such as China, India, and Southeast Asia increase their infrastructure investments and construction spending. The demand for various equipment and rising gear expenses forces contractors and builders to choose between loans, leases, and rentals as their financing alternatives. Equipment purchasing has become easier because of multiple financial institutions and OEM-backed loan programs, real estate development growth, and public-private partnership (PPP) expansion. The Asia Pacific region maintains its global market leadership position through the combined power of these factors.

Key Construction Equipment Finance Companies:

The following are the leading companies in the construction equipment finance market. These companies collectively hold the largest market share and dictate industry trends.

- Caterpillar

- Mitsubishi HC Capital America

- DLL

- Deere & Company

- AB Volvo

- Siemens Financial Services GmbH

- BNP Paribas Leasing Solutions

- Komatsu

- CNH Industrial Capital Private Limited

- Sumitomo Mitsui Finance and Leasing Co., Ltd

- Others

Recent Developments

- In September 2025, to improve and broaden its commercial equipment financing capabilities, asset management company Gordon Brothers acquired a lender finance facility from Wells Fargo Capital Finance and established a USD 1.5 billion joint venture with Davidson Kempner Capital Management. Gordon Brothers can provide middle-market and large corporate clients in important industries, including manufacturing, construction, and lending, with flexible, tailored financing options thanks to its increased capital base. It offers a wide range of financing alternatives for equipment, including capital leases, loans, and special lease arrangements such as leases with Terminal Rental Adjustment Clauses (TRAC) and Fair Market Value (FMV).

- In February 2024, through a Memorandum of Understanding (MoU), Mahindra Construction Equipment (MCE) and Bank of Maharashtra established a strategic collaboration to offer customised financing options for MCE's line of construction equipment. The goal of this partnership is to provide consumers with convenient and sufficient credit alternatives for the purchase of Mahindra's existing and future BSV line of construction equipment, which includes items like the EarthMaster motor grader and EarthMaster backhoe loader.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the construction equipment finance market based on the below-mentioned segments:

Global Construction Equipment Finance Market, By Financing

- Loans/Term Loans

- Finance Leases/Capital Leases

- Operating Leases/Rental Financing

- Vendor/Dealer Financing

- Others

Global Construction Equipment Finance Market, By Equipment

- Earthmoving Equipment

- Material Handling Equipment

- Compaction Equipment

- Specialized Equipment

- Others

Global Construction Equipment Finance Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 167 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |