Global Container Depot Services Market

Global Container Depot Services Market Size, Share, and COVID-19 Impact Analysis, By Service Type (Storage, Handling/Movement, Maintenance & Repair, Transportation, Others), By Container Type (Dry/Standard, Reefer (Temperature-Sensitive), Tank (Liquid/Chemical), Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Container Depot Services Market Summary

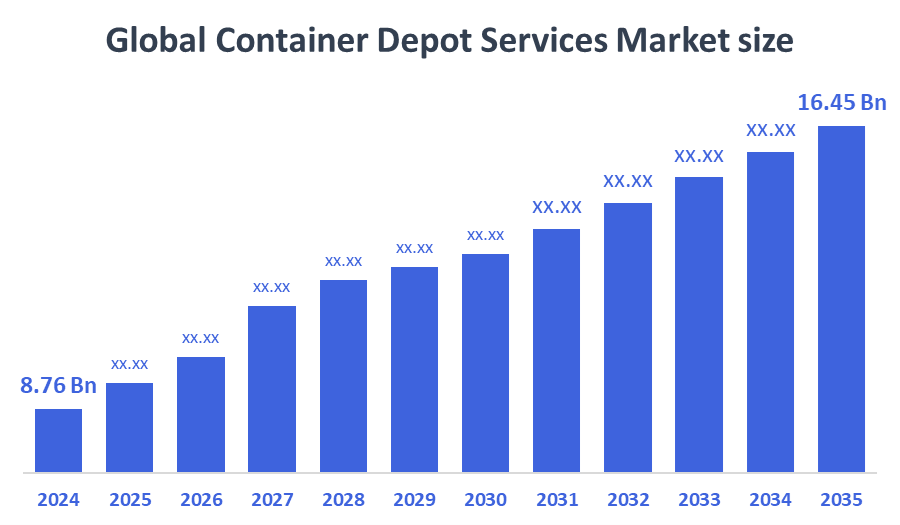

The Global Container Depot Services Market Size Was Estimated at USD 8.76 Billion in 2024, and is Projected to Reach USD 16.45 Billion by 2035, Growing at a CAGR of 5.9% from 2025 to 2035. The market for container depot services is expected to rise as a result of growing international trade, an increase in container traffic at ports, the need for effective storage and maintenance solutions, and the development of intermodal transportation networks that provide more efficient supply chain and logistics operations.

Key Regional and Segment-Wise Insights

- In 2024, the Asia Pacific container depot services market held the largest revenue share of 40.7% and dominated the global market.

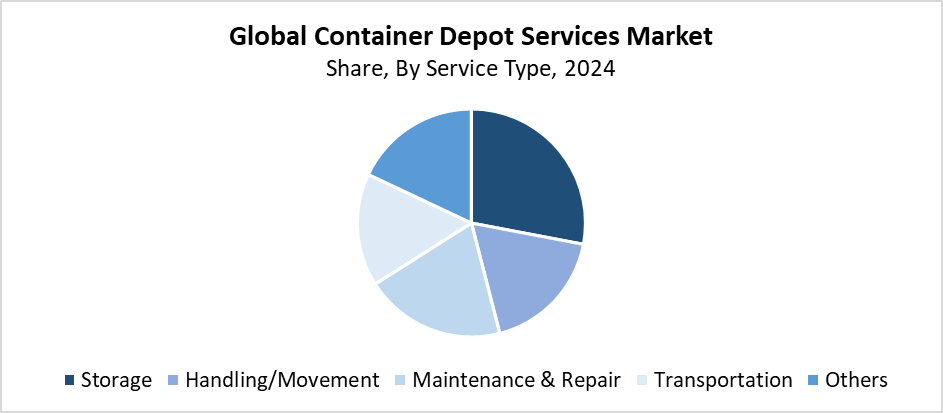

- In 2024, the storage segment held the highest revenue share of 28.5% and dominated the global market by service type.

- With the biggest revenue share in 2024, the dry/standard segment led the worldwide container depot services market by container type.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 8.76 Billion

- 2035 Projected Market Size: USD 16.45 Billion

- CAGR (2025-2035): 5.9%

- Asia Pacific: Largest market in 2024

The market for container depot services operates as a sector which delivers storage for empty shipping containers, together with maintenance, repair, and handling operations at designated sites near ports and inland terminals and major logistics centres. These depots serve as essential nodes within the global supply network because they verify that containers stay operational while getting ready for their next deployment. The market shows strong growth because containerised cargo volumes rise and international trade expands. Businesses need better container management between shipping operations. The demand for container depot services has grown because of e-commerce expansion, and multimodal transportation operations, and port congestion problems have intensified. The logistics industry seeks to achieve faster operations through better efficiency in its work performance.

The operations at container depots transform because of modern technological advancements, which enhance both operational transparency and efficiency. The combination of AI inspections with automated yard systems, GPS tracking, and Internet of Things sensors creates a unified system that streamlines inventory operations and container management. These technologies enable faster container turnaround operations while providing predictive maintenance capabilities and real-time tracking systems. The government backs industry growth through its investment programs for smart logistics corridors, digital trade, customs modernisation, and port infrastructure development. The market for container depot services receives growth support from these various elements. They function as a unified system.

Service Type Insights

The storage segment leads the container depot services market with the largest revenue share of 28.5% in 2024. The growing need for secure container storage solutions emerged because ports experienced congestion while international trade volumes expanded. Storage services enable shipping lines and logistics firms to optimise their container capacity and reduce downtime through efficient management of container movement between shipments. The development of inland container depots (ICDs), together with increasing intermodal transportation, has created a higher requirement for storage facilities in strategic locations. The market sector experiences growth because automated yard management systems and digital inventory systems have improved storage efficiency.

The maintenance and repair segment of the container depot services market is expected to grow at the fastest CAGR during the forecast period because container lifespan extension and safety compliance requirements continue to increase. The world sees increased container traffic, which leads to more container damage, so shipping lines and logistics companies perform regular maintenance and cleaning activities, together with structural repairs. Container repairs prove more sustainable and affordable than replacements, which drives market growth because this method supports cost-effective operations and environmental protection. The market expansion receives additional support from digital maintenance tracking systems that combine AI damage assessment with automated inspection systems. These deliver faster service delivery and better service quality.

Container Type Insights

The dry/standard segment held the largest market share and led the container depot services market in 2024. International trade relies heavily on dry containers to transport non-perishable goods, including consumer products, textiles, electronics, and machinery. This leads to their market dominance. The shipping industry relies on these containers as its primary choice because they provide economical solutions through their standardised measurements and versatile design. The rising containerised goods volume from manufacturing growth and e-commerce expansion has created a higher demand for dry container storage, handling, and maintenance operations at depots. The market position of this segment has become stronger because inventory management systems and container monitoring technologies have developed better ways to handle large quantities of standard containers.

The reefer (temperature-sensitive) container segment within the container depot services market will experience the fastest CAGR during the forecast period. The worldwide demand for perishable goods transportation, which includes medications, fresh produce, dairy products, and frozen food that require precise temperature control, drives this increase. The worldwide traffic of temperature-sensitive commodities creates an increasing need for specialised depot services, which include power supply, maintenance, monitoring, and chilled container storage. The maintenance of these units becomes more difficult and expensive because reefer container technology now includes automated diagnostics and real-time temperature tracking systems. The expansion of cold chain logistics infrastructure, together with rising food and medication safety regulations, creates additional requirements for reefer depot services.

Regional Insights

The North American container depot services market held 14.5% revenue share during 2024, which shows ongoing growth because of expanding port operations, international commerce, and container handling system needs. The interior transportation networks of the country, together with major ports at Long Beach, Los Angeles, and New York/New Jersey, create strong requirements for depot services. The growing imports and exports from the manufacturing, retail, and agricultural sectors lead to more container traffic. This creates higher needs for maintenance, repair, and storage facilities. Adoption of technology is improving operational efficiency. The system provides automated yard management together with real-time container tracking capabilities. The region continues to grow its market through the establishment of e-commerce fulfilment centres and intermodal logistics operations.

Europe Container Depot Services Market Trends

Europe held a significant revenue share of the container depot services market during 2024 because it has strong logistics systems, numerous ports, and handles large amounts of domestic and international trade. The major ports of Rotterdam, Hamburg, and Antwerp maintain a constant requirement for container handling, storage, and repair services because they serve as critical shipping hubs. Digital logistics technologies and effective supply chain management systems, and European sustainability initiatives have enhanced depot operations throughout Europe. The growing movement of products via land routes, sea routes, and rail systems creates an essential need for depots that are strategically positioned. Europe's growing dominance in the global container depot services market stems from three main factors, which include cold chain logistics expansion, container safety regulatory compliance, and smart port infrastructure development.

Asia Pacific Container Depot Services Market Trends

The Asia Pacific container depot services market led globally with the largest revenue share of 40.7% in 2024 because the region controls worldwide manufacturing and commercial operations. The growing export and import activities of China, India, Japan, and Southeast Asian nations require urgent solutions for container storage and maintenance, and handling services. The region maintains its leadership position through the major ports of Shanghai, Singapore, and Busan, together with expanding port facilities and growing infrastructure investments. The expansion of multimodal transportation systems and e-commerce operations, and government initiatives for digital transformation and smart logistics have enhanced both the operational capacity and performance of depot facilities. All of these elements work together to solidify Asia Pacific's market leadership.

Key Container Depot Services Companies:

The following are the leading companies in the container depot services market. These companies collectively hold the largest market share and dictate industry trends.

- DP World

- DCI

- Hutchison Port Holdings Trust

- A.P. Moller – Maersk

- Gateway Distriparks Limited

- Adani Group

- PSA International

- ICTSI

- COSCO Shipping Corporation

- CONCOR

- Others

Recent Developments

- In June 2025, A.P. Moller-Maersk formally modified the empty-container release protocols at a few depots (requiring a transit order, updated documentation, and clarification of drop-off restrictions). This change has a direct impact on depot collection flows and empty-box turnaround.

- In May 2025, DP World announced a USD 2.5 billion logistics infrastructure investment program that will finance significant projects in Europe, Africa, and India. This move is anticipated to increase the capacity of depots, yards, and rail-linked container handling in a number of countries.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the container depot services market based on the below-mentioned segments:

Global Container Depot Services Market, By Service Type

- Storage

- Handling/Movement

- Maintenance & Repair

- Transportation

- Others

Global Container Depot Services Market, By Container Type

- Dry/Standard

- Reefer (Temperature-Sensitive)

- Tank (Liquid/Chemical)

- Others

Global Container Depot Services Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 213 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |