Copolyester Elastomers Market

Global Copolyester Elastomers Market Size, Share, and COVID-19 Impact Analysis, By Type (Injection Molding, Blow Molding, Others), By Application (Automotive, Electrical, Industrial, Medical, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Copolyester Elastomers Market Size Summary

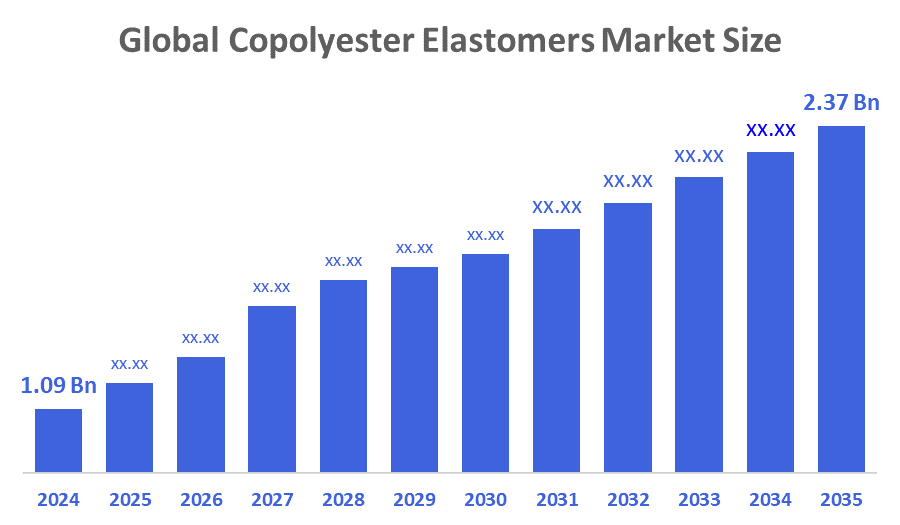

The Global Copolyester Elastomers Market Size Was Estimated at USD 1.09 Billion in 2024 and is Projected to Reach USD 2.37 Billion by 2035, Growing at a CAGR of 7.32% from 2025 to 2035. The market for copolyester elastomers is expanding as a result of increased demand from the consumer goods, electronics, and automotive sectors for these materials' resilience, recyclability, and adaptability in high-performance and environmentally friendly applications.

Key Regional and Segment-Wise Insights

- In 2024, the Asia Pacific copolyester elastomers market held the largest revenue share of 34.6% and dominated the global market.

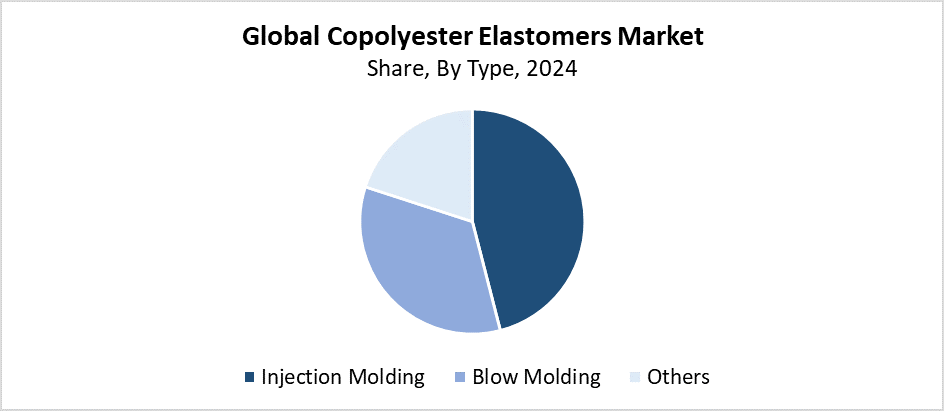

- In 2024, the injection molding segment held the highest revenue share of 46.3% and dominated the global market by type.

- With the biggest revenue share of 49.5% in 2024, the automotive segment led the worldwide copolyester elastomers market by application.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 1.09 Billion

- 2035 Projected Market Size: USD 2.37 Billion

- CAGR (2025-2035): 7.32%

- Asia Pacific: Largest market in 2024

The worldwide market for copolyester elastomers (COPEs) exists to manufacture and apply high-performance thermoplastic elastomers which stem from copolyesters. These materials find their applications in automotive parts, consumer items, electrical components, and industrial equipment because they unite thermoplastic strength and processing capabilities with rubber flexibility. The market receives its main support from two factors, which include developing consumer electronics and medical devices. Rising demand for lightweight, recyclable materials that automotive manufacturers use to improve fuel efficiency also supports the market. The market requires producers to choose copolyester elastomers as their preferred option because they produce better environmental outcomes than traditional materials and help fulfil market demand for sustainable products.

The performance and application range of COPEs have increased because of polymer processing and compounding technology advancements. Bio-based copolyesters and customised blend development technology have made sustainable product design applications more widespread. The market growth receives support from government regulations, which promote eco-friendly, recyclable materials through their implementation in Europe and North America. The government supports market expansion through its eco-friendly, recyclable material policies. These focus on European and North American regions. The industry supports the development of copolyester elastomer technology through the implementation of tax incentives for green manufacturing, the enforcement of stricter emission regulations, and public research funding for sustainable materials.

Type Insights

The injection molding segment held the largest revenue share of 46.3% in 2024 and led the global copolyester elastomers market. Injection molding maintains its dominant position because it produces intricate and precise components which serve multiple industries, including electronics, consumer products, and automotive sectors. Manufacturers choose injection molding because it provides stable dimensions during production, produces minimal waste, and allows for fast, large-scale manufacturing. The market segment expands because materials must fulfil two essential requirements of being lightweight and recyclable, yet maintaining strength. The market share of copolyester elastomer injection molding has increased through technological advancements in molding processes and automated manufacturing systems. These deliver better production efficiency and cost savings.

The blow molding segment of the copolyester elastomers market is expected to grow at a substantial CAGR during the forecast period. The demand for hollow components that are lightweight, flexible, and long-lasting continues to rise mainly because of their application in automotive, medical, and packaging industries. Blow molding stands as the ideal manufacturing process for creating fluid reservoirs and air ducts, and medical containers because it enables the production of complex designs with uniform wall thickness at high production rates. The market segment continues to grow because businesses focus on developing recyclable packaging solutions that protect the environment. The industrial sector has adopted Copolyester elastomers at a higher rate because blow molding technology has advanced through improved process control systems, energy efficiency, superior product quality, and increased production rates.

Application Insights

The automotive segment held the largest revenue share of 49.5% and dominated the copolyester elastomer market in 2024. The market leadership exists because of the growing need for strong yet lightweight materials that deliver high performance while reducing emissions and improving fuel efficiency. The automotive industry uses copolyester elastomers because these materials offer excellent chemical resistance, flexibility and thermal stability. This makes them suitable for CVJ boots and air ducts, seals, and gaskets, and under-the-hood components. The increasing popularity of electric vehicles (EVs), together with automotive emission standards, has created a higher demand for COPE materials. The automotive industry concentrates on sustainable, recyclable materials, which makes copolyester elastomers essential for modern car production.

The industrial segment of the copolyester elastomers market is expected to grow at the fastest CAGR during the forecast period. The main cause of this growth results from the increasing demand for durable high-performance materials which serve machinery and equipment, and manufacturing needs. Copolyester elastomers provide ideal industrial solutions for belts and hoses, gaskets, and seals because they withstand both wear and chemical exposure and high temperatures. The requirement for materials that handle severe operating conditions and frequent stress continues to rise because manufacturing systems operate at high speeds and automated systems take over. The adoption of sustainable and energy-efficient industrial operations drives the market growth. Manufacturers now select COPEs made from recyclable and durable materials.

Regional Insights

The Asia Pacific copolyester elastomers market leads the global industry with the largest revenue share of 42.7% in 2024. The main market position results from China's industrial growth, together with its rising automobile manufacturing and consumer electronics production in China, India, Japan, and South Korea. The Asia Pacific region has experienced a surge in copolyester elastomers usage because of its affordable manufacturing and its rising demand for lightweight and recyclable materials that deliver high performance across multiple industrial sectors. The market expansion receives support from government initiatives that promote sustainable materials, together with increasing environmental awareness. The Asia Pacific region serves as the main manufacturing and usage centre for copolyester elastomers because of its established manufacturing facilities, ongoing infrastructure development, and technological progress.

North America Copolyester Elastomers Market Trends

Over the course of the forecast period, the North American market for copolyester elastomers is anticipated to expand significantly due to rising demand in the consumer goods, automotive, and medical industries. Copolyester elastomers and other sophisticated, recyclable materials are being adopted by manufacturers due to the region's strong emphasis on innovation, sustainability, and regulatory compliance. The usage of COPEs for parts that need to be durable and heat-resistant is being fueled by the automobile industry's move toward electric vehicles and lightweight components. Market expansion is also being aided by the rise of the healthcare industry, namely with regard to medical equipment and tubing. Copolyester elastomers are becoming more and more popular in North America, and their uses are being further enhanced by technological breakthroughs and increased research and development expenditures.

Europe Copolyester Elastomers Market Trends

The European market for copolyester elastomers is growing significantly because of new environmental rules and increasing need for sustainable materials, and technological progress in the industrial and automotive sectors. Germany, together with France and the UK, leads the way in adopting environmentally friendly, high-performance materials within the automotive and electronics industries. The European Union promotes circular economy principles through its support of recyclable, energy-efficient materials like copolyester elastomers. The strong presence of industrial equipment and automotive OEM in the area continues to drive market expansion. The European market will see increased COPE adoption because of ongoing research advancements and government programs that support environmentally friendly technologies.

Key Copolyester Elastomers Companies:

The following are the leading companies in the copolyester elastomers market. These companies collectively hold the largest market share and dictate industry trends.

- DuPont

- DSM Engineering Plastics

- Eastman Chemical Company

- BASF SE

- LyondellBasell Industries N.V.

- Mitsubishi Chemical Corporation

- Arkema Group

- PolyOne Corporation

- Celanese Corporation

- Kuraray Co., Ltd.

- Others

Recent Developments

- In October 2024, BASF announced the release of its new Elastollan 1400 TPU line, which has a thermoplastic polyurethane based on ether that has remarkable resistance to hydrolysis. This novel material, which offers excellent mechanical qualities and ageing stability, is made for a variety of uses, including copolyester elastomers. Manufacturers who care about the environment will be drawn to the series' promises of reduced carbon footprints. Now that experimental grades are accessible for sampling, consumers may directly witness the improved performance in a variety of sectors, including footwear and transportation.

- In July 2024, Celanese introduced Hytrel TPC, a biobased product made especially for foamed sports shoes. This novel substance, a kind of copolyester elastomer, promotes sustainability while improving comfort and performance. By lowering dependency on fossil fuels, the biobased formulation supports environmentally friendly production methods. Celanese wants to satisfy the increasing need for eco-friendly materials in the shoe sector by giving producers a high-performing choice that satisfies consumer demands for longevity and quality, as well as environmental objectives.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the copolyester elastomers market based on the below-mentioned segments:

Global Copolyester Elastomers Market, By Type

- Injection Molding

- Blow Molding

- Others

Global Copolyester Elastomers Market, By Application

- Automotive

- Electrical

- Industrial

- Medical

- Others

Global Copolyester Elastomers Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 166 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |