Global Corrugated Steel Panels Market

Global Corrugated Steel Panels Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Product Types (Galvanized Steel Panels, Aluminum Coated Panels, and Other Coated Steel Panels), By End-Use Sectors (Residential, Commercial, and Industrial), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035

Report Overview

Table of Contents

Corrugated Steel Panels Market Summary, Size & Emerging Trends

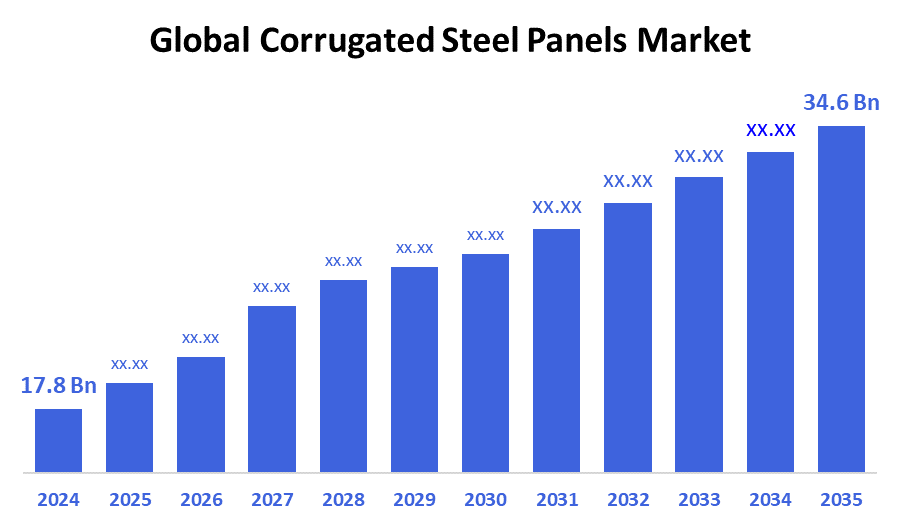

According to Decision Advisors, The Global Corrugated Steel Panels Market Size is expected to grow from USD 17.8 Billion in 2024 to USD 34.6 Billion by 2035, at a CAGR of 6.2% during the forecast period 2025-2035. Increasing demand for durable, lightweight, and cost-effective roofing and cladding materials in both residential and industrial construction sectors is a key factor propelling market growth.

Key Market Insights

- Asia Pacific is projected to lead the corrugated steel panels market in 2024 due to rapid urbanization and infrastructure investments.

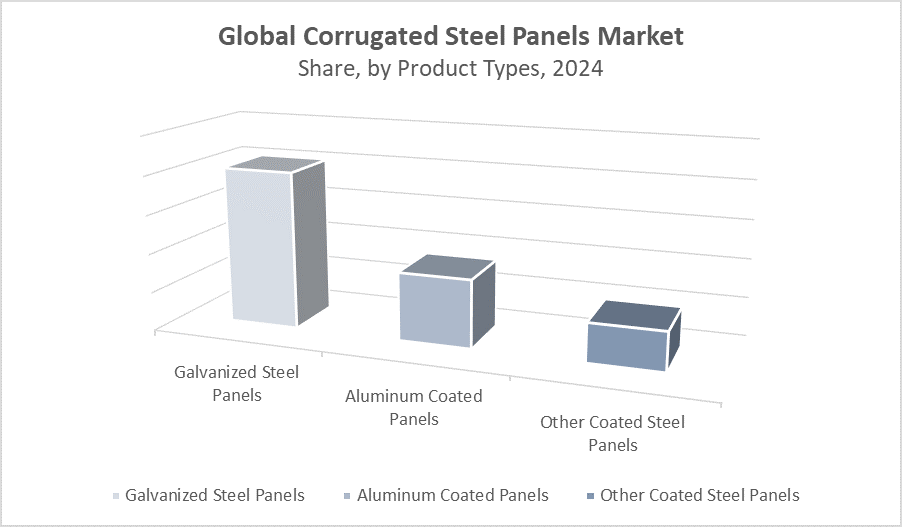

- Galvanized Steel Panels dominated the market by type in 2024 due to their corrosion resistance and cost efficiency.

- Residential construction accounted for the largest application segment globally.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 17.8 Billion

- 2035 Projected Market Size: USD 34.6 Billion

- CAGR (2025-2035): 6.2%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Corrugated Steel Panels Market

The corrugated steel panels market revolves around the production and application of wave-shaped steel sheets known for their durability, structural strength, and effective water drainage. These panels are commonly used in roofing, wall cladding, warehouses, and agricultural or industrial buildings. Their popularity stems from being lightweight, cost-effective, and easy to install. Galvanized and aluminum-coated variants are especially favored for their corrosion resistance in extreme climates. The market is expanding due to rising demand for prefabricated structures, rural housing, and government infrastructure projects. In addition, innovations in anti-rust coatings, aesthetic finishes, and interlocking systems continue to enhance product performance and broaden usage across both developed and developing regions.

Corrugated Steel Panels Market Trends

- Rising demand for lightweight and durable roofing in rural housing and prefabricated buildings

- Technological innovations in coating and panel strength

- Expansion of green building and energy-efficient construction practices

Corrugated Steel Panels Market Dynamics

Driving Factors: The corrugated steel panels market is driven by rising demand for cost-effective

The corrugated steel panels market is driven by rising demand for cost-effective, durable, and low-maintenance construction materials. Their lightweight nature, corrosion resistance, and ease of installation make them ideal for use in residential, agricultural, and industrial buildings. Infrastructure development in emerging economies and increasing adoption of prefabricated or modular structures further fuel demand. Their suitability for both urban and rural construction projects contributes to widespread usage. Additionally, government investment in infrastructure, particularly in Asia and Africa, is accelerating the need for fast and economical building materials like corrugated steel panels.

Restrain Factors: Volatility in steel prices directly impacts the cost structure and profit margins for manufacturers

Volatility in steel prices directly impacts the cost structure and profit margins for manufacturers, posing a key restraint. Corrugated steel panels also face competition from alternative roofing and cladding materials like fiber cement, asphalt shingles, and composite panels. These alternatives may offer better insulation or aesthetics in some applications. Furthermore, environmental concerns related to energy-intensive steel production and recycling inefficiencies limit market growth, especially in regions with strict environmental policies. End-users may also hesitate due to noise issues or a lack of thermal efficiency without additional insulation layers.

Opportunity: The expansion of construction sectors in emerging markets such as India

The expansion of construction sectors in emerging markets such as India, Indonesia, and parts of Africa presents a significant opportunity for corrugated steel panel adoption. Rising interest in sustainable and green buildings allows room for innovation in eco-friendly coatings and finishes, improving longevity and environmental performance. Technological advancements in manufacturing, such as color-coated and solar-reflective panels, also enhance visual appeal and functional value. Additionally, government support for rural housing, disaster-resistant buildings, and industrial zones opens new revenue streams for manufacturers that can offer high-performance, cost-effective panel solutions tailored to regional demands.

Challenges: Key challenges include meeting regulatory standards for structural safety

Key challenges include meeting regulatory standards for structural safety, fire resistance, and environmental impact across different regions. Transporting large, heavy panels to remote or mountainous locations adds to logistical complexity and cost. Moreover, handling issues like denting or bending during transit can lead to material wastage. There’s also growing competition from alternative building materials that offer superior insulation or aesthetic advantages. Lastly, convincing end-users to adopt steel panels in residential applications can be difficult due to traditional preferences for concrete or tile roofing, especially in developed markets.

Global Corrugated Steel Panels Market Ecosystem Analysis

The global corrugated steel panels market ecosystem comprises raw material suppliers, manufacturers, builders, architects, distributors, and regulatory agencies. Manufacturers rely on close collaboration with architects and contractors to ensure structural integrity, design efficiency, and compliance with regional building codes. R&D investments and automation enhance product innovation and production efficiency. Distributors and logistics providers enable market reach, particularly in remote and emerging regions. Regulatory bodies influence demand through sustainability mandates, while green certifications increasingly drive adoption in eco-conscious construction projects. This interconnected ecosystem supports steady market growth.

Global Corrugated Steel Panels Market, By Product Types

Galvanized steel panels dominated the market in 2024, capturing approximately 52% of total revenue. Their widespread popularity is due to their cost-effectiveness, excellent corrosion resistance, and high tensile strength. These panels are commonly used in residential and rural buildings, making them the preferred choice for general-purpose roofing and siding across various construction projects.

Aluminum-coated panels accounted for around 28% of the market share. They are especially favored in coastal and high-moisture regions because of their superior resistance to rust and longer lifespan compared to other steel panels. Although they come at a higher price point, their durability in harsh environmental conditions makes them a valuable investment for long-term applications.

Global Corrugated Steel Panels Market, By End-Use Sectors

The residential segment led the market in 2024 with approximately 47% of the total revenue. This growth is largely driven by increasing demand for affordable and cost-efficient housing in rural and suburban areas, especially in emerging markets. Corrugated steel panels are favored for their durability, low maintenance, and quick installation, making them ideal for residential roofing and siding projects.

The commercial segment accounted for about 32% of the market revenue. Corrugated steel panels are widely used in retail outlets, warehouses, and institutional buildings due to their aesthetic appeal, structural strength, and ability to enable fast construction. Their versatility and functional benefits make them a popular choice in commercial infrastructure development.

Asia Pacific dominated the corrugated steel panels market in 2024, contributing approximately 40% of total global revenue. The region’s strong performance is attributed to rapid urbanization, large-scale affordable housing projects, and ongoing infrastructure expansion in countries such as China, India, Indonesia, and Vietnam. Governments and private developers are increasingly adopting corrugated steel panels for cost-efficient construction due to their durability, low maintenance, and fast installation, especially in rural and semi-urban areas.

North America emerged as the fastest-growing region, with a projected CAGR of 6.8%. Growth is fueled by the rising preference for metal roofing in rural and hurricane-prone areas, where durability and wind resistance are critical. Additionally, innovations in protective coatings and growing awareness of energy-efficient, sustainable building materials are increasing adoption in residential and commercial construction across the U.S. and Canada.

Europe holds a stable 22% share of the global market in 2024. Market growth is driven by renovation and retrofit projects, particularly in Western Europe, along with rising demand for energy-efficient and eco-friendly building materials. Regulatory mandates focused on sustainable construction practices and improved thermal insulation have led to steady usage of corrugated steel panels, especially in residential and institutional buildings.

WORLDWIDE TOP KEY PLAYERS IN THE CORRUGATED STEEL PANELS MARKET INCLUDE

- ArcelorMittal

- Tata Steel / Tata BlueScope Steel

- BlueScope Steel

- Nucor Corporation

- Kingspan Group

- POSCO

- Nippon Steel

- ThyssenKrupp

- SSAB

- Doongkuk Steel

- Voestalpine AG

- Essar Steel

- SAIL

- Others

Product Launches in Corrugated Steel Panels Market

- In April 2025, ATAS International introduced the Corra-Max panel, a 2-inch-deep corrugated metal panel designed for wall cladding applications. This panel features an exposed fastener system, offering both aesthetic appeal and cost-effective installation. It is available in aluminum and steel substrates with various coatings and finishes, providing design flexibility for commercial and industrial projects.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the corrugated steel panels market based on the below-mentioned segments:

Global Corrugated Steel Panels Market, By Product Types

- Galvanized Steel Panels

- Aluminum Coated Panels

- Other Coated Steel Panels

Global Corrugated Steel Panels Market, By End-Use Sectors

- Residential

- Commercial

- Industrial

Global Corrugated Steel Panels Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

FAQs

1. What factors are driving the growth of the global corrugated steel panels market?

Increasing demand for lightweight, durable, and cost-effective roofing and cladding materials in residential, commercial, and industrial construction sectors is the primary growth driver.

2. Which product type holds the largest market share in the corrugated steel panels market?

Galvanized steel panels dominate the market due to their excellent corrosion resistance, cost efficiency, and high tensile strength.

3. What are the main end-use sectors for corrugated steel panels?

The primary sectors are residential, commercial, and industrial, with residential construction accounting for the largest revenue share.

4. Which region is the largest market for corrugated steel panels?

Asia Pacific is the largest market, driven by rapid urbanization, infrastructure projects, and affordable housing demand.

5. What is the projected market size and CAGR for the global corrugated steel panels market?

The market is expected to grow from USD 17.8 billion in 2024 to USD 34.6 billion by 2035, at a CAGR of 6.2%.

6. What challenges does the corrugated steel panels market face?

Key challenges include volatility in steel prices, competition from alternative materials, environmental concerns, and meeting regional regulatory standards.

7. How is innovation influencing the corrugated steel panels market?

Technological advances in coatings, panel strength, and design (e.g., solar-reflective and anti-rust coatings) are improving product durability, aesthetics, and energy efficiency.

8. Why is galvanized steel preferred over aluminum-coated and other steel panels?

Galvanized steel panels offer a balance of cost-effectiveness, corrosion resistance, and structural strength, making them ideal for a wide range of construction needs.

9. What opportunities exist for growth in the corrugated steel panels market?

Growth opportunities lie in emerging markets with expanding construction sectors, innovations in eco-friendly coatings, and government support for infrastructure and rural housing.

10. Who are the major companies operating in the global corrugated steel panels market?

Top players include ArcelorMittal, Tata Steel / Tata BlueScope Steel, BlueScope Steel, Nucor Corporation, Kingspan Group, POSCO, Nippon Steel, ThyssenKrupp, and SSAB.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 220 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |