Global COVID-19 Vaccine Market

Global COVID-19 Vaccine Market Size, Share, and COVID-19 Impact Analysis, By Technology (mRNA Vaccines, Viral Vector Vaccines, and Others), By End User (Government, Hospitals & Clinics, Retail & Chain Pharmacies, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

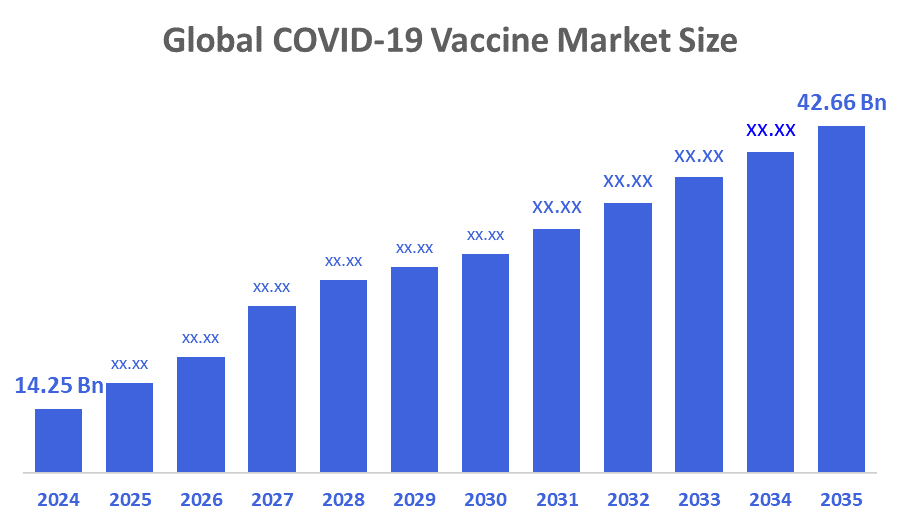

Global COVID-19 Vaccine Market Size Insights Forecasts to 2035

- The Global COVID-19 Vaccine Market Size Was Estimated at USD 14.25 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 10.48% from 2025 to 2035

- The Worldwide COVID-19 Vaccine Market Size is Expected to Reach USD 42.66 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

According to a Research Report Published by Decisions Advisors and Consulting, The Global COVID-19 Vaccine Market Size was worth around USD 14.25 Billion in 2024 and is predicted to Grow to around USD 42.66 Billion by 2035 with a compound annual growth rate (CAGR) of 10.48% from 2025 to 2035. Market participants are seeing development prospects due to the rise in demand for booster shots to maintain immunisation against new virus types. Moreover, due to the sharp increase in incidence and rise in immunisation rates worldwide, the COVID-19 vaccine industry entered into stable growth.

Market Overview

The global industry is devoted to the discovery, production, distribution, and commercialisation of vaccinations intended to prevent SARS-CoV-2 infection. COVID-19 vaccinations are pharmaceuticals created to shield people from the new coronavirus (SARS-CoV-2) that causes COVID-19. The immunisations reduce the risk of serious disease or death from COVID-19 by teaching the immune system to identify and combat the virus. Worldwide, a number of COVID-19 vaccines, including those made by Pfizer-BioNTech, Moderna, AstraZeneca-Oxford, and others, have been developed and approved for use in emergencies. The two main COVID vaccines are mRNA and viral vector vaccines. These vaccines teach the body to mount an immunological defence against the virus using a variety of technologies, including messenger RNA (mRNA) and adenovirus vectors. Moreover, to guarantee their effectiveness and safety, vaccines have undergone extensive testing in clinical trials.

India successfully developed four indigenous COVID-19 vaccines within just two years, showcasing the country’s rapid scientific and biopharmaceutical progress during the pandemic. "Mission COVID Suraksha," the Department of Biotechnology (DBT) in the Ministry of Science & Technology has delivered four vaccines, increased the production of Covaxin, and established the infrastructure required for the efficient development of future vaccines, making our nation prepared for a pandemic, he said. These vaccines were developed in partnership with different organisations.

Imperial College London received £18.5 million in new UK government funding to accelerate development of its self-amplifying RNA COVID-19 vaccine, enabling Phase 3 clinical trials later in 2020.

Report Coverage

This research report categorises the COVID-19 vaccine market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the COVID-19 vaccine market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the COVID-19 vaccine market.

Driving Factors

The quick global spread of the virus and the pressing need to lower infection rates, hospitalisations, and mortality were the main factors driving the COVID-19 vaccine market. The production and distribution of vaccines were expedited by governments and international health organisations prioritising mass immunisation programs, which were supported by significant public financing, advance purchase agreements, and emergency regulatory clearances. Strong public-private partnerships, extensive clinical trials, and quick technical developments—especially in mRNA and viral vector platforms—all contributed to the market's expansion. Furthermore, greater public awareness of vaccination and preventive healthcare continued market expansion during and after the pandemic, while ongoing virus changes and the appearance of new variations raised demand.

Restraining Factors

The COVID-19 vaccine market is hindered by several kinds of problems, such as decreased demand following the pandemic, vaccine hesitancy, distribution logistical difficulties, regulatory obstacles, and competition from alternative therapies.

Market Segmentation

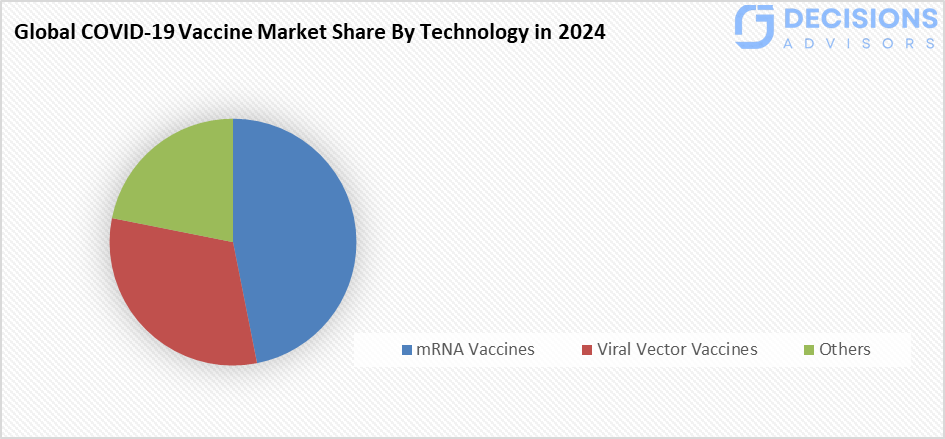

The COVID-19 vaccine market share is classified Into technology and end user.

- The mRNA vaccines segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the technology, the COVID-19 vaccine market is segmented into mRNA vaccines, viral vector vaccines, and others. Among these, the mRNA vaccines segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The mRNA vaccines are quite successful in eliciting an immunological response; some have effectiveness rates as high as compared of other vaccines, with the simple development process. mRNA vaccines can be made more quickly and cheaply.

- The government segment dominated the market in 2024 and is projected to grow at a significant CAGR during the forecast period.

Based on the end user, the COVID-19 vaccine market is divided into government, hospitals & clinics, retail & chain pharmacies, and others. Among these, the government segment dominated the market in 2024 and is projected to grow at a significant CAGR during the forecast period. This is for to prevent the pandemic, governments have made significant financial investments in the creation, testing, and distribution of vaccinations. This financing has played a critical role in accelerating the development of vaccines and guaranteeing their prompt public availability.

Regional Segment Analysis of the COVID-19 Vaccine Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the COVID-19 vaccine market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the COVID-19 vaccine market over the predicted timeframe. The market in the Asia Pacific is being driven by the existence of the biggest vaccine producers in the world, including BioNTech and the Serum Institute of India, as well as increased government assistance for the development of COVID-19 vaccines. This is due to its vast population base, high population density, and early exposure to the virus, which resulted in rapid community transmission. The quick implementation of diagnostic solutions was also aided by government-led public health programs, such as extensive testing programs, funding for emergency medical care, and expedited regulatory clearances. Additionally, the pandemic reinforced the local industry, raised awareness of infectious diseases, and hastened the development of laboratory and healthcare facilities.

COVAXIN is India’s first indigenous COVID-19 vaccine, developed by Bharat Biotech in collaboration with the Indian Council of Medical Research (ICMR) and the National Institute of Virology (NIV).

North America is expected to grow at a rapid CAGR in the COVID-19 vaccine market during the forecast period. This is because of the early and widespread epidemic, which produced a pressing need for extensive diagnostic testing and disease monitoring. Moreover, strong government support in the form of emergency funds, testing mandates, and expedited regulatory clearances, as well as a well-established healthcare infrastructure and quick adoption of cutting-edge molecular diagnostics like PCR, all helped the region. Furthermore, the rapid development and commercialisation of COVID-19 testing solutions were made possible by the existence of significant biotechnology and diagnostics companies, considerable healthcare spending, and robust R&D skills. North America was a major driving region during the COVID-19 pandemic due to increased public awareness of early disease identification and preventive healthcare.

In May 2025, the U.S. FDA approved Novavax’s Biologics License Application (BLA) for its COVID-19 vaccine, Nuvaxovid. This makes Nuvaxovid the only recombinant protein-based, non-mRNA COVID-19 vaccine currently available in the United States.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the COVID-19 vaccine market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AstraZeneca

- Bharat Biotech

- CanSino Biologics

- CureVac

- Gamaleya Research Institute

- GlaxoSmithKline

- Johnson & Johnson

- Moderna

- Novavax

- Pfizer-BioNTech

- Sanofi-GSK

- Serum Institute of India

- Sinopharm

- Sinovac

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In December 2025, GC Biopharma received approval from South Korea’s Ministry of Food and Drug Safety (MFDS) to begin Phase 1 clinical trials of its COVID-19 mRNA vaccine candidate, GC4006A. This marks a significant milestone in Korea’s push to localise mRNA vaccine technology and strengthen preparedness for future pandemics.

- In September 2025, Pfizer and BioNTech announced that their LP.8.1-adapted COVID-19 vaccine (2025–2026 formula). It showed a strong immune response in Phase 3 trials, with at least a four-fold increase in neutralising antibody titers against the LP.8.1 sublineage.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the COVID-19 vaccine market based on the below-mentioned segments:

Global COVID-19 Vaccine Market, By Technology

- mRNA Vaccines

- Viral Vector Vaccines

- Others

Global COVID-19 Vaccine Market, By End User

- Government

- Hospitals & Clinics

- Retail & Chain Pharmacies

- Others

Global COVID-19 Vaccine Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

1. What is the projected size of the global COVID-19 vaccine market by 2035?

The market is expected to grow from USD 14.25 billion in 2024 to USD 42.66 billion by 2035.

2. What is the CAGR for the COVID-19 vaccine market from 2025 to 2035?

The compound annual growth rate (CAGR) is 10.48% during the forecast period.

3. Which technology segment leads the market?

mRNA vaccines held the largest share in 2024 and are expected to grow at a significant CAGR due to their high efficacy, fast development, and cost-effectiveness.

4. Which end-user segment dominates the market?

The government segment dominated in 2024 and is projected to grow significantly, driven by major investments in vaccine development, testing, and distribution to combat the pandemic.

5. Which region will hold the largest market share?

Asia-Pacific is anticipated to hold the largest share, fueled by major producers like Serum Institute of India, a vast population, government support, and rapid public health responses.

6. Which region is expected to grow the fastest?

North America is projected to grow at the fastest CAGR, supported by advanced healthcare infrastructure, strong R&D, government funding, and quick adoption of vaccines like Novavax's Nuvaxovid.

7. Who are the key players in the COVID-19 vaccine market?

Major companies include Pfizer-BioNTech, Moderna, AstraZeneca, Bharat Biotech, Johnson & Johnson, Novavax, Serum Institute of India, Sinovac, and others, with recent advances like Pfizer-BioNTech's LP.8.1-adapted vaccine and GC Biopharma's trials.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Market Attractiveness Analysis By Technology

- Market Attractiveness Analysis By End User

- Market Attractiveness Analysis By Region

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Market players are observing growth opportunities and the demand to boost their sustainability

- Restraints

- Strict adherence to regulations required

- Opportunities

- Rise in cases and the increase in vaccination rates globally

- Challenges

- Distribution issues, and competition from other treatment options

- Global COVID-19 Vaccine Market Analysis and Projection, By Technology

- Segment Overview

- mRNA Vaccines

- Viral Vector Vaccines

- Others

- Global COVID-19 Vaccine Market Analysis and Projection, By End User

- Segment Overview

- Government

- Hospitals & Clinics

- Retail & Chain Pharmacies

- Others

- Global COVID-19 Vaccine Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South America

- Brazil

- Middle East and Africa

- UAE

- South Africa

- Global COVID-19 Vaccine Market-Competitive Landscape

- Overview

- Market Share of Key Players in the COVID-19 Vaccine Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Coverage Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- AstraZeneca

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Bharat Biotech

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- CanSino Biologics

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- CureVac

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Gamaleya Research Institute

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- GlaxoSmithKline

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Johnson & Johnson

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Moderna

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Novavax

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Pfizer-BioNTech

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Sanofi-GSK

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Serum Institute of India

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Sinopharm

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Sinovac

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Others

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- AstraZeneca

List of Table

- Global COVID-19 Vaccine Market, By Technology, 2024-2035(USD Billion)

- Global mRNA Vaccines, COVID-19 Vaccine Market, By Region, 2024-2035(USD Billion)

- Global Viral Vector Vaccines, COVID-19 Vaccine Market, By Region, 2024-2035(USD Billion)

- Global Others, COVID-19 Vaccine Market, By Region, 2024-2035(USD Billion)

- Global COVID-19 Vaccine Market, By End User, 2024-2035(USD Billion)

- Global Government, COVID-19 Vaccine Market, By Region, 2024-2035(USD Billion)

- Global Hospitals & Clinics, COVID-19 Vaccine Market, By Region, 2024-2035(USD Billion)

- Global Retail & Chain Pharmacies, COVID-19 Vaccine Market, By Region, 2024-2035(USD Billion)

- Global Others, COVID-19 Vaccine Market, By Region, 2024-2035(USD Billion)

- North America COVID-19 Vaccine Market, By Technology, 2024-2035(USD Billion)

- North America COVID-19 Vaccine Market, By End User, 2024-2035(USD Billion)

- U.S. COVID-19 Vaccine Market, By Technology, 2024-2035(USD Billion)

- U.S. COVID-19 Vaccine Market, By End User, 2024-2035(USD Billion)

- Canada COVID-19 Vaccine Market, By Technology, 2024-2035(USD Billion)

- Canada COVID-19 Vaccine Market, By End User, 2024-2035(USD Billion)

- Mexico COVID-19 Vaccine Market, By Technology, 2024-2035(USD Billion)

- Mexico COVID-19 Vaccine Market, By End User, 2024-2035(USD Billion)

- Europe COVID-19 Vaccine Market, By Technology, 2024-2035(USD Billion)

- Europe COVID-19 Vaccine Market, By End User, 2024-2035(USD Billion)

- Germany COVID-19 Vaccine Market, By Technology, 2024-2035(USD Billion)

- Germany COVID-19 Vaccine Market, By End User, 2024-2035(USD Billion)

- France COVID-19 Vaccine Market, By Technology, 2024-2035(USD Billion)

- France COVID-19 Vaccine Market, By End User, 2024-2035(USD Billion)

- U.K. COVID-19 Vaccine Market, By Technology, 2024-2035(USD Billion)

- U.K. COVID-19 Vaccine Market, By End User, 2024-2035(USD Billion)

- Italy COVID-19 Vaccine Market, By Technology, 2024-2035(USD Billion)

- Italy COVID-19 Vaccine Market, By End User, 2024-2035(USD Billion)

- Spain COVID-19 Vaccine Market, By Technology, 2024-2035(USD Billion)

- Spain COVID-19 Vaccine Market, By End User, 2024-2035(USD Billion)

- Asia Pacific COVID-19 Vaccine Market, By Technology, 2024-2035(USD Billion)

- Asia Pacific COVID-19 Vaccine Market, By End User, 2024-2035(USD Billion)

- Japan COVID-19 Vaccine Market, By Technology, 2024-2035(USD Billion)

- Japan COVID-19 Vaccine Market, By End User, 2024-2035(USD Billion)

- China COVID-19 Vaccine Market, By Technology, 2024-2035(USD Billion)

- China COVID-19 Vaccine Market, By End User, 2024-2035(USD Billion)

- India COVID-19 Vaccine Market, By Technology, 2024-2035(USD Billion)

- India COVID-19 Vaccine Market, By End User, 2024-2035(USD Billion)

- South America COVID-19 Vaccine Market, By Technology, 2024-2035(USD Billion)

- South America COVID-19 Vaccine Market, By End User, 2024-2035(USD Billion)

- Brazil COVID-19 Vaccine Market, By Technology, 2024-2035(USD Billion)

- Brazil COVID-19 Vaccine Market, By End User, 2024-2035(USD Billion)

- The Middle East and Africa COVID-19 Vaccine Market, By Technology, 2024-2035(USD Billion)

- The Middle East and Africa COVID-19 Vaccine Market, By End User, 2024-2035(USD Billion)

- UAE COVID-19 Vaccine Market, By Technology, 2024-2035(USD Billion)

- UAE COVID-19 Vaccine Market, By End User, 2024-2035(USD Billion)

- South Africa COVID-19 Vaccine Market, By Technology, 2024-2035(USD Billion)

- South Africa COVID-19 Vaccine Market, By End User, 2024-2035(USD Billion)

List of Figures

- Global COVID-19 Vaccine Market Segmentation

- COVID-19 Vaccine Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top investment pocket in the COVID-19 Vaccine Market

- Top Winning Strategies, 2024-2035

- Top Winning Strategies, By Development, 2024-2035(%)

- Top Winning Strategies, By Company, 2024-2035

- Moderate Bargaining power of Buyers

- Moderate Bargaining power of Suppliers

- Moderate Bargaining power of New Entrants

- Low threat of Substitution

- High Competitive Rivalry

- Top Player Positioning, 2024

- Market Share Analysis, 2024

- Restraint and Drivers: COVID-19 Vaccine Market

- COVID-19 Vaccine Market Segmentation, By Technology

- COVID-19 Vaccine Market For mRNA Vaccines, By Region, 2024-2035 ($ Billion)

- COVID-19 Vaccine Market For Viral Vector Vaccines, By Region, 2024-2035 ($ Billion)

- COVID-19 Vaccine Market For Others, By Region, 2024-2035 ($ Billion)

- COVID-19 Vaccine Market Segmentation, By End User

- COVID-19 Vaccine Market For Government, By Region, 2024-2035 ($ Billion)

- COVID-19 Vaccine Market For Hospitals & Clinics, By Region, 2024-2035 ($ Billion)

- COVID-19 Vaccine Market For Retail & Chain Pharmacies, By Region, 2024-2035 ($ Billion)

- COVID-19 Vaccine Market For Others, By Region, 2024-2035 ($ Billion)

- AstraZeneca: Net Sales, 2024-2035 ($ Billion)

- AstraZeneca: Revenue Share, By Segment, 2024 (%)

- AstraZeneca: Revenue Share, By Region, 2024 (%)

- Bharat Biotech: Net Sales, 2024-2035 ($ Billion)

- Bharat Biotech: Revenue Share, By Segment, 2024 (%)

- Bharat Biotech: Revenue Share, By Region, 2024 (%)

- CanSino Biologics: Net Sales, 2024-2035 ($ Billion)

- CanSino Biologics: Revenue Share, By Segment, 2024 (%)

- CanSino Biologics: Revenue Share, By Region, 2024 (%)

- CureVac: Net Sales, 2024-2035 ($ Billion)

- CureVac: Revenue Share, By Segment, 2024 (%)

- CureVac: Revenue Share, By Region, 2024 (%)

- Gamaleya Research Institute: Net Sales, 2024-2035 ($ Billion)

- Gamaleya Research Institute: Revenue Share, By Segment, 2024 (%)

- Gamaleya Research Institute: Revenue Share, By Region, 2024 (%)

- GlaxoSmithKline: Net Sales, 2024-2035 ($ Billion)

- GlaxoSmithKline: Revenue Share, By Segment, 2024 (%)

- GlaxoSmithKline: Revenue Share, By Region, 2024 (%)

- Johnson & Johnson: Net Sales, 2024-2035 ($ Billion)

- Johnson & Johnson: Revenue Share, By Segment, 2024 (%)

- Johnson & Johnson: Revenue Share, By Region, 2024 (%)

- Moderna: Net Sales, 2024-2035 ($ Billion)

- Moderna: Revenue Share, By Segment, 2024 (%)

- Moderna: Revenue Share, By Region, 2024 (%)

- Novavax.: Net Sales, 2024-2035 ($ Billion)

- Novavax.: Revenue Share, By Segment, 2024 (%)

- Novavax.: Revenue Share, By Region, 2024 (%)

- Pfizer-BioNTech: Net Sales, 2024-2035 ($ Billion)

- Pfizer-BioNTech: Revenue Share, By Segment, 2024 (%)

- Pfizer-BioNTech: Revenue Share, By Region, 2024 (%)

- Sanofi-GSK: Net Sales, 2024-2035 ($ Billion)

- Sanofi-GSK: Revenue Share, By Segment, 2024 (%)

- Sanofi-GSK: Revenue Share, By Region, 2024 (%)

- Serum Institute of India: Net Sales, 2024-2035 ($ Billion)

- Serum Institute of India: Revenue Share, By Segment, 2024 (%)

- Serum Institute of India: Revenue Share, By Region, 2024 (%)

- Sinopharm: Net Sales, 2024-2035 ($ Billion)

- Sinopharm: Revenue Share, By Segment, 2024 (%)

- Sinopharm: Revenue Share, By Region, 2024 (%)

- Sinovac: Net Sales, 2024-2035 ($ Billion)

- Sinovac: Revenue Share, By Segment, 2024 (%)

- Sinovac: Revenue Share, By Region, 2024 (%)

- Others: Net Sales, 2024-2035 ($ Billion)

- Others: Revenue Share, By Segment, 2024 (%)

- Others: Revenue Share, By Region, 2024 (%)

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 270 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |