Global Crohns Disease Market

Global Crohns Disease Market Size, Share, and COVID-19 Impact Analysis, By Treatment (Non-Surgical and Surgical), By Route of Administration (Injectable, and Oral), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035

Report Overview

Table of Contents

Global Crohn’s Disease Market Insights Forecasts to 2035

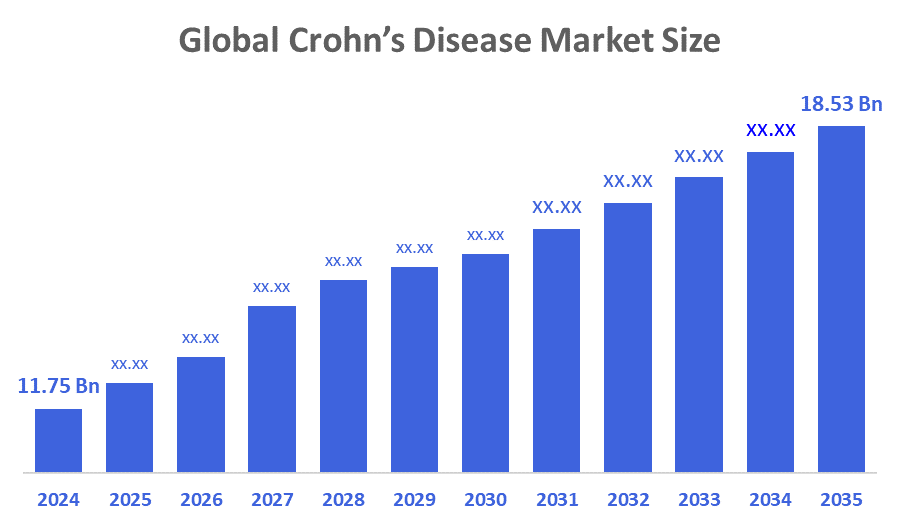

- The Global Crohn’s Disease Market Size Was Estimated at USD 11.75 billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.23% from 2025 to 2035

- The Worldwide Crohn’s Disease Market Size is Expected to Reach USD 18.53 billion by 2035

- Europe is expected to grow the fastest during the forecast period.

According to a research report published by Decisions Advisors and Consulting, The Global Crohn's Disease Market Size was Worth around USD 11.75 Billion in 2024 and is Predicted to Grow to around USD 18.53 Billion by 2035 with a Compound Annual Growth Rate (CAGR) of 4.23% From 2025 To 2035. The necessity for treatments has arisen due to the rise in Crohn's disease cases in a number of nations. Additionally, the technique of finding new drugs, especially more targeted treatments, has improved patient outcomes and treatment options. Furthermore, initiatives to improve diagnosis rates and raise awareness of Crohn's disease have led to more patients obtaining early treatments, which is expected to fuel market expansion.

Market Overview

The Crohn’s disease market refers to the global healthcare and pharmaceutical segment focused on the diagnosis, management, and treatment of Crohn’s disease, a chronic inflammatory bowel disease (ibd). It includes drugs, biologics, nutritional therapies, surgeries, and distribution channels aimed at reducing symptoms, preventing complications, and improving patient quality of life. Chronic inflammatory bowel disease (Crohn's) - it is a long-term inflammatory bowel disease that causes chronic inflammation of the digestive system from the mouth to the anus. Symptoms of Crohn's include diarrhoea, abdominal pain, fatigue, unintentional weight loss, and blood and/or mucus in the stool. Those with Crohn's disease may also have sores on their mouth, fever, skin problems, eye swelling/inflammation, and swollen and/or painful joints. Crohn's disease can result in life-threatening flare-ups and complications such as bowel obstruction, colon cancer, fistulae, anaemia, etc. Diagnosis of Crohn's disease is made based on history, physical exam, laboratory studies and imaging. Blood work-up shows signs of ongoing inflammation, while stool samples can identify/diagnose any potential bacterial/fungal infections inside the gastrointestinal tract. Imaging techniques, such as ct scans, magnetic resonance imaging (MRI), and X-rays, help identify areas of inflammation caused by Crohn's and damage to the GI tract due to Crohn's disease. In some instances, colonoscopy or endoscopy can be done to allow for the direct visualisation of the GI tract to collect tissue for the purpose of histological examination.

Trethera received a $1.8 million NIH grant to support preclinical development of TRE-515, its lead candidate for Crohn’s disease. This award builds on the promising results announced at the 2025 Crohn's & Colitis Congress and comes after Trethera's previous $400,000 NIH Crohn's research grant. TRE-515 preferentially inhibited the growth of activated CD4 T cells, hence blocking the symptoms of inflammatory bowel disease in mice.

INTERCEPT is a €38 million, five-year international research initiative aiming to prevent Crohn’s disease before symptoms appear by using predictive biomarkers. Approximately 10,000 first-degree relatives of those with the illness will be recruited for the research throughout seven European nations. About 80 members of this group, who have been identified as being at higher risk, will take part in a novel therapy trial to stop the disease from progressing to its fullest extent.

Report Coverage

This research report categorises the Crohn's disease market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Crohn's disease market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the Crohn’s disease market.

Driving Factors

The market for Crohn's disease is rapidly evolving due to increased knowledge of how Crohn's disease works and new ways of treating it. This is because of the growing number of people diagnosed with Crohn's disease; there is greater demand for better options for treating the condition. Also, the trend toward personalised medicine means that more and more people with Crohn's disease will likely be treated based on their individual situation. In addition to developing better therapies, there are also new levels of awareness and education for both patients and healthcare professionals. Increased awareness may result in earlier diagnosis and more effective interventions, improving the overall quality of life for patients with Crohn's disease. Moreover, collaborations between pharmaceutical companies and academic researchers are expected to create a stronger pipeline of novel therapies for the treatment of Crohn's disease. As the market continues to evolve, stakeholders need to closely monitor evolving trends and adapt their strategies in response to the changing needs of both patients and healthcare systems.

Restraining Factors

This is due to high treatment costs and restricted patient access to cutting-edge biologics; the Crohn's disease industry is constrained. Wider acceptance of long-term immunosuppressive medications is also hampered by safety concerns and side effects. Furthermore, regional reimbursement issues and sluggish diagnostic rates limit market expansion.

Market Segmentation

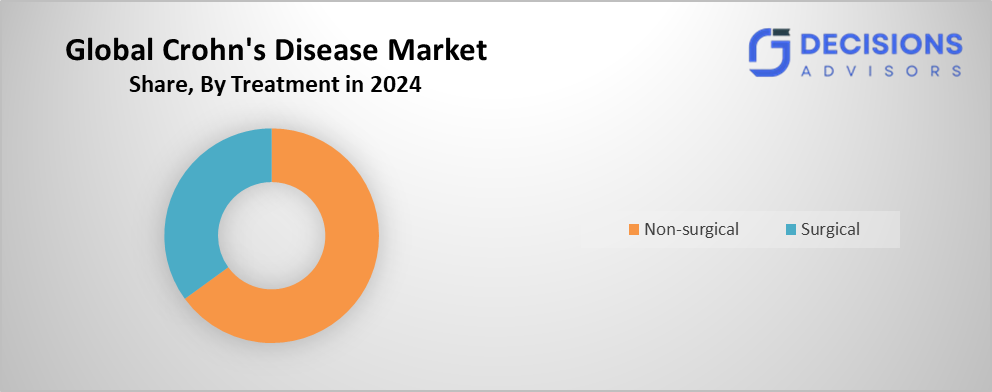

The Crohn’s disease market share is classified into treatment, and route of administration.

- The non-surgical segment accounted for the largest market share in 2024 and is anticipated to grow at a notable CAGR over the forecast period.

Based on the treatment, the crohns disease market is divided into non-surgical and surgical. Among these, the non-surgical segment accounted for the largest market share in 2024 and is anticipated to grow at a notable CAGR over the forecast period. This isdue to the discovery of potent biological treatments and biosimilars that successfully treat Crohn's disease, as well as advances in medicine. Moreover, as compared to conventional choices, these drugs also provide superior control and therapeutic results.

- The injectable segment accounted for the highest share in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the route of administration, the Crohn's disease market is divided into injectable and oral. Among these, the injectable segment accounted for the highest share in 2024 and is projected to grow at a substantial CAGR during the forecast period. This is because of the usage of biologics, which are extremely powerful medications given by injection. Crohn's disease is treated with several biologic injections that lessen the severity and frequency of flare-ups. For example, Adalimumab (Humira) and Adalimumab-adbm relieve symptoms and keep patients from going into remission.

Regional Segment Analysis of the Crohn's Disease Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the Crohn’s disease market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the Crohn’s disease market over the predicted timeframe. The Asia-Pacific region currently has a Crohn's disease market that is growing with increasing awareness surrounding the illness (along with advances in diagnosing it). Several other factors, including urbanisation, rapid lifestyle changes and the accompanying dietary shifts, have led to ever-increasing rates of Crohn's Disease occurring within this region. As Asian and Pacific Island governments have continued to enhance their health care systems, they have supported further growth in this market. Several large multinational companies like Takeda Pharmaceuticals and Amgen are expanding into the Asia/Pacific market with a strong focus on innovative therapies. As a result, both the competitive landscape and number of local companies entering the Crohn's Disease market continue to grow, providing patients with more options for treatment.

Today, Japan and Australia lead the way when it comes to the Crohn's disease market; health care providers within both countries are embracing new treatment options. For instance, Melbourne’s Bionics Institute has secured AUD $4.8 million (USD $3.2 million) from an American charitable trust to pioneer a world-first, personalised electrical treatment for Crohn’s disease.

Europe is expected to grow at a rapid CAGR in the Crohn's disease market during the forecast period. The region benefits from a strong regulatory environment that encourages innovation and the introduction of new therapies. Increased awareness and diagnosis of Crohn's Disease, along with a rise in healthcare spending, are key drivers of market growth. The European Medicines Agency (EMA) plays a crucial role in facilitating access to new treatments, enhancing patient care across member states. Major pharmaceutical companies, such as Takeda and Sanofi, are actively involved in research and development, and such key players ensure a steady supply of innovative treatments, catering to the diverse needs of patients in Europe.

Leading countries in this market include Germany, France, and the UK, where healthcare systems are increasingly adopting advanced therapies. For instance, the UK’s Medicines and Healthcare products Regulatory Agency (MHRA) has approved guselkumab (Tremfya) for the treatment of moderately to severely active Crohn’s disease and ulcerative colitis in adults who have not responded well to other therapies or experienced unacceptable side effects.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Crohn's Disease market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AbbVie Inc.

- Amgen Inc.

- AstraZeneca

- Biogen

- Celgene Corporation

- Celgene Corporation

- Genentech

- Janssen Pharmaceuticals

- Johnson & Johnson

- Merck & Co., Inc.

- Pfizer Inc.

- Prometheus Laboratories Inc. (Nestle)

- Salix Pharmaceuticals Inc.

- Takeda Pharmaceutical Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2026, Broad Institute scientists developed small molecules that mimic a protective gene variant (CARD9), showing promise as future treatments for Crohn’s disease and other inflammatory bowel disorders. Small-molecule drug candidates that mirror the effects of this uncommon gene mutation have now been developed by researchers at the Broad Institute, Mass General Brigham, Harvard Medical School, and Johnson & Johnson Innovative Medicine.

- In October 2024, PathAI announced a collaboration with the Crohn’s & Colitis Foundation to accelerate novel research in inflammatory bowel disease (IBD) by combining AI-powered histopathology with multi-modal clinical and molecular data. Digitised histology photos from the Crohn's and Colitis Foundation's IBD Plexus dataset will be used to generate quantitative histopathology data using PathAI's IBD ExploreTM and AIM-HI UCTM algorithm products 1.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Crohn’s disease market based on the below-mentioned segments:

Global Crohn's Disease Market, By Treatment

- Non-Surgical

- Surgical

Global Crohn’s Disease Market, By Route of Administration

- Injectable

- Oral

Global Crohn’s Disease Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

1. What is the projected size and growth rate of the Global Crohn's Disease Market?

The market was valued at USD 11.75 billion in 2024 and is expected to reach USD 18.53 billion by 2035, growing at a CAGR of 4.23% during 2025-2035.

2. What are the main market segments by treatment and route of administration?

The market segments by treatment into non-surgical (the largest share in 2024, driven by biologics and biosimilars) and surgical. By route of administration, it divides into injectable (the highest share in 2024, led by biologics like Adalimumab) and oral.

3. Which region holds the largest market share, and which is expected to grow fastest?

Asia-Pacific is anticipated to hold the largest share due to rising awareness, urbanisation, dietary shifts, and healthcare improvements. Europe is expected to grow at the fastest CAGR, supported by strong regulations, R&D from companies like Takeda and Sanofi, and approvals like guselkumab.

4. What are the primary driving factors for market growth?

Key drivers include rising Crohn's disease diagnoses, demand for advanced treatments like biologics and personalised medicine, improved diagnostics, patient awareness, and collaborations between pharma companies and researchers.

5. What are the main restraining factors affecting the market?

Challenges include high treatment costs, limited access to biologics, safety concerns with immunosuppressants, regional reimbursement issues, and slow diagnostic rates.

6. Who are the leading companies in the Crohn's Disease Market?

Key players include AbbVie Inc., Amgen Inc., AstraZeneca, Biogen, Janssen Pharmaceuticals, Johnson & Johnson, Merck & Co., Pfizer Inc., Takeda Pharmaceutical Ltd., and others like Prometheus Laboratories and Salix Pharmaceuticals.

7. What are some recent developments in the market?

In January 2026, Broad Institute developed small molecules mimicking a protective CARD9 gene variant for Crohn's treatment. In October 2024, PathAI partnered with the Crohn’s & Colitis Foundation for AI-driven IBD research. Other highlights include Trethera's $1.8M NIH grant for TRE-515 and the €38M INTERCEPT initiative.

8. What does the report cover in terms of data and analysis?

It provides historical data (2020-2023), base year 2024 forecasts to 2035, segment and regional breakdowns, growth drivers/restraints, competitive landscape with SWOT, and recent developments like partnerships and product launches.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 250 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |