Global Date Sugar Market

Global Date Sugar Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Product Form (Fine Powder Date Sugar and Coarse Granule Date Sugar), By End-Use Industry (Bakery & Pastry Products, Functional & Health Beverages, and Sweet Confectionery & Desserts), and By Region (Asia Pacific, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035

Report Overview

Table of Contents

Date Sugar Market Summary, Size & Emerging Trends

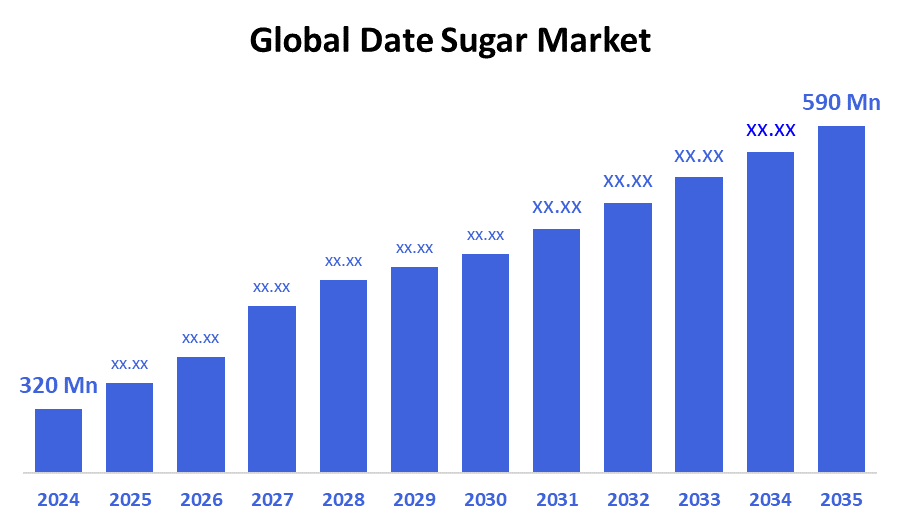

According to Decision Advisors, The Global Date Sugar Market Size is expected to grow from USD 320 Million in 2024 to USD 590 Million by 2035, at a CAGR of 5.5% during the forecast period 2025-2035. Increasing consumer preference for natural and healthier sugar alternatives in baked goods, beverages, and confectionery products is a major factor fueling the market growth.

Key Market Insights

- North America is expected to hold the largest share during the forecast period, driven by rising health consciousness and demand for organic sweeteners.

- The powdered date sugar segment dominates in terms of market share due to its ease of use and wide application in food manufacturing.

- Bakery & Pastry Products represent the largest end-use sector, attributed to growing demand for clean-label ingredients and natural sweeteners in baked foods.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 320 Million

- 2035 Projected Market Size: USD 590 Million

- CAGR (2025-2035): 5.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Date Sugar Market

The date sugar market centers on producing a natural sweetener derived from dried dates, offering nutritional benefits such as fiber and antioxidants. It serves as an excellent alternative to refined sugar with a lower glycemic index, making it highly suitable for health-conscious consumers and specialty food producers. The market benefits from rising demand in bakery, beverage, and confectionery industries, where clean-label and organic ingredients are increasingly prioritized. Government support for organic farming and sustainable agriculture practices further supports market expansion globally. Increasing awareness of natural sweeteners and digital sales channels accelerates market penetration.

Date Sugar Market Trends

- Growing consumer shift towards natural and organic sugar alternatives due to health concerns.

- Innovation in product forms, such as powdered and granulated date sugar, to cater to diverse food manufacturing needs.

- Expansion of e-commerce platforms facilitating niche product accessibility and consumer education.

- Rising incorporation of date sugar in specialty foods targeting diabetic and health-conscious consumers.

Date Sugar Market Dynamics

Driving Factors: The date sugar market is expanding rapidly due to increasing demand for healthier sugar alternatives across baked goods

The date sugar market is expanding rapidly due to increasing demand for healthier sugar alternatives across baked goods, beverages, and confectionery sectors. Consumers are leaning towards natural sweeteners that offer added nutritional benefits alongside flavor enhancement. This shift aligns with clean-label trends, pushing food manufacturers to reformulate products without artificial ingredients. Date sugar stands out by providing a natural sweetness coupled with dietary fiber and antioxidants, making it a preferred choice for health-conscious buyers. These factors collectively drive market growth as more brands adopt date sugar to meet evolving consumer preferences.

Restrain Factors: Date sugar’s relatively higher cost compared to conventional refined sugar can deter price-sensitive consumers and producers

Despite its benefits, date sugar faces limitations such as a shorter shelf life and solubility issues compared to refined sugar, which restricts its use in certain beverages and processed foods. These technical challenges reduce its versatility and can limit adoption among food manufacturers looking for easy-to-use ingredients. Additionally, date sugar’s relatively higher cost compared to conventional refined sugar can deter price-sensitive consumers and producers, especially in highly competitive markets. Such factors act as restraints on market growth, requiring ongoing product innovation and cost optimization to broaden acceptance.

Opportunity: The expansion of e-commerce platforms globally facilitates easier access to niche health products

The market holds significant opportunities with the increasing popularity of organic and specialty date sugar products. As consumers become more health-aware, they seek natural, minimally processed sweeteners, driving demand for certified organic date sugar. Additionally, the expansion of e-commerce platforms globally facilitates easier access to niche health products, enabling market penetration in emerging economies. This creates avenues for manufacturers to innovate with new formulations, packaging, and marketing strategies. Growing awareness about natural sweeteners and sustainable sourcing further opens doors for date sugar to expand into new regions and consumer segments.

Challenges: Supply chain complexities

Market growth is challenged by price sensitivity among consumers, who often compare date sugar costs to cheaper alternatives like coconut sugar and stevia. This competition forces manufacturers to differentiate their products through quality and marketing efforts. Supply chain complexities, including sourcing quality dates and maintaining product consistency, pose operational hurdles. Educating consumers about the unique benefits of date sugar also requires significant investment, as awareness is still limited in many markets. Overcoming these challenges demands innovation, transparent communication, and strategic partnerships to strengthen market position and build consumer trust.

Global Date Sugar Market Ecosystem Analysis

The ecosystem includes raw material suppliers, date sugar manufacturers, food and beverage companies, and distribution channels such as supermarkets, specialty stores, and e-commerce platforms. Key suppliers are involved in organic farming and sustainable harvesting of dates. Regulatory bodies focus on organic certification and food safety compliance, influencing market standards. Collaboration across the supply chain ensures quality, innovation, and growth opportunities.

Global Date Sugar Market, By Product Form

The fine powder date sugar segment dominates the market with an estimated 65% share during the forecast period. Its fine, smooth texture allows for easy incorporation into a wide range of food and beverage applications, including baked goods, confectionery, and beverages. Manufacturers prefer this form because it blends seamlessly without affecting texture or appearance, making it ideal for mass production and commercial use. Its consistent quality and solubility make it highly favored in industries aiming for uniform sweetness and clean-label products. This ease of use and versatility significantly contribute to its leading market position.

The coarse granule date sugar segment holds approximately 35% of the market share and is steadily gaining popularity, particularly in specialty and artisan baking markets. The coarse granules provide a unique texture and visual appeal that appeals to consumers seeking natural and traditional food experiences. It is often used as a topping or ingredient in gourmet baked products, where its grainy texture enhances sensory qualities. The growing demand for artisanal, organic, and minimally processed foods drives the expansion of this segment, especially among health-conscious and niche consumers.

Global Date Sugar Market, By End-Use Industry

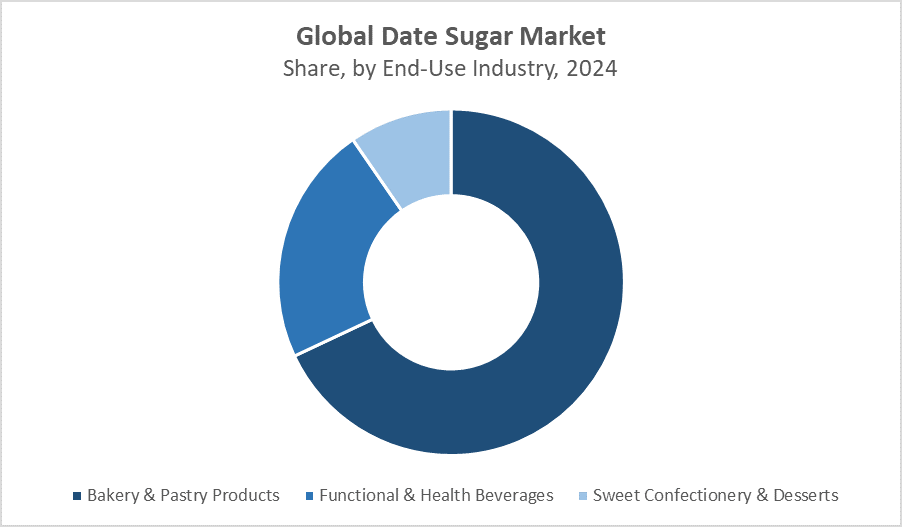

The bakery & pastry products segment holds the largest revenue share in the date sugar market, accounting for approximately 55% of the total market during the forecast period. This dominance is driven by food manufacturers reformulating traditional recipes to incorporate natural sweeteners like date sugar, responding to increasing consumer demand for healthier, clean-label baked goods. Date sugar’s natural flavor and nutritional benefits make it a preferred choice in breads, cakes, cookies, and pastries, helping manufacturers cater to health-conscious consumers while maintaining product quality and taste.

The functional & health beverages segment is a rapidly growing market, representing about 30% of the total share. This growth is fueled by rising consumer interest in clean-label energy drinks, health tonics, and other beverages formulated with natural ingredients. Date sugar is increasingly used in this segment due to its natural sweetness and added nutritional value, aligning with consumer preferences for functional drinks that support wellness and provide sustained energy without artificial additives.

North America is the largest market for date sugar, accounting for approximately 35-40% of the global market share.

This dominance is driven by a growing base of health-conscious consumers who prioritize natural and organic products. The region benefits from a well-established specialty retail ecosystem, including organic grocery stores and online platforms, which facilitate the availability and adoption of date sugar. Additionally, increasing awareness about the health benefits of natural sweeteners and the demand for clean-label ingredients contribute to strong market growth in the United States and Canada.

Europe holds a significant market share of around 25-30%, led by key countries such as the UK, Germany, and France.

Consumers in these countries have a strong preference for natural and organic ingredients, supported by robust regulatory frameworks promoting organic farming and food safety. The demand is also fueled by growing trends in sustainable and clean-label foods, making date sugar an attractive alternative sweetener in the region’s bakery, beverage, and confectionery industries. Europe’s focus on environmental sustainability and health awareness further supports market expansion.

Asia Pacific is the fastest-growing region in the global date sugar market, projected to expand at a CAGR exceeding 7% during the forecast period.

This rapid growth is primarily driven by increasing health awareness among urban populations, particularly in emerging economies such as India, China, and Southeast Asian countries. Consumers are showing greater interest in natural and plant-based sweeteners as they shift away from refined sugars. Additionally, the expansion of the region’s food processing industries and the growing presence of health-focused product lines are accelerating the adoption of date sugar. Rising disposable income and the growth of e-commerce are also enabling wider access to organic and specialty ingredients, further fueling regional demand.

WORLDWIDE TOP KEY PLAYERS IN THE DATE SUGAR MARKET INCLUDE

- Al Foah

- Bateel International

- Datec International

- Hatta Food Industries

- Saad Group

- Organic Date Co.

- Arabian Dates Factory

- Ajwa Dates

- Pure Date

- Nature’s Nectar

- Others

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the date sugar market based on the below-mentioned segments:

Global Date Sugar Market, By Product Form

- Fine Powder Date Sugar

- Coarse Granule Date Sugar

Global Date Sugar Market, By End-Use Industry

- Bakery & Pastry Products

- Functional & Health Beverages

- Sweet Confectionery & Desserts

Global Date Sugar Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

FAQs

Q1: What is driving the growth of the global date sugar market?

A1: Rising demand for natural, healthier alternatives to refined sugar in bakery, beverage, and confectionery products.

Q2: Which region leads the global date sugar market?

A2: North America, due to strong health awareness, organic product adoption, and advanced retail channels.

Q3: Why is powdered date sugar more popular than coarse granule form?

A3: Powdered form blends easily, offers better solubility, and is ideal for mass food production.

Q4: What is the biggest challenge facing date sugar adoption?

A4: Its higher cost and limited solubility compared to conventional sugar.

Q5: Which end-use industry dominates the market?

A5: Bakery and pastry products, driven by clean-label trends and natural ingredient demand.

Q6: How is e-commerce impacting the market?

A6: It boosts accessibility and consumer awareness, especially in emerging economies.

Q7: What’s the market outlook for Asia Pacific?

A7: It’s the fastest-growing region due to rising health consciousness and expanding food processing sectors.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 240 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |