Global Dental Membrane And Bone Graft Substitutes Market

Global Dental Membrane And Bone Graft Substitutes Market Size, Share, and COVID-19 Impact Analysis, By Product (Bone Graft Substitutes (BGS), Dental Membranes And Soft Tissue Regeneration Materials), By Application (Ridge Augmentation, Sinus Lift, Periodontal Defect Regeneration, Implant Bone Regeneration, Socket Preservation, Soft Tissue Regeneration, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035.

Report Overview

Table of Contents

Dental Membrane And Bone Graft Substitutes Market Summary

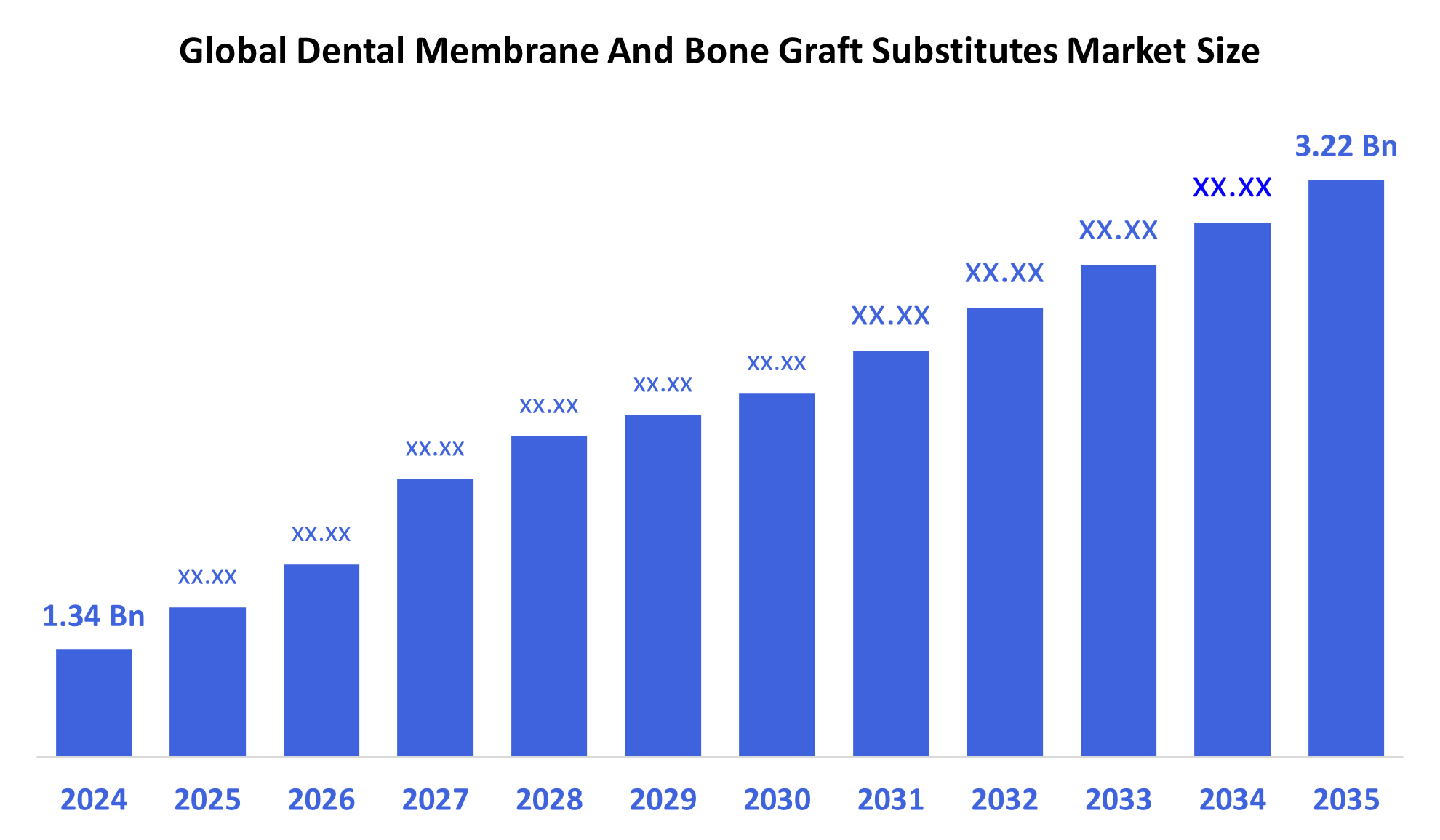

The Global Dental Membrane And Bone Graft Substitutes Market Size Was Valued at USD 1.34 Billion in 2024 and is Projected to Reach USD 3.22 Billion by 2035, Growing at a CAGR of 8.3% from 2025 to 2035. The market for dental membranes and bone graft substitutes is expanding as a result of the growing need for restorative dental procedures among the world's aging population, the growing prevalence of dental issues such as periodontal disease and tooth loss, and the growing demand for dental implants.

Key Regional and Segment-Wise Insights

- In 2024, North America held the greatest revenue share of 36.52% in the dental membrane and bone graft substitutes market.

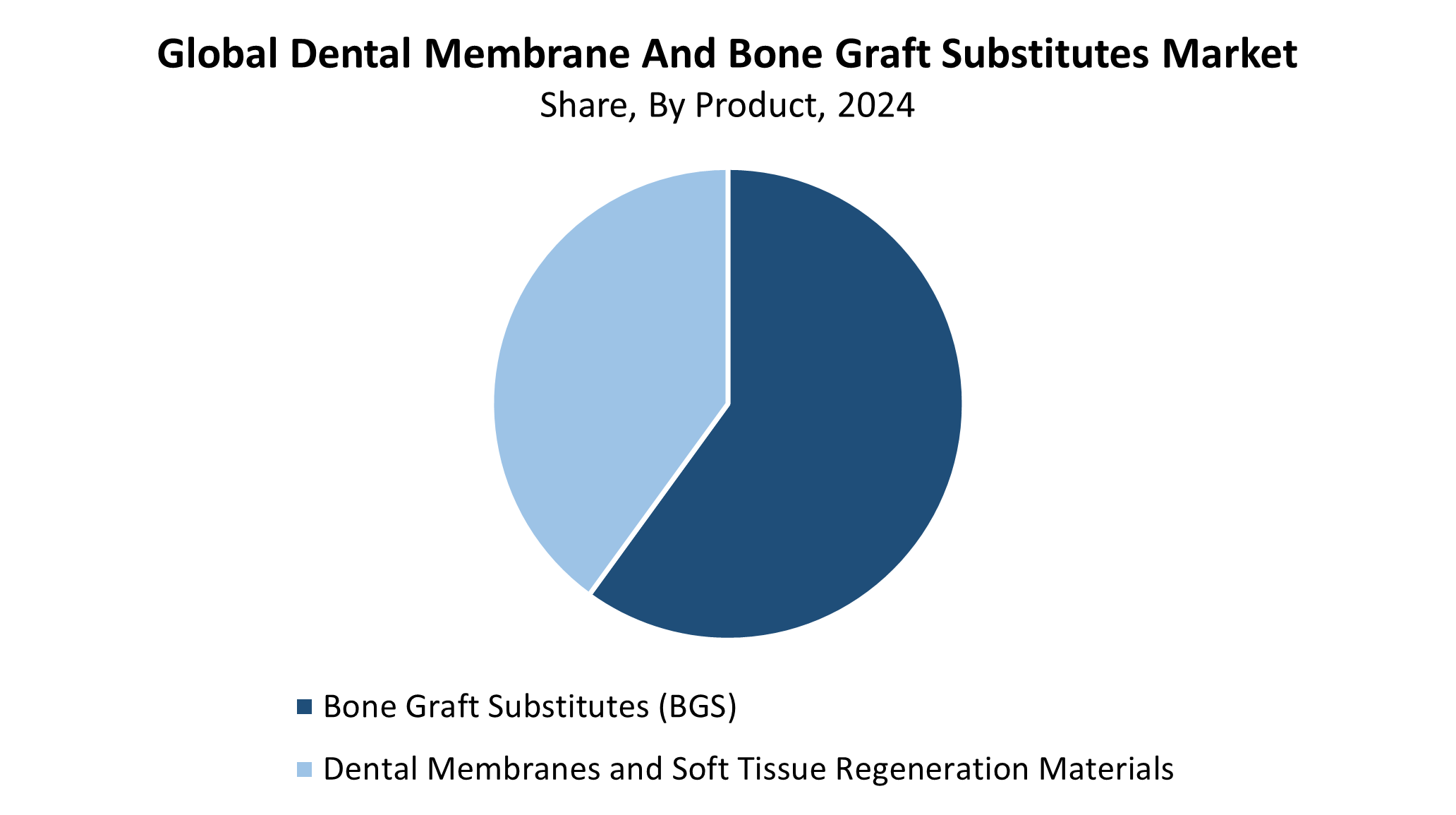

- In 2024, the bone graft substitutes (BGS) segment accounted for the largest revenue share and led the market based on product.

- In 2024, the socket preservation segment had the highest revenue share of 26.84%, leading the market by application.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 1.34 Billion

- 2035 Projected Market Size: USD 3.22 Billion

- CAGR (2025-2035): 8.3%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The Dental Membrane and Bone Graft Substitutes Market operates as the dental biomaterial market which targets products that assist bone healing and regeneration during dental implant procedures and periodontal surgeries, and oral reconstructions. The dental membrane functions as a tissue barrier that protects the graft while guiding tissue development, and bone graft substitutes, which include allografts, xenografts, and synthetic materials, function as materials to rebuild or enhance bone tissue. The expanding market growth stems from increased worldwide dental implant operations, combined with an older demographic, rising periodontal disease prevalence, tooth loss incidents, and increasing dental cosmetic interest. The market growth stems from enhanced dental care availability and rising disposable family incomes, mainly across developing countries.

Technological advancements have enhanced the effectiveness and application of dental membranes and bone graft substitutes. The field has seen developments in bioresorbable membranes along with 3D-printed graft materials and growth factor-enhanced substitutes that stimulate rapid and reliable healing. Government initiatives that enhance oral healthcare infrastructure and boost public health funding and dental research support are driving market expansion. Regulatory bodies from different countries are expediting biomaterial approval systems, which hasten their clinical accessibility. The integrated initiatives will drive higher use rates alongside better patient results, which will expand the worldwide dental membrane and bone graft substitutes market in the upcoming years.

Product Insights

The bone graft substitutes (BGS) segment led the dental membrane and bone graft substitutes market, accounting for the largest revenue share during 2024. Bone graft substitutes gain selection priority among dental professionals because they provide both stimulation for bone regeneration and structural support during implant and periodontal interventions. Market expansion occurred because dental implant operations became more frequent, and patients required better bone augmentation methods with less invasiveness. The adoption of BGS has grown because research into synthetic and biologically active graft materials has enhanced their safety and performance metrics. The market position of this category during 2024 receives assistance from rising awareness among patients and dental experts regarding the benefits of BGS compared to traditional grafts.

The dental membranes and soft tissue regeneration materials segment is anticipated to experience substantial growth during the forecast period. The increasing demand for advanced solutions that deliver efficient guided tissue and bone regeneration during dental procedures drives this growth. The surgical site protection and soft tissue healing promotion make dental membranes essential for both implant integration and periodontal therapy. The clinical outcomes and patient satisfaction levels improve through advancements in collagen-based and bioresorbable membranes, which reduce subsequent surgical interventions. The growing awareness among dental professionals regarding soft tissue regeneration benefits, along with bone grafting, is expected to drive market expansion throughout the upcoming years.

Application Insights

The socket preservation segment led the dental membrane and bone graft substitutes market with the largest revenue share of 26.84% in 2024. Socket preservation represents an essential surgical procedure performed after tooth extraction to maintain alveolar ridge structure and prevent bone deterioration. The procedure creates optimal conditions for the upcoming dental implant placement. The number of tooth extractions has surged because of decay, trauma, and periodontal disease, thus driving up demand for socket preservation strategies. The demand for bone graft substitutes and membranes in dental implant procedures has increased because patients now better understand why bone preservation after extraction matters. Membrane technology and graft material advancements have solidified this category's market position through enhanced clinical outcome delivery.

The sinus lift segment of the dental membrane and bone graft substitutes market is anticipated to grow at the fastest CAGR during the forecast period. The main factor leading to this expansion is the rising demand for dental implants in the posterior maxilla, where sinus augmentation becomes necessary because of insufficient bone structure. Bone graft substitutes, along with membranes, play an essential role in promoting proper bone development at this site while sinus lift procedures create enough mass for implant support. The market has seen increased adoption because of new sinus lift techniques that are less intrusive and the availability of compatible and easy-to-handle graft materials. The rapid and steady growth of the sinus lift industry is projected to continue because implant-based restorations are becoming more popular throughout the world.

Regional Insights

The dental membrane and bone graft substitutes market is dominated by the North America region, with the largest revenue share of 36.52% in 2024. High rates of dental issues, together with the widespread use of dental implants and modern dental facilities across the region, drive its market dominance. The increasing number of older individuals and rising oral health knowledge have driven surgical operations to require dental membranes and bone graft substitutes. The market dominance of this region stems from its strategic market participants as well as strong reimbursement systems and continuous dental biomaterial research and development. Regulatory support and fast adoption of advanced technology have established North America's leading market position.

Europe Dental Membrane And Bone Graft Substitutes Market Trends

The European dental membrane and bone graft substitutes market continues to expand because of the main factors such as the aging European population, increasing periodontal disease prevalence, and rising dental implant requirements. Dental membranes alongside bone graft replacements have seen growing popularity because modern regenerative dentistry techniques and minimally invasive procedures have emerged. Market growth occurs because countries such as Germany, the UK, France, and Italy maintain significant interest in oral health alongside established healthcare networks. Market growth stems from innovative biomaterials combined with dental care support from governments and expanded public knowledge about dental health. The rising number of qualified dentists, along with the expansion of private dental clinics across Europe, leads to increased adoption of regenerative dental solutions.

Asia Pacific Dental Membrane And Bone Graft Substitutes Market Trends

Throughout the forecast period the Asia Pacific dental membrane and bone graft substitutes market will grow at the fastest CAGR. The rapid expansion results from developing nations including China and India and Southeast Asia having better access to modern dental treatment along with rising dental implant surgeries and increasing oral health awareness. Urbanization along with aging populations and rising medical expenses drive the expanding market for bone grafts and dental regenerative materials. The rising number of domestic and international market participants, together with government healthcare infrastructure modernization initiatives, serve as drivers for market growth. The dental tourism industry experiences substantial growth in Asia Pacific because this region acts as its primary growth driver.

Key Dental Membrane And Bone Graft Substitutes Companies:

The following are the leading companies in the dental membrane and bone graft substitutes market. These companies collectively hold the largest market share and dictate industry trends.

- Dentsply Sirona

- Institut Straumann AG

- META BIOMED CO,. LTD

- REGEDENT AG

- Nobel Biocare Services AG (Envista)

- Botiss

- Osteogenics Biomedical (Envista)

- Regenity

- TBR Dental

- BioHorizons

- Curasan, Inc.

- Septodont Holding

- Medtronic

- NovaBone (Halma)

- SigmaGraft Biomaterials

- Others

Recent Developments

- In February 2025, LifeNet Health unveiled OraGen, the first viable oral bone allograft composed of endogenous lineage-committed bone cells and demineralized bone matrix derived from cryopreserved corticocancellous bone.

- In November 2024, RTI Surgical declared that it has successfully completed the purchase of Collagen Solutions, a worldwide provider of collagen tissue and created medical-grade xenograft.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the dental membrane and bone graft substitutes market based on the below-mentioned segments:

Global Dental Membrane And Bone Graft Substitutes Market, By Product

- Bone Graft Substitutes (BGS)

- Dental Membranes and Soft Tissue Regeneration Materials

Global Dental Membrane And Bone Graft Substitutes Market, By Application

- Ridge Augmentation

- Sinus Lift

- Periodontal Defect Regeneration

- Implant Bone Regeneration

- Socket Preservation

- Soft Tissue Regeneration

- Others

Global Dental Membrane And Bone Graft Substitutes Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 235 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |