Global Dental Service Organization Market

Global Dental Service Organization Market Size, Share, and COVID-19 Impact Analysis, By Service (Human Resources, Marketing & Branding, Accounting, Medical Supplies Procurement, Others), By End-use (Dental Surgeons, Endodontists, General dentists, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035

Report Overview

Table of Contents

Dental Service Organization Market Summary

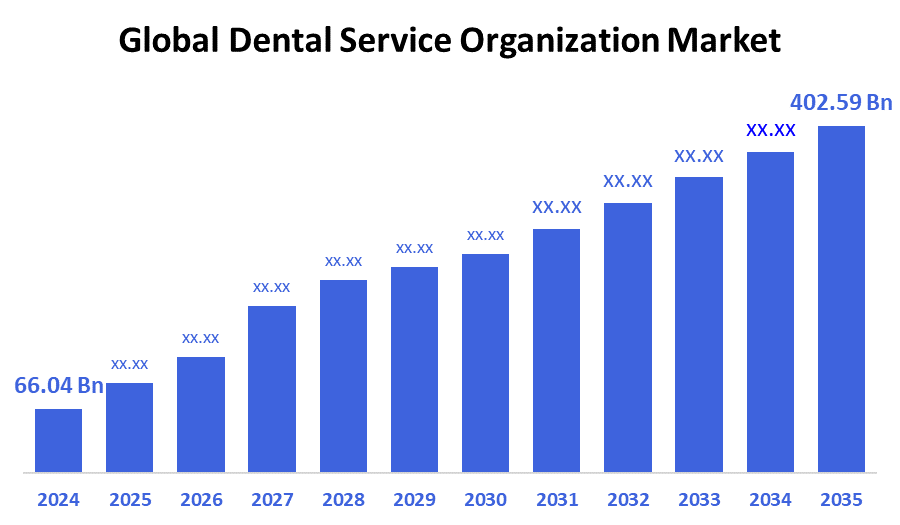

The Global Dental Service Organization Market Size Was Estimated at USD 66.04 Billion in 2024 and is Projected to Reach USD 402.59 Billion by 2035, Growing at a CAGR of 17.86% from 2025 to 2035. The market for dental service organization is expanding as a result of growing demand for dental care, rising dental insurance coverage, greater awareness of oral health issues, the expansion of dental clinics, and the tendency toward outsourcing non-clinical and administrative activities.

Key Regional and Segment-Wise Insights

- In 2024, North America held the largest revenue share of over 41.74% and dominated the market globally.

- In 2024, the medical supplies procurement segment had the highest market share by service.

- In 2024, the general dentists segment had the biggest market share by end use, accounting for 32.53%.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 66.04 Billion

- 2035 Projected Market Size: USD 402.59 Billion

- CAGR (2025-2035): 17.86%

- North America: Largest market in 2024

Dental Service Organizations (DSOs) refer to businesses that supply dental clinics with services, including supply chain management and marketing, along with human resources and administrative support. This organizational framework enables dentists to focus on patient care because it provides efficient operations, together with reduced costs for overhead expenses. The industry experiences growth because more people understand oral health needs, while dental insurance coverage expands and dental care services become more popular. Dental office consolidations and rising demand for affordable management solutions have propelled DSO adoption at a faster pace. The dental market demonstrates growth because of two main factors such as the expanding elderly population and the development of dental tourism services across multiple regions.

The DSO industry experiences a transformative revolution because technology enables better practice administration through digital solutions that include cloud-based software, tele-dentistry, and patient management systems. Advancements in technology enhance both patient interaction and business efficiency. The implementation of government programs supporting oral healthcare access and preventive care alongside public health campaigns leads to increasing dental service usage. The growth of DSOs receives support through reimbursement modifications and regulatory assistance, which simplifies compliance while lowering costs. The worldwide Dental Service Organization market experiences robust expansion and modernization because these multiple elements unite.

Service Insights

The medical supplies procurement segment led the dental service organization (DSO) market with the largest revenue share in 2024. The rising need for practical and cost-effective procurement systems within dental practices serves as the main reason for this segment's market leadership. The acquisition process of essential dental equipment and supplies through DSOs enables dental practices to obtain better prices through volume buying while maintaining dependable product delivery. The rising number of dental clinics within DSOs, together with their increasing dental treatment volume, drives higher demand for medical supply procurement services. The market leader position of this segment grows stronger because of enhanced supply chain management technology combined with centralized procurement systems, which boost operational efficiency.

The dental service organization (DSO) market's human resources segment is anticipated to grow at the fastest CAGR during the upcoming forecast period. The complexity of handling the demands of the dental staff, including hiring, training, compliance, and retention, is what is causing this rise. The successful management of human resources plays an essential role in maintaining operational efficiency, together with quality patient care, when DSOs expand and integrate multiple dental facilities. The rising demand for specialized HR services stems from both talent development initiatives and regulatory compliance requirements, and employee well-being programs. The DSO market places significant attention on this segment while its development accelerates through HR management system technological progress and workforce analytics, and scheduling digital tool usage.

End-use Insights

The general dentists segment dominated the dental service organization (DSO) market with the largest revenue share of 32.53% during 2024. The market leader exists because of high demand for basic dental services, including routine checkups, cleaning, and basic restoration work. The fundamental dental care services exist through general dentists who provide treatment to patients from all age groups. The increasing dental appointment frequency, together with better patient oral health understanding, drives strong revenue generation within this segment. The administrative and operational support from DSOs enables general dentistry clinics to boost productivity while focusing their attention on patient care delivery. The large market demand, combined with service scalability, makes this particular market segment maintain its leading position.

The dental service organization (DSO) market's endodontists segment is anticipated to grow at a significant CAGR during the forecast period. The increasing number of dental diseases, including tooth decay and root canal infections requiring endodontic treatment, drives this market expansion. Patient demand is increasing as a result of growing knowledge of the need of maintaining natural teeth and developments in endodontic technologies, such as rotary tools and enhanced imaging methods. Endodontic practices under DSOs receive centralized administrative support, which enables their endodontists to focus solely on patient care. The market's rapid growth also benefits from increased complex procedure referrals alongside enhanced dentistry specialty financial support.

Regional Insights

The North America dental service organization (DSO) market dominated globally with the largest revenue share of 41.74% in 2024. The established healthcare system, together with advanced dental care knowledge and broad acceptance of DSO business models, drives the region to lead this market. The industry has expanded because dental offices now outsource non-clinical functions such as procurement, administration, and human resources. The dental market experiences major shifts because patient demand for affordable dental care grows alongside increasing dental insurance coverage. The strong market position of North America results from its major DSO players combined with advanced technical systems and supportive regulatory structures. The combination of these factors strengthens North America's dominance across global markets by establishing ideal conditions for DSO expansion.

Asia Pacific Dental Service Organization Market Trends

The Asia Pacific dental service organization (DSO) market is expected to experience a significant CAGR throughout the forecast period. The rapid expansion in this market stems from increasing dental health awareness combined with rising disposable incomes and developing healthcare infrastructure throughout countries such as China, India and Southeast Asia. The surge in dental tourism together with increased demand for premium dental care motivates dental offices to adopt DSO operations for cost reduction and streamlined processes. Government programs focused on oral treatment accessibility together with increasing dental technology investments fuel the industry expansion. The area's industry growth stems from dental clinics joining DSOs for administrative outsourcing so they can dedicate their focus to patient care.

Europe Dental Service Organization Market Trends

The European dental service organization (DSO) market experiences steady growth because people want simplified dental services and oral health education continues to increase. The elderly population together with increased dental disease rates creates a growing need for dental services which drives clinics toward adopting the DSO model to enhance operational efficiency and reduce expenses. The healthcare improvement programs along with dental insurance expansion from government agencies enhance the market expansion. Modern healthcare systems combined with rising dental insurance coverage throughout the region create better access to dental services. Practice management technology together with digital dentistry solutions help DSOs improve their operational processes. The rapid growth of DSO adoption owes itself to dental practice consolidation and strategic investments from major players who are driving Europe toward continued expansion during the forecast period.

Key Dental Service Organization Companies:

The following are the leading companies in the dental service organization (DSO) market. These companies collectively hold the largest market share and dictate industry trends.

- Heartland

- SmileGrove Dental

- Odonto Empresas

- Portman Dental Care

- Colosseum Dental Group

- Colosseum Dental

- European Dental Group (EDG)

- Primary Dental

- Praktikertjanst

- Donte Group

- Sani Dental Group

- Q & M Dental Group

- mydentist

- Dentalpar

- Passion Dental Group

- Dental Beauty Group Ltd.

- Others

Recent Developments

- In May 2025, Philips Oral Healthcare and Dental Care Alliance (DCA) teamed up to expand the prospects for Dental Service Organizations (DSOs). Through this partnership, DCA is able to integrate Philips' cutting-edge dental care products like powered toothbrushes and digital hygiene solutions—into patient care and aftercare initiatives.

- In April 2025, the expansion of Rodeo Dental & Orthodontics' collaboration with Overjet demonstrates how American Dental Service Organizations (DSOs) are utilizing AI to enhance patient care and operational effectiveness. Through improving patient experiences, expediting workflows, and promoting growth and competition in the dentistry sector, this partnership highlights the advantages of digital technologies.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the dental service organization market based on the below-mentioned segments:

Global Dental Service Organization Market, By Service

- Human Resources

- Marketing and Branding

- Accounting

- Medical Supplies Procurement

- Others

Global Dental Service Organization Market, By End Use

- Dental Surgeons

- Endodontists

- General dentists

- Others

Global Dental Service Organization Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 240 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |