Global Dental Sleep Medicine Market

Global Dental Sleep Medicine Market Size, Share, and COVID-19 Impact Analysis, By Diagnostics (Polysomnography and Polygraphy, Oximetry, and Actigraphy), By Treatment (Positive Airway Pressure (PAP) Therapy, Oral and Nasal Devices, Airway Systems, Drugs, Surgery, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

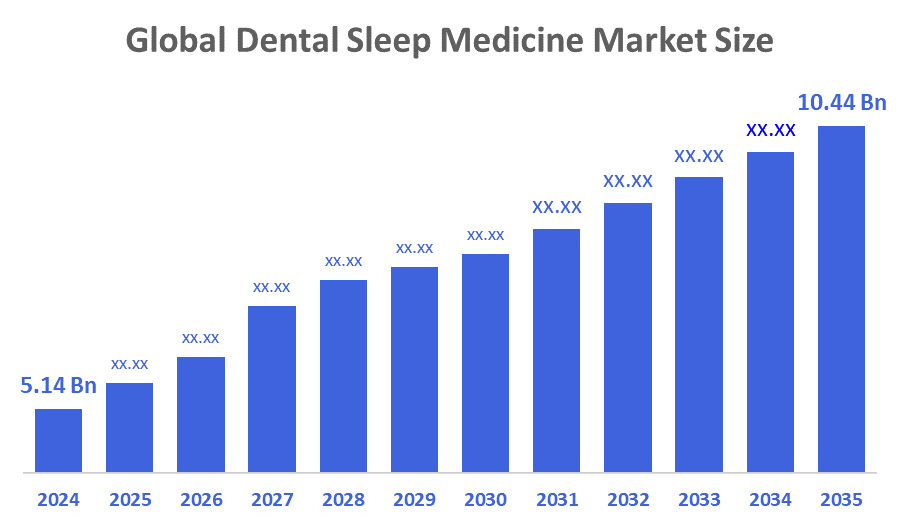

Global Dental Sleep Medicine Market Size Insights Forecasts to 2035

- The Global Dental Sleep Medicine Market Size Was Estimated at USD 5.14 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.65% from 2025 to 2035

- The Worldwide Dental Sleep Medicine Market Size is Expected to Reach USD 10.44 Billion by 2035

- Europe is expected to Grow the fastest during the forecast period.

According to a Research Report Published by Decisions Advisors and Consulting, The Global Dental Sleep Medicine Market Size was worth around USD 5.14 Billion in 2024 and is predicted to Grow to around USD 10.44 Billion by 2035 with a compound annual growth rate (CAGR) of 6.65% from 2025 to 2035. The market for dental sleep medicines is mostly driven by the increased knowledge and understanding of sleep health. Public awareness campaigns concerning the dangers of untreated sleep problems have gained traction. Dental sleep medicine is becoming better understood as a result of medical experts' growing emphasis on the connection between oral health and sleep quality.

Market Overview

The dental sleep medicine market is a sector within healthcare that focuses on the diagnosis, management, and treatment of sleep-related breathing disorders, primarily obstructive sleep apnea (OSA) and snoring. The treatments involved are oral appliance therapy and other dental interventions. This market involves products such as mandibular advancement devices, tongue retaining devices, and customised oral appliances that are designed to keep the airway open during sleep. Growth in this market is largely due to the increasing prevalence of sleep apnea and the growing awareness of non-invasive alternatives to CPAP therapy. Additionally, advancements in precision dental devices that enhance patient compliance and comfort also contribute to market growth. The market is further supported by the expanding insurance coverage, provision of clinical guidelines, and collaboration between dentists, sleep specialists, and medical providers. With an increasing elderly population, higher rates of obesity, and rising demand for personalised treatment options, dental sleep medicine is becoming a major player in the overall sleep health industry. This sector is providing effective, patient, and friendly solutions to make sleep better and improve overall health.

Report Coverage

This research report categorises the dental sleep medicine market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the dental sleep medicine market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the dental sleep medicine market.

Driving Factors

The dental sleep medicine market is going through a significant change, a transformation that is largely attributed to the growing awareness of sleep disorders and their effects on general health. The market in question includes the various therapeutic interventions that may be used to treat the symptoms of sleep disorders, such as oral appliances and continuous positive airway pressure (CPAP) devices. Moreover, technological advancements are enabling manufacturers to come up with innovative solutions that ultimately enhance patient compliance and comfort. Besides technology, the dental sleep medicine market is also being driven by the care paradigm shift towards prevention. Healthcare providers are now more than ever focused on early diagnosis and intervention, which may result in better patient outcomes. The market is getting bigger; it seems that there will be more opportunities for growth to be driven by continuous research and the increasing rate of sleep-related disorders.

Restraining Factors

Patient acceptance is further hampered by high upfront expenses for oral appliances, diagnostic procedures, and variable insurance coverage, particularly in low-income groups. Over moderate to severe cases of sleep apnea go undetected, which limits the market for dental sleep aids. Inconsistent insurance coverage and diagnostic procedures further restrict patient adoption and market expansion.

Market Segmentation

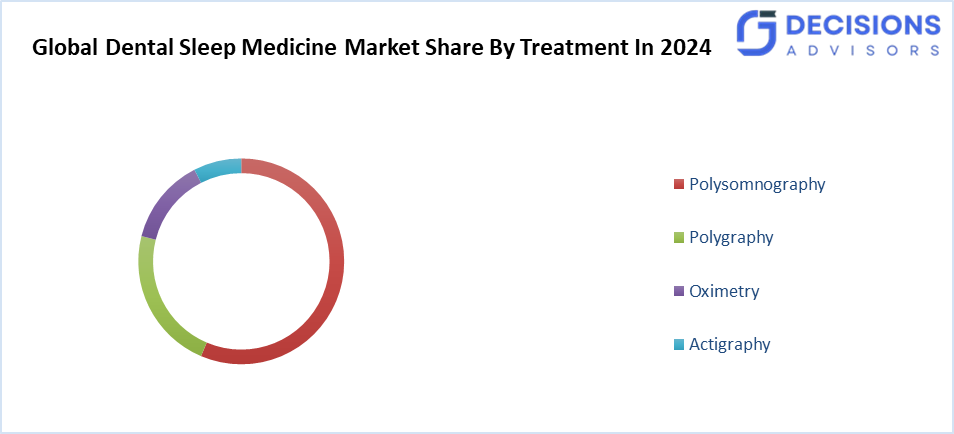

The dental sleep medicine market share is classified into treatment, and diagnostics.

- The polysomnography segment accounted for the largest market share in 2024 and is expected to grow at a substantial CAGR during the forecast period.

Based on the treatment, the dental sleep medicine market is divided into polysomnography, polygraphy, oximetry, and actigraphy. Among these, the polysomnography segment accounted for the largest market share in 2024 and is expected to grow at a substantial CAGR during the forecast period. Polysomnography holds the largest share in the dental sleep medicine market as a diagnostic method. It is the most informative and detailed method for determining sleep patterns and sleep-related issues. Further, to understand sleep disorders, polysomnography records various physiological activities such as EEG, EOG, and EMG; hence, it is the most accurate way of diagnosis.

- The oral and nasal devices segment accounted for the highest market revenue in 2024 and is anticipated to grow at a rapid pace during the forecast period.

Based on the diagnostics, the dental sleep medicine market is segmented into positive airway pressure (PAP) therapy, oral and nasal devices, airway systems, drugs, surgery, and others. Among these, the oral and nasal devices segment accounted for the highest market revenue in 2024 and is anticipated to grow at a rapid pace during the forecast period. Oral and Nasal Devices are becoming increasingly popular, especially among those who want less intrusive options. They serve a demographic that loves the convenience of the device without compromising on the quality of the treatment.

Regional Segment Analysis of the Dental Sleep Medicine Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the dental sleep medicine market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the dental sleep medicine market over the predicted timeframe. The key factors contributing to this regional market growth include rapid urbanisation, increasing awareness, and China's, Japan's, India's, and South Korea's expanding diagnostic capabilities. Additionally, the market penetration is further facilitated by affordability and regional manufacturing capabilities. Japan, with its tech-savvy population, government initiatives, and wide availability of advanced diagnostic tools, is a leading country in the region. While China was the leader in the Asia-Pacific market due to the middle class, smart device adoption and public hospital infrastructure. Further, local manufacturers offering affordable oral appliances and home sleep testing kits are supporting the growth.

Europe is expected to grow at a rapid CAGR in the dental sleep medicine market during the forecast period. The main factors driving the market growth include the rising awareness of obstructive sleep apnea (OSA), the ageing population, and expanded access to PAP therapy. Adoption of OSA treatment is spreading to the major countries due to government-supported healthcare systems and innovation in sleep diagnostics. Growth in the U.K. market is expected to be very dynamic as a result of the rising trend of home sleep testing and early OSA intervention using oral appliances. Additionally, initiatives by both public and private sectors to promote non-invasive therapies are also likely to contribute to this growth. On the other hand, Germany's market size is projected to increase significantly over the next years, due to factors such as integration of digital health, a well-developed sleep labs network, and increased attention to minimally invasive therapy for moderate sleep apnea cases.

Upskilling UK dentists to treat sleep apnoea and snoring is a critical step in expanding access to care, reducing NHS bottlenecks, and offering patients effective alternatives like oral appliance therapy. With initiatives from 32Co, BADSM, and professional training programs, the UK is building a stronger dental sleep medicine ecosystem that integrates dentists into the frontline of sleep disorder management.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the dental sleep medicine market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Apex Dental Sleep Lab

- Braebon Medical Corporation

- Cadwell Industries Inc.

- Compumedics Limited

- Curative, Inc.

- Fisher & Paykel Healthcare Limited

- Henry Schein, Inc.

- Koninklijke Philips N.V.

- Medical Depot, Inc.

- ResMed

- SomnoMed

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In May 2025, Apnimed’s investigational once-daily oral pill, AD109, showed strong Phase 3 results in treating obstructive sleep apnea (OSA), reducing apnea-hypopnea index (AHI) by nearly 50% and improving oxygenation. The company plans to submit a New Drug Application (NDA) to the FDA in early 2026, potentially making AD109 the first oral pharmacotherapy for OSA.

- In September 2022, ProSomnus announced that its precision oral appliance therapy devices, specifically the ProSomnus EVO Sleep and Snore Device, are now reimbursable under Germany’s public health insurance system. This marks a major milestone in expanding access to non-CPAP treatments for obstructive sleep apnea (OSA) patients in Europe.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the dental sleep medicine market based on the below-mentioned segments:

Global Dental Sleep Medicine Market, By Treatment

- Polysomnography

- Polygraphy

- Oximetry

- Actigraphy

Global Dental Sleep Medicine Market, By Diagnostics

- Positive Airway Pressure (PAP) Therapy

- Oral and Nasal Devices

- Airway Systems

- Drugs

- Surgery

- Others

Global Dental Sleep Medicine Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

- What is the current size of the global dental sleep medicine market?

The market was valued at USD 5.14 billion in 2024.

- What is the projected market size by 2035?

It is expected to reach USD 10.44 billion by 2035.

- What is the CAGR for the market from 2025 to 2035?

The compound annual growth rate (CAGR) is 6.65%.

- What drives growth in the dental sleep medicine market?

Key drivers include rising awareness of sleep disorders like OSA, demand for non-invasive treatments, technological advancements in oral appliances, and an ageing population.

- Which diagnostic segment leads the market?

Polysomnography held the largest share in 2024 due to its detailed accuracy in recording sleep patterns.

- Which treatment segment generated the most revenue in 2024?

Oral and nasal devices led, thanks to their convenience and popularity as less invasive alternatives to CPAP.

- Which region will hold the largest market share?

Asia-Pacific is anticipated to dominate, driven by urbanisation, awareness, and manufacturing in countries like China, Japan, and India.

- Which region is expected to grow the fastest?

Europe, fueled by OSA awareness, ageing populations, and innovations in sleep diagnostics and non-invasive therapies.

- What are some recent developments in the market?

In May 2025, Apnimed's AD109 pill showed strong Phase 3 results for OSA treatment, with an FDA submission planned for early 2026.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 278 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |