Global Diabetic Macular Edema (DME) Market

Global Diabetic Macular Edema (DME) Market Size, Share, and COVID-19 Impact Analysis, By Type (Focal Diabetic Macular Edema (DME), Diffuse Diabetic Macular Edema (DME)), By Drug Type (Ranibizumab (Lucentis), Aflibercept (Eylea), Dexamethasone (Ozurdex), Fluocinolone Acetonide (Iluvien), and Other Drugs), By Route of Administration (Intravitreal Injections, Intravitreal Implants, and Others), By Diagnosis (Fluorescein Angiography, Fundus Imaging, Optical Coherence Tomography (OCT), and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Global Diabetic Macular Edema (DME) Market Size Insights Forecasts to 2035

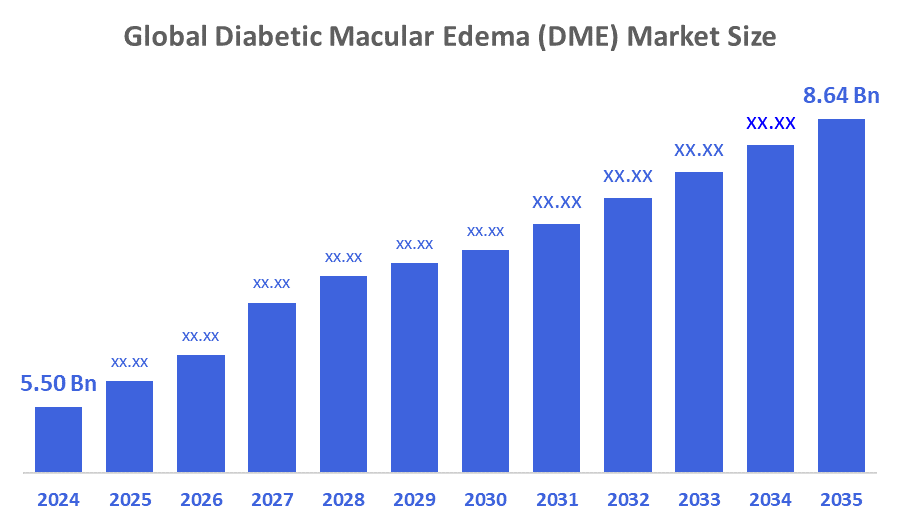

- The Global Diabetic Macular Edema (DME) Market Size Was Estimated at USD 5.50 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.19 % from 2025 to 2035

- The Worldwide Diabetic Macular Edema (DME) Market Size is Expected to Reach USD 8.64 Billion by 2035

- Europe is expected to Grow the fastest during the forecast period.

According to a Research Report Published by Decisioins Advisors and Consulting, The Global Diabetic Macular Edema (DME) Market Size was worth around USD 5.50 Billion in 2024 and is predicted to Grow to around USD 8.64 Billion by 2035 with a compound annual growth rate (CAGR) of 4.19 % from 2025 to 2035. The market for diabetic macular edema continues to grow due to a growing proportion of individuals globally suffering from diabetes and the consequent risk of vision impairment. The need for effective therapy substitutes is being driven by rising awareness of diabetic eye problems and early diagnostic campaigns. Developments in ophthalmic treatments, especially focused medication interventions that treat vascular leakage and retinal edema, have an impact on industry potential.

Market Overview

The worldwide business related to health care, which is dedicated to the diagnosis, treatment, and management of diabetic macular edema (DME), a potentially blinding consequence of Type 2 diabetes caused by fluid buildup in the retina's macula, is commonly referred to as the DME market. It is a dangerous side effect of diabetic retinopathy is diabetic macular edema, which is characterised by fluid buildup in the macula that causes swelling, blurred vision, and possibly blindness. Diabetes primarily affects working-age adults, and it has a major global impact on health and the economy. Implants, pharmaceutical treatments, anti-VEGF intravitreal injections, diagnostic technologies, and chronic illness management solutions are the main focus of the market. Anti-VEGF medications, corticosteroids, and laser photocoagulation are the major treatments. Moreover, to stop macular edema from developing, nonsteroidal anti-inflammatory medications (NSAIDs) in the form of eye drops are occasionally given either before or after cataract surgery.

In May 2025, Therini Bio obtained $39 billion in Series A extension funding to proceed with Phase 1b trials of THN391 for Alzheimer's disease and diabetic macular edema (DME). This investment promotes its fibrin-targeting immunotherapy's clinical development and positions it as a cutting-edge treatment for retinal diseases.

EyePoint Pharmaceuticals extended its funding runway until Q4 2027 to finance Phase 3 studies of DURAVYU for DME and wet AMD by raising $172.5 billion through a stock offering in late 2025. Its DME program was previously strengthened by a capital increase in 2024, and topline data is anticipated in 2026.

Report Coverage

This research report categorises the diabetic macular edema (DME) market based on various segments and regions, forecasts revenue growth, and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the diabetic macular edema (DME) market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the diabetic macular edema (DME) market.

Driving Factors

The key reason behind this is that the increasing incidence of diabetes and diabetic macular edema is driving the market. Besides, diabetic macular edema (DME) is more common in patients with type 2 diabetes than in those with type 1 diabetes. Neovascular age-related macular degeneration (AMD) is thought to impact about 200 billion individuals globally. The industry of ocular medical care is changing swiftly, with an increasing focus on combination therapies that combine anti-VEGF drugs with steroids or lasers to increase effectiveness. Implants and long-acting, sustained-release formulations are being developed to lessen the strain on patients and decrease the frequency of treatments, which influence and knock out the news market opportunities. The use of teleophthalmology and AI for remote monitoring and early detection is growing, enhancing access to treatment in underserved areas, which boosts the market development through a novel way in medical care. Moreover, personalised medicine, which customises treatment plans to each patient's needs for better results, is also driving the industry revenue.

In April 2025, over 800 patients from 119 sites participated in Oculis' Phase 3 DIAMOND-1 and DIAMOND-2 studies for OCS-01 eye drops in DME concluded enrolment. DIAMOND is the first and only pivotal trial program using a topical therapy for diabetic macular edema.

Restraining Factors

The market for diabetic macular edema (DME) is restricted by an array of difficulties, such as high treatment costs, safety concerns with corticosteroid implants, limited patient awareness, and regulatory hurdles that delay the adoption of novel treatments.

Market Segmentation

The diabetic macular edema (DME) market share is classified into type, drug type, route of administration, and diagnosis.

- The diffuse diabetic macular edema (DME) segment accounted for the largest share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

Based on the type, the diabetic macular edema (DME) market is segmented into focal diabetic macular edema (DME), and diffuse diabetic macular edema (DME). Among these, the diffuse diabetic macular edema (DME) segment accounted for the largest share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This is because of the large affected area; it is more common than focal DME and frequently results in more severe visual impairment. It usually needs more intensive therapy than focal DME, and symptoms include faded colour perception, impaired vision, and trouble reading. Widespread swelling and fluid leakage throughout the macula, the core region of the retina that is crucial for crisp vision, are the symptoms of diffuse diabetic macular edema (DME).

- The ranibizumab (Lucentis) segment accounted for the largest share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

Based on the drug type, the diabetic macular edema (DME) market is divided into ranibizumab (Lucentis), aflibercept (Eylea), dexamethasone (Ozurdex), fluocinolone acetonide (Iluvien), and other drugs. Among these, the ranibizumab (Lucentis) segment accounted for the largest share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. This dominance is mostly due to the medication's demonstrated ability to improve visual acuity and reduce retinal swelling in diabetic macular edema patients. Ranibizumab's established safety profile, robust clinical validation, and broad awareness among ophthalmologists all contribute to its high acceptance rate. Its efficacy in combination therapy regimens as well as monotherapy has strengthened its status as the recommended course of treatment.

- The intravitreal injections segment dominated the market in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the route of administration, the diabetic macular edema (DME) market is differentiated into intravitreal injections, intravitreal implants, and others. Among these, the intravitreal injections segment domainted the market in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This segment contributed to market expansion due to its supremacy as the favoured mode of administration. Moreover, the direct administration of therapeutic chemicals to the retina, which allows for quicker and more focused treatment outcomes, has fueled this segment expansion. High bioavailability and decreased systemic exposure are two benefits of intravitreal injections that improve safety and effectiveness. Additionally, patient acceptance has increased due to the established clinical procedures for intravitreal injection and the increasing knowledge of ophthalmologists.

- The optical coherence tomography (OCT) segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the diagnosis, the diabetic macular edema (DME) market is divided into fluorescein angiography, fundus imaging, optical coherence tomography (OCT), and others. Among these, the optical coherence tomography (OCT) segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This is because of its excellent precision and extensive use for early detection and monitoring of diabetic macular edema (DME). OCT is the diagnostic method of choice for physicians because it offers detailed cross-sectional images of the retina. OCT is also the fastest-growing category due to ongoing technology developments, AI integration, and its vital role in remote patient monitoring and customised treatment planning.

Regional Segment Analysis of the Diabetic Macular Edema (DME) Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the diabetic macular edema (DME) market over the predicted timeframe.

North America is projected to hold a substantial share of the diabetic macular edema (DME) market over the predicted timeframe. The main reason for the North America region's leading position is due to its strong healthcare system and significant market participants, and the United States is predicted to lead for the duration of the projection period. The region's ongoing research endeavours additionally support the expansion of the market. Leveraging gene therapy to provide access to better solutions has received a lot of attention.

In October 2025, the FDA officially approved aflibercept-boav (Eydenzelt) as a biosimilar to aflibercept (Eylea) for the treatment of diabetic macular edema (DME), along with other retinal conditions such as neovascular age-related macular degeneration (AMD), macular edema following retinal vein occlusion, and diabetic retinopathy.

In November 2023, Researchers used gene therapy ABBV-RGX-314 to give patients with diabetic macular edema and retinal vascular blockage regulated dexamethasone release. ABBV-RGX-314 is an injectable monoclonal antibody fragment that was created by RegenXBio and AbbVie working together. It delayed the course of the disease and decreased vision-threatening episodes by 89% in a cohort of 100 individuals with DME.

Europe is expected to grow at a rapid CAGR in the diabetic macular edema (DME) market during the forecast period. Diabetic Macular Edema (DME) treatments are seeing strong market expansion in Europe due to research investments and sophisticated healthcare systems; nonetheless, recent reports indicate that funding assistance for DME biotechs is needed. Proactive clinical trials and innovative treatments, bolstered by robust ophthalmology networks and EU-wide approvals for medications, and Germany is the market leader.

In March 2022, the European Commission approved Novartis’ Beovu® (brolucizumab) for the treatment of diabetic macular edema (DME), expanding its use beyond wet age-related macular degeneration. This approval provides patients in Europe with a new anti-VEGF therapy option that offers flexible dosing intervals (up to 12 weeks) and aims to reduce treatment burden while maintaining vision outcomes.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the diabetic macular edema (DME) market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Alimera Sciences Inc

- Arctic Vision

- Allergan Plc

- Bayer AG

- Allergan Plc.

- F. Hoffmann-La Roche Ltd.

- Valeant Pharmaceuticals International, Inc. (Bausch & Lomb Inc.)

- KalVista Pharmaceuticals

- Genentech

- Novartis AG

- Ocugen, Inc

- Regeneron Pharmaceuticals, Inc.

- Clearside Biomedical

- Daiichi Sankyo

- Chugai Pharmaceutical Co., Ltd.

- Oxurion (fka ThromboGenics)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2025, 4D Molecular Therapeutics (4DMT) and Otsuka Pharmaceutical entered a strategic partnership to develop and commercialise 4D-150, a gene therapy for wet age-related macular degeneration (AMD) and diabetic macular edema (DME), across the Asia-Pacific region (including Japan). Otsuka gains exclusive rights in APAC, while 4DMT receives upfront payments, cost-sharing, and milestone-based royalties.

- In July 2025, ANI Pharmaceuticals announced results from the NEW DAY clinical trial of ILUVIEN in diabetic macular edema (DME). The prosecution did not meet its primary endpoint of reducing supplemental aflibercept injections, but secondary and post-hoc analyses showed potential benefits, including extended time to first supplemental injection and reduced injection burden in certain patient subsets.

- In February 2025, the FDA approved Roche’s Susvimo (ranibizumab injection, 100 mg/mL) as the first and only continuous delivery treatment for diabetic macular edema (DME), a leading cause of diabetes-related blindness. This approval means patients may need as few as two treatments per year, offering a major alternative to frequent eye injections.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the diabetic macular edema (DME) market based on the below-mentioned segments:

Global Diabetic Macular Edema (DME) Market, By Type

- Focal Diabetic Macular Edema (DME)

- Diffuse Diabetic Macular Edema (DME)

Global Diabetic Macular Edema (DME) Market, By Drug Type

- Ranibizumab (Lucentis)

- Aflibercept (Eylea)

- Dexamethasone (Ozurdex)

- Fluocinolone Acetonide (Iluvien)

- Other off-label drugs

Global Diabetic Macular Edema (DME) Market, By Route of Administration

- Intravitreal Injections

- Intravitreal Implants

- Others

Global Diabetic Macular Edema (DME) Market, By Diagnosis

- Fluorescein Angiography

- Fundus Imaging

- Optical Coherence Tomography (OCT)

- Others

Global Diabetic Macular Edema (DME) Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

- What is the CAGR of the diabetic macular edema (DME) market over the forecast period?

The global diabetic macular edema (DME) market is projected to expand at a CAGR of 4.19% during the forecast period.

- What is the market size of the diabetic macular edema (DME) market?

The global diabetic macular edema (DME) market size is expected to grow from USD 5.50 billion in 2024 to USD 8.64 billion by 2035, at a CAGR of 4.19 % during the forecast period 2025-2035.

- Which region holds the largest share of the diabetic macular edema (DME) market?

North America is anticipated to hold the largest share of the diabetic macular edema (DME) market over the predicted timeframe.

- What are the main types of DME, and which has the largest share?

The DME market is segmented into focal and diffuse DME. Diffuse DME holds the largest share because it affects a broader area of the macula and often leads to more severe vision impairment, requiring more intensive treatment.?

- What are the leading drugs used for DME treatment?

Ranibizumab (Lucentis) is the leading drug, with the largest market share, due to its proven efficacy, safety, and broad clinical acceptance. Other major drugs include aflibercept (Eylea), dexamethasone (Ozurdex), and fluocinolone acetonide (Iluvien).?

- What is the most common route of administration for DME treatments?

Intravitreal injections are the most common and dominant route, as they allow direct delivery of medication to the retina, offering quick and targeted results with high bioavailability and reduced systemic exposure.?

- Which diagnostic method is most widely used for DME?

Optical coherence tomography (OCT) is the most widely used diagnostic method, valued for its precision and ability to provide detailed cross-sectional images of the retina. OCT is also the fastest-growing segment due to technological advancements and integration with AI.?

- What are the main growth drivers for the DME market?

Key drivers include rising diabetes prevalence, increased awareness of diabetic eye complications, advances in treatment options (such as combination therapies and long-acting implants), and the expansion of teleophthalmology and AI for early detection and remote monitoring.?

- Who are the key players in the DME market?

Major companies include Alimera Sciences, Allergan, Bayer, F. Hoffmann-La Roche, Genentech, Novartis, Regeneron, and Valeant Pharmaceuticals, among others.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 278 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |