Global Drilling Polymers Market

Global Drilling Polymers Market Size, Share, and COVID-19 Impact Analysis, By Technique (DTH Drills, Diamond Drilling, and Top Hammer Drilling), By End-Use (Oil & Gas, Mining, and Construction) and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035

Report Overview

Table of Contents

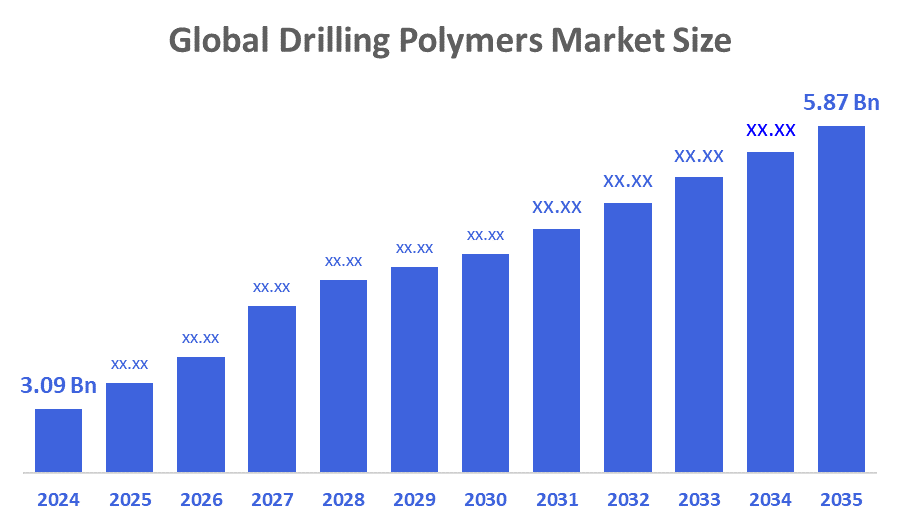

Global Drilling Polymers Market Size Insights Forecasts to 2035

- The Global Drilling Polymers Market Size Was valued at USD 3.09 Billion in 2024

- The Global Drilling Polymers Market Size is Expected to Grow at a CAGR of around 6.01% from 2025 to 2035

- The Worldwide Drilling Polymers Market Size is Expected to Reach USD 5.87 Billion by 2035

- Asia-Pacific is expected to grow the fastest during the forecast period.

According to a research report published by Decisions Advisors and Consulting, The Global Drilling Polymers Market Size Was Worth Around USD 3.09 Billion In 2024 And Is Predicted To Grow To Around USD 5.87 Billion By 2035 With A Compound Annual Growth Rate (CAGR) Of 6.01% From 2025 To 2035. The global drilling polymers market provides future market opportunities through its expansion in emerging markets that experience increased energy exploration activities and through the development of sustainable biodegradable polymer products and through the implementation of digital advanced AI technologies which enhance drilling operations and environmental sustainability.

Market Overview

The Global Drilling Polymers Market Size refers to the worldwide industry which produces and uses polymer-based additives for drilling fluids. These additives are used to improve viscosity, lubrication, and fluid loss control, which results in improved overall drilling efficiency. The oil and gas industry uses these drilling fluids for its operations. Additionally, technological innovations are significantly influencing the Drilling Polymer Market. The introduction of advanced drilling techniques, which include horizontal and directional drilling methods, has transformed the oil and gas extraction industry. The operation of these techniques depends on specialized drilling fluids which use polymers to achieve their maximum efficiency. The market has shifted its focus to high-performance polymers during recent years because these materials improve drilling efficiency while minimizing environmental damage. The need for advanced drilling fluids has increased because drilling operations now use real-time data analytics together with automated systems. The Drilling Polymer Market will experience growth because customers demand drilling solutions that provide better performance and environmentally friendly operations.

Report Coverage

This research report categorizes the drilling polymers market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the drilling polymers market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the drilling polymers market.

Driving Factors

The drilling polymer market receives its main impetus from the exploration activities that target unconventional resources which include shale gas and tight oil. The extraction process for these resources requires the implementation of advanced drilling methods together with specific drilling fluids. The increasing focus on unconventional resources is evident, with estimates suggesting that shale gas production could account for over 50% of total natural gas production by 2030. The industry requires high-performance drilling polymers which can handle the specific difficulties presented by unconventional reservoir operations. The drilling polymer market will expand because exploration activities into new geographic zones will create a greater need for effective drilling fluids.

Restraining Factors

Fluctuating raw material prices increase production costs, disrupt supply chains, and reduce profitability in polymer manufacturing. Price volatility delays purchasing decisions, forcing companies to balance performance and costs while adopting diversified sourcing and advanced production technologies.

Market Segmentation

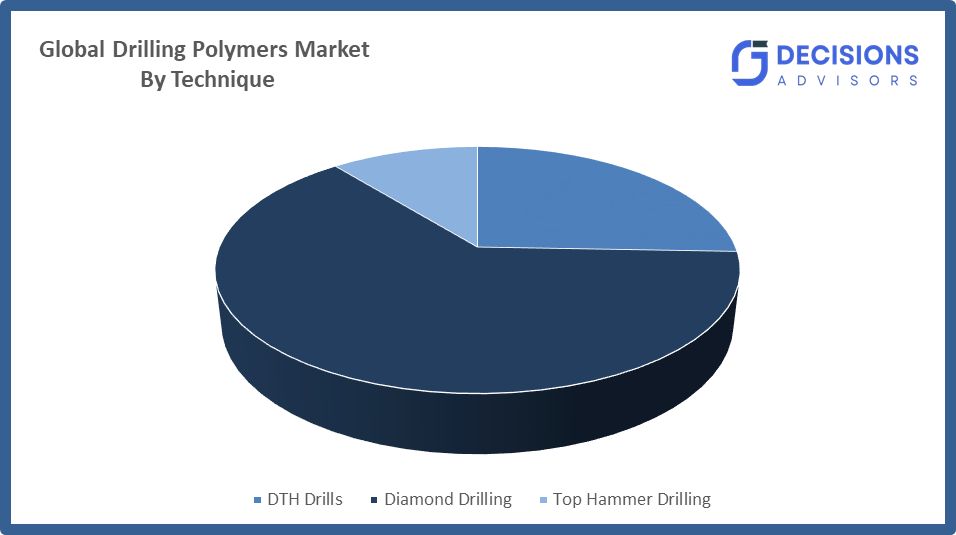

The drilling polymers market share is classified into technique and end-use.

- The diamond drilling segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the technique, the drilling polymers market is divided into DTH drills, diamond drilling, and top hammer drilling. Among these, the diamond drilling segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The method employs diamond drill bits to create cuts and bore holes through solid rock and concrete and additional materials. The drill bits use diamond-impregnated tips which grind through material during their rotational movement to achieve rapid drilling progress. The diamond drilling process uses polymers to enhance both the operational efficiency and effectiveness of the drilling work. The polymers function as viscosifiers while they decrease friction between the drill bit and the rock surface.

- The oil & gas segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end-use, the drilling polymers market is divided into oil & gas, mining, and construction. the oil & gas segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Oil and gas exploration activities have increased due to the rising worldwide demand for oil and gas resources. This has resulted in driving the demand for drilling polymers. According to the Organization of the Petroleum Exporting Countries the oil demand will rise by 17.6 million barrels per day between 2020 and 2045 which will increase from 90.6 million barrels per day in 2020 to 108.2 million barrels per day in 2045.

Regional Segment Analysis of the Drilling Polymers Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the drilling polymers market over the predicted timeframe.

North America is anticipated to hold the largest share of the drilling polymers market over the predicted timeframe. The product market will experience increased demand because oil and gas and mining operations in Canada and Mexico and the United States continue to develop during the forecast period. According to Canada’s Oil and Natural Gas Producers Canada ranks as the fourth-largest oil producer and sixth-largest natural gas producer worldwide while Alberta serves as the top oil and natural gas-producing province which generated 80 percent of Canada’s total oil output in 2021. The product market in the region experiences expansion because all these factors work together to create demand.

Asia-Pacific is expected to grow at a rapid CAGR in the drilling polymers market during the forecast period. The rise in mining and drilling operations throughout China and India and Japan and South Korea led to this increase in production. According to Trade Commissioner Service, China has over 1,500 major mining operations and is the leading producer of cement, coal, gold, aluminum, graphite, iron, steel, zinc, magnesium, and rare earth elements (antimony, tellurium, and other minerals). The country spends approximately USD 200 billion annually on its mine supply and services while producing minerals worth more than USD 400 billion each year.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the drilling polymers market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- SINO MUD

- Baroid Industrial Drilling Products

- Baker Hughes, Inc.

- Halliburton, Inc.

- Chevron Corp.

- Schlumberger Ltd.

- Global Drilling Fluids and Chemicals Ltd.

- Global Envirotech

- Di-Corp

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In 21 January 2026, GeoPark Limited reported that its 2025 oil and gas production had exceeded guidance, launched a polymer injection project to boost recovery, and streamlined its portfolio by divesting non-core assets while it advanced key operations.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the drilling polymers market based on the below-mentioned segments:

Global Drilling Polymers Market, By Technique

- DTH Drills

- Diamond Drilling

- Top Hammer Drilling

Global Drilling Polymers Market, By End-Use

- Oil & Gas

- Mining

- Construction

Global Drilling Polymers Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

- What is the CAGR of the drilling polymers market over the forecast period?

A: The global drilling polymers market is projected to expand at a CAGR of 6.01% during the forecast period.

- What is the market size of the drilling polymers market?

A: The global drilling polymers market size is estimated to grow from USD 3.09 billion in 2024 to USD 5.87 billion by 2035, at a CAGR of 6.01% during the forecast period 2025-2035.

- Which region holds the largest share of the drilling polymers market?

A: North America is anticipated to hold the largest share of the drilling polymers market over the predicted timeframe.

- Who are the top 10 companies operating in the global drilling polymers market?

A: SINO MUD, Baroid Industrial Drilling Products, Baker Hughes, Inc., Halliburton, Inc., Chevron Corp., Schlumberger Ltd., Global Drilling Fluids and Chemicals Ltd., Global Envirotech, Di-Corp, and Others.

- What are the market trends in the drilling polymers market?

A: The drilling polymers market shows three important trends which include rising demand for environmentally friendly biodegradable products and emerging advanced smart polymer technologies and increasing product usage for deepwater and unconventional drilling operations and the application of technology to improve drilling efficiency and maintain environmental compliance throughout operations.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 190 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Feb 2026 |

| Access | Download from this page |