Global Drilling Rig Market

Global Drilling Rig Market Size, Share, and COVID-19 Impact Analysis, By Deployment (Onshore, Offshore), By Type (Jack-ups, Submersible, Drill Ships, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035

Report Overview

Table of Contents

Drilling Rig Market Summary

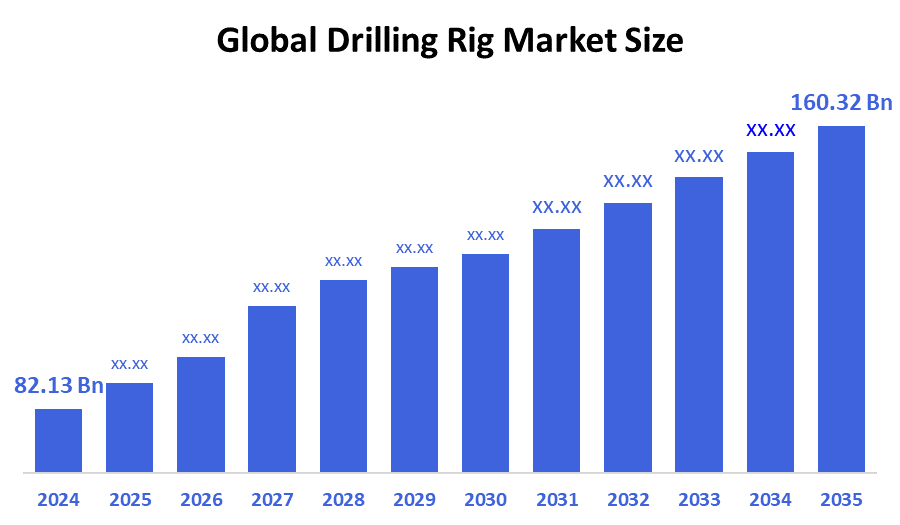

The Global Drilling Rig Market Size Was Estimated at USD 82.13 Billion in 2024 and is Projected to Reach USD 160.32 Billion by 2035, Growing at a CAGR of 6.27% from 2025 to 2035. Increased oil and gas exploration, growing offshore projects, especially in emerging nations and unexplored hydrocarbon reserves, technological developments in drilling equipment, and rising worldwide energy consumption are the main factors propelling the drilling rig market.

Key Regional and Segment-Wise Insights

- In 2024, North America held the greatest revenue share of 37.1%, dominating the drilling rig market worldwide.

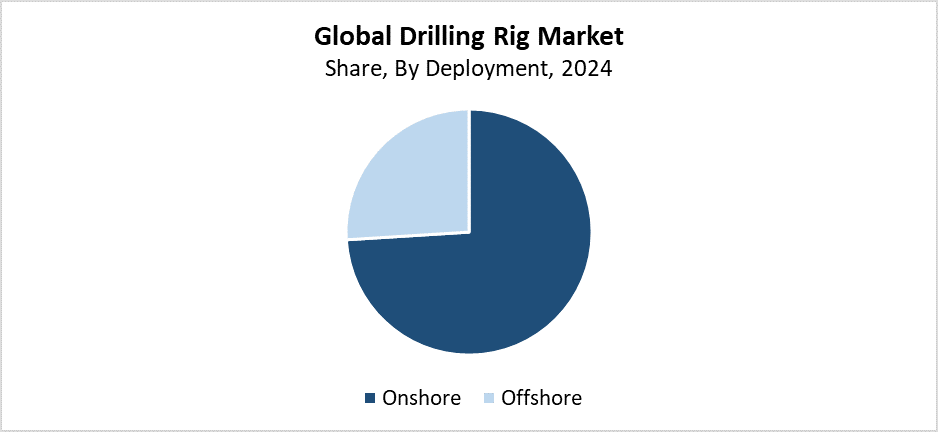

- In 2024, the onshore segment held the biggest revenue share of 74.8%, leading the market by deployment.

- In 2024, the jack-ups segment had the biggest market revenue share and led the market by type.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 82.13 Billion

- 2035 Projected Market Size: USD 160.32 Billion

- CAGR (2025-2035): 6.27%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The global drilling rig market operates as an industry which designs, builds, and operates rigs for gas, oil, and other subterranean resource extraction. The market shows a strong demand for energy worldwide, which drives exploration and production of both onshore and offshore resources. The search for new hydrocarbon reserves, together with increasing natural gas and oil usage in developing countries, creates a need for advanced drilling technology. Market growth has been supported by the rising crude oil prices, which have encouraged fresh investments in upstream oil and gas projects. The market experiences an upward trend because unconventional drilling techniques such as tight oil extraction and shale gas production continue to expand.

The drilling rig industry undergoes major changes because of technological progress. The implementation of automated drilling equipment, remote monitoring systems, and advanced data analytics has led to lower drilling costs and better operational effectiveness, and reduced environmental impact. The domestic energy sector receives support from various governments through investment incentives, exploration permits, and advantageous regulatory frameworks to boost domestic production. National energy security targets, together with strategic partnerships, lead to increased offshore drilling activities in the designated areas. The worldwide drilling rig industry experiences growth through the combined impact of these legislative changes and technological progress.

Deployment Insights

The onshore segment led the global drilling rig market in 2024 by holding the largest revenue share of 74.8%. The main reasons for this dominance are that onshore drilling is easier to access, has lower operating costs, and can mobilise more quickly than offshore ventures. The regions of Asia and the Middle East, and North America, which possess substantial land-based oil reserves, continue their exploration and production activities through onshore drilling rigs. The demand for energy, along with rising tight oil and shale gas investments in China and the United States, has driven up the number of onshore drilling operations. The market has maintained its growth because horizontal drilling technology and fracking methods have achieved better productivity and efficiency for onshore rigs.

The offshore segment of the drilling rig market is expected to grow at the fastest CAGR because deepwater and ultra-deepwater exploration activities keep increasing. Energy companies now focus on offshore basins, which contain large amounts of untapped hydrocarbon resources, because their onshore reserves are running out. The offshore drilling industry has achieved better safety standards and higher operational efficiency, and lower costs through technological progress in rig design and subsea systems, and remote operations. Offshore exploration activities continue to grow in the North Sea, the Gulf of Mexico, and offshore West Africa. Offshore development receives support from favourable licensing rounds and supportive government policies, as well as growing global energy demand. The recovery of oil prices together with international efforts to enhance energy security, supports this development path.

Type Insights

The jack-up segment led the drilling rig market in 2024 by holding the largest revenue share. The preferred choice remains jack-up rigs because they operate in shallow offshore waters up to 150 meters while offering cost-effective and versatile solutions. The units provide excellent performance for offshore exploration and production activities, which require quick deployment in coastal zones. The growing need for offshore oil and gas resources in the Asia Pacific region, together with the Middle East and North Sea, has driven the global expansion of jack-up rig operations. The demand for these products has grown because of technological progress, which enables better operational performance. Safer and more mobile rig operations. The drilling rig market took control of the jack-up sector through its global market dominance in 2024 because all these components worked together.

The drill ships segment of the drilling rig market is expected to grow at the fastest rate throughout the forecast period. The ability of drill ships to manoeuvre and their modern equipment enable them to operate in challenging offshore conditions. This makes them the preferred choice for deepwater and ultra-deepwater exploration. The devices offer greater operational flexibility than fixed rigs and jack-ups because they can explore remote and hard-to-reach locations such as Brazil, West Africa, and the Gulf of Mexico. The energy sector shows increasing interest in drill ships because technological advancements have made operations safer and more efficient through dynamic positioning systems and automated drilling systems. The drill ships segment experiences rapid expansion because deepwater drilling investments continue to rise since onshore and shallow water reserves keep running out, and worldwide gas and oil demand keeps increasing.

Regional Insights

North America held the largest revenue share of 37.1% and led the global drilling rig market during 2024. The exploration activities for oil and gas in the United States and Canada served as the main factor behind this market dominance. The region experienced a major expansion of drilling operations because of its large shale deposits and the development of horizontal drilling and hydraulic fracturing methods. The market expanded because of government support through regulations and major energy companies increasing their investments, and continued efforts to find unconventional oil and gas deposits. North America maintained its position as the global leader in the drilling rig industry because the region possessed both established infrastructure and skilled personnel who managed to operate rigs successfully. The pattern will persist because energy consumption shows an increasing trend.

Europe Drilling Rig Market Trends

The European drilling rig market experienced steady growth throughout 2024 because companies increased their offshore oil and gas exploration activities in the North Sea and Mediterranean regions. The United Kingdom, Norway, and the Netherlands used government programs which enhanced their energy security to become the main drivers of increased regional energy demand. The need for oil and gas exploration remained vital to meet immediate energy requirements because renewable energy adoption continued to grow rapidly. The market experienced growth because of technological developments, which improved the ability to perform deepwater and ultra-deepwater drilling operations. Europe wants to reduce its dependence on imported energy. So it has become more interested in domestic production, which leads to steady but small growth in the drilling rig industry across the continent.

Asia Pacific Drilling Rig Market Trends

The drilling rig market in the Asia Pacific is anticipated to grow at the fastest CAGR throughout the forecasted period because of rising energy needs and quick industrial growth, and expanding oil and gas exploration activities. The countries of China, India, Indonesia, and Australia have started exploring new energy sources to reduce their dependence on imports while strengthening their domestic energy supply. The South China Sea and Southeast Asia have witnessed a major rise in offshore drilling operations. The government supports advanced drilling technology through its programs and policies. These help increase domestic energy production. The region's market growth will continue at a steady pace because of its untapped hydrocarbon resources and rising demand for energy infrastructure during the next few years.

Key Drilling Rig Companies:

The following are the leading companies in the drilling rig market. These companies collectively hold the largest market share and dictate industry trends.

- Nabors Industries Ltd.

- Baker Hughes

- Schlumberger NV (SLB)

- Transocean Ltd.

- Noble Corporation

- China Oilfield Services Ltd. (COSL)

- Valaris Limited

- SAIPEM SpA

- Seadrill Limited

- ADNOC Drilling

- Others

Recent Developments

- In August 2025, Clean Rig Power introduced a battery-powered well servicing rig that reduces noise, fuel expenses, and pollution in comparison to conventional diesel rigs. The rig has supplemental battery packs and several charging options, including a grid connection and on-site recharging, which allow it to operate for more than a full shift on a single charge. It is presently undergoing prototype assembly and testing, and operators in the Permian Basin, as well as areas with stringent emissions restrictions like California and Colorado, as well as international markets, are very interested. Crews can work more effectively and safely because of the design's emphasis on safety and silent operation. Additionally, Clean Rig intends to license its patented technology, and manufacturing and assembly will be located in McGregor, Texas.

- In September 2024, Komatsu introduced its new Z3 line of medium-sized class underground hard rock mining equipment, which includes the ZB31 bolter and ZJ32 drill. The Z3 line, which is based on an all-purpose modular platform, prioritises productivity through efficiency, simpler maintenance, and interchangeable parts. The machines include cutting-edge technology like a ground support system that was co-developed with JENNMAR, as well as drilling attachments made for more efficient operation and less downtime, and simpler operator controls. Future models will facilitate the transition to autonomous underground mining by coming with sophisticated machine control and battery-powered versions.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the drilling rig market based on the below-mentioned segments:

Global Drilling Rig Market, By Deployment

- Onshore

- Offshore

Global Drilling Rig Market, By Type

- Jack-ups

- Submersible

- Drill ships

- Others

Global Drilling Rig Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 245 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |