Global Drone Pipeline Inspection Market

Global Drone Pipeline Inspection Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Drone Type (Fixed Wing, Rotary Wing, and Hybrid), By Payload Type (Visual Inspection Cameras, Thermal Imaging Cameras, LiDAR Sensors, Acoustic Sensors, Gas Detectors, and Laser Scanners), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 ? 2035

Report Overview

Table of Contents

Drone Pipeline Inspection Market Size Summary, Size & Emerging Trends

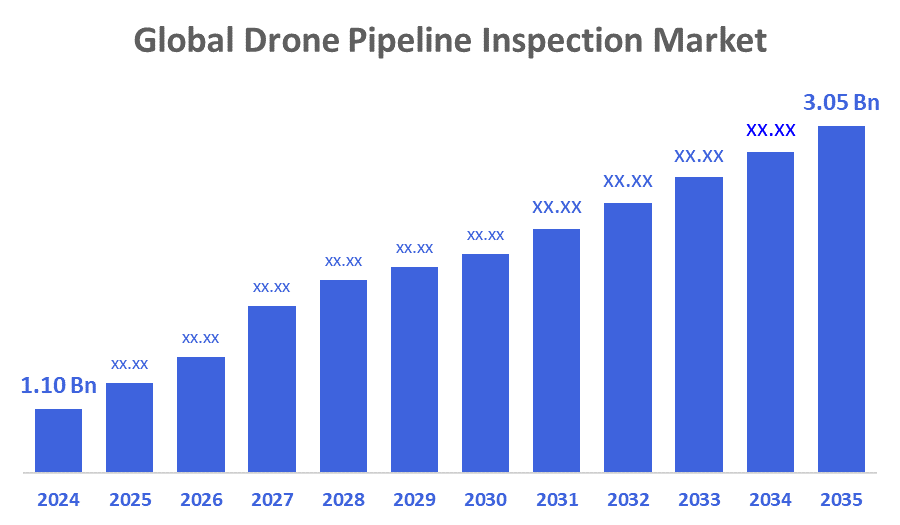

According to Decisions Advisors, The Global Drone Pipeline Inspection Market Size is expected to Grow from USD 1.10 Billion in 2024 to USD 3.05 Billion by 2035, at a CAGR of 9.2% during the forecast period 2025-2035. The increasing need for efficient and cost-effective pipeline monitoring solutions driven by safety regulations, environmental concerns, and the rise of smart infrastructure is a key factor propelling market growth.

Key Market Insights

- North America is projected to hold the largest market share in the drone pipeline inspection market during the forecast period.

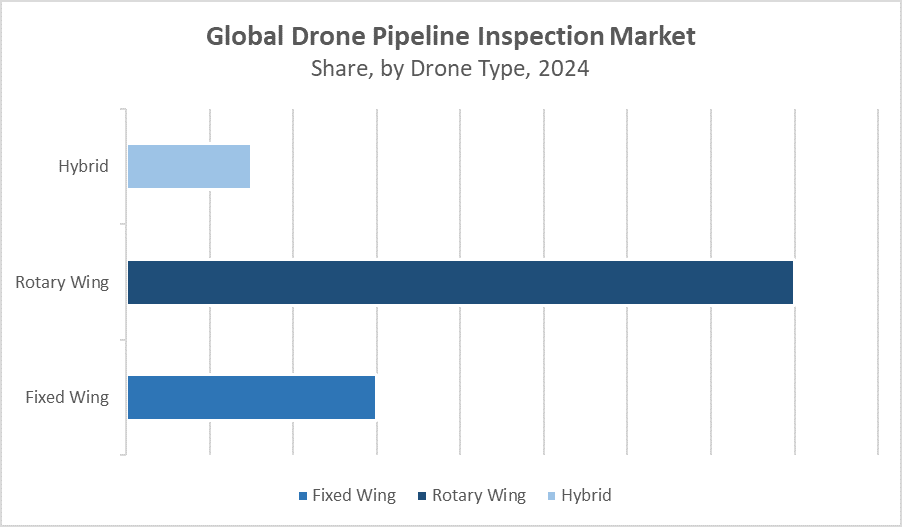

- Among drone types, rotary wing drones dominated the market share in 2024 due to their versatility and maneuverability in complex pipeline environments.

- Visual inspection cameras accounted for the largest payload segment revenue share globally, owing to their widespread adoption and cost-effectiveness.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 1.10 Billion

- 2035 Projected Market Size: USD 3.05 Billion

- CAGR (2025-2035): 9.2%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Drone Pipeline Inspection Market

The drone pipeline inspection market focuses on the use of advanced unmanned aerial vehicles (drones) equipped with specialized sensors and cameras to monitor and maintain pipelines. These drones offer real-time data on pipeline conditions, enabling quick detection of leaks, corrosion, and other defects, which is more efficient than traditional inspection methods. The growing adoption of automation in the oil & gas, water, and gas utility sectors is driven by the need to reduce operational costs and improve worker safety. Continuous technological improvements in drone design and sensor payloads are expanding their capabilities and applications, fueling market growth globally by making pipeline inspection faster, safer, and more cost-effective.

Drone Pipeline Inspection Market Trends

- Growing adoption of rotary wing drones for their operational flexibility and endurance.

- Integration of AI and machine learning algorithms for predictive maintenance and anomaly detection.

- Expansion of cloud-based data analytics platforms to enhance real-time monitoring capabilities.

Drone Pipeline Inspection Market Dynamics

Driving Factors: Rising emphasis on pipeline safety and regulatory compliance

Increasing pipeline failures and leaks worldwide have heightened the focus on pipeline safety. Governments and industry bodies are enforcing stricter regulations, compelling companies to adopt advanced inspection solutions. Drones offer a cost-effective, quicker, and safer alternative to manual inspections, reducing the risk to human workers and enabling early detection of damages or leaks. As pipeline networks grow more complex and spread across difficult terrains, drones’ ability to cover large areas efficiently is pushing their widespread adoption in oil & gas, water, and gas utilities sectors.

Restrain Factors: Technical limitations and high initial investment

Despite their advantages, drones still face key limitations. Limited battery life restricts their flight time, especially over long pipeline routes. Payload capacity constraints affect the variety and quality of sensors that can be used. Harsh weather conditions like strong winds or rain can hinder drone operations. Additionally, the upfront costs for acquiring sophisticated drones with advanced sensors and integration technologies are high, particularly for small and medium-sized enterprises. These factors limit rapid adoption and expansion of drone pipeline inspection solutions.

Opportunity: Growing integration of AI and sensor technologies

Emerging AI-powered data analytics and integration of multiple sensor types (thermal, visual, LiDAR, etc.) are enhancing drone inspection capabilities. AI enables real-time anomaly detection, predictive maintenance, and automated reporting, improving accuracy while saving time and costs. The ability to combine data from various sensors delivers a comprehensive assessment of pipeline conditions. Increasing collaboration between drone manufacturers and software firms is driving innovation, creating new market opportunities for smarter, more efficient pipeline inspection solutions globally.

Challenges: Regulatory hurdles and data security concerns

Stringent regulations on drone flights, particularly around sensitive infrastructure or populated areas, pose operational challenges. Obtaining flight permissions and navigating airspace restrictions can delay deployments. Additionally, drones collect vast amounts of sensitive data, raising concerns about data privacy, cybersecurity, and unauthorized access. Market players must address these risks through robust data protection measures, encryption, and compliance with privacy laws to build trust and ensure the secure handling of inspection information. These challenges can slow adoption and require ongoing coordination with regulators.

Global Drone Pipeline Inspection Market Ecosystem Analysis

The global drone pipeline inspection market ecosystem includes drone manufacturers, sensor technology providers, pipeline operators, data analytics companies, and regulatory authorities. Collaboration among these stakeholders fosters technological innovation, ensures compliance with safety standards, and promotes market expansion. Continuous R&D investments improve drone capabilities and sensor accuracy, while regulatory frameworks evolve to accommodate drone operations safely and efficiently.

Global Drone Pipeline Inspection Market, By Drone Type

Rotary wing drones led the drone pipeline inspection market in 2024, capturing about 55% of the revenue share. Their dominance is mainly due to their ability to hover in place and maneuver through complex and confined environments, which is essential for detailed inspections. This flexibility allows operators to closely examine pipeline sections, especially in challenging terrains like mountainous or densely vegetated areas. The versatility of rotary wing drones makes them the preferred choice for many inspection tasks that require precision and stability.

Fixed wing drones accounted for roughly 30% of the market revenue in 2024. They are favored for their longer flight endurance and capability to cover extensive distances efficiently, making them ideal for monitoring long stretches of pipelines. Their design enables faster speeds and greater range compared to rotary wing drones, though they cannot hover, limiting their effectiveness in detailed inspections. Fixed wing drones are commonly used for broad surveillance and mapping tasks in pipeline inspection.

Global Drone Pipeline Inspection Market, By Payload Type

Visual inspection cameras held the largest share in the drone pipeline inspection market, accounting for approximately 40%. Their popularity stems from being cost-effective and easy to operate, making them a go-to choice for routine pipeline monitoring. These cameras provide high-resolution images and videos, allowing operators to visually detect surface defects, corrosion, and physical damages along pipelines. Their straightforward functionality and affordability make them widely adopted across industries, especially where quick and frequent inspections are needed without extensive technical setup.

Thermal imaging cameras closely follow in market share due to their specialized use in detecting temperature variations along pipelines. These cameras identify heat anomalies that may indicate leaks, blockages, or equipment malfunctions by capturing infrared radiation. Thermal imaging is particularly valuable for early leak detection in oil and gas pipelines, as temperature changes often precede visible damage. Despite being more expensive than visual cameras, their ability to uncover hidden issues makes them essential for preventive maintenance and safety assurance.

North America led the global drone pipeline inspection market in 2024, accounting for approximately 38% of the total revenue,

driven by advanced pipeline infrastructure, stringent regulatory requirements, and early adoption of drone and sensor technologies. The United States and Canada continue to invest heavily in digital monitoring solutions to ensure pipeline safety and environmental compliance. High awareness of operational efficiency, coupled with a mature oil & gas sector, supports strong market demand for drone-based inspections in the region.

Asia Pacific is the fastest-growing region in the drone pipeline inspection market, projected to register a CAGR of around 10.1% during the forecast period.

Rapid industrialization and expanding infrastructure projects in countries like China, India, and Australia are fueling demand for advanced inspection methods. With increasing energy consumption and growing awareness of pipeline safety, regional governments and private operators are turning to drones for efficient, cost-effective monitoring. The region's untapped potential and supportive government initiatives make it a key growth area.

Europe holds a significant share of the drone pipeline inspection market,

supported by well-established pipeline infrastructure and a strong focus on environmental safety. Countries such as Germany, the UK, and Norway are investing in smart monitoring systems and drone technologies to maintain aging pipelines and meet strict EU safety standards. The region’s emphasis on digital transformation in energy and utility sectors, along with proactive regulatory frameworks, is boosting the adoption of drones for efficient pipeline inspection and maintenance.

WORLDWIDE TOP KEY PLAYERS IN THE DRONE PIPELINE INSPECTION MARKET INCLUDE

- DJI Innovations

- AeroVironment, Inc.

- Parrot SA

- Delair

- Teledyne FLIR

- senseFly

- Kespry, Inc.

- FLIR Systems, Inc.

- Intel Corporation

- Lockheed Martin Corporation

- Others

Product Launches in Drone Pipeline Inspection Market

- In March 2025, DJI Innovations launched an advanced rotary wing drone equipped with AI-enabled thermal imaging and LiDAR sensors, targeting pipeline operators in North America. The product offers enhanced real-time monitoring and predictive maintenance capabilities, boosting operational efficiency and safety.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the drone pipeline inspection market based on the below-mentioned segments:

Global Drone Pipeline Inspection Market, By Drone Type

- Fixed Wing

- Rotary Wing

- Hybrid

Global Drone Pipeline Inspection Market, By Payload Type

- Visual Inspection Cameras

- Thermal Imaging Cameras

- LiDAR Sensors

- Acoustic Sensors

- Gas Detectors

- Laser Scanners

Global Drone Pipeline Inspection Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 180 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |