Global Drug Reference Apps Market

Global Drug Reference Apps Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Pricing Model (Freemium (Free) and Paid (Subscription)), By Device (Smartphones and Tablets), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Drug Reference Apps Market Summary, Size & Emerging Trends

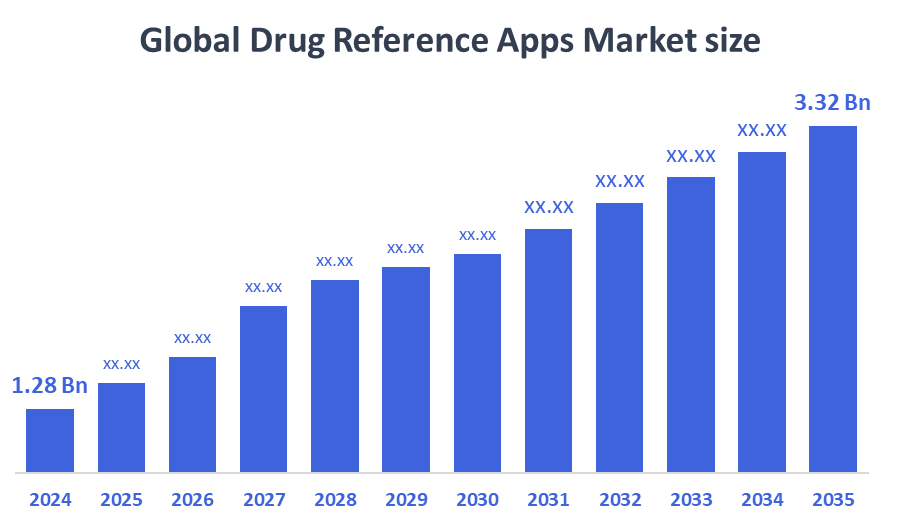

According to Decision Advisor, The Global Drug Reference Apps Market Size is Expected to Grow from USD 1.28 Billion in 2024 to USD 3.32 Billion by 2035, at a CAGR of 9.05% during the forecast period 2025-2035. Growing smartphone penetration and rising demand for easy access to drug information among healthcare professionals and patients are key driving factors for the drug reference apps market.

Key Market Insights

- Smartphones are expected to account for the largest share in the drug reference apps market during the forecast period.

- In terms of pricing model, the freemium (Free) segment dominated in terms of revenue during the forecast period.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 1.28 Billion

- 2035 Projected Market Size: USD 3.32 Billion

- CAGR (2025-2035): 9.05%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Drug Reference Apps Market

The drug reference apps market focuses on mobile applications that provide detailed and accurate drug-related information to healthcare professionals and consumers. These apps offer features such as drug identification, dosage guidelines, drug interactions, and adverse effects, improving medication safety and patient care. The increasing adoption of smartphones and tablets, coupled with the need for instant access to drug data, is propelling market growth. Governments and healthcare organizations support the market by promoting digital healthcare solutions, encouraging the adoption of mobile health applications for better patient management and informed clinical decisions. The shift towards telemedicine and remote healthcare further amplifies the demand for drug reference apps globally.

Drug Reference Apps Market Trends

- Increasing integration of AI and machine learning for personalized drug recommendations and alerts.

- Growing demand for offline access and multilingual support in drug reference apps.

- Expansion of subscription-based models offering premium content and features.

Drug Reference Apps Market Dynamics

Driving Factors: Increasing adoption of smartphones globally

The increasing adoption of smartphones globally enables easy access to drug reference apps, while healthcare professionals are becoming more aware of digital tools for better drug management. The rising prevalence of chronic diseases demands accurate and timely medication information to improve patient outcomes. Additionally, the rapid growth of telemedicine services supports the need for reliable digital drug references. Governments and regulators promoting digital health applications further accelerate market expansion by encouraging innovation and adoption in healthcare.

Restrain Factors: Data privacy concerns are significant

Data privacy concerns are significant, as users worry about sensitive health information security on these apps. Many remote or underserved regions suffer from poor internet connectivity, limiting app accessibility. Moreover, the availability of free online drug information alternatives reduces the incentive to pay for premium apps. Regulatory barriers in approving drug reference applications and differences in drug formularies between regions complicate standardization, restricting broader market penetration and user trust in some areas.

Opportunity: Expanding digital literacy and smartphone penetration

Advances in technology, particularly AI integration, allow apps to offer personalized drug recommendations and alerts, enhancing user experience and safety. Expanding digital literacy and smartphone penetration in emerging markets create vast untapped user bases. Investments in healthcare infrastructure and government initiatives to digitize health services open doors for app developers to collaborate and innovate. These factors collectively provide a fertile ground for the drug reference apps market to grow significantly over the forecast period.

Challenges: Developing advanced features like AI-driven

The market faces challenges due to fragmented regulatory frameworks across countries, which complicate app approvals and compliance. Developing advanced features like AI-driven alerts requires substantial investment, raising entry barriers for smaller players. Building and maintaining user trust is crucial amid concerns over data security and privacy. Balancing innovation with compliance and safeguarding sensitive health information remains a critical hurdle for market players aiming for sustainable growth.

Global Drug Reference Apps Market Ecosystem Analysis

The global drug reference apps ecosystem comprises app developers, pharmaceutical companies, healthcare providers, and regulatory bodies. Developers continuously improve app functionalities by integrating extensive clinical databases and advanced tools to meet user needs. Collaborations with hospitals and clinics help expand market reach and enhance real-world application. Ensuring strict data privacy compliance and maintaining up-to-date, accurate content are essential for building user trust and securing regulatory approvals, which are critical for sustained growth and credibility in this competitive market.

Global Drug Reference Apps Market, By Pricing Model

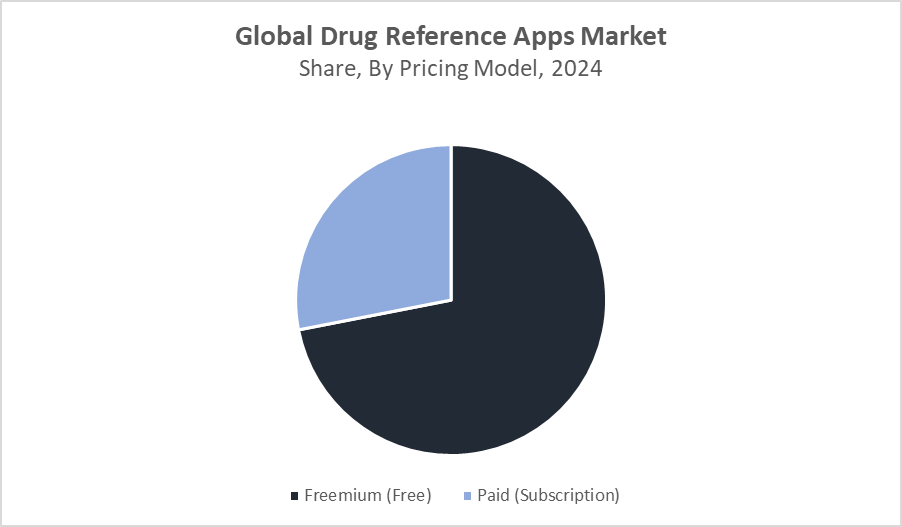

The freemium (Free) segment leads the global market, capturing about 55% of the market share throughout the forecast period. This model offers free access to basic drug information, which encourages widespread use among medical students, healthcare professionals, and patients who need quick and reliable drug details on the go. The freemium apps often generate revenue through in-app purchases or advertisements, unlocking premium features like drug interaction alerts, offline access, and personalized medication reminders. This balance of free access and optional upgrades makes the freemium model highly popular and accessible.

The paid (subscription) segment accounts for roughly 45% of the market share. This segment is mainly driven by institutional users such as hospitals, clinics, and pharmacies and healthcare professionals who require access to more comprehensive and verified drug databases, along with advanced clinical tools. Subscription-based apps provide enhanced features like dosage calculators, real-time drug recall notifications, and seamless integration with electronic health records (EHRs). These features make the paid model especially appealing to institutions focused on accuracy, reliability, and regulatory compliance in patient care.

Global Drug Reference Apps Market, By Device

The smartphones segment dominates the global market with approximately 70% market share during the forecast period. This dominance reflects the widespread use and convenience of smartphones, allowing healthcare professionals and patients to access drug information anytime and anywhere. Smartphone apps offer real-time updates, push notifications, and integration with telemedicine platforms, making them highly suitable for fast-paced medical environments and on-the-go users.

The tablets segment holds around 30% of the market share. Tablets are preferred in clinical and institutional settings due to their larger screens, which make it easier to read detailed drug information and interact with app features. Tablets are commonly used in hospitals, pharmacies, and educational environments, supporting collaborative care and patient counseling with enhanced visual clarity and user experience.

North America held the largest share of the drug reference apps market in 2024, accounting for approximately 38% of the global market.

This strong position is supported by a well-established healthcare IT infrastructure, widespread smartphone penetration, and robust digital health initiatives. The U.S. leads the region, driven by major app developers and healthcare institutions that are heavily investing in medication safety and digital transformation efforts. These factors combine to create a favorable environment for the adoption and growth of drug reference applications.

Asia Pacific is the fastest-growing region, with a projected CAGR of 14% during the forecast period.

This rapid growth is fueled by increasing smartphone adoption, accelerated healthcare digitization, and proactive government programs in countries such as India, China, and Japan. These initiatives are focused on expanding e-health solutions, making drug reference apps more accessible and widely used across the region’s diverse healthcare markets.

WORLDWIDE TOP KEY PLAYERS IN THE DRUG REFERENCE APPS MARKET INCLUDE

- Medscape

- Epocrates

- Drugs.com

- Micromedex

- MedInfo Technologies

- Cerner Corporation

- IBM Watson Health

- PharmaSoft Solutions

- Elsevier (ClinicalKey)

- Wolters Kluwer

- Others

Product Launches in Drug Reference Apps Market

- In August 2024, MedInfo Technologies launched a freemium drug reference app that incorporates AI-powered drug interaction alerts and personalized medication scheduling features. This app quickly gained traction, attracting over 1 million downloads within its first quarter. The combination of free access and advanced AI functionalities helped it stand out in the competitive market, appealing to a broad user base including patients and healthcare professionals.

- In March 2023, PharmaSoft Solutions released a subscription-based app designed for hospital networks across North America and Europe. This app integrates with electronic health records (EHR) to provide real-time drug updates and advanced tools such as dosage calculators. Targeting institutional users, the app supports improved medication management and compliance, aligning with healthcare providers’ needs for reliable, comprehensive drug information.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisor has segmented the drug reference apps market based on the below-mentioned segments:

Global Drug Reference Apps Market, By Pricing Model

- Freemium (Free)

- Paid (Subscription)

Global Drug Reference Apps Market, By Device

- Smartphones

- Tablets

Global Drug Reference Apps Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

FAQs

Q: Which pricing model dominates the Global Drug Reference Apps Market?

A: The freemium (free) pricing model dominates the market, accounting for about 55% of the market share during the forecast period.

Q: Which device segment holds the largest share in the Global Drug Reference Apps Market?

A: Smartphones dominate the market with approximately 70% share due to their widespread use and convenience.

Q: Which region held the largest share of the Global Drug Reference Apps Market in 2024?

A: North America held the largest market share in 2024, accounting for about 38% of the global market.

Q: Which region is expected to witness the fastest growth in the Global Drug Reference Apps Market?

A: Asia Pacific is expected to grow the fastest, with a projected CAGR of 14% during the forecast period.

Q: Who are the top key players operating in the Global Drug Reference Apps Market?

A: Key players include Medscape, Epocrates, Drugs.com, Micromedex, MedInfo Technologies, Cerner Corporation, IBM Watson Health, PharmaSoft Solutions, Elsevier (ClinicalKey), and Wolters Kluwer.

Q: What are the main drivers of growth in the Global Drug Reference Apps Market?

A: Growing smartphone penetration, rising demand for easy access to drug information, increased adoption of telemedicine, and government initiatives promoting digital healthcare are key growth drivers.

Q: What are the major challenges facing the Global Drug Reference Apps Market?

A: Data privacy concerns, poor internet connectivity in remote areas, regulatory barriers, and availability of free online drug information alternatives limit market growth.

Q: What trends are emerging in the Global Drug Reference Apps Market?

A: Increasing integration of AI and machine learning for personalized drug recommendations, demand for offline access and multilingual support, and expansion of subscription-based premium content are key trends.

Q: What opportunities exist in the Global Drug Reference Apps Market?

A: Expanding digital literacy and smartphone penetration in emerging markets, technological advancements like AI integration, and government initiatives to digitize healthcare services offer significant growth opportunities.

Q: What are the main application segments in the Global Drug Reference Apps Market by pricing model?

A: The market is segmented into freemium (free) apps popular among individual users and paid (subscription) apps favored by institutional users like hospitals and clinics.

Q: How do smartphones and tablets compare in their use for drug reference apps?

A: Smartphones dominate due to portability and real-time update capabilities, while tablets are preferred in clinical settings for their larger screens and ease of use in collaborative care.

Q: What recent product launches have impacted the Global Drug Reference Apps Market?

A: Notable launches include MedInfo Technologies' AI-powered freemium app in August 2024 and PharmaSoft Solutions’ subscription-based app for hospitals in March 2023.

Q: What is the long-term outlook for the Global Drug Reference Apps Market?

A: The market is expected to sustain robust growth driven by rising smartphone adoption, healthcare digitization, and innovation in AI-powered drug information solutions.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 213 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |