Global Dry Age-Related Macular Degeneration Market

Global Dry Age-Related Macular Degeneration Market Size, Share, and COVID-19 Impact Analysis, By Stages (Early Age-Related Macular Degeneration, Intermediate Age-Related Macular Degeneration, and Late Age-Related Macular Degeneration), By Route of Administration (Oral and Injectables), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035

Report Overview

Table of Contents

Global Dry Age-Related Macular Degeneration Market Size Insights Forecasts to 2035

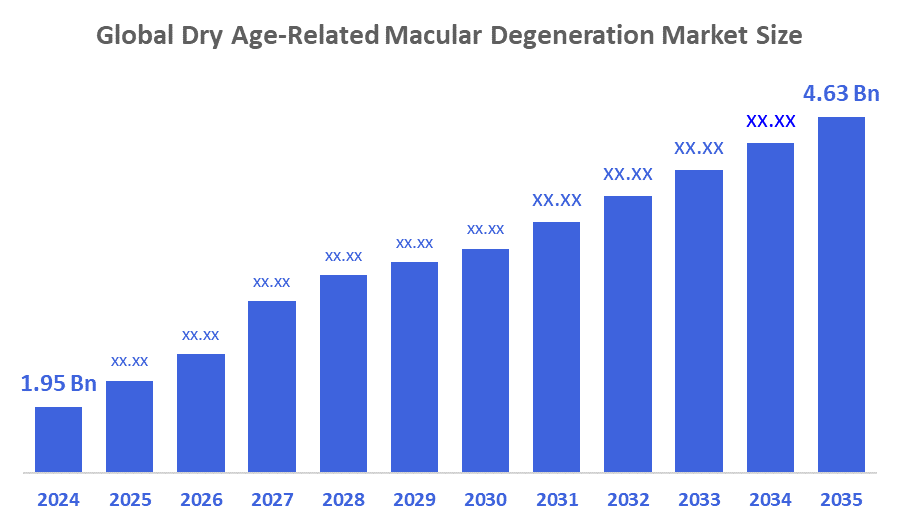

- The Global Dry Age-Related Macular Degeneration Market Size Was Estimated at USD 1.95 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.18 % from 2025 to 2035

- The Worldwide Dry Age-Related Macular Degeneration Market Size is Expected to Reach USD 4.63 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

According to a research report published by Decisions Advisors and Consulting, The Global Dry Age-Related Macular Degeneration Market Size Was Worth Around USD 1.95 Billion In 2024 And Is Predicted To Grow To Around USD 4.63 Billion By 2035 With A Compound Annual Growth Rate (CAGR) Of 8.18 % From 2025 To 2035. Dry age-related macular degeneration (AMD) is expected to experience a significant increase in sales due to the growing elderly population and a higher prevalence of dry AMD. Some lifestyle and environmental risk factors associated with the development of AMD include smoking, alcohol consumption, and not having enough physical activity. Market growth will also be aided by significant R&D investment and development of new product(s), better reimbursement policies & clinical trials.

Market Overview

Dry age-based macular degeneration is one of the most common vision-related disorders among older persons. The macula is composed of a number of different layers, specifically responsible for helping our brains process colour, perceive details, and see clearly. Oftentimes, this condition results in progressive changes in vision (i.e., deteriorating) where we lose our ability to read, drive, and identify other people. Those with dry age based macular degeneration may also have to increase the brightness of the light while they read or perform close-up work, see a spot or dark area in their line of sight, have a greater amount of difficulty getting used to seeing in dim conditions, experience straight lines as bent or twisted, experience central vision with blur or reduced brightness, etc. Diagnosing dry age-related macular degeneration is done by performing a medical history review, gathering and studying symptom information provided by the patient, and then performing a medical assessment that involves a dilated ocular examination. In order to help evaluate an individual's dry age macular degeneration, healthcare professionals look for changes in the retina and macula, characteristic of DRY (desktop resource indicator). These changes can include the presence of deposits made up of yellowish substructures known as Drusen. To assist with the diagnosis of dry age macular degeneration, the healthcare provider may request a variety of additional tests that assess visual function (e.g., fluorescein angiography, Optical Coherence Tomography).

Cirrus Therapeutics raised $11 million in seed funding to advance its gene therapy program for dry age-related macular degeneration (AMD). The company is focusing on targeting the complement system, a key driver of inflammation and retinal damage in AMD. This investment will support preclinical development and early-stage trials, aiming to address the unmet need for effective therapies in dry AMD, where treatment options remain limited compared to wet AMD.

Report Coverage

This research report categorises the dry age-related macular degeneration market based on various segments and regions, forecasts revenue growth, and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the dry age-related macular degeneration market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the dry age-related macular degeneration market.

Driving Factors

The dry AMD market has been undergoing significant changes due to improvements in both available treatments and increased awareness of the ageing population. As the prevalence of Dry AMD continues to increase, there is also a more significant focus on new therapies, such as pharma and possibly even gene therapies; this has created an opportunity for a more proactive approach to managing the disease by emphasising early detection and early intervention strategies within the healthcare community. Additionally, the use of technology to aid in monitoring and treating dry AMD has probably improved patient outcomes, suggesting that there is much potential growth within the dry AMD Market. Furthermore, since there has been more research and development activity regarding Dry AMD, we can expect that a better understanding of the underlying mechanism(s) of the disease will lead researchers to develop new therapeutic targets and/or new treatment modalities. The partnership of pharmaceutical companies and research institutions is playing an essential role in advancing this research. Overall, the Dry AMD Market appears to be very promising going forward, in that we can anticipate more efficient methods of managing dry AMD will develop over time, ultimately benefiting patients and healthcare systems alike.

Restraining Factors

This is because of ongoing clinical trial failures and severe regulatory restrictions (lampalizumab, eculizumab, emixustat, palucorcel), the pharmaceutical industry is suffering from substantial delays, losses of capital, and decreased overall growth of the market in the dry AMD sector throughout the projected time frame.

Market Segmentation

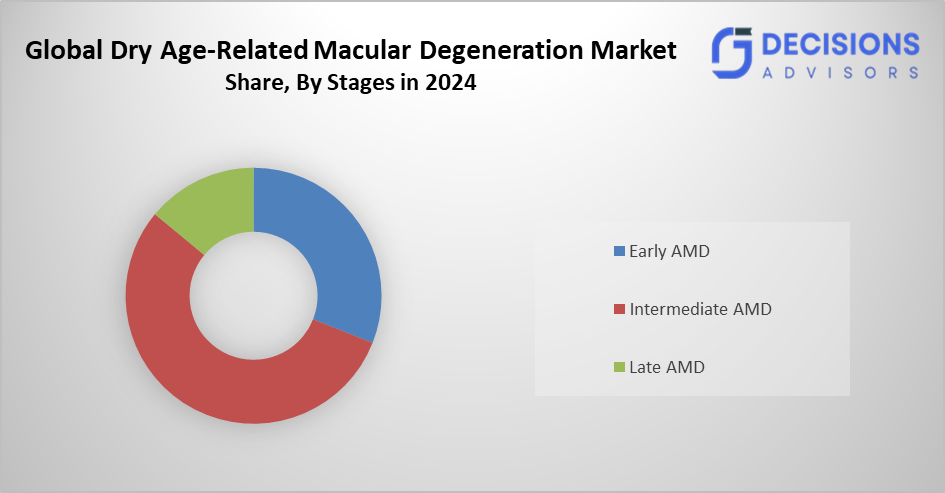

The dry age-related macular degeneration market share is classified into stages and route of administration.

- The intermediate age-related macular degeneration segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the stages, the dry age-related macular degeneration market is divided into early age-related macular degeneration, intermediate age-related macular degeneration, and late age-related macular degeneration. Among these, the intermediate age-related macular degeneration segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The predominant segment in this market is Intermediate age-related macular degeneration, which will significantly influence treatment strategies and health care priorities for the foreseeable future. The observable visual changes at this stage are a result of drusen (deposits of cellular waste product) accumulation; therefore, this stage is an important time for treatment to take place early.

- The injectables segment accounted for the highest market share in 2024 and is anticipated to grow at a substantial CAGR over the forecast period.

Based on the route of administration, the dry age-related macular degeneration market is divided into oral and injectables. Among these, the injectables segment accounted for the highest market share in 2024 and is anticipated to grow at a substantial CAGR over the forecast period. They provide a precise delivery and rapid onset of action for the treatment of this condition; therefore, the most commonly used routes for delivery of these therapies include injecting medication directly into the eye and delivering medication by way of systemic circulation (i.e., injectable into the body). Further, injectable medications demonstrate a higher degree of efficacy than other types of treatment for this disease.

Regional Segment Analysis of the Dry Age-Related Macular Degeneration Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the dry age-related macular degeneration market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the dry age-related macular degeneration market over the predicted timeframe. Factors contributing to the growth rate of dry age-related macular degeneration (AMD) in the Asia-Pacific region include the area's rapid economic development, new players entering the market, and increasing incidence of eye disease. Further, increasing healthcare expenditure, enlargement of multinational companies into developing countries, and the World Health Organisation's (WHO) estimated 90% of the world’s visually impaired people live in developing countries located in the Asia-Pacific region. China and India are also substantial contributors to the growth of the AMD dry AMD marketplace as a result of the rapid development of healthcare infrastructure and growing demand for enhanced healthcare within those countries.

North America is expected to grow at a rapid CAGR in the dry age-related macular degeneration market during the forecast period. Individuals who suffer from dry age-related macular degeneration can expect their market size to be larger in North America than anywhere else due to having more patients who have been diagnosed with this disease. In addition, there is an increasing number of patients suffering from other diseases of the eye and a large number of patients diagnosed as diabetic. According to a retrospective study presented at the Association for Research in Vision and Ophthalmology 2020, it has been shown that the number of patients who have retinal diseases, including dry AMD, retinal vein occlusion, and diabetic eye disease, is continually increasing in the United States. Additionally, there has been a peak in the number of patients who were found to have dry AMD who were between the ages of 80 and 89 years old. Continued expansion into the North American region is due to continued federal funding and initiatives to treat patients diagnosed with dry age-related macular degeneration.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the dry age-related macular degeneration market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Annexon Biosciences

- Apellis Pharmaceuticals, Inc

- Astellas Pharma Inc. (Iveric Bio)

- AstraZeneca (Alexion Pharmaceuticals)

- Biogen

- Boehringer Ingelheim

- Disc Medicine, Inc. (Gemini Therapeutics, Inc.)

- Hoffmann-La Roche AG (Genentech, Inc.)

- Ionis Pharmaceuticals

- NGM Biopharmaceuticals

- Novartis AG

- ONL Therapeutics

- Stealth Biotherapeutics Corp.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In December 2025, Researchers at the USC Roski Eye Institute (Keck Medicine of USC) launched a Phase 2b clinical trial to test whether bioengineered stem cells could restore vision in patients with dry age-related macular degeneration (AMD). A novel clinical trial offered hope for patients with advanced "dry" age-related macular degeneration. Dry age-related macular degeneration was the most common form of the disease.

- In November 2025, Aalto University scientists developed a laser-based therapy for dry age-related macular degeneration (AMD) that uses gentle heat to activate the eye’s natural repair and cleanup systems. By stimulating heat shock proteins and autophagy, the treatment helps retinal cells manage damaged proteins and reduce drusen buildup, slowing disease progression.

- In February 2025, Researchers at the University of Southampton’s Faculty of Medicine investigated a promising new approach to treat dry age-related macular degeneration (AMD), which was the leading cause of vision loss in older adults and had no approved treatment. Building on Cognition Therapeutics’ previous studies, this research explored how a sigma-2 receptor modulator (CT1812) affected retinal pigment epithelial (RPE) cells, which were crucial for maintaining vision by clearing waste from photoreceptors.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the dry age-related macular degeneration market based on the below-mentioned segments:

Global Dry Age-Related Macular Degeneration Market, By Stages

- Early Age-Related Macular Degeneration

- Intermediate Age-Related Macular Degeneration

- Late Age-Related Macular Degeneration

Global Dry Age-Related Macular Degeneration Market, By Route of Administration

- Oral

- Injectables

Global Dry Age-Related Macular Degeneration Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

- What is the projected market size and growth rate for dry age-related macular degeneration (AMD)?

The market was valued at USD 1.95 billion in 2024 and is expected to reach USD 4.63 billion by 2035, growing at a CAGR of 8.18% from 2025 to 2035.

- What are the main market segments by stages and route of administration?

By stages: Early, Intermediate (the largest share in 2024, expected to grow significantly), and Late AMD. By route: Oral and Injectables (the highest share in 2024, with a substantial CAGR ahead).

- Which region holds the largest market share, and which is growing fastest?

Asia-Pacific is anticipated to hold the largest share due to economic growth, rising eye disease incidence, and healthcare expansion in countries like China and India. North America is expected to grow at the fastest CAGR, driven by high diagnosis rates and federal funding.

- What are the primary drivers of market growth?

Key factors include the ageing population, increasing dry AMD prevalence, lifestyle risks (e.g., smoking), R&D investments in gene therapies and new products, improved reimbursement, and early detection strategies.

- What challenges or restraining factors affect the market?

Clinical trial failures (e.g., lampalizumab, eculizumab) and strict regulatory hurdles have caused delays, capital losses, and slower growth in the dry AMD sector.

- Who are the major companies in the dry AMD market?

Key players include Annexon Biosciences, Apellis Pharmaceuticals, Astellas Pharma (IvericzBio), AstraZeneca (Alexion), Biogen, Boehringer Ingelheim, Hoffmann-La Roche (Genentech), Novartis, and others like Ionis Pharmaceuticals and Stealth Biotherapeutics.

- What are some recent developments in dry AMD treatments?

Notable advances include Cirrus Therapeutics' $11M funding for complement-targeting gene therapy (2025), USC Roski Eye Institute's Phase 2b stem cell trial (Dec 2025), Aalto University's laser-based therapy (Nov 2025), and University of Southampton's sigma-2 modulator research (Feb 2025).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 240 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Feb 2026 |

| Access | Download from this page |