Global Ductile Iron Fittings Market

Global Ductile Iron Fittings Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Material Grade (Grade 60?40?18 and Grade 65?45?12), By Application (Water Supply, Sewage & Wastewater, and Industrial Piping), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035

Report Overview

Table of Contents

Ductile Iron Fittings Market Summary, Size & Emerging Trends

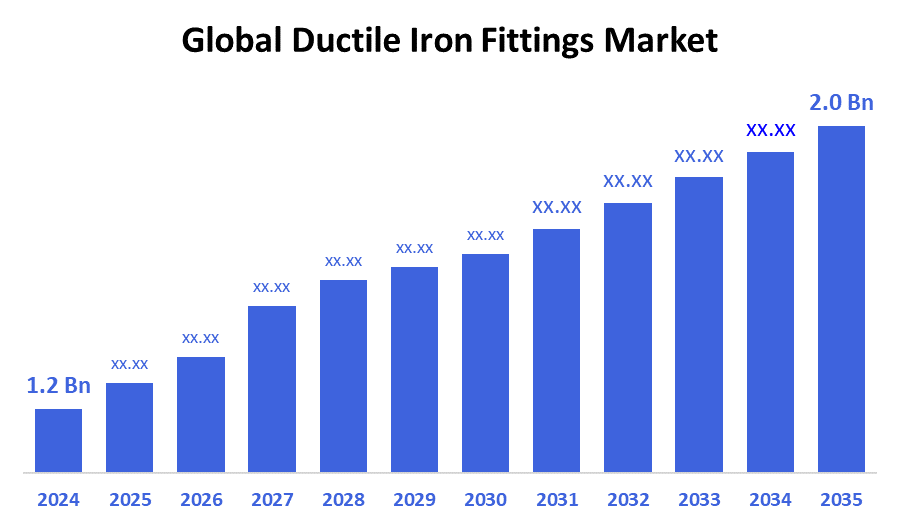

According to Decision Advisors, The Global Ductile Iron Fittings Market Size is expected to grow from USD 1.2 Billion in 2024 to USD 2.0 Billion by 2035, at a CAGR of 5.0% during the forecast period 2025-2035. Key trends include increased demand for longevity and corrosion-resistant fittings, modernization of aging pipeline networks, tougher environmental regulations, and rising automated manufacturing and coating technologies to improve product life and performance.

Key Market Insights

- Asia Pacific is emerging as a major growth region due to large scale infrastructure investments and government focus on upgrading water and sewage systems.

- North America remains the largest regional market, with strong maintenance and replacement demand driven by aging pipelines.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 1.2 Billion

- 2035 Projected Market Size: USD 2.0 Billion

- CAGR (2025-2035): 5.0%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Ductile Iron Fittings Market

Ductile iron fittings are essential components used in pipelines to connect, divert, or close off pipe systems. Known for their exceptional strength, flexibility, and high-pressure resistance, these fittings outperform traditional cast iron and are widely used in water supply, wastewater management, industrial pipelines, and infrastructure networks. They are engineered to handle long-term stress and harsh environments, offering durability and safety over time. Technological improvements in ductile iron casting, joint sealing, and anti-corrosion coatings have significantly boosted their reliability and efficiency. As urbanization accelerates globally and aging infrastructure demands replacement, ductile iron fittings have become a preferred choice due to their extended service life, low maintenance needs, and compliance with modern water and environmental standards.

Ductile Iron Fittings Market Trends

- Shift toward advanced coating and lining materials to prevent corrosion and leakage.

- Growing replacement of old cast iron or corroded systems in developed countries.

- Increasing investment in water infrastructure projects in emerging markets.

- Lean?manufacturing and automation to reduce production costs and improve precision.

Ductile Iron Fittings Market Dynamics

Driving Factors: The ductile iron fittings market is largely driven by increasing government investments in water infrastructure and rapid urbanization

The ductile iron fittings market is largely driven by increasing government investments in water infrastructure and rapid urbanization. Cities are demanding durable, long-lasting pipe systems that can withstand high pressure and resist corrosion. Ductile iron offers superior strength, making it ideal for municipal water, wastewater, and stormwater systems. Advancements in coatings and joint sealing technologies further improve reliability and reduce maintenance requirements. Additionally, growing global awareness of public health and environmental risks associated with pipeline leaks is encouraging the use of high-integrity materials like ductile iron, positioning it as a preferred option for critical infrastructure projects in both developed and emerging markets.

Restrain Factors: Ductile iron fittings face constraints related to cost and logistics

Despite their advantages, ductile iron fittings face constraints related to cost and logistics. They are generally more expensive than alternatives like PVC or HDPE, making them less attractive for cost-sensitive projects. The heavyweight of ductile iron increases transportation costs and requires more labor-intensive installation, raising total project expenses. Specialized machinery may also be needed, adding complexity. Moreover, the production process has a larger environmental footprint due to high energy usage and iron ore extraction. Price volatility in raw materials and energy markets can further affect manufacturing margins, making it difficult for producers to offer competitive pricing consistently.

Opportunity: Emerging economies present significant growth opportunities for the ductile iron fittings market

Emerging economies present significant growth opportunities for the ductile iron fittings market. Urbanization and planned investments in sanitation and water infrastructure in countries across Asia, Africa, and Latin America are driving demand for reliable, long-life piping systems. Industries such as oil & gas, power generation, and chemicals also require high-performance pipe fittings, creating niche opportunities. Technological innovations are improving ductile iron’s performance lighter designs and advanced anti-corrosion coatings are reducing traditional drawbacks. Strategic collaborations with local governments and utility companies can unlock long-term contracts. Moreover, the global push toward water conservation and leak prevention makes ductile iron fittings highly relevant.

Challenges: Manufacturers must maintain high-quality production standards to ensure material consistency

Manufacturers must maintain high-quality production standards to ensure material consistency and corrosion resistance across different regions and supply chains. In remote or uneven terrains, the weight and size of ductile iron fittings pose challenges in logistics and installation. Additionally, increasingly strict regulatory requirements related to environmental sustainability and water safety are pressuring manufacturers to modernize their operations. Alternative materials, especially plastic-based options, are gaining traction due to cost and convenience, making it crucial for stakeholders to justify ductile iron’s long-term value. Convincing utilities and contractors to invest in upfront costs for lifecycle savings remains a persistent industry hurdle.

Global Ductile Iron Fittings Market Ecosystem Analysis

The global ductile iron fittings market ecosystem includes raw material suppliers (iron ore, alloys), manufacturers, distributors, and end-users such as municipal utilities, construction firms, and industrial sectors. Key players invest in advanced casting technologies, corrosion-resistant coatings, and efficient supply chains. Regulatory bodies influence product standards and environmental compliance. Infrastructure development agencies and government water boards act as major demand drivers. Collaboration among stakeholders ensures product innovation, cost efficiency, and sustainable adoption across water, wastewater, and industrial pipeline systems worldwide.

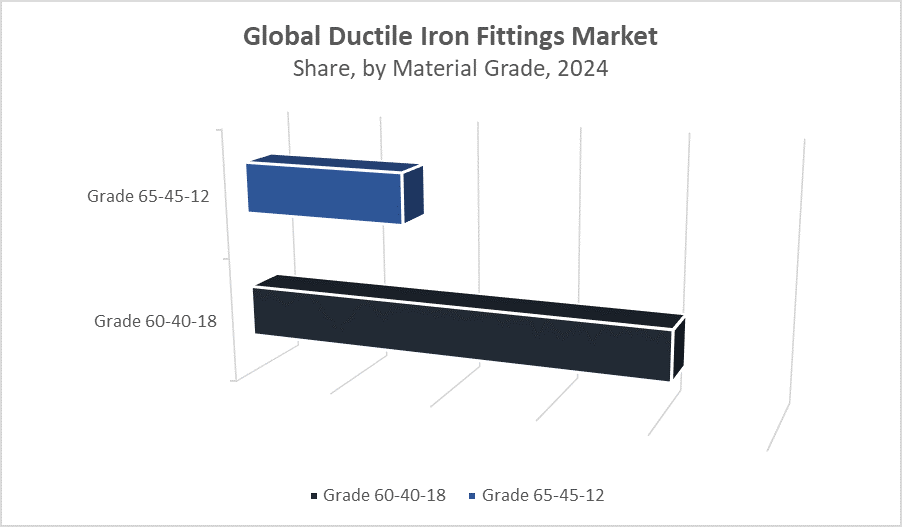

Global Ductile Iron Fittings Market, By Material Grade

Grade 60?40?18 holds the largest share of the global ductile iron fittings market, accounting for approximately 62% of total revenue in 2024. This dominance is attributed to its optimal balance of tensile strength, ductility, and machinability, making it highly suitable for municipal water supply and wastewater systems. Its ability to withstand moderate pressure, combined with high impact resistance, ensures reliable long-term performance. Additionally, its cost-effectiveness and wide applicability across various infrastructure projects make it the most preferred material grade globally.

Grade 65?45?12 holds a significant share of the global ductile iron fittings market, accounting for approximately 28% of total revenue in 2024. This material grade is primarily used in high-pressure applications, including industrial piping systems, fire protection networks, and specific gas distribution setups. Its higher tensile strength and enhanced corrosion resistance make it well-suited for demanding operational conditions and environments requiring heavy-duty performance. As industries prioritize durability and reliability under stress, the demand for Grade 65?45?12 continues to grow steadily.

Global Ductile Iron Fittings Market, By Application

Water supply systems dominate the ductile iron fittings market, contributing approximately 54% of the global revenue in 2024. This dominance is driven by extensive urban infrastructure projects and municipal water distribution networks that require durable, pressure-resistant piping solutions. The excellent longevity and strength of ductile iron fittings make them ideal for transporting clean water over long distances with minimal leakage, ensuring reliable and efficient water delivery.

The sewage and wastewater segment holds a significant share of about 24% in 2024, supported by increasing investments in sanitation and environmental management worldwide. Ductile iron fittings are favored in this sector due to their superior resistance to corrosion and structural stress, making them well-suited for modern sewage and wastewater systems that demand durability and reliability.

Asia Pacific is the fastest-growing market for ductile iron fittings

driven by rapid infrastructure expansion in countries like China, India, and Southeast Asia. Urbanization, government investments in water supply and sanitation projects, and growing industrialization fuel demand for durable piping solutions. The region’s focus on upgrading and expanding municipal water and wastewater networks supports significant market growth, with increasing adoption of ductile iron fittings due to their strength and longevity in diverse environmental conditions.

North America holds the largest share of the ductile iron fittings market in 2024

largely due to the urgent need to replace aging infrastructure. Strong regulatory frameworks promoting sustainable and resilient water management systems further support market dominance. Investments in modernization projects and stringent standards for material performance ensure continued preference for ductile iron fittings in municipal and industrial applications across the region.

WORLDWIDE TOP KEY PLAYERS IN THE DUCTILE IRON FITTINGS MARKET INCLUDE

- Saint?Gobain PAM

- AMERICAN Cast Iron Pipe Company (AMERICAN)

- Tyco International

- Mueller Water Products, Inc.

- China National Building Material Company (CNBM)

- Jindal Saw Ltd.

- Zhejiang Chuanju Heavy Industry Co., Ltd.

- Tata Steel

- Nippon Steel Corporation

- Victaulic Company

- Others

Product Launches in Ductile Iron Fittings Market

- In March 2024, Saint-Gobain PAM launched a new line of epoxy-coated ductile iron fittings designed to enhance corrosion resistance and extend service life. This product targets European water distribution networks, aiming to improve durability and reliability in municipal infrastructure.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the ductile iron fittings market based on the below-mentioned segments:

Global Ductile Iron Fittings Market, By Material Grade

- Grade 60?40?18

- Grade 65?45?12

Global Ductile Iron Fittings Market, By Application

- Water Supply

- Sewage & Wastewater

- Industrial Piping

Global Ductile Iron Fittings Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

FAQs

1. What is the current size of the global ductile iron fittings market?

As of 2024, the global ductile iron fittings market is valued at approximately USD 1.2 billion.

2. What is the projected market size by 2035?

The market is expected to reach USD 2.0 billion by 2035, growing at a CAGR of 5.0% from 2025 to 2035.

3. What factors are driving the growth of the ductile iron fittings market?

Key growth drivers include urbanization, infrastructure modernization, government investments in water systems, and increasing focus on leak-proof, long-lasting pipeline solutions.

4. Which region held the largest market share in 2024?

North America held the largest share in 2024, driven by aging infrastructure replacement and strict water quality regulations.

5. Which region is expected to grow the fastest?

Asia Pacific is projected to be the fastest-growing region, due to large-scale infrastructure projects in countries like China, India, and Southeast Asia.

6. Which application segment generates the highest revenue?

Water supply systems accounted for approximately 54% of global market revenue in 2024, making it the dominant segment.

7. Are there any recent product innovations in the market?

Yes, in March 2024, Saint-Gobain PAM launched epoxy-coated ductile iron fittings for enhanced corrosion resistance and longer service life, especially targeting European water networks

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 220 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |