Global Dura Substitutes Market

Global Dura Substitutes Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Biological dura substitute, and Synthetic dura substitute), By Material (Collagen-based, Polymers, and Other materials), By Application (Neurosurgery, Spinal surgery, Trauma/accident, Post-surgical repair, and Other applications), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035

Report Overview

Table of Contents

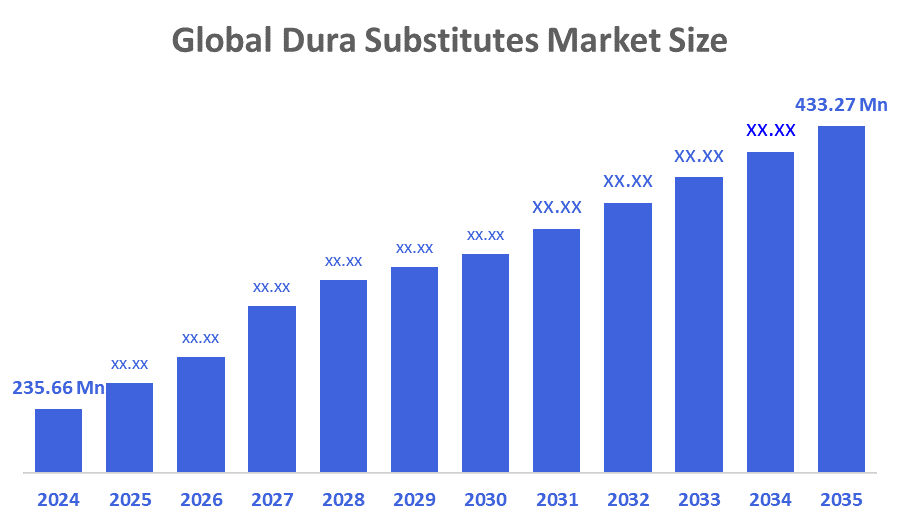

Global Dura Substitutes Market Size Insights Forecasts to 2035

- The Global Dura Substitutes Market Size Was Estimated at USD 235.66 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.69 % from 2025 to 2035

- The Worldwide Dura Substitutes Market Size is Expected to Reach USD 433.27 Million by 2035

- North America is expected to grow the fastest during the forecast period.

According to a research report published by Decisions Advisors and Consulting, The Global Dura Substitutes Market Size Was Worth Around USD 235.66 Million In 2024 And Is Predicted To Grow To Around USD 433.27 Million By 2035 With A Compound Annual Growth Rate (CAGR) Of 5.69 % From 2025 To 2035. The market growth is propelled by the advancement of neurosurgical techniques and the rise in the occurrence of diseases that need cranial or spinal surgeries, such as traumatic brain injuries, meningiomas, and Chiari malformations, among others. Additionally, the growing emphasis on minimally invasive neurosurgical techniques has led to a greater need for dura substitutes designed specifically for small incisions and endoscopic procedures.

Market Overview

The worldwide dura substitutes market is a worldwide industry that covers the development, production, and distribution of durable substitute materials that are designed to replace traditional materials that are often less sustainable in various sectors. These substitutes consist of advanced polymers, composites, and bio-based materials that are capable of providing additional strength, longer life, and environmental benefits. This market applies to a wide range of sectors, including construction, automotive, healthcare, and industrial manufacturing, where both durability and sustainability are of great importance. Changes in material science and a greater emphasis on meeting regulations are some of the factors that have led to the wider use of these substitutes. Besides this, the market expansion is supported by the increasing awareness of consumers as well as innovations in the different industries that aim at reducing carbon footprints and lifecycle costs.

Dura mater substitutes, which are used to repair or replace the dura mater, play a critical role in the treatment of traumatic injuries, tumour resections, and congenital abnormalities. A report by UpToDate, Inc., dated May 2023, indicates that Traumatic Brain Injury (TBI) is a major global health problem and a significant cause of both disability and death. The number of people who suffer from TBI every year is believed to be between 27 and 69 million worldwide. Such a large number of TBIs is likely to result in an increased need for advanced solutions that provide improved patient outcomes, thereby driving the market growth during the forecast period. Moreover, the elderly are more susceptible to neurological diseases, and such conditions may require surgical operations involving the use of dura substitutes. According to the UN population projections, the global 65+ population is ageing very quickly.

Report Coverage

This research report categorises the dura substitutes market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the dura substitutes market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the dura substitutes market.

Driving Factors

The dura substitute market is undergoing a significant transformation at present. Various changes in consumer preferences and advances in technology are the main drivers of this transformation. The trend towards sustainable alternatives in different industries has led to an increased demand for durable substitutes. This change seems to be due to the environment, related concerns that are leading people to seek products that last long and at the same time do not harm the environment. To keep up with the market, manufacturers are coming up with new ideas and upgrading their products, which might cause more competition in the market soon. In addition, the dura substitute market is found to be expanding its reach and usage in different sectors, such as construction, automotive, and consumer goods. These products are used in a wide range of scenarios is a clear indication of the opportunity for growth as businesses find new ways to incorporate durable substitutes in their product offerings. It is the combination of consumers' demand for sustainable products and the continuous creation of the latest materials that will keep the market evolving, hence providing chances for both the already running businesses and newcomers as well.

Restraining Factors

Despite the promising growth prospects for the dura substitutes market, the industry is still faces with challenges. For one, the hefty initial expenses of R&D and manufacturing may slow down the rate of adoption, most likely in the case of small and medium enterprises. Besides, if there is insufficient knowledge and experience in the application of high-tech substitute materials, the market penetration might be limited. Different regulations and complex compliance requirements in varied regions make it difficult for a company to enter the market. On top of that, the doubt about the durability and recyclability of some substitutes is probably the reason that acceptance is still low.

Market Segmentation

The dura substitutes market share is classified into product type, material, and application.

- The biological dura substitute segment accounted for the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the product type, the dura substitutes market is divided into biological dura substitutes and synthetic dura substitutes. Among these, the biological dura substitute segment accounted for the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This segment expansion is driven by biological dura substitutes, which are natural materials based (such as collagen or animal tissues), which guarantee greater compatibility with the body. These types of substitutes generally cause very little immune reaction or rejection in comparison to synthetic dura substitutes. Moreover, biological dura substitutes have a quicker healing process because of their biological characteristics.

- The collagen-based paste segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the material, the dura substitutes market is divided into collagen-based, polymer-based, and other materials. Among these, the collagen-based paste segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Collagen-based substitutes are likely to cause fewer side effects than synthetic methods, which in turn leads to a lower chance of infection, inflammation, and even cerebrospinal fluid leakages. Because of their natural origin and high compatibility with tissues, they provide a strong argument for their use in challenging and sophisticated brain surgeries and thus are increasingly being used.

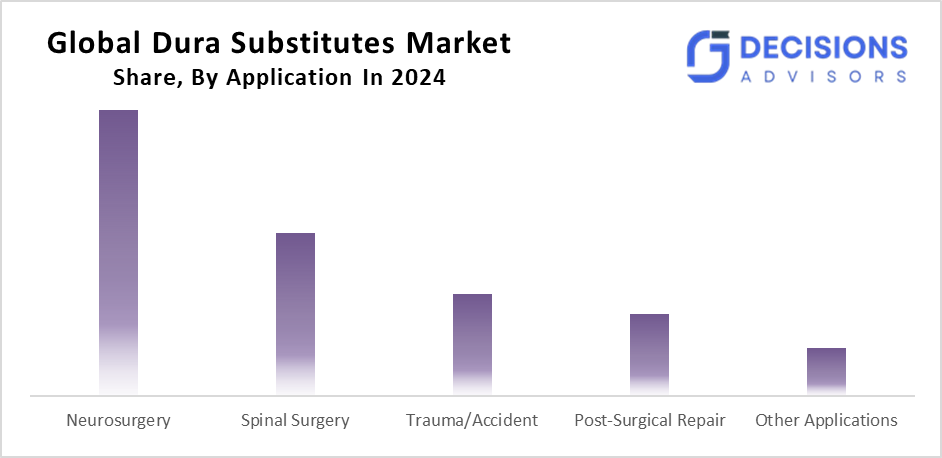

- The neurosurgery segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the dura substitutes market is segmented into neurosurgery, spinal surgery, trauma/accident, post-surgical repair, and other applications. Among these, the neurosurgery segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This segmental growth is influenced by the rise in brain surgeries among the elderly population, who, as time goes by, develop more neurological disorders such as brain tumours, intracranial aneurysms, and traumatic brain injuries. In many cases, these types of operations involve repairing or replacing dura mater, which, hence, is driving the demand for effective dura substitutes.

Regional Segment Analysis of the Dura Substitutes Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the dura substitutes market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the dura substitutes market over the predicted timeframe. The growth of the region is mainly driven by increased industrialisation and urbanisation, along with the rising demand for sustainable materials in a variety of sectors, such as electronics and construction. China dominates the market in this region, while Japan and South Korea are also experiencing significant growth in dura substitute adoption. The competitive scenario in the asia, pacific region is made up of a combination of local and international players, such as Mitsubishi Chemical Corporation and LG Chem. These firms are concentrating on developing new products and broadening their product lines to meet the increasing demand. Moreover, government programs that encourage the use of green technologies and the adoption of sustainable practices are acting as additional market growth drivers, thus making the region a major player in the durable substitute.

North America is expected to grow at a rapid CAGR in the dura substitutes market during the forecast period. The growth in the area is largely influenced by rising demand in the automotive, aerospace, and construction industries, as well as strict regulations that encourage the use of sustainable materials. The U.S. is the frontrunner in this market, benefiting from its technologically advanced manufacturing capabilities and a strong emphasis on R&D. Canada is the next largest market. Major players such as DuPont, 3M, and Eastman Chemical Company dominate the competitive landscape in North America. These companies are putting a lot of their resources into innovation and sustainability projects to satisfy the increasing demand for green product alternatives. The local regulations, including those from the Environmental Protection Agency, play a significant role in the region by facilitating the use of Dura substitutes while also fulfilling the environmental compliance requirements.

The document is titled “Guidance Document for Dura Substitute Devices – Guidance for Industry” and was issued by the FDA’s Centre for Devices and Radiological Health. It provides regulatory expectations for manufacturers submitting 510(k) premarket notifications for dura substitutes, including both synthetic and natural materials.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the dura substitutes market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ACERA SURGICAL

- B. Braun

- Baxter

- Bennett

- Biosynth

- Cook Medical

- DePuy Synthes

- GUNZE

- INTEGRA

- Medprin

- Medtronic

- Natus

- Severn Healthcare Technologies

- Stryker

- GORE

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In August 2023, Nurami Medical’s ArtiFascia® dura substitute received FDA 510(k) clearance, marking a major milestone for neurosurgical innovation. The product is a resorbable graft designed to repair the dura mater, prevent cerebrospinal fluid (CSF) leaks, and promote tissue regeneration.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the dura substitutes market based on the below-mentioned segments:

Global Dura Substitutes Market, By Product Type

- Biological dura substitute

- Synthetic dura substitute

Global Dura Substitutes Market, By Material

- Neurosurgery

- Spinal surgery

- Trauma/accident

- Post-surgical repair

- Other applications

Global Dura Substitutes Market, By Application

- Neurosurgery

- Spinal surgery

- Trauma/accident

- Post-surgical repair

- Other applications

Global Dura Substitutes Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

- What is the current size of the global dura substitutes market?

It was valued at USD 235.66 million in 2024.

- What is the projected market size by 2035?

The market is expected to reach USD 433.27 million by 2035.

- What is the growth rate of the market?

It is projected to grow at a CAGR of 5.69% from 2025 to 2035.

- Which product type leads the market?

Biological dura substitutes held the largest share in 2024 due to better body compatibility and faster healing.

- What material dominates the market?

Collagen-based materials accounted for the largest share in 2024, offering low infection risk and high tissue compatibility.

- Which application segment is the biggest?

Neurosurgery generated the highest revenue in 2024, driven by rising brain surgeries in ageing populations.

- Which region will grow the fastest?

North America is expected to grow at the fastest CAGR, fueled by advanced healthcare and R&D.

- Who are some key players in the market?

Major companies include Medtronic, Integra, Stryker, B. Braun, and DePuy Synthes.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 230 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Feb 2026 |

| Access | Download from this page |