Global Durable Gloves Market

Global Durable Gloves Market Size, Share, and COVID-19 Impact Analysis, By Material (Natural Rubber/Latex, Nitrile, Leather, Nylon, Vinyl, Others), By Type (Mechanical Gloves, Chemical handling, Thermal/flame retardant, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Durable Gloves Market Size Summary

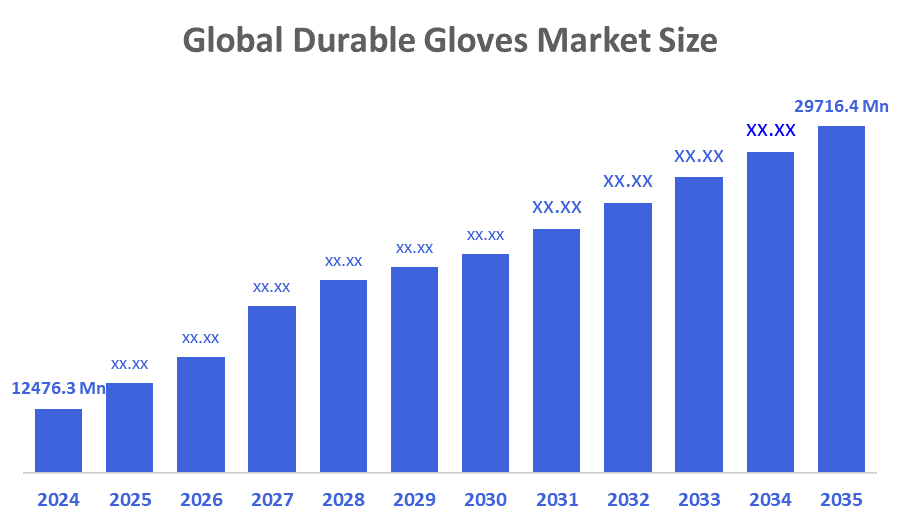

The Global Durable Gloves Market Size Was Estimated at USD 12476.3 Million in 2024 and is Projected to Reach USD 29716.4 Million by 2035, Growing at a CAGR of 8.21% from 2025 to 2035. The market for durable gloves is expanding as a result of growing demands for protective gear in the construction, medical, and industrial sectors; increased workplace safety laws; and increased awareness of hand protection, durability, and cleanliness in high-performance and hazardous work environments.

Key Regional and Segment-Wise Insights

- In 2024, the European durable gloves market held the largest revenue share of 27.2% and dominated the global market.

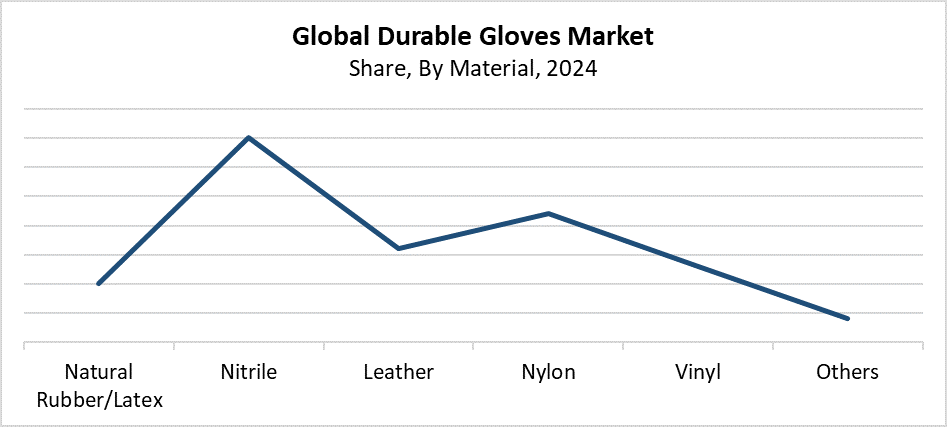

- In 2024, the nitrile segment held the highest revenue share of 35.2% and dominated the global market by material.

- With the biggest revenue share of 39.4% in 2024, the mechanical gloves segment led the worldwide market by type.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 12476.3 Million

- 2035 Projected Market Size: USD 29716.4 Million

- CAGR (2025-2035): 8.21%

- Europe: Largest market in 2024

- Asia Pacific: Fastest growing region

The market for durable gloves exists as a specialised industry which produces and delivers high-performance gloves that protect users in multiple industrial settings, including manufacturing, construction, healthcare, automotive, and chemical sectors. The gloves contain materials such as nitrile, latex, leather, neoprene, and high-performance textiles to provide protection against abrasions, chemical exposure, punctures, and extreme temperatures. The main drivers for this market include worker safety awareness growth, strict occupational safety laws, and industrial and healthcare sector expansion. The manufacturing and automotive industries, along with rising construction activities, drive market growth. The COVID-19 pandemic has shown that people require sturdy gloves for their daily activities as well as their professional duties because they need to protect themselves while keeping things clean.

The performance metrics and overall quality of durable gloves have experienced substantial improvements through technological progress. Safety-conscious industries show interest in new safety products because of their implementation of cut-resistant fibres, touchscreen-compatible materials, ergonomic designs, and eco-friendly manufacturing methods. Specialised applications now use smart gloves with sensors that track motion and monitor fatigue. The government mandates workplace safety standards through regulations, which drive companies to create protective equipment that lasts. This supports environmentally friendly recycling practices. The market growth for durable gloves will continue because of these developments and increasing spending on worker protection equipment.

Material Insights

What Factors Enabled the Nitrile Segment to Dominate the Durable Gloves Market with the Largest Revenue Share of 35.2% in 2024?

The nitrile segment dominated the durable gloves market by holding the largest revenue share of 35.2% in 2024. Nitrile maintains its market dominance because it offers superior protection against wear, chemical exposure, and punctures. This makes it the best choice for industrial applications and medical and chemical handling tasks. The use of nitrile gloves is further increased by the fact that they are more durable and a great substitute for people who are allergic to latex. The gloves maintain their tactile sensitivity because they provide flexibility and comfort. This makes them suitable for extended use in harsh industrial environments. Nitrile gloves maintain their leading position in the worldwide durable glove market because the manufacturing and healthcare sectors require them for safety and cleanliness purposes.

The nylon segment of the durable gloves market is expected to grow at the fastest CAGR during the forecast period. The material expands because of its abrasion resistance, lightweight nature and flexibility, which suits operations that require comfort and precision, such as maintenance work, automotive tasks, and electronics manufacturing. Nylon gloves receive nitrile or polyurethane coatings to boost their grip and protection. This enables their use in multiple industrial applications. The market expansion accelerates because of the growing requirement for affordable reusable gloves which possess both durability and mechanical strength. The market demand for nylon gloves continues to rise because fabric technology keeps advancing, while commercial and industrial operations need gloves that deliver both high performance, breathability, and extended durability.

Type Insights

What made the Mechanical Gloves Segment hold the Largest Share of 39.4% in the Durable Gloves Market in 2024?

The mechanical gloves segment led the durable gloves market in 2024 by holding the largest revenue share of 39.4%. Mechanical gloves serve as vital protective equipment for manufacturing, metalworking, automotive, and construction industries because they defend against mechanical dangers, including cuts, abrasions, punctures, and collisions. These gloves deliver excellent performance in tough work environments because their construction includes leather, Kevlar, and reinforced textiles. They provide strong protection. The use of mechanical gloves is also fueled by the increased focus on job safety and adherence to strict occupational health laws. The mechanical glove sector has achieved market leadership status for durable gloves because global infrastructure development and expanding industry demand continue to increase.

The thermal and flame-retardant segment of the durable gloves market is expected to grow at the fastest CAGR during the forecasted period. The market expansion results from growing safety requirements and legal compliance needs that affect manufacturing operations, firefighting activities, metallurgy, and oil and gas sectors, which expose staff members to extreme heat and fire dangers. The combination of thermal and flame-retardant gloves serves as an essential protective measure for workers who handle hazardous tasks because these gloves protect against fire-related dangers and thermal exposure. The gloves have become more durable and effective because manufacturers now use Kevlar and Nomex, along with other heat-resistant textiles. The market growth happens because industrial operations increase while workers become more knowledgeable about workplace safety requirements.

Regional Insights

North America experiences steady growth in the durable gloves market because manufacturing, healthcare, construction, and oil and gas industries now follow stricter regulations and workplace safety standards. The need for long-lasting gloves that provide exceptional defence against chemicals, abrasions, and mechanical dangers has increased due to the increased focus on personal protective equipment (PPE) compliance, particularly in the wake of the pandemic. The region's healthcare system, together with its established industrial base, creates conditions for ongoing market expansion. The market experiences growth because of technological advancements, which produce nitrile and thermal-resistant glove materials. Government programs that back workplace safety initiatives. They allocate more money for employee protection programs and drive increased adoption of these programs. The North American market for robust gloves will continue to grow because of these market drivers.

Europe Durable Gloves Market Trends

Europe leads the market for durable gloves by holding the largest revenue share of 27.2% in 2024. The region maintains its market leadership because it enforces strict workplace safety regulations that apply to various sectors, including manufacturing, healthcare, construction, and automotive industries. The need for strong, long-lasting gloves is rising as a result of growing industrial activity and growing awareness of occupational health and safety. The European continent stands as the leading global producer of personal protective equipment (PPE) because of its well-established manufacturing facilities. These create products from leather, nitrile, and flame-retardant textiles. The European durable glove market continues to grow because governments back worker safety initiatives and sustainability programs, and because more businesses choose environmentally friendly, reusable gloves.

Asia Pacific Durable Gloves Market Trends

The Asia Pacific durable gloves market will experience the fastest growth rate during the forecast period because industrialisation and urbanisation speed up, while workplace safety awareness continues to spread across the region. China, India, Japan, and South Korea experience strong development in manufacturing, construction, healthcare, and automotive industries. These industries heavily use durable gloves. Organisations require protective gloves with high-quality standards because government bodies enforce more rules about workplace safety and health. The market expansion receives backing from both the growing e-commerce industry and the rising use of nitrile and nylon gloves as advanced materials. The Asia Pacific market for durable gloves experiences growth because the region needs to protect its huge workforce.

Key Durable Gloves Companies:

The following are the leading companies in the durable gloves market. These companies collectively hold the largest market share and dictate industry trends.

- Ansell Ltd

- SHOWA CORPORATION

- Delta Plus Group

- Superior Glove

- NITRAS

- Newell Co.

- Unigloves (UK) Limited

- PIP

- The Glove Company

- Uvex Safety Group

- United Glove

- 3M

- Others

Recent Developments

- In July 2025, the third-generation Diamond 3.0 fibre from Dyneema was introduced, resulting in protective gloves that are 40% lighter than earlier generations. With six times the protection of conventional HPPE gloves, the new fiber offers noticeably greater cut resistance. Its single-yarn construction improves flexibility, dexterity, and comfort without the need for reinforcement. It is appropriate for industrial activities because of its enhanced coating adherence and touchscreen device compatibility, among other qualities.

- In November 2024, Ansell has introduced the AlphaTec 53-002 and 53-003 gloves, which use MICROCHEM technology to provide improved chemical protection. The majority of the chemicals in these gloves achieve high breakthrough times, and they fulfil EN ISO 374-1:2016 criteria. With its nylon lining, the 53-003 model offers both mechanical protection and thermal resistance up to 100°C. They are appropriate for applications involving the handling of chemicals and demanding industries.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the durable gloves market based on the below-mentioned segments:

Global Durable Gloves Market, By Material

- Natural Rubber/Latex

- Nitrile

- Leather

- Nylon

- Vinyl

- Others

Global Durable Gloves Market, By Type

- Mechanical gloves

- Chemical handling

- Thermal/flame retardant

- Others

Global Durable Gloves Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 167 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |