Global Dural Graft Market

Global Dural Graft Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Material Type (Xenograft, Allograft, and Synthetic), By Application (Neurosurgery and ENT/Spinal), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Dural Graft Market Summary, Size & Emerging Trends

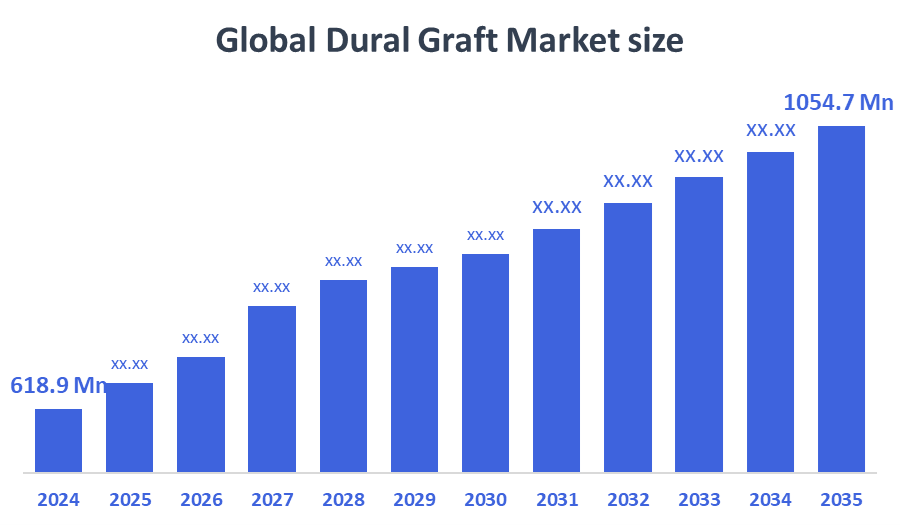

According to Decision Advisor, The Global Dural Graft Market Size is Expected to Grow from USD 618.9 Million in 2024 to USD 1054.7 Million by 2035, at a CAGR of 4.97% during the forecast period 2025-2035. Increasing prevalence of neurological disorders and rising number of neurosurgical procedures are key driving factors for the dural graft market.

Key Market Insights

- Asia Pacific is expected to account for the largest share in the dural graft market during the forecast period.

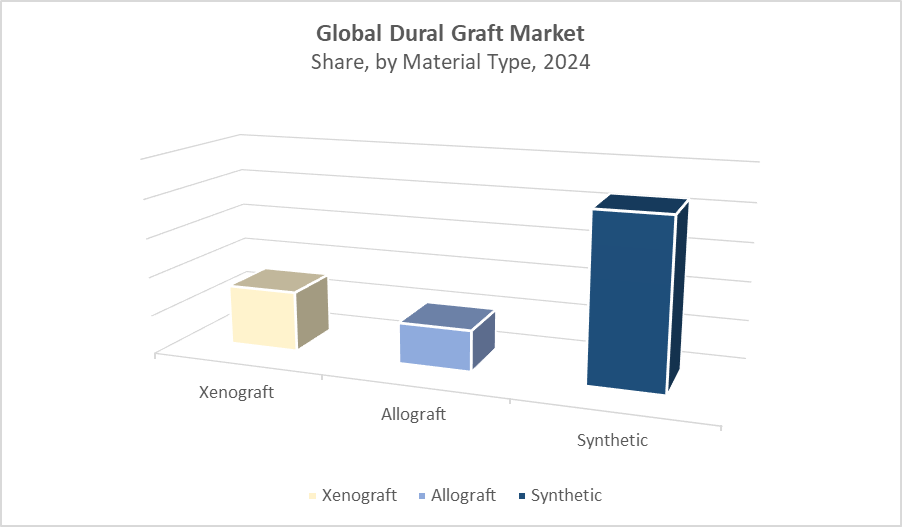

- In terms of material type, the synthetic dural graft segment dominated in terms of revenue during the forecast period.

- In terms of application, the neurosurgery segment accounted for the largest revenue share in the global dural graft market during the forecast period.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 618.9 Million

- 2035 Projected Market Size: USD 1054.7 Million

- CAGR (2025-2035): 4.97%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Dural Graft Market

The dural graft market revolves around the production and application of graft materials used to repair the dura mater, the tough membrane surrounding the brain and spinal cord during neurosurgical and ENT/spinal procedures. These grafts play a critical role in preventing cerebrospinal fluid leakage and promoting tissue regeneration. Dural grafts are commonly used in surgeries addressing trauma, tumours, and congenital defects. The market growth is fueled by advances in biomaterials, increased healthcare infrastructure investments, and a rise in minimally invasive procedures. Governments worldwide are supporting research and development through funding and favourable regulatory frameworks to encourage innovation in safer, more effective graft materials. The growing demand for synthetic grafts reflects a shift toward biocompatible, low-risk solutions that minimize immune reactions and surgical complications.

Dural Graft Market Trends

- Development of next-generation synthetic grafts with enhanced bioactivity and mechanical strength.

- Increasing adoption of minimally invasive neurosurgical techniques driving graft demand.

- Strategic collaborations and mergers among biomaterial manufacturers to expand product portfolios.

Dural Graft Market Dynamics

Driving Factors: Rising incidence of neurological disorders and growing neurosurgical interventions

The global rise in neurological disorders, including traumatic brain injuries, spinal cord trauma, brain tumours, and congenital abnormalities, has significantly increased the demand for surgical interventions, thereby driving the dural graft market. As healthcare systems across both developed and developing regions improve diagnostic accuracy and early detection, more patients are being referred for neurosurgical procedures. This, in turn, necessitates the use of dural grafts to repair or reconstruct the dura mater post-surgery. Technological advancements in surgical techniques, such as minimally invasive neurosurgery, have also enhanced the precision and safety of procedures, further supporting the adoption of high-quality graft materials. Moreover, governments in emerging economies are increasing investments in neurosurgical infrastructure and medical training, further expanding access to these complex procedures and creating a conducive environment for market growth.

Restrain Factors: High cost of advanced grafts and regulatory challenges

Despite their clinical value, dural grafts especially those made from advanced synthetic or bioengineered materials can be prohibitively expensive for many healthcare facilities, particularly in lower-income countries. These higher costs can deter widespread adoption, especially when traditional grafting techniques or less expensive alternatives are available. Additionally, the regulatory environment surrounding medical devices is becoming increasingly stringent. Graft products must meet strict biocompatibility, safety, and performance standards, and navigating these approval pathways can be time-consuming and costly for manufacturers. The risk of complications such as cerebrospinal fluid leakage, infection, or immunological rejection remains a concern, especially in biologically sourced grafts, which may further hinder clinician confidence and market uptake. Reimbursement limitations in certain healthcare systems also restrict patient access to premium graft solutions, slowing market penetration.

Opportunity: Growing demand in emerging markets and innovations in bioengineered grafts

Emerging economies across Asia Pacific, Latin America, and parts of the Middle East are witnessing rapid growth in surgical volumes due to better healthcare funding, rising medical tourism, and increased awareness about neurological care. These markets represent untapped potential for dural graft manufacturers, especially as they transition to advanced surgical methods. Simultaneously, innovation in the field of biomaterials is opening new frontiers. Bioengineered grafts that combine synthetic scaffolds with biological components are showing promise in promoting faster tissue regeneration and reducing complications. Developments in nanotechnology, regenerative medicine, and tissue engineering are enabling next-generation grafts with enhanced mechanical strength, antimicrobial properties, and superior integration with host tissue. As global healthcare systems place greater emphasis on long-term surgical outcomes and patient recovery, these innovations are expected to attract strong demand and investment.

Challenges: Supply chain disruptions and variability in raw material sourcing

The dural graft market remains sensitive to supply chain issues, particularly for xenograft and allograft materials, which depend on consistent biological sourcing and rigorous processing protocols. Fluctuations in the availability and pricing of raw materials due to geopolitical instability, pandemics, or trade restrictions can disrupt production timelines and affect market stability. Manufacturers also face logistical challenges in transporting temperature-sensitive grafts across borders while maintaining sterility and compliance with import regulations. Furthermore, differing standards and regulatory requirements across countries complicate the global distribution of dural grafts, making it difficult for companies to scale efficiently without significant adaptation costs. These factors necessitate robust supply chain management and flexible manufacturing strategies to ensure business continuity and meet growing global demand.

Global Dural Graft Market Ecosystem Analysis

The dural graft market ecosystem includes key stakeholders such as raw material suppliers (collagen, synthetic polymers), graft manufacturers (e.g., Medtronic, Integra LifeSciences), healthcare providers, and regulatory bodies. Manufacturers are focusing on developing grafts with improved biocompatibility and reduced immune response. Hospitals and surgical centers form the primary end-users, while government agencies regulate safety and efficacy. Collaborative partnerships between research institutes and companies accelerate innovation. The balance between supply availability, technological advancement, and regulatory compliance shapes the ecosystem’s growth trajectory.

Global Dural Graft Market, By Material Type

What key advantages helped the synthetic dural graft segment outperform others in the market?

The synthetic dural graft segment dominates the dural graft market due to its consistent quality, lower risk of disease transmission, and wide availability compared to biological alternatives. Synthetic grafts offer superior handling properties, reduced immunogenic response, and are increasingly favored in neurosurgical procedures. These advantages, along with advancements in biomaterials and growing surgeon preference, have contributed to the segment’s leading position.

How did the xenograft segment achieve a notable share in the dural graft market?

The xenograft segment holds a significant share in the dural graft market due to its high biocompatibility, availability, and cost-effectiveness. Derived from animal tissues, xenografts offer structural similarity to human dura mater and are widely used in neurosurgical procedures. Advancements in sterilization and processing techniques have improved safety and acceptance, contributing to their sustained demand and notable market presence.

Global Dural Graft Market, By Application

Why is neurosurgery preferred over other applications in the dural graft industry?

Neurosurgery accounts for the largest share of the dural graft market due to the high volume of cranial and spinal procedures requiring dural repair. The critical nature of neurosurgical interventions demands reliable graft materials, leading to consistent demand for both synthetic and biological dural substitutes. Increasing incidence of neurological disorders, advancements in surgical techniques, and the growing number of neurosurgical procedures globally have further solidified this segment’s leading position.

What makes the ENT/spinal segment a consistently growing area in the dural graft industry?

The ENT/spinal segment is growing steadily in the dural graft market due to increasing numbers of otolaryngology and spinal surgeries that require effective dural repair and reconstruction. Rising awareness of minimally invasive procedures, advances in surgical techniques, and the growing adoption of biologically compatible graft materials in ENT and spinal applications are driving this segment’s consistent growth. Additionally, a steady rise in age-related spinal disorders and ENT complications further supports its expansion.

Asia Pacific is poised to dominate the dural graft market throughout the forecast period, projected to account for approximately 44% of global market revenue by 2035,

driven by a combination of factors, including rapidly expanding healthcare infrastructure, increased accessibility to surgical care, and a growing prevalence of neurological conditions that require surgical interventions. Countries such as China, India, and Japan are experiencing a surge in demand for neurosurgical procedures due to improved diagnostics, higher patient awareness, and a rising aging population vulnerable to neurological and spinal disorders. Additionally, governments across the region are actively investing in modernizing healthcare systems through public health initiatives, the expansion of specialty hospitals, and the promotion of advanced surgical technologies. Private sector participation, including the growth of medical tourism and investment in high-end surgical facilities, is also playing a key role in driving adoption of advanced dural graft materials particularly synthetic and bioengineered variants that offer improved safety and outcomes.

India is emerging as a high-growth market within Asia Pacific, with a projected CAGR of approximately 11% through 2035,

attributed to the rising burden of neurological and spinal disorders, the expansion of tertiary care hospitals, and national healthcare initiatives such as Ayushman Bharat and the "Make in India" campaign, which promote medical technology development and access. Increasing penetration of health insurance, the proliferation of neurosurgical training programs, and improved patient awareness about surgical options are also expanding the target patient base for dural graft procedures. Moreover, collaborations between domestic and international medical device companies are helping to bridge the gap between demand and supply, making advanced graft technologies more accessible to Indian healthcare providers.

North America is expected to be the fastest-growing regional market, anticipated to hold approximately 24% of the global dural graft market revenue by 2035.

The region's growth is underpinned by a robust healthcare system, high per capita healthcare spending, and a well-established surgical infrastructure. The United States, in particular, accounts for the majority of neurosurgical procedures globally, with a large patient population suffering from age-related degenerative neurological conditions, brain tumors, and spinal defects. The market is further supported by strong R&D investments from both public institutions and private companies aimed at developing next-generation synthetic grafts that offer better biocompatibility and lower infection risks. Regulatory pathways such as FDA approvals, while rigorous, are clearly defined, enabling innovation and faster commercialization of new graft materials. The U.S. market is also benefiting from the increasing preference for minimally invasive neurosurgical techniques, where high-quality graft materials are critical for reducing recovery time and improving patient outcomes.

WORLDWIDE TOP KEY PLAYERS IN THE DURAL GRAFT MARKET INCLUDE

- Medtronic

- Integra LifeSciences

- Stryker Corporation

- Baxter International Inc.

- Aesculap (B. Braun Melsungen AG)

- Synovis Life Technologies

- Syntekabio

- SurGenTec Corporation

- Others

Product Launches in Dural Graft Market

- In April 2024, Medtronic introduced a next-generation synthetic dural graft specifically engineered for enhanced biocompatibility and faster tissue integration. This product is targeted toward neurosurgical applications in North America and Europe, two regions characterized by advanced surgical capabilities and high adoption rates of innovative medical devices. The graft aims to address key clinical concerns such as graft rejection, infection, and delayed healing, by leveraging improved material science and design tailored for precision neurosurgery. With this launch, Medtronic seeks to strengthen its position in the synthetic graft segment and cater to growing demand for high-performance, reliable dura mater substitutes in complex cranial and spinal procedures.

- In September 2023, Integra LifeSciences expanded its allograft dural substitute portfolio with a newly developed, processed human dura mater graft. This product is designed to offer improved structural integrity and reduced immunogenic response, making it a favorable choice for surgeons seeking biologically sourced yet clinically effective graft solutions. The company is focusing on meeting the rising demand in the Asia-Pacific region, where increasing surgical volumes, particularly in India, China, and Southeast Asia, are driving the need for high-quality graft materials. This strategic portfolio expansion reflects Integra’s commitment to innovation in biologic grafts and its efforts to broaden geographic presence in high-growth emerging markets.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisor has segmented the dural graft market based on the below-mentioned segments:

Global Dural Graft Market, By Material Type

- Xenograft

- Allograft

- Synthetic

Global Dural Graft Market, By Application

- Neurosurgery

- ENT/Spinal

Global Dural Graft Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

FAQs

Q. What is the expected growth rate of the global dural graft market?

A: The market is expected to grow at a CAGR of 4.97% from 2025 to 2035, reaching USD 1,054.7 million by 2035.

Q. Which material type dominates the dural graft market?

A: Synthetic dural grafts dominate the market due to their consistent quality, lower risk of disease transmission, and growing surgeon preference.

Q. Why is neurosurgery the largest application segment for dural grafts?

A: Neurosurgery involves a high volume of cranial and spinal procedures requiring dural repair, creating consistent demand for reliable graft materials.

Q. Which region holds the largest market share in dural grafts?

A: Asia Pacific is the largest regional market, accounting for approximately 44% of the global market revenue by 2035.

Q. What factors are driving growth in the Asia Pacific dural graft market?

A: Expansion of healthcare infrastructure, rising prevalence of neurological disorders, government initiatives, and growing accessibility to advanced surgical care.

Q. What challenges does the dural graft market face?

A: High cost of advanced grafts, regulatory hurdles, supply chain disruptions, and variability in raw material sourcing limit market expansion.

Q. How are innovations influencing the dural graft market?

A: Developments in bioengineered grafts, nanotechnology, and regenerative medicine are creating next-generation grafts with improved mechanical strength and tissue integration.

Q. Who are the key players in the dural graft market?

A: Major companies include Medtronic, Integra LifeSciences, Stryker Corporation, Baxter International, and B. Braun Melsungen AG (Aesculap).

Q. What recent product launches have occurred in the dural graft market?

A: In 2024, Medtronic launched a next-gen synthetic dural graft with enhanced biocompatibility, and Integra LifeSciences expanded its allograft portfolio in 2023.

Q. Why is North America expected to be the fastest-growing market?

A: Due to robust healthcare infrastructure, high R&D investment, widespread adoption of minimally invasive surgical techniques, and clear regulatory pathways facilitating innovation.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 165 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |