Global E Clinical Solution Market

Global E Clinical Solution Market Size, Share, and COVID-19 Impact Analysis, By Product (Clinical Data Management, Clinical Trial Management System (CTMS), Electronic Clinical Outcome Assessment (eCOA) Solution, Randomization and Trial Supply Management (RTSM), Safety Solution, Others), By Mode of Delivery (Licensed enterprise (on-premise) Solutions, Cloud-based (SAAS) solution (CBS), and Web-hosted (on-demand) solution (WHS)), By End-user (Contract research organizations (CROs), Medical device companies, Pharma/biotech companies, Hospitals and clinics, and Other end users), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Global E Clinical Solution Market Size Insights Forecasts to 2035

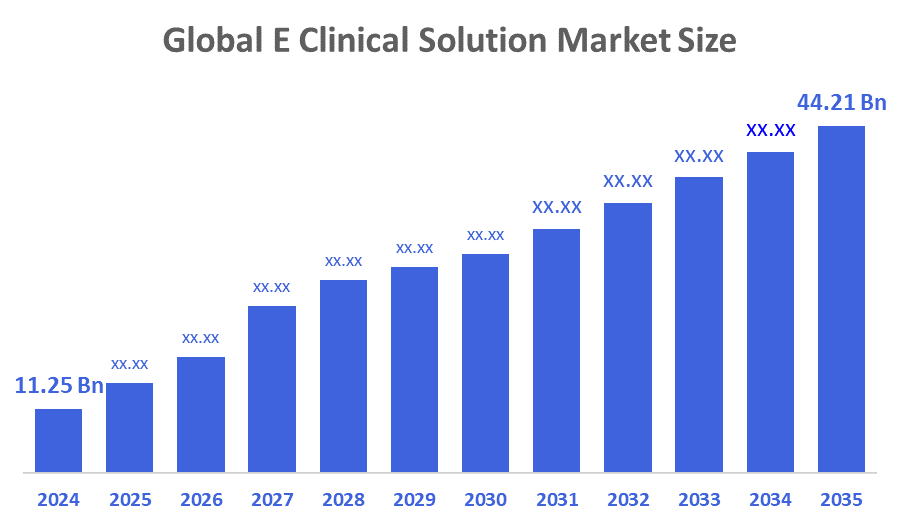

- The Global E Clinical Solution Market Size Was Estimated at USD 11.25 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 13.25% from 2025 to 2035

- The Worldwide E Clinical Solution Market Size is Expected to Reach USD 44.21 Billion by 2035

- North America is expected to Grow the fastest during the forecast period.

According to a Research Report Published by Decisions Advisors and Consulting, The Global E Clinical Solution Market Size was worth around USD 11.25 Billion in 2024 and is predicted to Grow to around USD 44.21 Billion by 2035 with a compound annual growth rate (CAGR) of 13.25% from 2025 to 2035. The market is anticipated to expand significantly with the growing adoption of decentralised clinical trials (DCT). The shift is additionally supported by the increasing use of wearable devices, electronic health records (EHRs), and mobile health platforms that facilitate real-time data collection and monitoring. Furthermore, the market is being propelled by the initiatives of regulatory bodies committed to technological changes that enhance patient safety and ensure a reliable trial system.

Market Overview

The ecosystem of digital platforms and technology intended to optimise, manage, and expedite clinical trials is known as the eClinical solutions market. Clinical trials and other research-related activities can be planned and carried out more efficiently with the use of sophisticated digital platforms and software programs. Besides, combining data from many electronic sources, such as EDC, CTMS, and ePRO, eClinical solutions enhance data quality, efficacy, and regulatory compliance. The growing adoption of wearable technology, mobile health systems, and electronic health records (EHRs), which enable real-time data gathering and monitoring, also contributes to this shift. Additionally, the market is driven by the regulatory bodies' efforts to improve patient safety through technological advancements. Adoption is being accelerated by the expanding worldwide internet footprint and enhanced digital accessibility as clinical studies evaluate the safety and efficacy of medications and medical devices before commercialisation. Wider use of e-clinical solutions is also being fueled by the promise of increased data reliability, real-time insights, and enhanced operational efficiency over conventional manual methods.

Almac Group’s $48 million investment and the launch of Almac Trial Coordinator represent a major step in addressing fragmentation and inefficiencies in clinical trial technologies. Almac Trial Coordinator is a first-in-class interoperable clinical trial technology platform designed to unify operational processes, clinical data, and systems.

Report Coverage

This research report categorises the E clinical solution market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the E clinical solution market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the E clinical solution market.

Driving Factors

The market is anticipated to expand significantly with the growing adoption of decentralised clinical trials (DCT). Furthermore, the market is being propelled by the initiatives of regulatory bodies committed to technological changes that enhance patient safety and ensure a reliable trial system. Apart from this, the rising use of software solutions in clinical trials is expected to be a major driver for the market. In addition, the increasing trend of outsourcing and externalisation of clinical trials by most of the top pharmaceutical and biotechnological companies is believed to be the primary factor that will propel the market to a record-breaking level during the forecast period. The growing need for software solutions for clinical trials by pharma and biopharma companies is the chief factor that has propelled the market for eClinical solutions. Besides this, government financing through grants to support trials and an increasing number of end users of eClinical solutions are likely to revitalise the eClinical solutions market.

Restraining Factors

Challenges with high costs, intricate regulations, and regional technical variations are constraining the global eClinical solutions market. The situation is further complicated by the presence of tightly regulated standards such as GDPR and the FDA's 21 CFR Part 11, which set the requirements for electronic records and signatures.

Market Segmentation

The E clinical solution market share is classified into product, mode of delivery, and application.

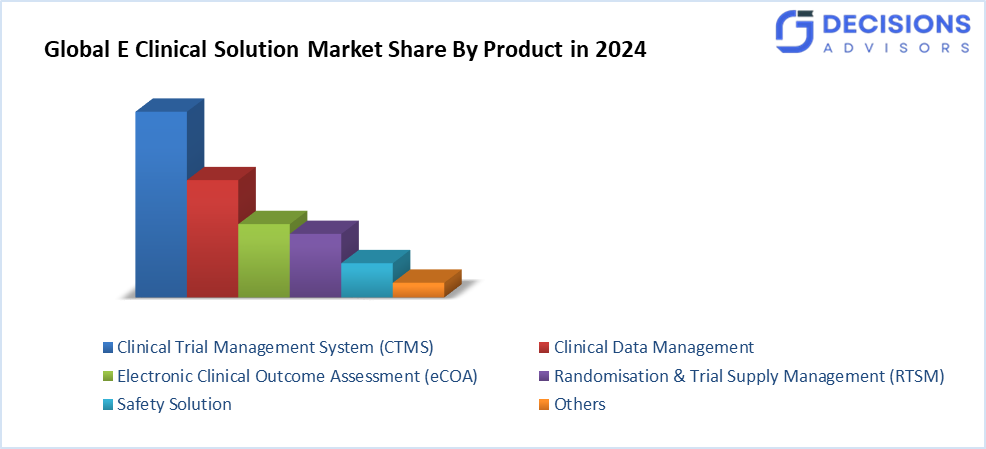

- The clinical trial management system (CTMS) segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the product, the E clinical solution market is differentiated into clinical data management, clinical trial management system (CTMS), electronic clinical outcome assessment (eCOA) solution, randomisation and trial supply management (RTSM), safety solution, and others. Among these, the clinical trial management system (CTMS) segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The market is anticipated to rise due to the quick development of healthcare IT, a desire for decentralised clinical trials, initiatives by major industry players, and an increase in clinical studies. Medical research is being driven by government initiatives and financing from pharmaceutical and biotechnology companies. These elements are anticipated to drive market expansion when combined with technology developments.

- The web-hosted (on-demand) solution (WHS) segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the mode of delivery, the E clinical solution market is classified into licensed enterprise (on-premise) solutions, cloud-based (SAAS) solutions (CBS), and web-hosted (on-demand) solutions (WHS). Among these, the web-hosted (on-demand) solution (WHS) segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The segment's dominance can be ascribed to related advantages, including cheap investment requirements, ease of access, and usage. Further, such products are readily adaptable; suppliers can alter how information is presented for various user groups. These products are also more interoperable.

- The contract research organisations (CROs) segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end user, the E clinical solution market is segmented into contract research organisations (CROs), medical device companies, pharma/biotech companies, hospitals and clinics, and other end users. Among these, the contract research organisations (CROs) segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The segment expansion is being further expanded by the increasing use of eClinical solutions in research. The advantages of contracting out clinical trials to CROs are the cause of this market's rapid expansion. These advantages include lower costs, better service efficiency, more productivity, and a greater emphasis on key areas of development that are essential to a business's expansion.

Regional Segment Analysis of the E Clinical Solution Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the E clinical solution market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the E clinical solution market over the predicted timeframe. The region's need for software solutions is being fueled by high unmet medical needs and an increase in the prevalence of key chronic diseases like cancer, heart disease, and infectious diseases. Moreover, with their vast patient populations and affordable costs, a growing number of studies are being outsourced to nations like China, India, Korea, and Japan boosts the market growth. The adoption of eClinical solutions in these areas has increased as a result of this outsourcing. Government financing for research and drug discovery is a major factor driving the APAC market's growth as a rising economy, and this funding is expected to boost the market's growth over the projected period.

The market for eClinical solutions in Japan is driven by biopharmaceutical companies' significant R&D efforts, the growing use of software in clinical trials, and the growing need for safety monitoring. Furthermore, Japan is a major participant in the international clinical research and pharmaceutical industries. Numerous clinical trials are carried out by the nation's academic institutions and pharmaceutical corporations.

North America is expected to grow at a rapid CAGR in the E clinical solution market during the forecast period. The market is set to be significantly influenced by the increased occurrence of lifestyle-associated diseases, notably diabetes and cardiac disorders. Furthermore, the regional market is being propelled by the initiation of innovative products by eClinical solution vendors and a surge in government grants. Besides, the local presence of influential players and the access to advanced infrastructure are a few of the other factors that are expected to contribute to the expansion of the regional market.

The U.S. market is highlighted the market due to the area's sophisticated healthcare set, up and thriving pharmaceutical sector. The establishment of leading companies, along with regulations that encourage such developments and create a conducive environment for the innovation and uptake of eClinical technologies.

In August 2024, Walgreens Boots Alliance introduced Decentralised Clinical Operations. This was done in collaboration with the Biomedical Advanced Research and Development Authority (BARDA) for the Healthcare and Research program. The project is designed to improve the U.S. capacity for decentralised clinical research. It is estimated that the initiative has a patient recruitment pool for clinical trials that extends to over five million individuals.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the E clinical solution market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Clario

- Clinfinite Solutions

- CRF Health

- eClinical Solutions LLC

- eClinicalWorks

- Florence Healthcare

- IQVIA

- Medidata

- Oracle

- RealTime Software Solutions, LLC

- Signant Health

- Summit Partners L.P.

- Suvoda LLC

- Viedoc Technologies

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2025, RealTime eClinical Solutions launched TrialAlign, a new trial analytics platform designed to transform clinical research site selection, feasibility assessment, and performance monitoring by providing sponsors and CROs with real-time, unbiased data. This rollout marks a significant shift in how stakeholders evaluate trial placement decisions.

- In September 2024, GI Partners acquired a majority stake in eClinical Solutions, a leading provider of digital clinical software and services, to accelerate the company’s growth in AI-powered data products and biometrics services. The investment, announced in September 2024, strengthens eClinical’s position as a trusted partner for pharmaceutical and biotech companies navigating increasingly complex clinical trials.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the E clinical solution market based on the below-mentioned segments:

Global E Clinical Solution Market, By Product

- Clinical Data Management

- Clinical Trial Management System (CTMS)

- Electronic Clinical Outcome Assessment (eCOA) Solution

- Randomisation and Trial Supply Management (RTSM)

- Safety Solution

- Others

Global E Clinical Solution Market, By Mode of Delivery

- Licensed enterprise (on-premise) Solutions

- Cloud-based (SAAS) solution (CBS)

- Web-hosted (on-demand) solution (WHS)

Global E Clinical Solution Market, By End User

- Contract research organisations (CROs)

- Medical device companies

- Pharma/biotech companies

- Hospitals and clinics

- Other end users

Global E Clinical Solution Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

- What is the projected growth of the Global E clinical solution market?

The market was valued at USD 11.25 billion in 2024 and is expected to reach USD 44.21 billion by 2035, growing at a CAGR of 13.25% from 2025 to 2035.

- Which product segment dominates the E clinical solution market?

The Clinical Trial Management System (CTMS) segment held the largest share in 2024 and is projected to grow at a significant CAGR, driven by healthcare IT advancements and decentralised trials.

- What mode of delivery leads the market, and why?

Web-hosted (on-demand) solutions (WHS) generated the highest revenue in 2024 and are expected to maintain strong growth due to low costs, easy access, adaptability, and interoperability.

- Which end-user segment has the highest market share?

Contract Research Organisations (CROs) accounted for the top revenue in 2024 and are set for robust expansion, fueled by outsourcing trends, cost efficiencies, and increased eClinical adoption in research.

- Which region is expected to grow the fastest, and what drives it?

North America is projected to grow at the fastest CAGR, supported by rising lifestyle diseases, innovative product launches, government grants, advanced infrastructure, and key players like those in the U.S.

- What are the main drivers and restraints for market growth?

Growth is propelled by decentralised clinical trials (DCT), regulatory support for tech enhancements, outsourcing by pharma/biotech firms, and real-time data tools. Restraints include high costs, complex regulations like GDPR and FDA 21 CFR Part 11, and regional tech variations.

- Who are the key players in the E clinical solution market?

Leading companies include Clario, IQVIA, Medidata, Oracle, eClinical Solutions LLC, Florence Healthcare, Signant Health, and others, with recent developments like RealTime eClinical's TrialAlign launch in September 2025.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 284 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |