Global E-house Market

Global E-house Market Size, Share, and COVID-19 Impact Analysis, By Type (Mobile, Semi-Mobile, Fixed), By Voltage (Low, Medium), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035.

Report Overview

Table of Contents

E-house Market Summary

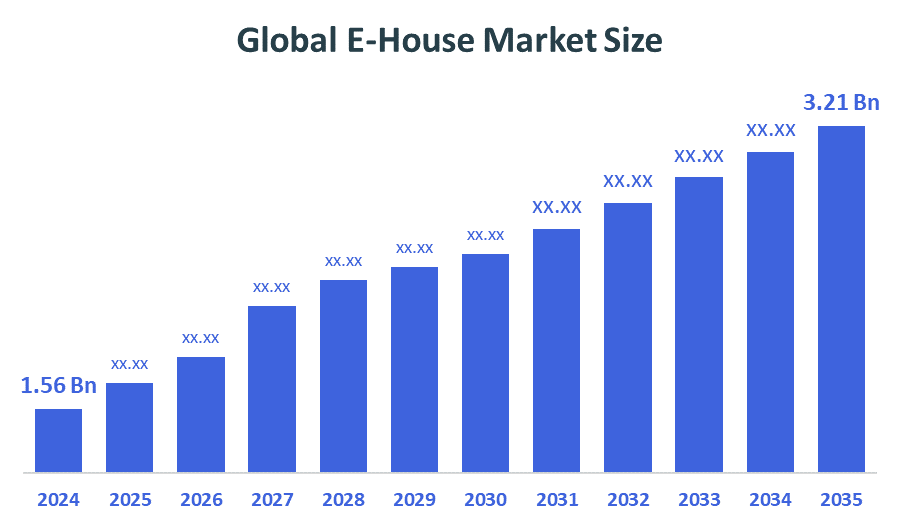

The Global E-House Market Size Was Estimated At USD 1.56 Billion in 2024 and is Projected to Reach USD 3.21 Billion by 2035, growing at a CAGR of 6.78% from 2025 to 2035. The market for e-houses is expanding as a result of increased industrialization, rising demand for dependable power supplies, the requirement for quick deployment, the expansion of infrastructure in remote places, and growing use of modular, affordable electrical solutions.

Key Regional and Segment-Wise Insights

- In 2024, the Asia Pacific e-house market accounted for the largest revenue share of 28.36%, and dominated the market globally.

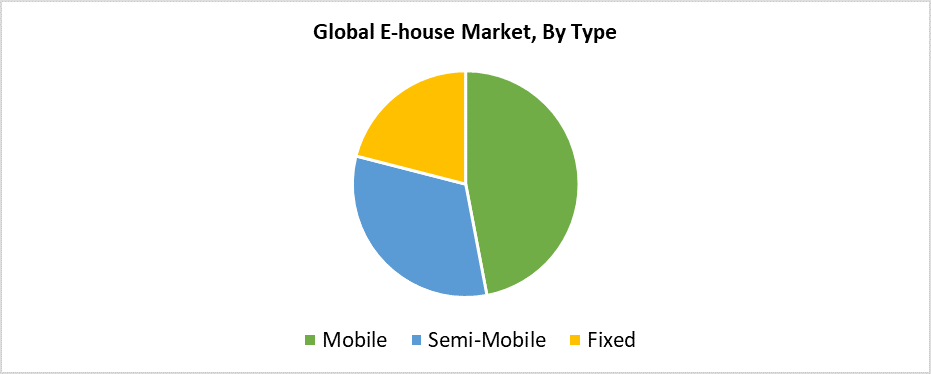

- In 2024, the mobile segment held the largest market share of 47.32% based on type.

- In 2024, the medium segment had the largest market share, accounting for 64.35% based on voltage.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 1.56 Billion

- 2035 Projected Market Size: USD 3.21 Billion

- CAGR (2025-2035): 6.78%

- Asia Pacific: Largest market in 2024

The E-houses market represents prefabricated modular walk-in enclosures that protect essential electrical control equipment, including motor control centers, transformers, and switchgear. Multiple industries, including mining, oil and gas, electrical utilities, and railroads, depend on E-houses for their quick setup and integration in distant and difficult environments. The market growth stems from three main drivers, which include the rising complexity of large infrastructure projects, together with the need for dependable power supply and fast electrification requirements. The adoption rate of e-houses is rising in both developed and emerging nations because they provide a cheaper, more compact, and faster solution compared to traditional brick-and-mortar substations.

The E-house industry experiences substantial changes because of technological advancements. E-house operations, maintenance, and safety and operational efficiency benefit from automation technology, along with remote monitoring systems and Internet of Things integration. The combination of modular construction with compact design enables faster on-site assembly and easier transportation methods. Governments support modern electrical infrastructure deployment through their financial backing of rural electrification projects and renewable energy initiatives, as well as smart grid development programs. The industry develops smarter, more flexible, and environmentally friendly E-house solutions because of these factors, together with stringent safety and environmental regulations.

Type Insights

The mobile segment dominated the E-house market with the largest revenue share of 47.32% in 2024. The leading position of mobile e-houses results from their ability to provide adaptable power solutions that serve the mining, construction, and oil and gas sectors. The main advantages of mobile e-houses include their easy transportability, combined with fast installation times, and their capacity to serve temporary and distant locations. Their compact design and modular construction make them ideal for operations that require fast power deployment and frequent site changes. The rising construction activity in rural areas, along with emergency and temporary project demands for mobile substations, propels mobile E-house solutions to the forefront of the market.

The semi-mobile category of the E-houses market is expected to grow at the fastest CAGR because it effectively combines stability with mobility. Semi-mobile E-houses present stronger infrastructure capabilities than fully mobile units and greater flexibility than fixed units. The design of these E-houses makes them suitable for mining, oil and gas operations as well as renewable energy projects that need reliable power management systems but must move between sites. The modular construction of this type allows for quicker installation and simple relocation procedures, which cuts both time and expenses in project development. The growing demand for scalable power solutions, together with increasing infrastructure development investments, has established semi-mobile E-houses as the market segment with the highest growth rate.

Voltage Insights

The medium voltage segment dominated the worldwide E-house market in 2024 with the largest revenue share of 64.35%. The leading position of medium voltage systems in worldwide E-house markets exists because various industrial sectors, including mining, power generation, and oil and gas, require reliable and efficient power distribution systems. The best value between price and performance, and safety makes medium voltage E-houses the most suitable choice for many applications. Their large power-handling abilities work together with compact modular construction to improve operational efficiency. Emerging economies require new electrical systems, and their expanding infrastructure leads to strong market growth for medium voltage E-houses, which maintain their position as market leaders.

The low-voltage segment of the E-houses market is projected to grow at the fastest CAGR during the forecast period. The market experiences rapid expansion because small power distribution systems meet the needs of telecommunications facilities, commercial buildings, and small-scale renewable energy installations. Users select low-voltage E-houses because these units provide adaptable solutions with straightforward installation processes and match the power requirements of smaller capacities. The rising adoption of advanced automation systems along with smart grids has driven market growth, which primarily operates at low voltage levels. The low voltage market segment displays strong potential for growth because it delivers adaptable electrical solutions to expanding infrastructure developments across both urban and rural regions worldwide.

Regional Insights

The Asia Pacific E-house market accounted for the largest revenue share of 28.36% in 2024 because of its extensive infrastructure projects and fast industrialization. The market experienced substantial expansion because businesses increased their investments in mining along with power generation and oil and gas operations while seeking dependable modular electrical solutions. The governmental initiatives to boost renewable energy development alongside energy infrastructure modernization in China and India and Australia serve as key market drivers. The rising need for flexible power distribution systems in urban and rural areas helps increase E-house adoption. The strong regional requirements have positioned Asia Pacific as the leading global market for E-house solutions.

North America E-House Market Trends

The North American E-house industry experiences continuous growth because of the region's focus on modernizing electrical systems and expanding renewable energy installations. Multiple industries, including industrial manufacturing, utilities, and oil and gas, require electrical solutions that deliver effectiveness along with adaptability and fast deployment. The increasing financial support for smart grid technologies and the transition to solar and wind energy drive E-house implementation. The requirement of strict safety and reliability standards, along with faster construction times, makes prefabricated E-house systems an attractive solution for installation. E-house producers find significant expansion opportunities in North America through development projects and technological advancements in infrastructure.

Europe E-House Market Trends

The European E-house market is growing significantly because of regional focus on grid modernization, alongside industrial automation and renewable energy integration. European governments dedicate substantial funds to environmentally friendly infrastructure development, including wind and solar farms, which need adaptable and dependable electricity distribution systems similar to E-houses. Modular electrical homes, which are small and straightforward to install, demonstrate increasing popularity throughout manufacturing sectors, utilities, and oil and gas industries. The trend toward using prefabricated E-house systems gains momentum because stringent environmental standards combine with efforts to achieve energy efficiency. Technology advancements and smart grid development in Europe will drive substantial demand for E-house solutions throughout the next years.

Key E-house Companies:

The following are the leading companies in the e-house market. These companies collectively hold the largest market share and dictate industry trends.

- ABB Ltd.

- Meidensha Corporation

- Siemens AG

- Schneider Electric

- General Electric (GE)

- TGOOD Global Ltd.

- Eaton Corporation

- Powell Industries

- WEG

- Unit Electrical Engineering

- Others

Recent Developments

- In March 2025, Schneider Electric plans to invest more than USD 700 million in its US operations, by 2027, concentrating on manufacturing, automation, and digitization to meet the growing energy demands of utilities and data centers. This would result in the creation of more than 1,000 jobs in many states.

- In March 2025, ABB strengthened its position in the smart-building technology market by completing the acquisition of Siemens' Wiring Accessories business in China, which generated over USD 150 million in revenue and expanded the distribution network to over 230 cities.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the e-house market based on the below-mentioned segments:

Global E-house Market, By Type

- Mobile

- Semi-Mobile

- Fixed

Global E-house Market, By Voltage

- Low

- Medium

Global E-house Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 256 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |