Global Edible Flakes Market

Global Edible Flakes Market Size, Share, and COVID-19 Impact Analysis, By Product (Corn Flakes, Oat Flakes, Wheat Flakes, Others), By Distribution Channel (Online, Offline), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Edible Flakes Market Summary

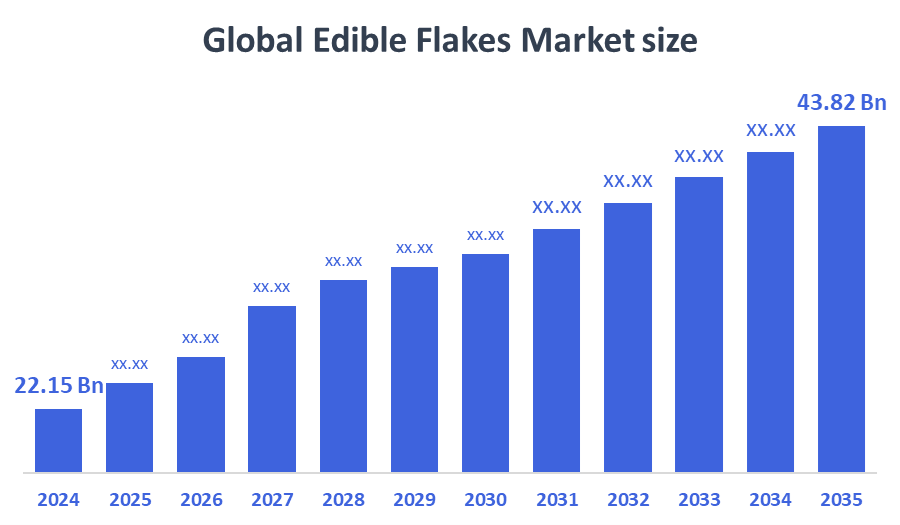

The Global Edible Flakes Market Size Was Estimated at USD 22.15 Billion in 2024 and is Projected to Reach USD 43.82 Billion by 2035, Growing at a CAGR of 6.4% from 2025 to 2035. The market for edible flakes is expanding because to factors such rising health consciousness, the need for quick breakfast options, the growing popularity of prepared foods, and consumers with hectic schedules becoming more mindful of the nutritional advantages of fiber, vitamins, and minerals.

Key Regional and Segment-Wise Insights

- In 2024, the North American edible flakes market held the largest revenue share of 37.5% and dominated the global market.

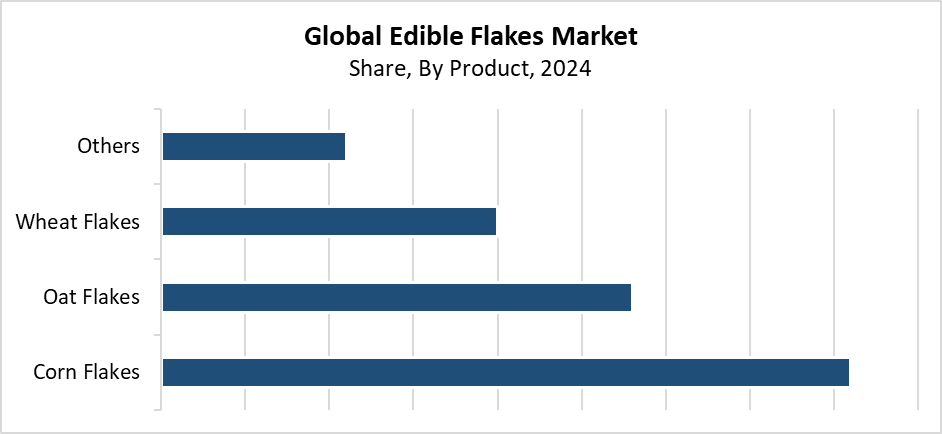

- In 2024, the corn flakes segment held the highest revenue share of 41.3% and dominated the global market by product.

- With the biggest revenue share in 2024, the offline segment led the worldwide market by distribution channel.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 22.15 Billion

- 2035 Projected Market Size: USD 43.82 Billion

- CAGR (2025-2035): 6.4%

- North America: Largest market in 2024

The edible flakes market exists as a market which distributes processed cereal products, such as corn flakes, wheat flakes, rice flakes, and oat flakes that people consume for breakfast or as snacks. These goods are popular because of their nutritional value, which includes fibre, vitamins, and minerals, as well as their long shelf life and ease of use. The market receives support from various elements, which include health awareness and the requirement for nutritious food with minimal fat content. The need for fast food because of busy schedules also supports the market. The market receives support from three factors, which include increasing working populations, urban development, and Western dietary patterns spreading through developing nations. The market growth also results from consumers choosing organic, clean-label, and fortified edible flakes.

The nutritional value and flavour quality of edible flakes have improved because of modern food processing methods. Modern manufacturing techniques enable the addition of functional ingredients such as probiotics, protein, and superfoods into products with minimal nutrient degradation. Innovative packaging designs that are innovative help consumers use products more efficiently while protecting them from damage during storage. Manufacturers receive support from government programs which promote balanced diets through their initiatives to develop healthier food products with reduced fat and sugar content in processed items. Support for labelling laws and food fortification initiatives continues to grow. This enhances consumer trust and drives market growth across international borders.

Product Insights

What Factors Enabled the Corn Flakes Segment to Capture the Largest Revenue Share of 41.3% in the Worldwide Edible Flakes Market in 2024?

The corn flakes segment led the worldwide edible flakes market with the largest revenue share of 41.3% in 2024. The widespread acceptance of corn flakes as a quick, healthy, affordable breakfast choice leads to their market dominance. Health-conscious consumers looking for low-fat, ready-to-eat meals are drawn to cornflakes because they are high in vital vitamins and minerals. Their versatility to combine with fruits, milk, and yoghurt makes them suitable for people of all ages. The market power of dominant companies strengthens through their strong brand recognition and extensive product lines, and their forceful promotional activities. The market segment for edible flakes has expanded its reach through the introduction of multigrain, sugar-free, and fortified corn flakes. These attract new customers to the worldwide market.

The oat flakes segment is expected to grow at a significant CAGR throughout the forecasted period because consumers now recognise the health advantages that oats provide. The fibre content of oat flakes, which includes beta-glucan, helps digestion and reduces cholesterol while supporting heart wellness. The demand for oat flakes as a wholesome breakfast or snack alternative grows because customers want products which contain natural ingredients, whole grains, and have clean labelling. The versatility of these ingredients allows them to enhance the appeal of baked goods, granola, and porridge recipes. The market expansion receives help from the increasing consumer interest in gluten-free and plant-based products. The market growth receives support from product development. Expanded availability of traditional retail stores and online platforms.

Distribution Channel Insights

Why Did the Offline Segment Hold the Largest Revenue Share in the Worldwide Edible Flakes Market in 2024?

The offline segment leads the worldwide edible flakes market by holding the largest revenue share in 2024. The market dominance exists because customers can find a wide range of edible flakes products at supermarkets, hypermarkets, grocery stores, and convenience stores. Shoppers choose offline channels because they want to see products in person and compare brands while getting store discounts. The presence of retail infrastructure in cities creates better product availability and visibility through its established distribution network. Offline sales depend heavily on impulsive purchases and customers who continue to choose the same brand repeatedly. Offline sales remain the preferred purchasing option for edible flakes because customers trust face-to-face shopping experiences that take place in physical stores.

The online segment of the edible flakes market is expected to grow at the fastest CAGR during the forecast period because of the increasing e-commerce adoption and changing consumer purchasing patterns. People choose to purchase food items, including edible flakes, through online platforms because internet usage expands and smartphones become more popular, while home delivery services provide convenient access to products. Online marketplaces serve as a platform for consumers to discover health-focused products which physical stores do not carry. Through their extensive brand selection, affordable prices, and subscription options, the platform offers customers complete product details and user reviews, and special discounts. The digital sales growth of edible flakes continues to rise because urban areas have more online grocery services, and cold-chain infrastructure and transportation systems have become more reliable.

Regional Insights

North America leads the global edible flakes market with the largest revenue share of 37.5% in 2024. The region maintains its position as the leading market because people require fast, nutritious morning meals since they lead active lifestyles and focus on their wellness. The United States and Canada lead all markets in consuming corn flakes, oat flakes, and multigrain flakes because these products offer nutritional benefits, quick preparation, and long-lasting storage. The market growth results from major market players and their distribution channels, and consumer knowledge about clean-label and fortified foods. Furthermore, ongoing product innovation, such as low-sugar and organic varieties, has reinforced North America's dominant position in the world market for edible flakes.

Europe Edible Flakes Market Trends

The European edible flakes market grows significantly during 2024 because more people understand the benefits of consuming whole grains and following healthy dietary patterns. European consumers now choose breakfast options which include corn flakes, oat flakes, and multigrain flakes that provide essential vitamins and minerals and fibre because these convenient and nutritious choices keep gaining popularity. The region's strong desire for natural and clean-label products has led to increased demand for organic gluten-free fortified edible flakes in Germany, the UK, and France. The development of contemporary retail formats, including supermarkets and online platforms, which improved product availability. This leads to market expansion. Government initiatives that promote balanced nutrition together with nutritional labelling regulations drive consumers toward healthier breakfast choices, which expands the European market.

Asia Pacific Edible Flakes Market Trends

The Asia Pacific edible flakes market is anticipated to experience a substantial CAGR over the forecasted period because consumers now eat differently and become more health-aware. The modern world has seen an increase in the popularity of breakfast items such as corn flakes, oat flakes, and multigrain flakes because people live fast lives, while their income grows and cities expand. People in China, India, Japan, and Australia are showing increasing interest in healthy breakfast choices. This drives the market for alternative breakfast options. The region benefits from modern retail expansion and e-commerce platforms, which provide better access to products and more choices. Manufacturers produce new regional flavours through organic and fortified alternatives to meet various consumer preferences. This drives market growth across the Asia Pacific.

Key Edible Flakes Companies:

The following are the leading companies in the edible flakes market. These companies collectively hold the largest market share and dictate industry trends.

- Nestlé

- The Brüggen Group

- General Mills Inc.

- WK Kellogg Co

- Bagrry's

- Dr. August Oetker KG

- Marico Ltd.

- The Quaker Oats Company (PepsiCo Inc.)

- Nature's Path

- Others

Recent Developments

- In November 2024, one of Premier Foods plc's brands, FUEL10K, debuted a line of multigrain flakes with two unique flavours, chocolate and red berry and high protein levels. The goal of FUEL10K's most recent portfolio addition is to meet the rising demand for breakfast items that are healthier, have less sugar, and offer more nutritional advantages.

- In October 2024, Tata Soulfull Corn Flakes+ was introduced by Tata Consumer Products Limited, one of its brands. Both the original and honey almond varieties of the recently launched product are available. Each flake in the package is advertised as a unique combination of corn and jowar.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the edible flakes market based on the below-mentioned segments:

Global Edible Flakes Market, By Product

- Corn Flakes

- Oat Flakes

- Wheat Flakes

- Others

Global Edible Flakes Market, By Distribution Channel

- Online

- Offline

Global Edible Flakes Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 213 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |