Global Electrical Activity Testing Market

Global Electrical Activity Testing Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Electroencephalography (EEG), Electromyography (EMG), Electrocardiography (ECG), and Others), By Application (Neurology, Cardiology, Sleep Disorders, and Others), By End-User (Hospitals, Diagnostic Centers, Ambulatory Surgical Centers, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035

Report Overview

Table of Contents

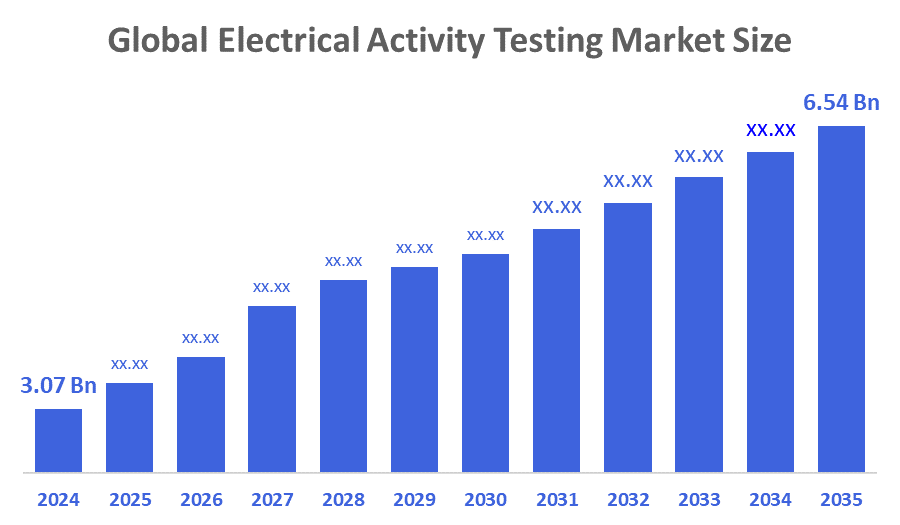

Global Electrical Activity Testing Market Size Insights Forecasts to 2035

- The Global Electrical Activity Testing Market Size Was Estimated at USD 3.07 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.12 % from 2025 to 2035

- The Worldwide Electrical Activity Testing Market Size is Expected to Reach USD 6.54 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

According to a research report published by Decisions Advisors and Consulting, The Global Electrical Activity Testing Market Size Was Worth Around USD 3.07 Billion In 2024 And Is Predicted To Grow To Around USD 6.54 Billion By 2035 With A Compound Annual Growth Rate (CAGR) Of 7.12 % From 2025 To 2035. The impressive growth in the market is a reflection of the various factors, such as the rising cases of neurological and cardiovascular disorders, the rise in innovations in medical technology, and increasing awareness of the importance of early diagnosis and treatment. The largest growth factor for the market of electrical activity testing is the rapid increase in the number of cases of neurological disorders, such as epilepsy, dementia, and Parkinson's disease. Since the world population is globally ageing, the prevalence of these diseases will certainly increase, and thus the demand for diagnostic tools such as electroencephalography (EEG) and electromyography (EMG) is also likely to grow.

Market Overview

The worldwide market for electrical activity testing can be defined as the sector that is primarily focused on the devices and technologies that measure, record, and analyse the electrical signals from the body's organs and tissues, mainly the brain, muscles, and heart, for clinical diagnosis, research, and monitoring purposes. It encompasses various tests like EEG (electroencephalography), EMG (electromyography), and ECG (electrocardiography), and is mainly influenced by demand in the fields of neurology, cardiology, and sleep disorder diagnostics. There is a growing demand for non-invasive testing methods, which provide patients with more comfort and convenience. Besides, the healthcare industry's increasing focus on preventive care is driving the use of electrocardiogram tests that enable early detection of health issues. Moreover, the incorporation of AI and machine learning into testing procedures is improving the diagnostic capabilities, thus making the testing process quicker and more accurate. Electrophysiology tests are vital in diagnosing and treating disorders such as arrhythmias and epilepsy. With the rise in the number of electrophysiological exams being conducted each year, mainly due to improvements in technology and methodology, the market is expected to continue expanding.

Beacon Biosignals raised an oversubscribed $86 million Series B round to expand its AI-driven neurodiagnostic platform, aiming to build the world’s largest dataset of brain activity and accelerate precision medicine for neurological and psychiatric diseases.

Report Coverage

This research report categorises the electrical activity testing market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the electrical activity testing market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the electrical activity testing market.

Driving Factors

Technological progress is a second key growth driver for this market. Changes in the devices for testing of electrical activity of the body, such as portable and wireless EEG, EMG, and ECG devices, have made these tools more available and easier to handle. Moreover, the integration of artificial intelligence (AI) and machine learning into the analysis of electrical activity data has significantly improved the diagnostic procedure, providing quicker and more precise outcomes. It is expected that these technological innovations will increase the utilisation of electrical activity testing in various healthcare settings. Moreover, the rise in healthcare spending and the governmental measures focusing on the improvement of diagnostic facilities are predicted to be major factors in the expansion of the market. Numerous nations are making substantial investments in healthcare infrastructure. As a part of this, they are equipping hospitals and diagnostic centers with state, of, the, art testing equipment. At the same time, campaigns by the government to raise public awareness about the benefits of early diagnosis in the treatment of chronic diseases have become one of the key factors in the market growth. Visual electrophysiology testing devices have found a new appeal in the healthcare sector because of their capacity to offer a thorough understanding of the workings of the visual tracks in the brain. These instruments are great for diagnosing and treating medical problems like glaucoma, optic neuritis, and retinal disorders.

Restraining Factors

Despite that, the electrical activity testing market is confronted with some problems that could limit its expansion. Among the major challenges is the expensive nature of advanced diagnostic devices that may be a hurdle for healthcare providers in developing and low-income countries. Moreover, the intricacies and requirement for specialised training to use and decipher results from these devices might restrict their extensive use, especially in areas that lack enough qualified health professionals. Additionally, regulatory compliance and the need to maintain high-quality standards for products may be challenging for manufacturers, which may result in new products not being introduced to the market promptly.

Market Segmentation

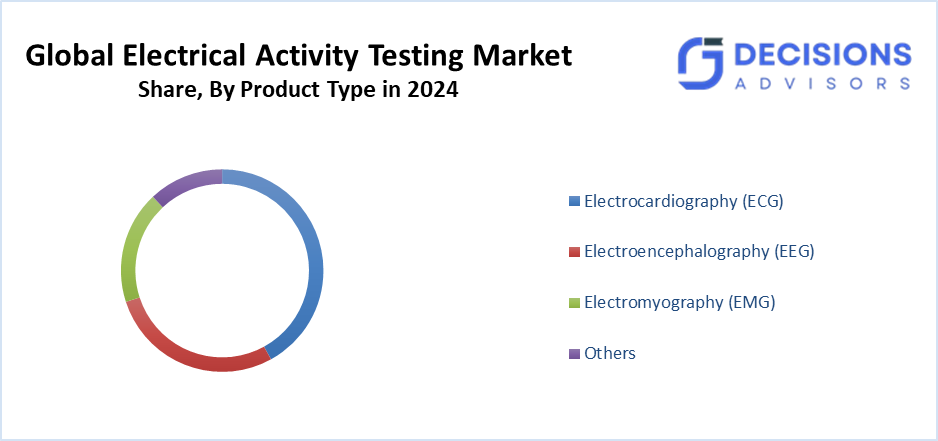

The electrical activity testing market share is classified into product type, application, and end user.

- The electrocardiography (ECG) segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the product type, the electrical activity testing market is divided into electroencephalography (EEG), electromyography (EMG), electrocardiography (ECG), and others. Among these, the electrocardiography (ECG) segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The ECG segment accounts for a major share of the market for electrical activity testing because of the high global incidence of cardiovascular diseases. ECG is one of the most crucial tests for diagnosing cardiovascular conditions, including arrhythmias, myocardial infarction, and other heart disorders. Their is cardiovascular diseases, being one of the top killers globally, there is a constant demand for ECG tests. Innovations like portable ECG monitors and smartphone-compatible ECG devices are increasing the accessibility of ECG testing and, hence, are the major factors in market growth.

- The cardiology segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the electrical activity testing market is divided into neurology, cardiology, sleep disorders, and others. Among these, the cardiology segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Cardiology is one of the major fields where electrical activity testing devices, especially ECG, are extensively used. Worldwide, the number of patients suffering from cardiovascular diseases is increasing dramatically, in part due to unhealthy lifestyle choices like obesity, smoking, and physical inactivity. Moreover, with the rapid development of telemedicine and the trend towards remote patient monitoring, the application of portable and connected ECG devices is increasingly becoming a reality.

- The hospitals segment accounted for the highest market revenue in 2024 and is projected to grow at a substantial CAGR over the forecast period.

Based on the end user, the electrical activity testing market is divided into hospitals, diagnostic centres, ambulatory surgical centres, and others. Among these, the hospitals segment accounted for the highest market revenue in 2024 and is projected to grow at a substantial CAGR over the forecast period. The electrical activity testing market's largest end-user segment is hospitals. Hospitals have a high-tech medical infrastructure, can handle many diagnostic tests, and do all that at a large scale. The rising cases of disease admissions in hospitals because of neurological and cardiovascular conditions are pushing up the need for electrical activity testing devices. Moreover, hospitals have the advantage of on, going technology developments and skilled healthcare professionals, thus facilitating the use of these diagnostic tools.

Regional Segment Analysis of the Electrical Activity Testing Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the electrical activity testing market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the electrical activity testing market over the predicted timeframe. The Asia Pacific region is experiencing rapid economic growth, increasing healthcare expenditure, and a growing prevalence of chronic diseases. Major players such as China, India, and Japan are witnessing remarkable development in healthcare infrastructures and an upsurge in the utilisation of advanced diagnostic technologies. The expansion of the middle-class population, rising awareness about the importance of early diagnosis, and government measures to extend healthcare access are some of the main factors that have contributed to the growth of the Asia-Pacific market.

North America is expected to grow at a rapid CAGR in the electrical activity testing market during the forecast period. North America is the biggest market for electrical activity testing, thanks to its advanced healthcare facilities, a large number of people suffering from neurological and cardiovascular diseases, and huge research and development investments. The existence of prominent market participants and the government's reimbursement policies that are supportive of the healthcare sector also help in the region's market growth. The United States is the main player in the region, with the widespread use of sophisticated diagnostic technology and continuous innovation.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the electrical activity testing market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Advanced Brain Monitoring Inc.

- BrainScope Company Inc.

- Cadwell Laboratories Inc.

- Compumedics Limited

- EB Neuro S.p.A.

- Electrical Geodesics Inc.

- GE Healthcare

- Lifelines Neurodiagnostic Systems Inc.

- Medtronic

- Natus Medical Incorporated

- Neurosoft

- Nihon Kohden Corporation

- Noraxon U.S.A. Inc.

- Philips Healthcare

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2026, PulseAI, a Belfast-based medtech startup, secured seed funding (January 2026) to expand its AI-driven ECG diagnostics platform and advance toward U.S. FDA 510(k) clearance. The round was led by Innovation Ulster Limited, with participation from The Mortara Group and The Francis Crick Institute.

- In December 2025, Northwestern University scientists developed a groundbreaking wireless brain implant that uses light to communicate directly with neurons, bypassing traditional sensory pathways. The soft, flexible device sits under the scalp and delivers precise light patterns through the skull, enabling artificial sensations and potential applications in prosthetics and sensory restoration.

- In July 2025, Zeto, Inc. announced the recipients of its 2024–2025 Clinical Trial Sponsorship Program, supporting research that advances EEG applications in critical care, stroke, and concussion. The initiative provides selected teams with access to Zeto’s rapid-setup, gel-free EEG technology and cloud platform to accelerate real-world healthcare and clinical research.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the electrical activity testing market based on the below-mentioned segments:

Global Electrical Activity Testing Market, By Product Type

- Electroencephalography (EEG)

- Electromyography (EMG)

- Electrocardiography (ECG)

- Others

Global Electrical Activity Testing Market, By Application

- Neurology

- Cardiology

- Sleep Disorders

- Others

Global Electrical Activity Testing Market, By End User

- Hospitals

- Diagnostic Centres

- Ambulatory Surgical Centres

- Others

Global Electrical Activity Testing Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

- What is the projected growth of the Global Electrical Activity Testing Market?

A:The market is expected to expand from USD 3.07 billion in 2024 to USD 6.54 billion by 2035, achieving a CAGR of 7.12% during 2025-2035. This growth stems from rising neurological and cardiovascular disorders, plus tech innovations like portable devices. North America leads in rapid expansion due to its advanced infrastructure.

- Which product segment dominates the market?

A:Electrocardiography (ECG) held the largest share in 2024 and will grow at a significant CAGR. High cardiovascular disease prevalence worldwide drives ECG demand, boosted by portable and smartphone-integrated monitors.

- What are the primary applications of electrical activity testing?

A:Key applications include neurology, cardiology (largest share), sleep disorders, and others. Cardiology benefits from ECG for arrhythmia detection amid lifestyle-driven heart issues, while neurology relies on EEG/EMG for epilepsy and Parkinson's.

- Who are the main end-users in this market?

A:Hospitals generated the highest revenue in 2024 and are set for substantial CAGR growth. They handle high-volume diagnostics with skilled staff, unlike diagnostic centres or ambulatory surgical centres.

- Why is Asia-Pacific expected to hold the largest market share?

A:Rapid economic growth, healthcare investments, and chronic disease rises in China, India, and Japan fuel dominance. Middle-class expansion and government access programs enhance advanced diagnostic adoption.

- What drives and restrains market expansion?

A:Drivers include AI integration, portable tech, and government healthcare spending for early detection. Restraints involve high device costs, the need for specialised training, and regulatory hurdles in low-income regions.

- Which companies lead the competitive landscape?

Key players feature GE Healthcare, Medtronic, Philips Healthcare, Nihon Kohden, Natus Medical, and others like Cadwell and Compumedics. Recent moves include PulseAI's 2026 seed funding and Zeto's EEG trial sponsorships.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 230 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Feb 2026 |

| Access | Download from this page |