Global Employer and Workplace Drug Testing Market

Global Employer And Workplace Drug Testing Market Size, Share, and COVID-19 Impact Analysis, By Sample Type (Urine, Saliva, Hair, Blood, and Others), By Application (Pre-Employment Screening, Random Testing, Post-Accident Testing, Return-to-Duty Testing, and Others), By End-User (Private Organizations, Government Agencies, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

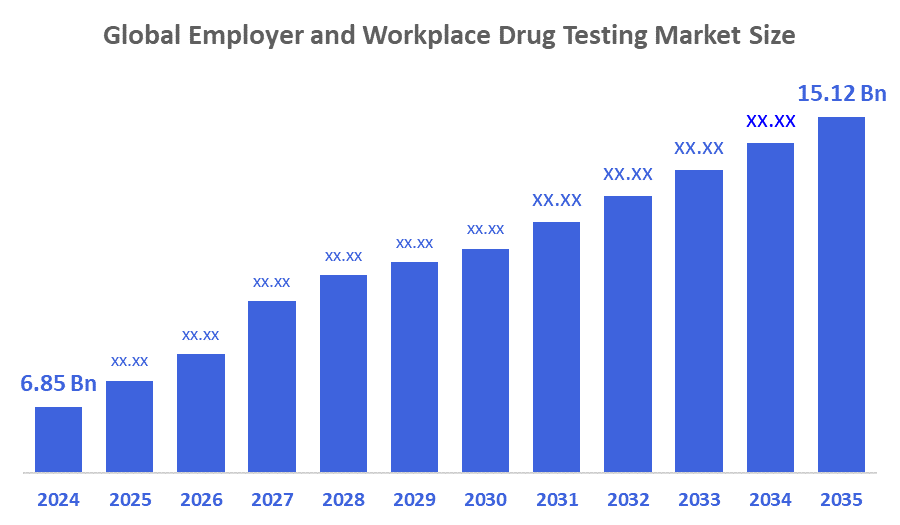

Global Employer and Workplace Drug Testing Market Size Insights Forecasts to 2035

- The Global Employer and Workplace Drug Testing Market Size Was Estimated at USD 6.85 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.46 % from 2025 to 2035

- The Worldwide Employer and Workplace Drug Testing Market Size is Expected to Reach USD 15.12 Billion by 2035

- Europe is expected to Grow the fastest during the forecast period.

According to a Research Report Published by Decisions Advisors and Consulting, The Global Employer and Workplace Drug Testing Market Size was worth around USD 6.85 Billion in 2024 and is predicted to Grow to around USD 15.12 Billion by 2035 with a compound annual growth rate (CAGR) of 7.46% from 2025 to 2035. The presence of increased regulations on workplace safety throughout every Industry is propelling the expansion of markets across these sectors. Through the implementation of comprehensive drug testing programs, companies can provide a safe working environment. Companies from many different industries are establishing a systematic drug testing protocol to comply with occupational safety standards and reduce their liability for substance abuse by employees.

Market Overview

The employer and workplace drug testing market encompasses diagnostic products, laboratory services, and technologies that organisations use to test employees and potential hires for illegal drugs, alcohol, and prescription misuse via biological specimens such as urine, hair, oral fluids, and blood. This market serves the needs of organisations performing pre-employment, random, post-accident, and periodic testing in high-risk industries, including, but not limited to, transportation, manufacturing, construction, healthcare, and finance. Testing is necessary to ensure compliance with government regulations, create safe working conditions, reduce workplace accidents, and limit the employer's liability related to drug and alcohol abuse. The market is fuelled by government mandates (e.g., DOT regulations) as well as company-driven initiatives to improve employee health and productivity. The increasing prevalence of substance abuse and the increased awareness of how substance abuse impacts workforce productivity, absenteeism, employee turnover, and workplace injury are also motivating employers to develop proactive screening programs.

In September 2022, Applied Monitoring, a Durham-based medtech company, secured £600,000 to commercialise its innovative non-invasive drug and alcohol detection technology. The funding will accelerate product development and market entry, particularly in workplace safety and law enforcement applications.

The 2025 Quest Diagnostics Drug Testing Index shows that fentanyl positivity is more than seven times higher in random workplace drug tests compared to pre-employment screenings, underscoring a sharp rise in fentanyl use among already-employed workers. Only 0.14% tested positive before being hired, and 1.13% of workers tested positive in random checks. Random testing rates were over 700% higher than pre-employment screening.

Report Coverage

This research report categorises the employer and workplace drug testing market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the employer and workplace drug testing market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the employer and workplace drug testing market.

Driving Factors

The drug screening market for employees and workplaces has been driven by increased demands for meeting government safety compliance regulations within high-risk industries, including transportation, construction, and manufacturing, to reduce accidents and liability. Technological advancements such as the development of rapid non-invasive testing systems (such as oral fluid tests), a1 integrated assays, and point-of-care testing kits improve the accuracy, efficiency, and cost-effectiveness of workplace screening programs. Additionally, the changing patterns of legalisation and new employee wellness initiatives will also aid the widespread use of alcohol and drug testing in global workplaces. There are many driving Forces behind the growth of the workplace drug testing market: in particular, there is greater awareness of employers about the effects that drug abuse has on productivity, safety and employee morale. Another key factor for growth is the ability of newer drug testing technologies, allowing for quicker and more precise results using noninvasive procedures.

Restraining Factors

There are currently many opportunities for growth in the workplace drug testing industry; there are also many factors that will restrain that growth in the future. Some of these include privacy concerns, legal issues, and changes in societal attitudes toward drug use. The companies active in the workplace drug testing market will have to deal with these issues by providing transparency, complying with all applicable laws, and implementing best practices for both testing and result management.

Market Segmentation

The employer and workplace drug testing market share is classified into sample type, application, and end user.

- The urine segment accounted for the largest market share in 2024 and is anticipated to grow at a substantial CAGR over the forecast period.

Based on the sample type, the employer and workplace drug testing market is segmented into urine, saliva, hair, blood, and others. Among these, the urine segment accounted for the largest market share in 2024 and is anticipated to grow at a substantial CAGR over the forecast period. Urine drug testing is a widely used method of detecting multiple drugs, and its cost-effectiveness makes it popular among many users, including private companies and government agencies. There is established infrastructure for both collecting urine samples for testing and analysing the samples; this also supports the broad adoption of urine testing in workplace drug testing programs.

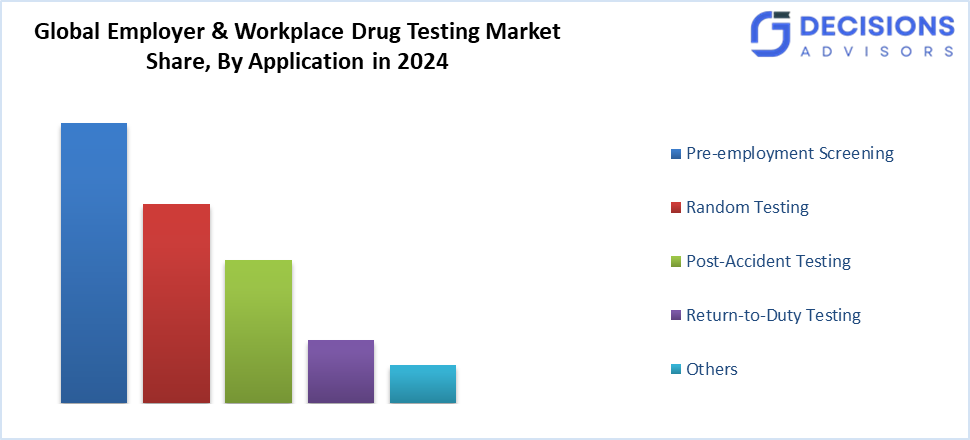

- The pre-employment screening segment accounted for the largest share in 2024 and is anticipated to grow at a rapid pace during the forecast period.

Based on the application, the employer and workplace drug testing market is divided into pre-employment screening, random testing, post-accident testing, return-to-duty testing, and others. Among these, the pre-employment screening segment accounted for the largest share in 2024 and is anticipated to grow at a rapid pace during the forecast period. This is due to maintain a safe and efficient workforce, as well as to limit liability and meet regulatory standards, companies from all sectors have been using pre-employment drug testing. The increased incidence of drug usage in the general population has increased employers' demand for thorough screening programs before hiring new employees.

- The private organisations segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end user, the employer and workplace drug testing market is differentiated into private organisations, government agencies, and others. Among these, the private organisations segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This is due to their desire to maintain an efficient, safe, and compliant workforce. Many businesses in different sectors, including finance, IT, healthcare, and retail, are now implementing drug testing programs as part of their overall risk mitigation strategy. Corporate social responsibility is becoming an increasingly important aspect to promote a culture of employee responsibility within the workplace.

Regional Segment Analysis of the employer and workplace Drug Testing Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the employer and workplace drug testing market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the employer and workplace drug testing market over the predicted timeframe. The increasing industrialisation, population growth, both in terms of workers, and public interest in work-related safety, have led to an increase in demand for drug-testing services. Moreover, growing adoption in countries such as China, India, Japan, and Australia is expected through the manufacturing, construction and transportation industries. The framework sets out standards for safety and quality of testing devices used for drug-testing (i.e. diagnostic devices), therefore creating an environment that allows companies providing drug testing products to operate.

In Japan, there is a regulatory framework, as drug testing is regulated by the Ministry of Health, Labour and Welfare (MHLW).

Europe is expected to grow at a rapid CAGR in the employer and workplace drug testing market during the forecast period. European market expansion is greatly influenced by the differences between countries with respect to regulations and the degree to which those regulations differ between countries within the same area (e.g., the European Union). Besides, the increasing emphasis placed on improving worker health and safety, coupled with the need to comply with European Union (EU) legislation mandating high health and safety standards in workplaces, has led many businesses throughout the EU to adopt workplace drug testing as an integral part of their operations.

Moreover, countries such as the United Kingdom, Germany, and France have developed specific drug-testing policies for workplaces primarily within industries considered to pose the greatest safety risks.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the employer and workplace drug testing market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Abbott Laboratories

- Alere Inc.

- Bio-Rad Laboratories, Inc.

- Danaher Corporation

- Drägerwerk AG & Co. KGaA

- F. Hoffmann-La Roche Ltd

- Omega Laboratories, Inc.

- Orasure Technologies, Inc.

- Premier Biotech, Inc.

- Psychemedics Corporation

- Quest Diagnostics

- Randox Laboratories

- Siemens Healthineers

- Thermo Fisher Scientific

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In December 2025, Altiscreen, a Swiss medtech startup, secured CHF 150,000 from Venture Kick to accelerate the development of its handheld rapid drug-screening device. The funding announced is intended to support the company’s mission of delivering fast, reliable, and portable drug testing solutions.

- In June 2024, the Swedish Labour Court issued a landmark ruling clarifying when workplace drug testing is permissible. The case involved an employee in the construction and installation industry who tested positive for cannabis and cocaine. The Court emphasised that employees must be available to perform work to remain entitled to wages, and drug use that impairs availability can justify employer action.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the employer and workplace drug testing market based on the below-mentioned segments:

Global Employer and Workplace Drug Testing Market, By Sample Type

- Urine

- Saliva

- Hair

- Blood

- Others

Global Employer and Workplace Drug Testing Market, By Application

- Pre-Employment Screening

- Random Testing

- Post-Accident Testing

- Return-to-Duty Testing

- Others

Global Employer and Workplace Drug Testing Market, By End Use

- Private Organisations

- Government Agencies

- Others

Global Employer and Workplace Drug Testing Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

- What is the current market size and projected growth?

The market was valued at USD 6.85 billion in 2024 and is expected to reach USD 15.12 billion by 2035, growing at a CAGR of 7.46% from 2025 to 2035.

- What drives growth in this market?

Key drivers include stricter workplace safety regulations, rising substance abuse awareness, and advancements in rapid, non-invasive testing technologies like oral fluid and point-of-care kits.

- Which sample type leads the market?

Urine testing holds the largest share in 2024 due to its cost-effectiveness, ability to detect multiple drugs, and established collection infrastructure.

- What application segment is dominant?

Pre-employment screening accounted for the largest share in 2024, driven by employers' needs to ensure safe hires, reduce liability, and comply with regulations.

- Who are the main end-users?

Private organisations generate the highest revenue, as they implement testing in sectors like finance, IT, healthcare, and retail to boost safety and productivity.

- Which region has the biggest market share?

Asia-Pacific is expected to hold the largest share, fueled by industrialisation, population growth, and adoption in manufacturing, construction, and transportation in countries like China and India.

- What are the main challenges?

Restraints include privacy concerns, legal issues around testing, and shifting societal views on drug use, requiring transparent practices and compliance.

- Who are the key players in the market?

Major companies include Quest Diagnostics, Abbott Laboratories, Thermo Fisher Scientific, Drägerwerk AG & Co. KGaA, and Siemens Healthineers, focusing on innovations like portable testing devices.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 254 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |