Global Emulsifier Alternatives Market

Global Emulsifier Alternatives Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Transglutaminase (TGaSe), Chickpea Flour, Tiger Nut Flour, Gum Arabic, Modified Cellulose, Modified Starches, and Maple Fiber), By End Use (Bakery & Confectionary, Beverages Products, Meat & Meat Alternatives, Personal Care, and Cosmetics), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

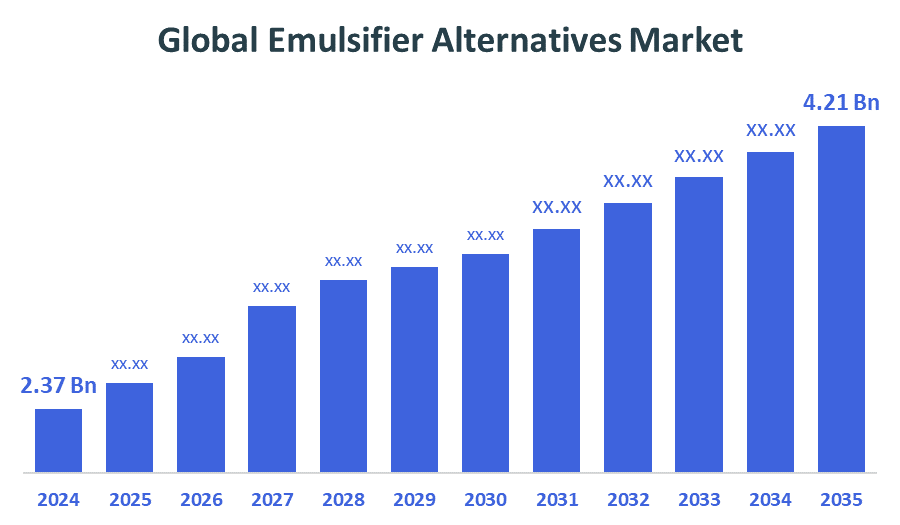

Global Emulsifier Alternatives Market Insights Forecasts to 2035

- The Global Emulsifier Alternatives Market Size Was Estimated at USD 2.37 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.36% from 2025 to 2035

- The Worldwide Emulsifier Alternatives Market Size is Expected to Reach USD 4.21 Billion by 2035

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Emulsifier Alternatives Market

The Global Emulsifier Alternatives Market is experiencing steady growth due to increasing consumer demand for clean-label, natural, and plant-based ingredients across the food, cosmetics, and pharmaceutical industries. Alternatives such as lecithin, guar gum, starches, and microbial-derived compounds are gaining popularity as safer, more sustainable options compared to synthetic emulsifiers. Government initiatives and regulatory shifts, such as tighter restrictions by the FDA and EFSA on artificial additives and support for organic, transparent labelling, are further propelling market expansion. These efforts align with broader sustainability goals and the push for healthier consumption patterns. Technological advancements in food processing and ingredient innovation are also contributing to the adoption of natural emulsifiers. As a result, the emulsifier alternatives market is poised for continued growth, driven by health-conscious consumers and supportive global policy environments.

Attractive Opportunities in the Emulsifier Alternatives Market

- Collaborations between biotech firms, food manufacturers, and research institutions offer significant potential to develop and commercialize novel, sustainable emulsifier alternatives. These partnerships can accelerate the creation of high-performance natural emulsifiers that match or outperform synthetic ones, tapping into rising consumer demand for clean-label and plant-based products.

- Rapid growth opportunities exist in emerging regions such as the Asia-Pacific and Latin America. These markets are driven by growing middle-class populations, shifting dietary preferences toward natural and allergen-free products, and increasing health awareness, making them ideal targets for new emulsifier alternative solutions.

- The rising popularity of specialty diets like veganism, gluten-free, and allergen-free foods supports strong demand for natural emulsifier alternatives. Developing emulsifiers that cater to these specific dietary needs presents an opportunity to capture niche yet fast-growing segments within the food and beverage, cosmetics, and personal care industries.

Global Emulsifier Alternatives Market Dynamics

DRIVER: Increasing awareness of health concerns linked to artificial additives

Rising consumer demand for clean-label and natural products is pushing manufacturers to replace synthetic emulsifiers with plant-based or microbial-derived alternatives. Increasing awareness of health concerns linked to artificial additives is further accelerating this shift. Government regulations favoring natural ingredients and promoting food transparency are also boosting market growth. Additionally, advancements in food processing technology and innovation in alternative ingredients are enabling better functionality and stability in products. The growing popularity of vegan, organic, and allergen-free foods further supports the adoption of natural emulsifier alternatives across industries.

RESTRAINT: Regulatory approval for new alternatives can be time-consuming and complex

Despite its growth, the emulsifier alternatives market faces several restraining factors. One major challenge is the limited functionality and stability of some natural alternatives compared to synthetic emulsifiers, which can affect product quality and shelf life. Additionally, the high cost of sourcing and processing natural ingredients can increase production expenses for manufacturers. Regulatory approval for new alternatives can be time-consuming and complex, slowing market entry. Limited consumer awareness in some regions and resistance to reformulating existing products also hinder adoption. Furthermore, supply chain issues related to raw materials, especially for plant-based options, may pose challenges to consistent availability and scalability.

OPPORTUNITY: Collaborations between biotech firms

The emulsifier alternatives market presents significant growth opportunities driven by rising health consciousness and demand for natural, clean-label products. As consumers increasingly avoid synthetic additives, there's strong potential for innovation in plant-based, microbial, and fermentation-derived emulsifiers. Emerging markets, particularly in Asia-Pacific and Latin America, offer untapped potential due to growing middle-class populations and shifting dietary preferences. The surge in vegan, gluten-free, and allergen-free product demand further supports the adoption of alternative emulsifiers. Additionally, ongoing advancements in food technology and ingredient formulation open doors for creating high-performance natural alternatives that match or exceed synthetic emulsifiers in functionality. Collaborations between biotech firms, food manufacturers, and research institutions can also accelerate the development and commercialization of novel, sustainable emulsifier solutions across industries.

CHALLENGES: Limited functional performance compared to synthetic counterparts

The emulsifier alternatives market faces several challenges, including limited functional performance compared to synthetic counterparts, which can affect product texture, stability, and shelf life. High production and sourcing costs for natural ingredients can reduce profit margins, especially for small manufacturers. Regulatory hurdles and lengthy approval processes for new ingredients can delay market entry. Additionally, inconsistent supply of raw materials, especially plant-based sources, and limited consumer awareness in certain regions further hinder widespread adoption and scalability of natural emulsifier alternatives.

Global Emulsifier Alternatives Market Ecosystem Analysis

The global emulsifier alternatives market ecosystem includes raw material suppliers (plant-based, microbial, fermentation-derived), manufacturers (e.g., Cargill, ADM, BASF), and R&D-driven startups innovating clean-label solutions. Regulatory bodies like the FDA and EFSA influence approvals and labeling standards. End-use industries food, cosmetics, and pharmaceuticals drive demand for sustainable and natural emulsifiers. Retailers and consumers push clean-label and allergen-free trends, prompting reformulation. This interconnected system relies on innovation, regulation, and sustainability to meet evolving health, safety, and environmental expectations across global markets.

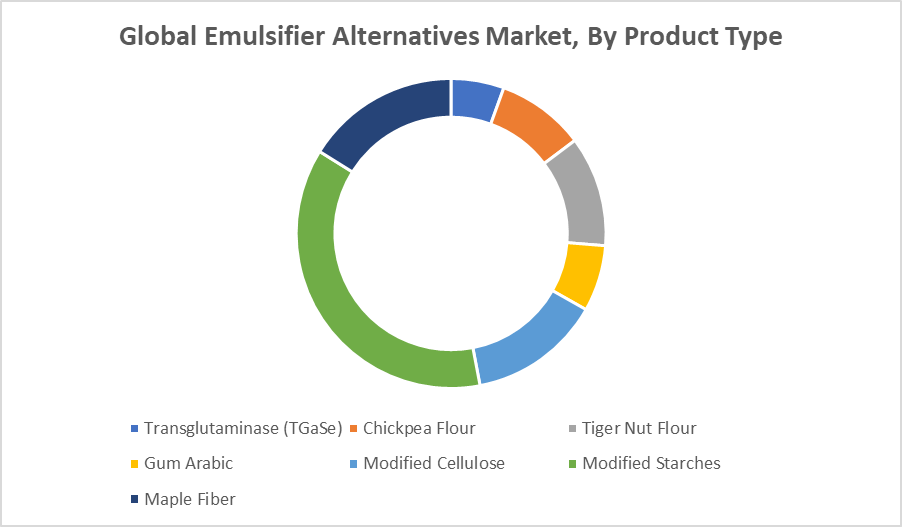

Based on the product type, the modified starches segment accounted for the largest market share over the forecast period

The modified starches segment dominance is primarily attributed to modified starches' high functionality, cost-effectiveness, and wide availability. They offer excellent emulsifying, thickening, and stabilizing properties, making them suitable for a broad range of applications in processed foods, dairy, bakery, and beverages. Furthermore, modified starches are often perceived as more natural and label-friendly than synthetic emulsifiers, aligning well with clean-label and health-conscious consumer trends. Their adaptability and compatibility with various formulations

Based on the end use, the beverages products segment accounted for the highest revenue share over the forecast period

The beverages segment accounted for the highest revenue share in the emulsifier alternatives market over the forecast period. This is largely due to the growing demand for natural and clean-label ingredients in functional drinks, plant-based beverages, and fortified products. Emulsifier alternatives are essential in maintaining the stability, texture, and uniformity of beverages, especially those containing oil-based ingredients like vitamins, flavors, or plant extracts. As consumers increasingly seek healthier and more transparent beverage options, manufacturers are turning to natural stabilizers such as modified starches, gums, and lecithin to meet these expectations, driving significant revenue growth in this segment.

Asia Pacific is anticipated to hold the largest market share of the emulsifier alternatives market during the forecast period

Asia Pacific is anticipated to hold the largest market share of the emulsifier alternatives market during the forecast period. This growth is driven by the region’s rapidly expanding food and beverage, cosmetics, and pharmaceutical industries, coupled with increasing consumer awareness of health and sustainability. Rising demand for clean-label, natural, and plant-based products, especially in countries like China, India, and Japan, further fuels market expansion. Additionally, supportive government initiatives promoting organic farming and natural ingredients, along with a growing middle-class population, contribute significantly to the region’s dominant position in the emulsifier alternatives market.

North America is expected to grow at the fastest CAGR in the emulsifier alternatives market during the forecast period

North America is expected to grow at the fastest CAGR in the emulsifier alternatives market during the forecast period. This rapid growth is driven by strong consumer demand for clean-label, organic, and natural products, especially in the food, beverage, and personal care sectors. Increasing health awareness and stringent regulations limiting synthetic additives encourage manufacturers to adopt natural emulsifier alternatives. Additionally, significant investments in research and development, coupled with innovation in plant-based and sustainable ingredients, are accelerating market expansion in the region. The presence of major industry players and growing trends toward vegan and allergen-free products further support this fast-paced growth.

Recent Development

- In February 2024, InnovoPro, a leader in chickpea-based ingredients, launched CP-Pro 70, a highly functional chickpea protein concentrate that also acts as a natural emulsifier. Designed for use in plant-based baked goods, dairy alternatives, and beverages, CP-Pro 70 is colorless, odorless, and tasteless, making it ideal for clean-label formulations. Its ability to replace synthetic emulsifiers while maintaining sensory neutrality helps food manufacturers simplify ingredient lists and meet consumer demands for allergen-free and plant-based products.

- In March 2024, Ingredion introduced a new microencapsulation-based emulsifier system, designed to enhance the stability of high-protein, ready-to-drink beverages. This innovation offers improved emulsification and shelf-life for formulations with sensitive ingredients like plant proteins. By utilizing encapsulation technology, the system protects emulsifiers from degradation and allows for controlled release in the final product. This aligns with broader trends in health drinks and functional foods, where natural yet technically advanced solutions are in demand.

Key Market Players

KEY PLAYERS IN THE EMULSIFIER ALTERNATIVES MARKET INCLUDE

- Cargill, Incorporated

- Ingredion Incorporated

- Archer Daniels Midland Company (ADM)

- BASF SE

- Corbion N.V.

- Kerry Group

- DuPont de Nemours, Inc. / IFF

- Sternchemie GmbH

- Givaudan / Naturex

- Nippon Fine Chemical

- Others

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the emulsifier alternatives market based on the below-mentioned segments:

Global Emulsifier Alternatives Market, By Product Type

- Transglutaminase (TGaSe)

- Chickpea Flour

- Tiger Nut Flour

- Gum Arabic

- Modified Cellulose

- Modified Starches

- Maple Fiber

Global Emulsifier Alternatives Market, By End Use

- Bakery & Confectionary

- Beverages Products

- Meat & Meat Alternatives

- Personal Care

- Cosmetics

Global Emulsifier Alternatives Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

FAQs

Q: What are the main drivers of growth in the Emulsifier Alternatives Market?

A: Growth drivers include increasing consumer demand for clean-label and natural ingredients, government regulations favoring natural additives, rising health awareness, and advances in food processing technology.

Q: What challenges are limiting the adoption of emulsifier alternatives?

A: Challenges include limited functional performance compared to synthetic emulsifiers, high production costs, regulatory approval complexities, raw material supply issues, and low consumer awareness in some regions.

Q: What opportunities are present in the Emulsifier Alternatives Market?

A: Opportunities lie in collaborations between biotech firms and food manufacturers, expansion in emerging markets like Asia-Pacific and Latin America, and growing demand for vegan, gluten-free, and allergen-free products.

Q: Who are the key players operating in the Global Emulsifier Alternatives Market?

A: Major players include Cargill, Ingredion, Archer Daniels Midland Company (ADM), BASF SE, Corbion N.V., Kerry Group, DuPont de Nemours (IFF), Sternchemie GmbH, Givaudan/Naturex, and Nippon Fine Chemical.

Q: What recent innovations have impacted the Emulsifier Alternatives Market?

A: Recent developments include InnovoPro’s launch of CP-Pro 70, a chickpea protein concentrate acting as a natural emulsifier, and Ingredion’s microencapsulation-based emulsifier system for enhanced beverage stability.

Q: How does the regulatory environment affect the Emulsifier Alternatives Market?

A: Regulations by bodies like the FDA and EFSA restricting synthetic additives and promoting clean-label ingredients encourage the adoption of natural emulsifier alternatives.

Q: What are the latest trends in the Emulsifier Alternatives Market?

A: Key trends include increasing use of plant-based and microbial emulsifiers, clean-label formulations, microencapsulation technologies, and product development targeting specialty diets.

Q: What is the long-term outlook (2025–2035) for the Emulsifier Alternatives Market?

A: The market is expected to maintain steady growth driven by consumer preference for natural products, technological innovation, and expanding applications across food, cosmetics, and pharmaceuticals.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 217 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Aug 2025 |

| Access | Download from this page |