Global Endoscopy Fluid Management Market

Global Endoscopy Fluid Management Market Size, Share, and COVID-19 Impact Analysis, By Application (Laparoscopy, Hysteroscopy, Arthroscopy, Gastroenterology, and Others), By End-User (Hospitals, Specialty clinics, Ambulatory surgical centers, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035

Report Overview

Table of Contents

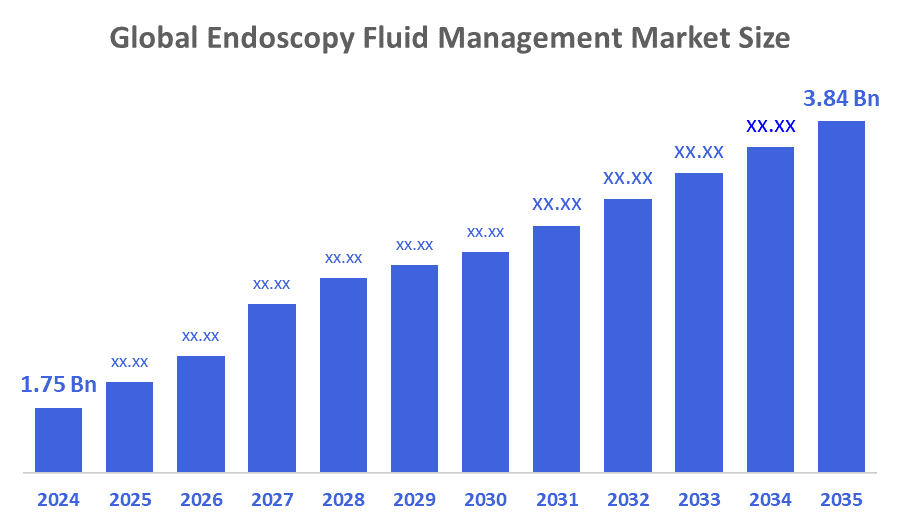

Global Endoscopy Fluid Management Market Size Insights Forecasts to 2035

- The Global Endoscopy Fluid Management Market Size Was Estimated at USD 1.75 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.41 % from 2025 to 2035

- The Worldwide Endoscopy Fluid Management Market Size is Expected to Reach USD 3.84 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

According to a research report published by Decisions Advisors and Consulting, The Global Endoscopy Fluid Management Market Size Was Worth Around USD 1.75 Billion In 2024 And Is Predicted To Grow To Around USD 3.84 Billion By 2035 With A Compound Annual Growth Rate (CAGR) Of 7.41% From 2025 To 2035. The growing incidence of gastrointestinal illnesses, an ageing population, and technological developments in endoscopic procedures are the main factors driving the market. Endoscopy fluid management systems are becoming more and more popular as a result of the demand for minimally invasive surgeries, which have shorter recovery times and fewer complications.

Market Overview

The endoscopy fluid management market includes the methodical regulation and control of fluids used in endoscopic operations. Maintaining a clean viewing field, allowing the endoscope to move smoothly, and creating ideal conditions for a range of diagnostic and therapeutic procedures all depend on fluid management. The administration, monitoring, and removal of fluids used during endoscopic operations are the main elements of endoscopy fluid management. In fact, Lung cancer is the commonest primary tumour causing bowel perforation and one of the most common causes of ileal perforation due to metastasis. According to the data from GLOBOCAN 2020, as quoted by WHO, lung cancer figured as the second most common cancer type with a total of 2, 206, 771 new cases worldwide in the year 2020. Besides that, globally, lung cancer had been the top killing cancer type resulting in 1, 796, 144 deaths worldwide.

Also, it has been confirmed that bronchoscopy is the main method to get a biopsy sample for lung cancer diagnosis. Besides, bronchoscopy is very useful in identifying precancerous lesions related to lung cancer, thus aiding in the early cancer diagnosis. The detection of early neoplastic lesions in the gastrointestinal tract is vital for a cure since the prognosis and survival depend on the size and stage of malignant lesions.

Report Coverage

This research report categorises the endoscopy fluid management market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the endoscopy fluid management market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the endoscopy fluid management market.

Driving Factors

The development of advanced fluid management systems with more automation and integration is an opportunity for growth for the endoscopy fluid management market. The endoscopy fluid management market is largely fueled by the increasing number of minimally invasive and endoscopic procedures performed globally. These systems play a crucial role in ensuring clear visualisation, accurate irrigation, and regulated suction during surgeries. The ever-increasing incidence of gastrointestinal, urological, gynaecological, and cancer diseases has created a huge demand for diagnostic and therapeutic endoscopy. Moreover, healthcare infrastructure development, mainly in the emerging market, combined with government initiatives promoting screening programs and facility expansion, will continue to drive the market forward. Besides that, the transition to outpatient treatments, growing attention to infection prevention, and the rising capital expenditure of healthcare providers on upgraded endoscopy suites are some of the major factors contributing to the sustained high growth rate of the endoscopy fluid management market.

Restraining Factors

Despite the significant market expansion, there are some factors, such as the high cost of research and development and costs associated with manufacturing, it limits adoption in smaller-sized health care facilities or cost-sensitive locations in a developing country. Moreover, the complexities and technical needs presently require a significant amount of specialised training, which will create additional barriers to adoption. Therefore, such costs and training challenges may be necessary for larger market penetration and adoption of the endoscope fluid management system within the market.

Market Segmentation

The endoscopy fluid management market share is classified into application and end user.

- The arthroscopy segment accounted for the largest market share in 2024 and is projected to grow at a substantial CAGR over the forecast period.

Based on the application, the endoscopy fluid management market is divided into laparoscopy, hysteroscopy, arthroscopy, gastroenterology, and others. Among these, the arthroscopy segment accounted for the largest market share in 2024 and is projected to grow at a substantial CAGR over the forecast period. Arthroscopy is the most attractive option for the diagnosis and treatment of knee injuries. It provides minimally invasive solutions with shorter recovery times. The arthroscopy segment mainly focuses on the unique fluid management aspects of knee surgeries, and thus has become a critical part of orthopaedic care. These efforts facilitate the creation of modern, ultramodern, and technically superior components.

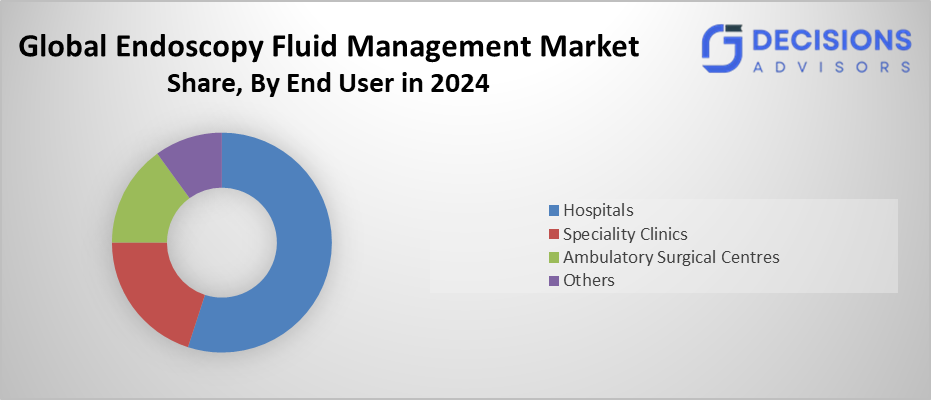

- The hospitals segment accounted for the highest revenue share in 2024 and is projected to grow at a notable CAGR over the forecast period.

Based on the end user, the endoscopy fluid management market is segmented into hospitals, speciality clinics, ambulatory surgical centres, and others. Among these, the hospitals segment accounted for the highest revenue share in 2024 and is projected to grow at a notable CAGR over the forecast period. The hospital constitutes the biggest application segment mainly on account of its broad spectrum of medical services and the massive number of endoscopic procedures that are carried out in these institutions. These facilities are capable of complex procedures and are equipped for advanced medical care, so they are the main users of the fluid management systems. Hospitals are a centre of at, traction for the use of fluid management systems mainly because of the increasing concern about patients' safety and the rising implementation of sophisticated medical technologies.

Regional Segment Analysis of the Endoscopy Fluid Management Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the endoscopy fluid management market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the endoscopy fluid management market over the predicted timeframe. Several factors contribute to the Asia-Pacific region's rapid growth in healthcare: the growing number of patients, the rising expense of healthcare, and therefore raising awareness of various types of surgical techniques available. For example, many countries within the region (including China and India) are investing heavily in building new healthcare facilities and upgrading older ones to provide better healthcare for all patients.

For instance, Olympus announced that its project titled “Feasibility study on the development of Japanese digitalised endoscopy infection control systems in India” has been selected for Japan’s Ministry of Economy, Trade and Industry (METI) FY2024 Supplementary Global South Future-Oriented Co-Creation Subsidy Program (Small-Scale Demonstration/Feasibility Study Project). This initiative aims to explore how Japanese infection control technologies can be adapted and implemented in India’s healthcare environment.

North America is expected to grow at a rapid CAGR in the endoscopy fluid management market during the forecast period. The area has a sophisticated healthcare system with a significant emphasis on implementing cutting-edge medical technology and enhancing patient outcomes. North America held the most market share in 2023 due to a number of factors, including advantageous reimbursement policies, a rising incidence of gastrointestinal and orthopaedic illnesses, and high healthcare spending. The endoscopic fluid management systems market's ongoing expansion and innovation are further supported by the existence of significant regional players. With a consistent CAGR over the course of the projected period, the North American market is anticipated to continue dominating.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the endoscopy fluid management market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Arthrex, Inc.

- B. Braun SE

- CONMED Corporation

- Hologic Inc.

- Johnson & Johnson

- KARL STORZ SE & Co. KG

- Medtronic plc

- Olympus Corporation

- Richard Wolf GmbH

- Smith & Nephew

- STERIS plc

- Stryker Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In May 2023, Olympus received FDA clearance for its EVIS X1™ endoscopy system along with new compatible gastrointestinal endoscopes, marking a significant advancement in imaging technology for GI procedures. The CF-HQ1100DL/I colonovideoscope is recommended for use in the lower digestive system, which includes the anus, rectum, sigmoid colon, colon, and ileocecal valve; the GIF-1100 gastrointestinal videoscope is recommended for use in the upper digestive tract, which includes the oesophagus, stomach, and duodenum.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the endoscopy fluid management market based on the below-mentioned segments:

Global Endoscopy Fluid Management Market, By Application

- Laparoscopy

- Hysteroscopy

- Arthroscopy

- Gastroenterology

- Others

Global Endoscopy Fluid Management Market, By End User

- Hospitals

- Speciality clinics

- Ambulatory surgical centres

- Others

Global Endoscopy Fluid Management Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

1. What is the projected market size and growth rate for the global endoscopy fluid management market?

The market was valued at USD 1.75 billion in 2024 and is expected to reach USD 3.84 billion by 2035, growing at a CAGR of 7.41% from 2025 to 2035.

2. What are the primary drivers of the endoscopy fluid management market?

Key drivers include the rising demand for minimally invasive surgeries, increasing incidence of gastrointestinal, urological, gynaecological, and cancer diseases, healthcare infrastructure development in emerging markets, and advancements in automated fluid management systems.

3. What are the main restraining factors for market growth?

High research and development costs, manufacturing expenses, and the need for specialised training limit adoption, particularly in smaller facilities and cost-sensitive developing regions.

4. Which application segment holds the largest market share?

The arthroscopy segment accounted for the largest share in 2024 and is projected to grow at a substantial CAGR, driven by its role in minimally invasive knee injury diagnosis and treatment.

5. Which end-user segment dominates the market?

Hospitals held the highest revenue share in 2024 and are expected to grow at a notable CAGR, due to their capacity for complex procedures and adoption of advanced technologies.

6. Which region is expected to grow the fastest, and why?

North America is projected to grow at the fastest CAGR, supported by advanced healthcare systems, favourable reimbursement policies, high spending, and prevalence of gastrointestinal and orthopaedic diseases.

7. Which region holds the largest market share?

Asia-Pacific is anticipated to hold the largest share over the forecast period, fueled by rising patient numbers, healthcare investments in countries like China and India, and initiatives like Olympus's infection control projects.

8. Who are the key players in the endoscopy fluid management market?

Major companies include Arthrex, Inc., B. Braun SE, CONMED Corporation, Hologic Inc., Johnson & Johnson, KARL STORZ SE & Co. KG, Medtronic plc, Olympus Corporation, Richard Wolf GmbH, Smith & Nephew, STERIS plc, and Stryker Corporation.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 220 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |