Global Endoscopy Visualisation Systems and Components Market

Global Endoscopy Visualization Systems and Components Market Size, Share, and COVID-19 Impact Analysis, By Resolution Type (2D and 3D variant, 4K, FHD), By End Use (Ambulatory Surgery Centers, Hospitals, and Specialty Clinics & Diagnostic Imaging Centers), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035

Report Overview

Table of Contents

Global Endoscopy Visualisation Systems and Components Market Size Insights Forecasts to 2035

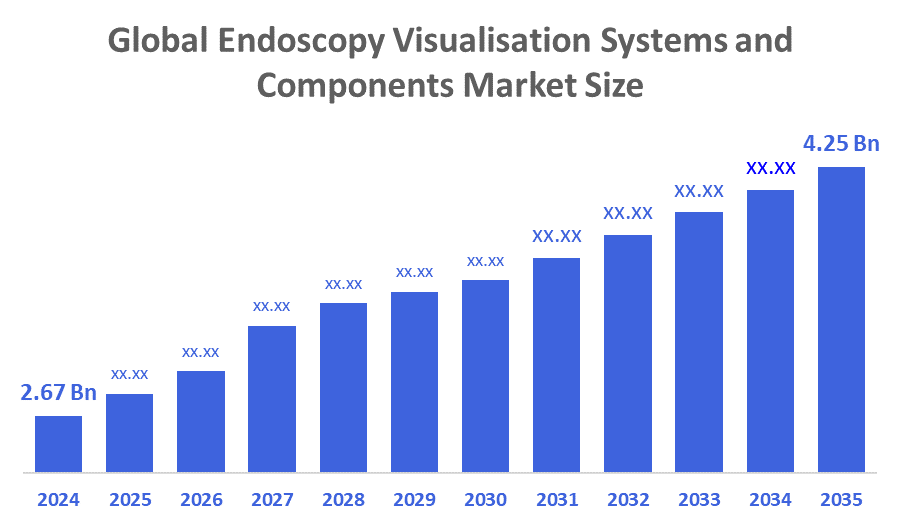

- The Global Endoscopy Visualisation Systems and Components Market Size Was Estimated at USD 2.67 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.32% from 2025 to 2035

- The Worldwide Endoscopy Visualisation Systems and Components Market Size is Expected to Reach USD 4.25 Billion by 2035

- Europe is expected to grow the fastest during the forecast period.

According to a research report published by Decisions Advisors and Consulting, the Global Endoscopy Visualisation Systems and Components Market Size was Worth around USD 2.67 Billion in 2024 and is Predicted to Grow to Around USD 4.25 Billion by 2035 with a Compound Annual Growth Rate (CAGR) of 4.32% from 2025 to 2035. The growing demand for better endoscopy visualisation systems is a major factor that fuels the growth and expansion of the market for endoscopic visualisation systems. Moreover, factors such as increasing obesity rates, an ageing population, technological innovations, reimbursement, and a higher incidence of associated diseases also contribute to the market growth. The market is growing as a result of both patients and healthcare providers becoming more knowledgeable about new endoscopy technologies that provide various medical benefits.

Market Overview

The Endoscopy Visualisation Systems and Components Market Size refers to the global industry segment that develops, manufactures, and distributes devices and technologies used to capture, process, and display images during endoscopic procedures. An endoscopy visualisation system is a sophisticated video system that enhances the quality of pictures and movies by including every facet of endoscopic procedures. By offering magnified, high-definition images that aid in the precise classification of flat and tiny polyp lesions and facilitate viewing, the endoscopy visualisation system improves endoscopic imaging. The endoscope visualisation system consists of light sources, displays, printers, and monitors. The positive features of Endoscopy Visualisation systems are that the issues related to a coherent fibre bundle are eliminated (poor image, progressive fibre loss due to usage interruption over time, fibre bundle volume within the endoscope shaft, etc.). The various components of next-generation visualisation systems include the built-in advanced camera (supporting the most advanced requirements of surgical monitoring technology, colour reproduction of HD 1080p), monitor, light source, insufflators, printers, wireless displays, and others.

Olympus officially launched the EVIS X1™, its most advanced endoscopy system, designed to improve detection, characterisation, and treatment of gastrointestinal disorders with cutting-edge imaging and AI-assisted features. The system was first showcased at the American College of Gastroenterology Annual Meeting in Vancouver in October 2023 and has since expanded globally, including Canada in 2025.

In October 2025, Fujifilm Healthcare Americas Corporation launched the ELUXEO® 8000 Endoscopic Imaging System featuring enhanced LED multi-light technology, 4K resolution, and advanced imaging modes to improve gastrointestinal diagnostics and therapeutic precision. The system is fully compatible with Fujifilm’s 500-, 600-, 700-, and new 800-series endoscopes, marking a major upgrade in endoscopic visualisation.

Report Coverage

This research report categorises the endoscopy visualisation systems and components market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the endoscopy visualisation systems and components market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the endoscopy visualisation systems and components market.

Driving Factors

With 4K ultra-high definition clarity, endoscopy visualisation systems are rapidly advancing, allowing surgeons to spot even minute abnormalities and thus, significantly improve patient outcomes. AI-powered real-time analysis, when combined with these technologies, further assists in increasing the level of diagnostic accuracy and the efficiency of the procedure by highlighting potential lesions during operations. Wireless endoscopes, which are being introduced, are giving the surgeons more freedom and flexibility, and are also helping in reducing the time of the procedures, thus enabling faster recovery. Cloud-based systems have been embraced for their ability to facilitate secure data storage, remote medical consultations, and the establishment of collaborative workflows very easily. At the same time, the use of single-use disposable parts ensures better hygiene, lowers the costs of reprocessing, and, at the same time, decreases the chances of cross-contamination. Another factor that has been taken into consideration is the ergonomic nature of the design, which helps in reducing surgeon fatigue as well as musculoskeletal disorders, thus assisting the surgeon in maintaining good health in the long run.

For instance, the FDA granted 510(k) clearance to the IMAGINA Endoscopy System by PENTAX Medical, allowing its use in ambulatory surgery centres (ASCs). This platform introduces advanced visualisation technology with a cost-effective model, aiming to expand access to gastrointestinal procedures outside traditional hospital settings.

Restraining Factors

One of the main reasons why the market of Endoscopy Visualisation Systems and Components is quite limited is that the equipment costs remain high, thus impeding adoption in the resource-constrained settings. On top of that, the stringent regulations, the lack of skilled professionals and low market penetration are the factors that slow down the market expansion.

Market Segmentation

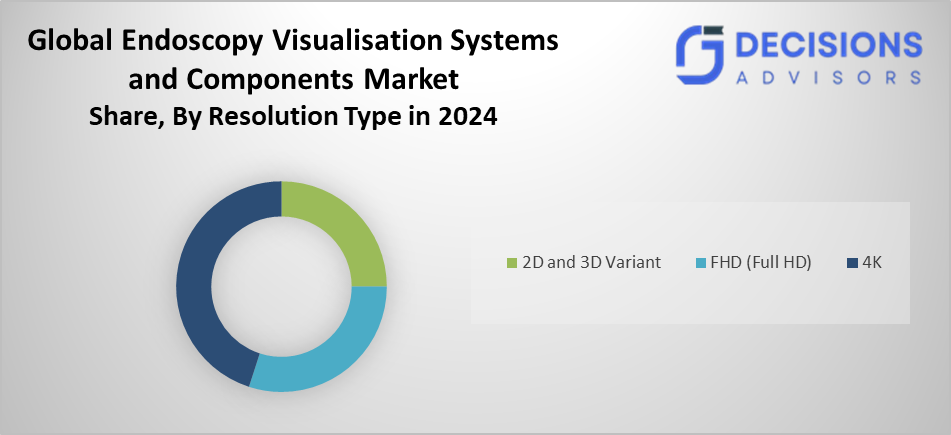

The endoscopy visualisation systems and components market share is classified into resolution type and end use.

- The 4K segment accounted for the largest market share in 2024 and is projected to grow at a substantial CAGR over the forecast period.

Based on the resolution type, the endoscopy visualisation systems and components market is classified into 2D and 3D variant, 4K, and FHD. Among these, the 4K segment accounted for the largest market share in 2024 and is projected to grow at a substantial CAGR over the forecast period. This is due to the widespread use of monitors that show images with 4K resolution. Additionally, compared to full HD quality, 4K resolution photos provide a higher degree of colour accuracy, allowing for improved precision and simpler anatomical structure discrimination.

- The diagnostic imaging centres segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end use, the endoscopy visualisation systems and components market is segmented into ambulatory surgery centres, hospitals, speciality clinics, and diagnostic imaging centres. Among these, the diagnostic imaging centres segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This is because of lower healthcare costs, the demand for improved services, the financial burden on physicians, and the enhancement of treatment quality. The advancements in medical technology with high class perform a range of therapies in an outpatient setting using minimally invasive procedures and better anaesthetic techniques.

Regional Segment Analysis of the Endoscopy Visualisation Systems and Components Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the endoscopy visualisation systems and components market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the endoscopy visualisation systems and components market over the predicted timeframe. This is due to the rapid advancement of technology, an increase in diseases, and rising disposable wealth in nations like China, Japan, India, and others. The market in this area has grown as a result of the increasing number of undiagnosed patients with a high prevalence of urology, cancer, gynaecological, gastrointestinal, and cavity illnesses.

China's endoscopic visualisation market is expected to increase significantly due to the expansion of healthcare infrastructure, particularly in rural areas. This growth potential is further enhanced by raising patient knowledge of minimally invasive procedures that need shorter recovery times. This presents manufacturers with an excellent opportunity to build efficient, user-friendly devices for low-endoscopy operations in a market that is open and demanding.

Europe is expected to grow at a rapid CAGR in the endoscopy visualisation systems and components market during the forecast period. because of the increasing occurrence of gastrointestinal diseases and cancer. The region enjoys a good medical insurance environment, which means that expensive surgeries are made more accessible. Moreover, the region is witnessing an uptrend in the practice of oligopoly purchasing of equipment. The government investment in healthcare resulted in the hospitals being equipped with advanced endoscopy visualisation systems, thereby increasing the sales of these systems in the market.

The cost-benefit evaluations conducted by German healthcare organisations are often highly strict. In Germany, an industry exists only for producers who can show advances in clinical results and cost-effectiveness. Even so, there are chances for cutting-edge innovations due to Germany's robust research and development.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the endoscopy visualisation systems and components market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Ambu A/S

- Boston Scientific Corporation

- CONMED Corporation

- Cook Medical

- Fujifilm Holdings Corporation

- Hoya Corporation

- Karl Storz SE & Co. KG

- Medtronic plc

- Olympus Corporation

- Pentax Medical

- Richard Wolf GmbH

- Stryker Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2026, VB Spine announced that it will acquire the SpineHawk™ intraoperative visualisation platform from Robotron Surgical Technologies, expanding its portfolio with AI-powered spinal endoscopy tools and software-enabled image recognition technology. The deal includes single-use visualisation-enabled instruments, a high-definition camera console, and related intellectual property, with FDA clearance targeted for 2026.

- In October 2025, Olympus Canada Inc. announced that the launch of its EZ1500 series advanced imaging endoscopes featuring Extended Depth of Field (EDOF™) technology, as part of the EVIS X1™ endoscopy system. These endoscopes were highlighted during the 36th annual Therapeutic Endoscopy Course in Toronto, marking a major step in enhancing gastrointestinal diagnostics and treatment.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the endoscopy visualisation systems and components market based on the below-mentioned segments:

Global Endoscopy Visualisation Systems and Components Market, By Resolution Type

- 2D and 3D variant

- 4K

- FHD

Global Endoscopy Visualisation Systems and Components Market, By End Use

- Ambulatory Surgery Centres

- Hospitals

- Speciality Clinics

- Diagnostic Imaging Centres

Global Endoscopy Visualisation Systems and Components Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

- What is the current market size in 2024?

The market size was estimated at USD 2.67 billion in 2024.

- What is the projected market size by 2035?

The market is expected to reach USD 4.25 billion by 2035.

- What is the CAGR during the forecast period?

The market is projected to grow at a CAGR of 4.32% from 2025 to 2035.

- Which resolution type holds the largest share?

The 4K segment accounted for the largest market share in 2024 and is expected to grow substantially.

- Which end-use segment leads in revenue?

Diagnostic imaging centres generated the highest revenue in 2024 and are anticipated to grow significantly.

- Which region will have the largest market share?

Asia Pacific is expected to hold the largest share due to technological advancements and rising disease prevalence.

- Which region is growing the fastest?

Europe is projected to grow at the fastest CAGR, driven by gastrointestinal diseases and strong healthcare investments.

- Who are the key market players?

Major companies include Olympus Corporation, Fujifilm Holdings Corporation, Stryker Corporation, Medtronic plc, and Karl Storz SE & Co. KG.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 230 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |