Global Enterprise Video Market

Global Enterprise Video Market Size, Share, and COVID-19 Impact Analysis, By Deployment Mode (On-Premises, and Cloud), By Delivery Mode (Video Conferencing, and Web Conferencing), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Global Enterprise Video Market Size Insights Forecasts to 2035

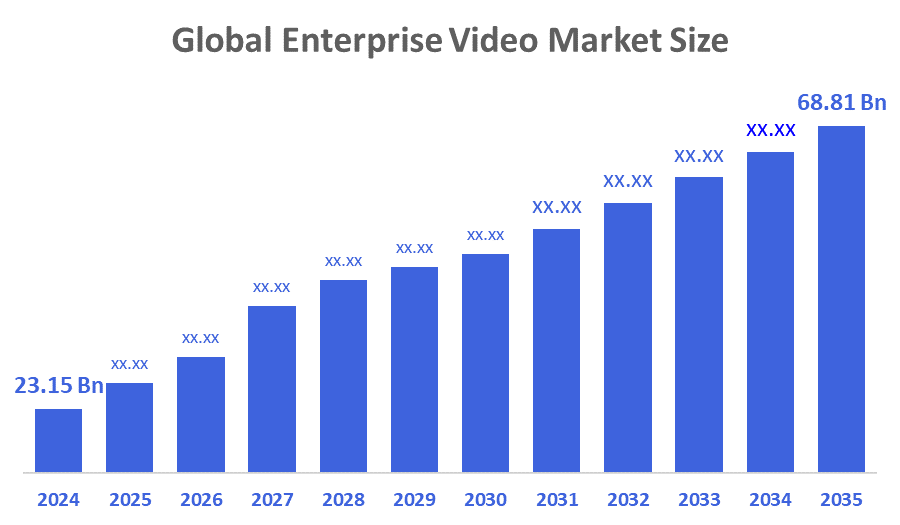

- The Global Enterprise Video Market Size Was Estimated at USD 23.15 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 10.41% from 2025 to 2035

- The Worldwide Enterprise Video Market Size is Expected to Reach USD 68.81 Billion by 2035

- Europe is expected to Grow the fastest during the forecast period.

According to a Research Report Published by Decisions Advisors and Consulting, The Global Enterprise Video Market Size was worth around USD 23.15 Billion in 2024 and is predicted to Grow to around USD 68.81 Billion by 2035 with a compound annual growth rate (CAGR) of 10.41 % from 2025 to 2035. The need for seamless communication and collaboration tools in sectors like IT, healthcare, and BFSI is driving the growth of business video. The companies are concentrating on implementing enterprise video solutions to improve customer engagement, corporate communication, and training and development.

Market Overview

The enterprise video market refers to the industry segment that provides video-based solutions and services designed specifically for businesses and organisations to enhance communication, collaboration, training, marketing, and customer engagement. The use of video technology in businesses and organisations for a variety of objectives, such as marketing, training, collaboration, and communication, is referred to as enterprise video. It includes a variety of platforms, tools, and applications connected to video that are intended to facilitate the production, delivery, and administration of video content in a business context. Enterprise video solutions are frequently used by businesses to enhance internal communication and team, employee, and departmental collaboration. In addition to creating on-demand video content for training, knowledge sharing, and employee engagement, this may entail live streaming of departmental updates, town hall meetings, executive communications, and company events. Video features are increasingly being incorporated into unified communications solutions. The popularity of workplace video solutions is driven by businesses' need for all-inclusive solutions that integrate voice calling, video conferencing, messaging, and collaboration capabilities into a single platform.

In January 2025, Synthesia raised $180 million in Series D funding, cementing its position as the world’s leading enterprise AI video platform and the UK’s most valuable generative AI media company.

Report Coverage

This research report categorises the enterprise video market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the enterprise video market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the enterprise video market.

Driving Factors

One of the main factors driving the enterprise video industry is the increasing trend of remote work, which has been accelerated by the COVID-19 pandemic. Additionally, the need for enterprise video solutions is being driven by the larger trend of digital transformation across industries. The demand for more dynamic and engaging content that can successfully engage both customers and staff is what is causing this change. Additionally, the appeal of workplace video solutions is being increased by developments in video technology, such as improved resolution and AI-driven analytics. Businesses are implementing these cutting-edge technologies to obtain a competitive advantage in their marketing and communications plans.

Restraining Factors

The expansion of the enterprise video market is hindered by high infrastructure costs, difficulties integrating with old systems, and ongoing worries about data security. Adoption is further slowed by a lack of qualified workers, unreliable networks in areas with poor connectivity, and opposition to change among established businesses.

Market Segmentation

The enterprise video market share is classified into deployment mode and delivery mode.

- The cloud segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the deployment mode, the enterprise video market is differentiated into on-premises and cloud. Among these, the cloud segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The growing adoption of cloud-based solutions by small and medium-sized enterprises (SMEs) is driving this expansion. Cloud deployment offers several advantages, including cheaper initial investment costs, lower maintenance overheads, and scalability, which are well-suited to the needs and budgetary constraints of SMEs.

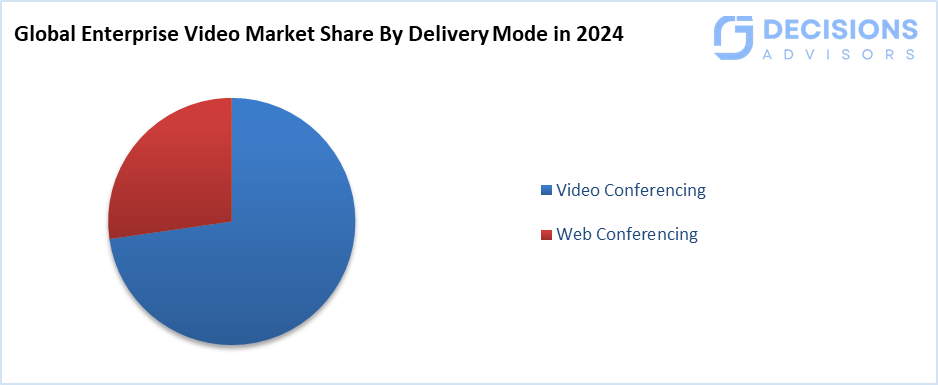

- The video conferencing segment dominated the market in 2024 and is projected to grow at a significant CAGR during the forecast period.

Based on the delivery mode, the enterprise video market is segmented into video conferencing and web conferencing. Among these, the video conferencing segment dominated the market in 2024 and is projected to grow at a significant CAGR during the forecast period. Because of its extensive capabilities that enable high-quality audio and video interactions, video conferencing stands out as the most popular delivery method in the enterprise video market. Face-to-face communication improves clarity and fosters relationships; hence, it is recommended for internal meetings, client engagements, and crucial conversations.

Regional Segment Analysis of the Enterprise Video Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the enterprise video market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the enterprise video market over the predicted timeframe. Increasing internet penetration, an increase in entrepreneurs, and a move toward digital communication are driving the region's growth. Nations are making investments in digital infrastructure, which is necessary to meet the growing demand for collaboration and video conferencing capabilities. A wide variety of domestic and foreign companies are vying for market dominance, with China, India, and Japan being the top three nations. There is a lot of competition, and businesses like Brightcove and Kaltura are growing in the area. The adoption of enterprise video solutions is further boosted by the growing emphasis on remote work and digital transformation projects in a number of industries.

Europe is expected to grow at a rapid CAGR in the enterprise video market during the forecast period. The growth of remote work and digital communication is driving demand for video conferencing and collaboration technologies. In addition to guaranteeing compliance and building user trust, regulatory frameworks that support digital infrastructure and data protection are important drivers of industry growth. Leading nations in this area are France, Germany, and the United Kingdom, where businesses are progressively implementing video technology for operations. Alongside regional businesses that address particular market needs, the competitive landscape includes major corporations like IBM and Zoom. A stable environment for innovation and expansion in the enterprise video industry is guaranteed by the existence of strong regulatory agencies.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the enterprise video market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Adobe

- AWS

- Cisco

- Haivision

- IBM

- INXPO

- Kollective Technology

- LogMeIn

- MediaPlatform

- Microsoft

- Poly

- RingCentral

- Zoom Video Communications

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2023, Mcarbon launched Spark, its new enterprise-grade video call platform designed to help businesses engage customers through seamless, customizable video communication. A major step into CPaaS-driven enterprise video, Mcarbon's Spark aims to transform the way companies engage with clients via customised, scalable video communication.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the enterprise video market based on the below-mentioned segments:

Global Enterprise Video Market, By Deployment Mode

- On-Premises

- Cloud

Global Enterprise Video Market, By Delivery Mode

- Video Conferencing

- Web Conferencing

Global Enterprise Video Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

- What is the current size and projected growth of the global enterprise video market?

The market was valued at USD 23.15 billion in 2024 and is expected to reach USD 68.81 billion by 2035, growing at a CAGR of 10.41% from 2025 to 2035.

- What are the main segments by deployment mode?

The market is segmented into On-Premises and Cloud, with Cloud holding the largest share in 2024 due to its scalability and lower costs for SMEs.

- What are the main segments by delivery mode?

Segments include Video Conferencing and Web Conferencing, with Video Conferencing dominating in 2024 for its high-quality interaction capabilities.

- Which region holds the largest market share?

Asia-Pacific is anticipated to hold the largest share, driven by rising internet penetration, digital infrastructure investments, and remote work trends in countries like China, India, and Japan.

- Which region is expected to grow the fastest?

Europe is projected to grow at the fastest CAGR, fueled by remote work adoption, digital communication demands, and strong regulatory support in nations like Germany, France, and the UK.

- What are the key drivers of market growth?

Growth is propelled by remote work trends post-COVID-19, digital transformation, demand for engaging content, and advancements in video tech like AI analytics.

- Who are some major companies in the market?

Key players include Adobe, AWS, Cisco, Google, IBM, Microsoft, Zoom Video Communications, and others like Haivision and RingCentral.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Market Attractiveness Analysis By Deployment Mode

- Market Attractiveness Analysis By Delivery Mode

- Market Attractiveness Analysis By Region

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- IT, healthcare, and BFSI are fueling the expansion of business video

- Restraints

- Persistent concerns regarding data security

- Opportunities

- Rising demand for comprehensive tools that combine voice calling, video conferencing

- Challenges

- High infrastructure expenses, challenges in integrating

- Global Enterprise Video Market Analysis and Projection, By Deployment Mode

- Segment Overview

- On-Premises

- Cloud

- Global Enterprise Video Market Analysis and Projection, By Delivery Mode

- Segment Overview

- Video Conferencing

- Web Conferencing

- Global Enterprise Video Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South America

- Brazil

- Middle East and Africa

- UAE

- South Africa

- Global Enterprise Video Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Enterprise Video Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Coverage Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- Adobe

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- AWS

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Cisco

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Google

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Haivision

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- IBM

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- INXPO

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Kollective Technology

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- LogMeIn

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- MediaPlatform

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Microsoft

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Poly

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- RingCentral

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Zoom Video Communications

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Others

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Adobe

List of Table

- Global Enterprise Video Market, By Deployment Mode, 2024-2035 (USD Billion)

- Global On-Premises, Enterprise Video Market, By Region, 2024-2035 (USD Billion)

- Global Cloud, Enterprise Video Market, By Region, 2024-2035 (USD Billion)

- Global Enterprise Video Market, By Delivery Mode, 2024-2035 (USD Billion)

- Global Video Conferencing, Enterprise Video Market, By Region, 2024-2035 (USD Billion)

- Global Web Conferencing, Enterprise Video Market, By Region, 2024-2035 (USD Billion)

- North America Enterprise Video Market, By Deployment Mode, 2024-2035 (USD Billion)

- North America Enterprise Video Market, By Delivery Mode, 2024-2035 (USD Billion)

- U.S. Enterprise Video Market, By Deployment Mode, 2024-2035 (USD Billion)

- U.S. Enterprise Video Market, By Delivery Mode, 2024-2035 (USD Billion)

- Canada Enterprise Video Market, By Deployment Mode, 2024-2035 (USD Billion)

- Canada Enterprise Video Market, By Delivery Mode, 2024-2035 (USD Billion)

- Mexico Enterprise Video Market, By Deployment Mode, 2024-2035 (USD Billion)

- Mexico Enterprise Video Market, By Delivery Mode, 2024-2035 (USD Billion)

- Europe Enterprise Video Market, By Deployment Mode, 2024-2035 (USD Billion)

- Europe Enterprise Video Market, By Delivery Mode, 2024-2035 (USD Billion)

- Germany Enterprise Video Market, By Deployment Mode, 2024-2035 (USD Billion)

- Germany Enterprise Video Market, By Delivery Mode, 2024-2035 (USD Billion)

- France Enterprise Video Market, By Deployment Mode, 2024-2035 (USD Billion)

- France Enterprise Video Market, By Delivery Mode, 2024-2035 (USD Billion)

- U.K. Enterprise Video Market, By Deployment Mode, 2024-2035 (USD Billion)

- U.K. Enterprise Video Market, By Delivery Mode, 2024-2035 (USD Billion)

- Italy Enterprise Video Market, By Deployment Mode, 2024-2035 (USD Billion)

- Italy Enterprise Video Market, By Delivery Mode, 2024-2035 (USD Billion)

- Spain Enterprise Video Market, By Deployment Mode, 2024-2035 (USD Billion)

- Spain Enterprise Video Market, By Delivery Mode, 2024-2035 (USD Billion)

- Asia Pacific Enterprise Video Market, By Deployment Mode, 2024-2035 (USD Billion)

- Asia Pacific Enterprise Video Market, By Delivery Mode, 2024-2035 (USD Billion)

- Japan Enterprise Video Market, By Deployment Mode, 2024-2035 (USD Billion)

- Japan Enterprise Video Market, By Delivery Mode, 2024-2035 (USD Billion)

- China Enterprise Video Market, By Deployment Mode, 2024-2035 (USD Billion)

- China Enterprise Video Market, By Delivery Mode, 2024-2035 (USD Billion)

- India Enterprise Video Market, By Deployment Mode, 2024-2035 (USD Billion)

- India Enterprise Video Market, By Delivery Mode, 2024-2035 (USD Billion)

- South America Enterprise Video Market, By Deployment Mode, 2024-2035 (USD Billion)

- South America Enterprise Video Market, By Delivery Mode, 2024-2035 (USD Billion)

- Brazil Enterprise Video Market, By Deployment Mode, 2024-2035 (USD Billion)

- Brazil Enterprise Video Market, By Delivery Mode, 2024-2035 (USD Billion)

- The Middle East and Africa Enterprise Video Market, By Deployment Mode, 2024-2035 (USD Billion)

- The Middle East and Africa Enterprise Video Market, By Delivery Mode, 2024-2035 (USD Billion)

- UAE Enterprise Video Market, By Deployment Mode, 2024-2035 (USD Billion)

- UAE Enterprise Video Market, By Delivery Mode, 2024-2035 (USD Billion)

- South Africa Enterprise Video Market, By Deployment Mode, 2024-2035 (USD Billion)

- South Africa Enterprise Video Market, By Delivery Mode, 2024-2035 (USD Billion)

List of Figures

- Global Enterprise Video Market Segmentation

- Enterprise Video Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top investment pocket in the Enterprise Video Market

- Top Winning Strategies, 2024-2035

- Top Winning Strategies, By Development, 2024-2035 (%)

- Top Winning Strategies, By Company, 2024-2035

- Moderate Bargaining power of Buyers

- Moderate Bargaining power of Suppliers

- Moderate Bargaining power of New Entrants

- Low threat of Substitution

- High Competitive Rivalry

- Top Player Positioning, 2024

- Market Share Analysis, 2024

- Restraint and Drivers: Enterprise Video Market

- Enterprise Video Market Segmentation, By Deployment Mode

- Enterprise Video Market For On-Premises, By Region, 2024-2035 ($ Billion)

- Enterprise Video Market For Cloud, By Region, 2024-2035 ($ Billion)

- Enterprise Video Market Segmentation, By Delivery Mode

- Enterprise Video Market For Video Conferencing, By Region, 2024-2035 ($ Billion)

- Enterprise Video Market For Web Conferencing, By Region, 2024-2035 ($ Billion)

- Adobe: Net Sales, 2024-2035 ($ Billion)

- Adobe: Revenue Share, By Segment, 2024 (%)

- Adobe: Revenue Share, By Region, 2024 (%)

- AWS: Net Sales, 2024-2035 ($ Billion)

- AWS: Revenue Share, By Segment, 2024 (%)

- AWS: Revenue Share, By Region, 2024 (%)

- Cisco: Net Sales, 2024-2035 ($ Billion)

- Cisco: Revenue Share, By Segment, 2024 (%)

- Cisco: Revenue Share, By Region, 2024 (%)

- Google: Net Sales, 2024-2035 ($ Billion)

- Google: Revenue Share, By Segment, 2024 (%)

- Google: Revenue Share, By Region, 2024 (%)

- Haivision: Net Sales, 2024-2035 ($ Billion)

- Haivision: Revenue Share, By Segment, 2024 (%)

- Haivision: Revenue Share, By Region, 2024 (%)

- IBM: Net Sales, 2024-2035 ($ Billion)

- IBM: Revenue Share, By Segment, 2024 (%)

- IBM: Revenue Share, By Region, 2024 (%)

- INXPO: Net Sales, 2024-2035 ($ Billion)

- INXPO: Revenue Share, By Segment, 2024 (%)

- INXPO: Revenue Share, By Region, 2024 (%)

- Kollective Technology: Net Sales, 2024-2035 ($ Billion)

- Kollective Technology: Revenue Share, By Segment, 2024 (%)

- Kollective Technology: Revenue Share, By Region, 2024 (%)

- LogMeIn.: Net Sales, 2024-2035 ($ Billion)

- LogMeIn.: Revenue Share, By Segment, 2024 (%)

- LogMeIn.: Revenue Share, By Region, 2024 (%)

- MediaPlatform: Net Sales, 2024-2035 ($ Billion)

- MediaPlatform: Revenue Share, By Segment, 2024 (%)

- MediaPlatform: Revenue Share, By Region, 2024 (%)

- Microsoft: Net Sales, 2024-2035 ($ Billion)

- Microsoft: Revenue Share, By Segment, 2024 (%)

- Microsoft: Revenue Share, By Region, 2024 (%)

- Poly: Net Sales, 2024-2035 ($ Billion)

- Poly: Revenue Share, By Segment, 2024 (%)

- Poly: Revenue Share, By Region, 2024 (%)

- RingCentral: Net Sales, 2024-2035 ($ Billion)

- RingCentral: Revenue Share, By Segment, 2024 (%)

- RingCentral: Revenue Share, By Region, 2024 (%)

- Zoom Video Communications: Net Sales, 2024-2035 ($ Billion)

- Zoom Video Communications: Revenue Share, By Segment, 2024 (%)

- Zoom Video Communications: Revenue Share, By Region, 2024 (%)

- Others: Net Sales, 2024-2035 ($ Billion)

- Others: Revenue Share, By Segment, 2024 (%)

- Others: Revenue Share, By Region, 2024 (%)

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 184 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |