Global Erectile Dysfunction Market

Global Erectile Dysfunction Market Size, Share, and COVID-19 Impact Analysis, By Treatment Type (Pharmaceutical Drugs, Devices, Surgical Treatments, and Other Therapies), By Mode of Administration (Oral, Injectable, Topical, and Transurethral), By Age Group (40-49 years, 50-59 years, 60-69 years, and 70+ years), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035

Report Overview

Table of Contents

Global Erectile Dysfunction Market Size Insights Forecasts to 2035

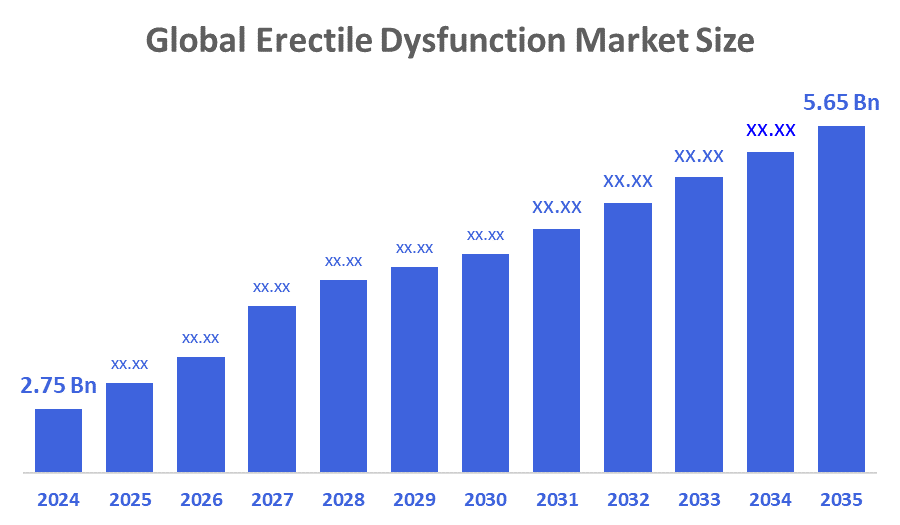

- The Global Erectile Dysfunction Market Size Was Estimated at USD 2.75 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.76 % from 2025 to 2035

- The Worldwide Erectile Dysfunction Market Size is Expected to Reach USD 5.65 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

According to a research report published by Decisions Advisors and Consulting, The Global Erectile Dysfunction Market Size Was Worth Around USD 2.75 Billion In 2024 And Is Predicted To Grow To Around USD 5.65 Billion By 2035 With A Compound Annual Growth Rate (CAGR) Of 6.76 % From 2025 To 2035. The increase in male sexual health issues, an ageing population, lifestyle risks, and developments in erectile dysfunction treatments such as oral medications, regenerative therapies, and telehealth options are all contributing to growth. Additionally, habits like smoking, excessive drinking, and inactivity can make the problem worse. It often leads to lower self-esteem and a reduced quality of life.

Market Overview

Erectile Dysfunction (ED) refers to the ongoing inability to achieve or maintain an erection that is adequate for satisfying sexual performance. It is a common issue in male sexual health and can arise from various physical, psychological, and lifestyle factors. Conditions like cardiovascular disease, diabetes, obesity, hormonal changes, and neurological disorders often contribute to ED. Mental health issues such as anxiety, stress, and depression also play a significant role. ED can have both physical and psychological causes, and it can greatly affect a person's quality of life and relationships. Atherosclerosis and other diseases that impact blood vessels can block or limit blood flow to the penis, resulting in erectile dysfunction. In neurological disorders, including multiple sclerosis, nerves that send signals to the penis can be damaged due to a stroke, diabetes, or other factors.

Psychological causes, such as stress, depression, lack of mental stimulation, and performance anxiety, can also contribute to ED by lowering libido. Common symptoms of erectile dysfunction include persistent trouble getting an erection, difficulty holding an erection, and reduced sexual desire. Diagnosis usually involves a thorough medical evaluation, including a physical exam, blood tests, and a review of the patient's medical history. In some cases, a specialist may perform further tests, like a penile ultrasound, to find the cause of the problem.

Comphya raised CHF 7.5 million to advance its neurostimulation therapy for erectile dysfunction (ED). This funding supports clinical development of a novel device-based approach, offering an alternative for patients unresponsive to or intolerant of pharmacological treatments.

Report Coverage

This research report categorizes the erectile dysfunction market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the erectile dysfunction market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the erectile dysfunction market.

Driving Factors

The rise in lifestyle diseases and the growing trend of sedentary living are boosting the market for erectile dysfunction drugs. The global demand for these drugs is linked to the increase in inactive lifestyles and related health issues like obesity, heart disease, diabetes, and high blood pressure. Additionally, awareness of health concerns is growing, thanks to public initiatives from governments, especially in developing areas, which is helping to stimulate market growth. The greater availability of generic drugs, along with changes in socioeconomic conditions and stress-related inactivity, will enhance market expansion, even with some major patents expiring, which worries stakeholders. Increased investment in research and development, along with ongoing medical studies, is expected to positively affect market growth in the coming years.

Restraining Factors

The erectile dysfunction (ED) market faces restraining factors including stigma, underdiagnosis, safety and side-effect concerns, regulatory hurdles, pricing pressures, and reimbursement challenges. These barriers limit patient acceptance, access, and market expansion despite therapeutic innovations.

Market Segmentation

The erectile dysfunction market share is classified into treatment type, mode of administration, and age group.

- The pharmaceutical drugs segment accounted for the largest market share in 2024 and is anticipated to grow at a substantial CAGR over the forecast period.

Based on the treatment type, the erectile dysfunction market is divided into pharmaceutical drugs, devices, surgical treatments, and other therapies. Among these, the pharmaceutical drugs segment accounted for the largest market share in 2024 and is anticipated to grow at a substantial CAGR over the forecast period. This section dominance is mainly due to the common use and effectiveness of oral PDE5 inhibitors like sildenafil, tadalafil, and vardenafil. These drugs remain the first-choice treatment for most patients. They are easily accessible at retail and online pharmacies. The availability of generic versions has boosted market reach by making these treatments more affordable for various demographics and regions.

- The oral segment accounted for the highest market share in 2024 and is projected to grow at a remarkable CAGR during the forecast period.

Based on the mode of administration, the erectile dysfunction market is segmented into oral, injectable, topical, and transurethral. Among these, the oral segment accounted for the highest market share in 2024 and is projected to grow at a remarkable CAGR during the forecast period. Oral therapies provide flexible dosing options. Patients can choose from on-demand usage or daily low-dose plans. This variety suits different lifestyles and medical needs. Additionally, the rise of online telemedicine platforms and e-pharmacies has made it simpler for patients to get these medications confidentially. This trend has increased the demand for oral treatments.

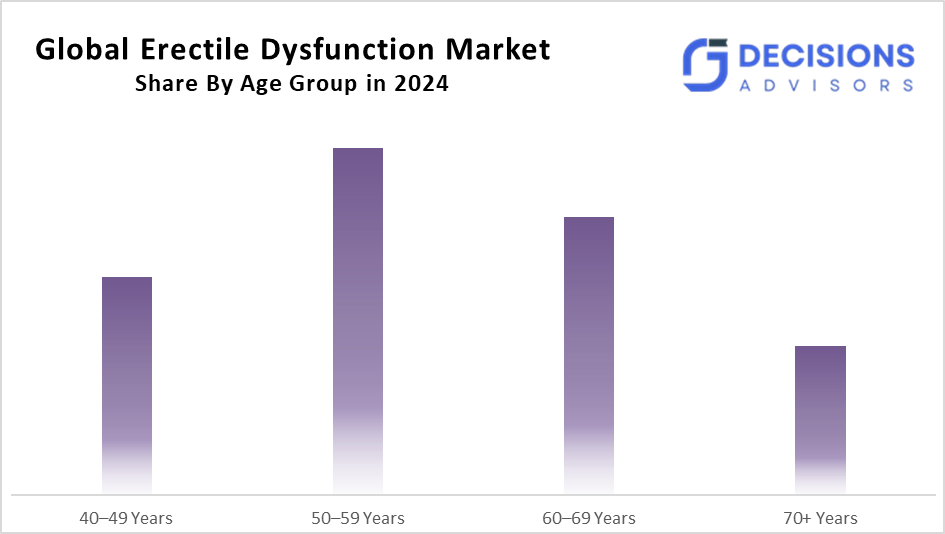

- The 50-59 years segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the age group, the erectile dysfunction market is divided into 40-49 years, 50-59 years, 60-69 years, and 70+ years. Among these, the 50-59 years segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This segment dominance mainly results from the natural emergence of age-related health issues at this stage, such as hypertension, type 2 diabetes, and hormonal imbalances, which greatly contribute to erectile dysfunction. The high rate of health checkups, along with a readiness to seek treatment, makes this age group a key target for ED drug makers and digital health providers.

Regional Segment Analysis of the Erectile Dysfunction Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the erectile dysfunction market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the erectile dysfunction market over the predicted timeframe. This significant contribution comes from the high rates of chronic lifestyle diseases like diabetes, obesity, and heart problems, which are major causes of erectile dysfunction. In addition, increased awareness, strong healthcare systems, and a willingness to discuss male health have led to earlier diagnoses and more men seeking treatment. The Japanese erectile dysfunction market is expected to grow at a steady pace. Factors driving this growth include public health efforts, better awareness of male sexual health, and more middle-aged and older men seeking help for ED. Japan is also starting to use telehealth and e-pharmacy services, which are helping to ease privacy concerns and lower obstacles to treatment.

Lupin Limited launched Cialis (tadalafil) in India, expanding access to one of the world’s leading oral PDE5 inhibitors for treating erectile dysfunction (ED) in adult males.

North America is expected to grow at a rapid CAGR in the erectile dysfunction market during the forecast period. The United States erectile dysfunction market holds the largest share in the global landscape. This is due to a high rate of lifestyle-related health issues like diabetes, obesity, and heart disease. An ageing male population, combined with greater awareness of sexual health matters, has led to more diagnoses and a higher demand for treatment options. Additionally, the rise of digital health platforms and online pharmacies has changed how patients access care. They now offer private consultations, remote prescriptions, and home delivery of ED medications nationwide. Technological improvements and ongoing clinical trials in the US are also enhancing the erectile dysfunction treatment landscape. New methods like low-intensity shockwave therapy, stem cell treatments, and platelet-rich plasma (PRP) injections are becoming more popular, especially among patients who do not respond to standard drug therapy.

UCI Health enrolled the first patient in the first U.S. clinical study of a medical device for erectile dysfunction (ED). This marks a significant milestone, as most ED treatments have traditionally been pharmacological (like PDE5 inhibitors such as Viagra).

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the erectile dysfunction market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Aurobindo Pharma

- Bayer AG

- Cipla Ltd.

- Dr Reddy’s Laboratories

- Eli Lilly and Company

- Endo International plc

- GlaxoSmithKline plc (GSK)

- Hims & Hers Health, In

- Lupin Ltd.

- Metuchen Pharmaceuticals

- Pfizer Inc.

- Sandoz (a Novartis division)

- Sun Pharmaceutical Industries Ltd.

- Teva Pharmaceutical Industries Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In February 2026, the FDA approved Vybrique, the first oral film formulation of sildenafil for treating erectile dysfunction (ED) in adult men. Unlike traditional tablets, Vybrique dissolves on the tongue, requiring no water or food, offering greater discretion and convenience.

- In September 2024, Haleon announced the launch of Eroxon, the first and only FDA-cleared over-the-counter (OTC) gel for erectile dysfunction (ED). It is now available for U.S. preorder without a prescription, marking a major shift in accessibility for ED treatment.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the erectile dysfunction market based on the below-mentioned segments:

Global Erectile Dysfunction Market, By Treatment Type

- Pharmaceutical Drugs

- Devices

- Surgical Treatments

- Other Therapies

Global Erectile Dysfunction Market, By Mode of Administration

- Oral

- Injectable

- Topical

- Transurethral

Global Erectile Dysfunction Market, By Age Group

- 40-49 years

- 50-59 years

- 60-69 years

- 70+ years

Global Erectile Dysfunction Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

- What is the projected size of the global erectile dysfunction market by 2035?

The market is expected to grow from USD 2.75 billion in 2024 to USD 5.65 billion by 2035, at a CAGR of 6.76% during 2025-2035.

- Which treatment type holds the largest market share?

Pharmaceutical drugs dominated in 2024 due to the popularity and accessibility of oral PDE5 inhibitors like sildenafil and tadalafil, and they are projected to grow at a substantial CAGR.

- What mode of administration leads the market, and why?

Oral administration held the highest share in 2024, driven by flexible dosing, telemedicine access, and e-pharmacies, with remarkable CAGR growth anticipated.

- Which age group generates the most revenue?

The 50-59 years segment led in 2024 revenue, fueled by age-related conditions like diabetes and hypertension, and is set for significant CAGR growth.

- Which region is expected to have the largest market share?

Asia-Pacific is projected to hold the largest share, thanks to high rates of diabetes, obesity, rising awareness, and strong healthcare systems in countries like Japan, China, and India.

- What are the main drivers of market growth?

Key factors include rising lifestyle diseases (e.g., obesity, diabetes), sedentary habits, an ageing population, increased awareness via public initiatives, and innovations like generics and telehealth.

- What challenges restrain the erectile dysfunction market?

Stigma, underdiagnosis, side-effect concerns, regulatory hurdles, high pricing, and reimbursement issues limit patient access and expansion.

- What are some recent developments in ED treatments?

In February 2026, the FDA approved Vybrique (oral film sildenafil); in September 2024, Haleon launched Eroxon (OTC gel), plus funding for neurostimulation devices and new clinical trials in the US.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 240 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Feb 2026 |

| Access | Download from this page |