Global EtherCAT Market

Global EtherCAT Market Size, Share, and COVID-19 Impact Analysis, By Component (Hardware, Software, Services), By Device Type (Master Controllers, Slave Controllers, I/O Modules, Gateways), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035.

Report Overview

Table of Contents

EtherCAT Market Summary

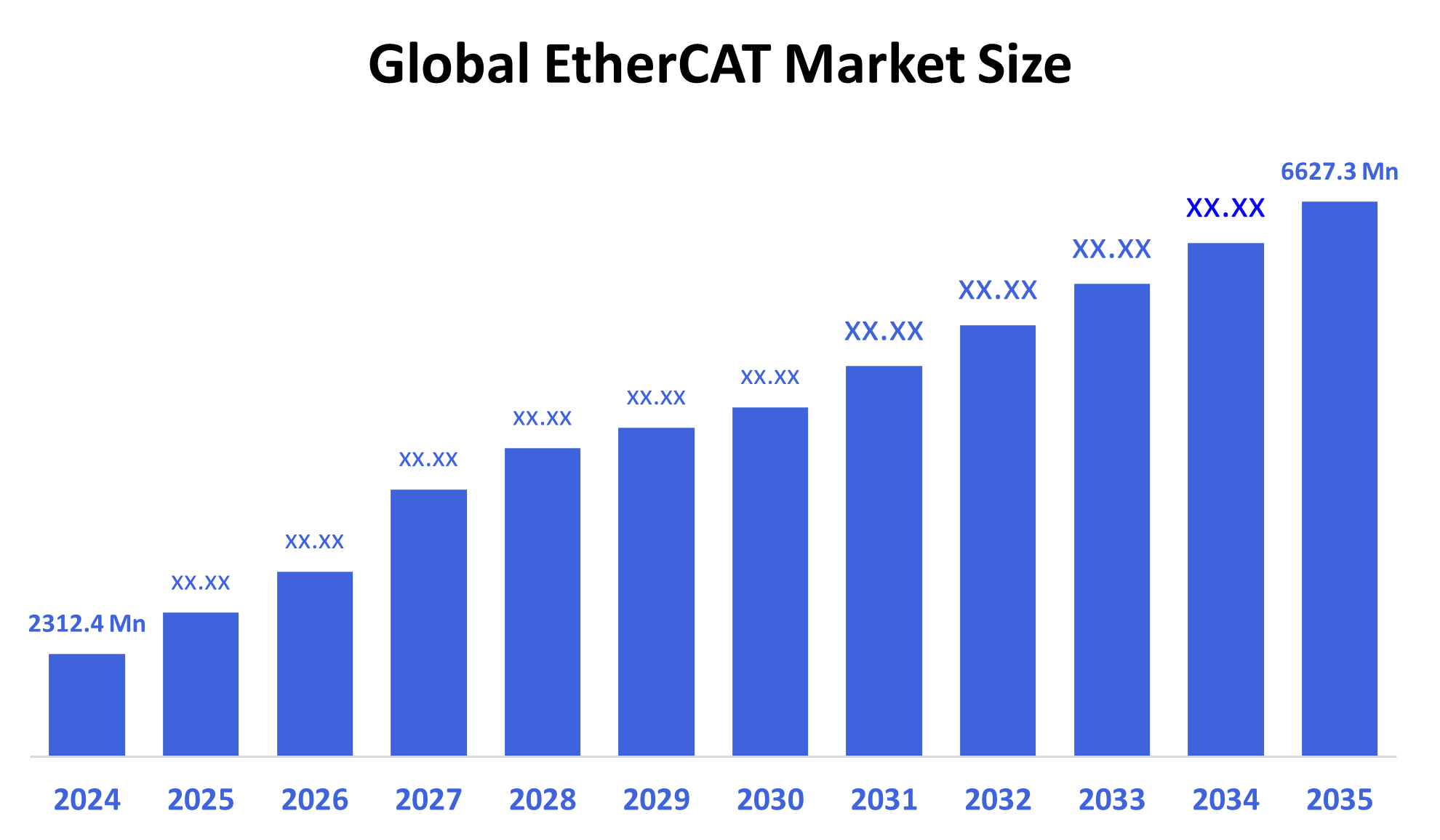

The Global Ethercat Market Size Was Estimated at USD 2312.4 Million in 2024 and is Projected to Reach USD 6627.3 Million by 2035, Growing at a CAGR of 10.05% from 2025 to 2035. The market for EtherCAT is expanding because of the growing need for precise, fast, and real-time communication in automated industrial settings. This demand is being driven by Industry 4.0 initiatives, industrial IoT (IIoT), and developments in robotics and automation in industries such as food processing, electronics, and the automotive sector.

Key Regional and Segment-Wise Insights

- In 2024, the North American EtherCAT market held the largest revenue share, accounting for 34.7%.

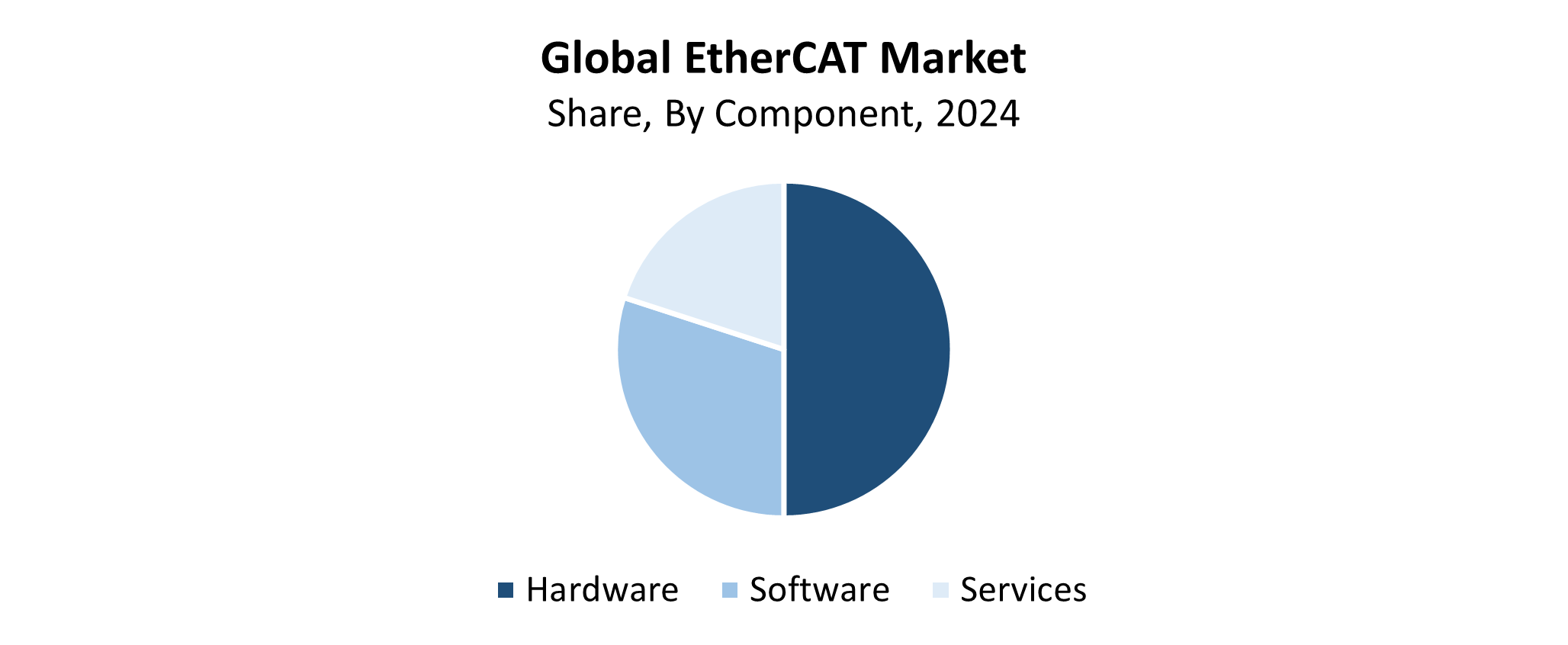

- In 2024, the hardware segment had the biggest revenue share of 50.7% and dominated the market by component.

- In 2024, the master controllers segment had the highest revenue share and dominated the market by device type.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 2312.4 Million

- 2035 Projected Market Size: USD 6627.3 Million

- CAGR (2025-2035): 10.05%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The EtherCAT market operates as the industrial networking field, which specializes in high-speed Ethernet-based fieldbus systems that offer real-time automation control. The low cost and precise synchronization, along with minimal latency, make EtherCAT the preferred choice for industrial applications across robotics and energy, automotive sectors, and manufacturing and packaging operations. Strong market expansion is being fueled by Industry 4.0 initiatives, smart manufacturing, and rising demand for industrial automation. Industries require EtherCAT's ability to handle large datasets instantly because modern operations demand fast device connections and efficient data handling solutions. The market experiences expansion due to the growing adoption of distributed control systems as well as motion control systems, and sophisticated robotic systems.

The EtherCAT industry is experiencing substantial growth because of cybersecurity improvements, together with better interoperability and complex industrial network support. Manufacturers apply AI-powered analytics together with IoT platforms and EtherCAT to achieve better process optimization and predictive maintenance functions. Time-sensitive networking (TSN) development, together with cloud-based system integration, leads to improved scalability and system transparency. Industrial digitalization receives worldwide governmental support through investment programs that focus on automation infrastructure and smart factory development. The adoption of EtherCAT accelerates because of programs such as "Made in China 2025" along with Germany's "Industrie 4.0" and similar initiatives in South Korea, Japan, and the United States, which establish EtherCAT as a core component for future industrial communication technologies.

Component Insights

The hardware segment led the market with the largest revenue share of 50.7% during 2024. The wide application of EtherCAT-compatible devices and equipment throughout industrial automation systems constitutes the primary reason behind this sector's market dominance. Real-time data exchange, together with precise control functions, is delivered through essential hardware components such as controllers along with I/O modules, sensors, actuators, and communication interfaces that serve manufacturing and process industries. The growing industrial need for high-speed deterministic communication has created a demand for dependable EtherCAT hardware solutions in semiconductor production as well as robotics, packaging, and automotive industries. The expanding industrial markets of developing nations continue to strengthen hardware adoption because they drive automation implementation, which maintains its leading position in the EtherCAT market.

The software segment within the EtherCAT market is anticipated to grow at a significant CAGR throughout the forecasted period. The rising requirement for advanced software tools that manage complex EtherCAT networks through setup, monitoring, diagnostic, and control functions stands as the main factor driving market expansion. Software solutions play an essential role in connecting systems smoothly while providing real-time data exchange and efficient device management for industrial automation systems, which become more data-driven and networked. The growing need for software solutions to enable analytics, together with remote management and predictive maintenance, emerged from Industry 4.0 alongside smart manufacturing initiatives. EtherCAT stands as a key growth factor within modern automation because it connects with cloud services and industrial IoT platforms, which accelerates software adoption rapidly.

Device Type Insights

The master controllers segment dominated the EtherCAT market, accounted for the largest revenue share in 2024. The master controllers function as essential components to maintain real-time data exchange while providing precise control operations through managing all network device communications in an EtherCAT system. The complex process management capabilities of these devices enable industries, including manufacturing and robotics and automotive, and packaging, to control multiple nodes within their operations. Master controllers with advanced features receive growing demand because Industry 4.0 initiatives, along with smart factories, require dependable and efficient control system solutions. The master controllers segment maintains its EtherCAT market dominance because technical progress and increasing automation infrastructure funding continue to drive its growth.

The slave controllers segment of the EtherCAT market is anticipated to experience substantial growth through the forecast period. Slave controllers within EtherCAT networks function as essential components that perform instructions from the master controller while enabling real-time communication between sensors and actuators and other field devices. Industrial automation growth in robotics and automotive, and manufacturing sectors drives the requirement for effective, scalable slave devices. Production systems demand more intelligent slave nodes because their complexity, along with their decentralization, continues to grow. The market will experience strong expansion due to EtherCAT adoption in developing regions and advancements in compact and power-saving slave controller technology.

Regional Insights

During 2024, North America held the largest revenue share of 34.7% and dominated the EtherCAT market worldwide. The advanced industrial automation infrastructure, together with Industry 4.0 technology adoption and smart manufacturing investments in this region, drives its leading market position. The accurate control capabilities and fast real-time communication of EtherCAT systems lead to their growing adoption in essential industries such as electronics and pharmaceuticals and automotive, and aerospace. The leading position of this region becomes stronger through the availability of top-level automation and control system manufacturers, combined with substantial innovation and research and development focus. The EtherCAT market in North America continues to grow because government programs promote industrial efficiency and digital transformation initiatives.

Europe EtherCAT Market Trends

The European market for EtherCAT experiences significant growth because of its devices, to attract new manufacturing techniques and digital automation strategies. The real-time control systems in Germany, France, and Italy require EtherCAT for high-speed data communication since these countries lead Industry 4.0 adoption. The market experiences substantial development because of the semiconductor industry, alongside automotive, packaging, robotics, and other industrial sectors. The German government supports "Industrie 4.0" initiatives, which accelerate EtherCAT adoption within smart manufacturing facilities. The market growth receives additional backing from leading industrial automation corporations, together with their ongoing investment in research and development. The EtherCAT market finds a prime opportunity in Europe because of the combined industrial needs alongside supportive regulations and technological innovation.

Asia Pacific EtherCAT Market Trends

The Asia Pacific EtherCAT market is anticipated to experience the fastest CAGR throughout the forecasted period, due to the rapid industrialization and expanding manufacturing sectors and rising automation technology usage in major economies, including China, Japan, South Korea, and India. The demand for high-performance communication systems continues to grow throughout the region as they support robotics applications and smart manufacturing solutions, and precision control systems. Government initiatives such as "Made in China 2025" and "Make in India" drive the rapid implementation of Industry 4.0 technologies, which include EtherCAT as a fundamental component. The rising number of automation solution providers, together with increased infrastructure and technology investments, makes the Asia Pacific the fastest-growing region for EtherCAT systems.

Key EtherCAT Companies:

The following are the leading companies in the EtherCAT market. These companies collectively hold the largest market share and dictate industry trends.

- Acontis Technologies GmbH

- WAGO

- Schneider Electric

- Beckhoff Automation

- KEB Automation KG

- Siemens

- Omron Corporation

- Bosch Rexroth AG

- Phoenix Contact

- Yaskawa Electric Corporation

- Others

Recent Developments

- In April 2024, EtherCAT capability was added to Omron's NXR Series, making remote I/O maintenance and IIoT adoption easier. Omron's automation products are now more interoperable thanks to this growth.

- In February 2024, Phoenix Contact introduced two new small safety I/O modules for Safety over EtherCAT (FSoE) that are intended to improve the security of industrial networks. These modules provide faster integration and effective system architecture in complex automation systems, while offering extensive protection features that guarantee dependable operation and fault detection across EtherCAT networks.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the EtherCAT market based on the below-mentioned segments:

Global EtherCAT Market, By Component

- Hardware

- Software

- Services

Global EtherCAT Market, By Device Type

- Master Controllers

- Slave Controllers

- I/O Modules

- Gateways

Global EtherCAT Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 220 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |