Global Family Business Advisory Services Market

Global Family Business Advisory Services Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Ownership Stage (First-generation Ownership, Second-generation Ownership, Third-generation Ownership, and Beyond Third-generation), By Application Area (Governance & Conflict Resolution, Financial & Tax Advisory, Strategic Planning & Business Growth, Legal & Estate Structuring, and Education & Talent Development), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Family Business Advisory Services Market Summary, Size & Emerging Trends

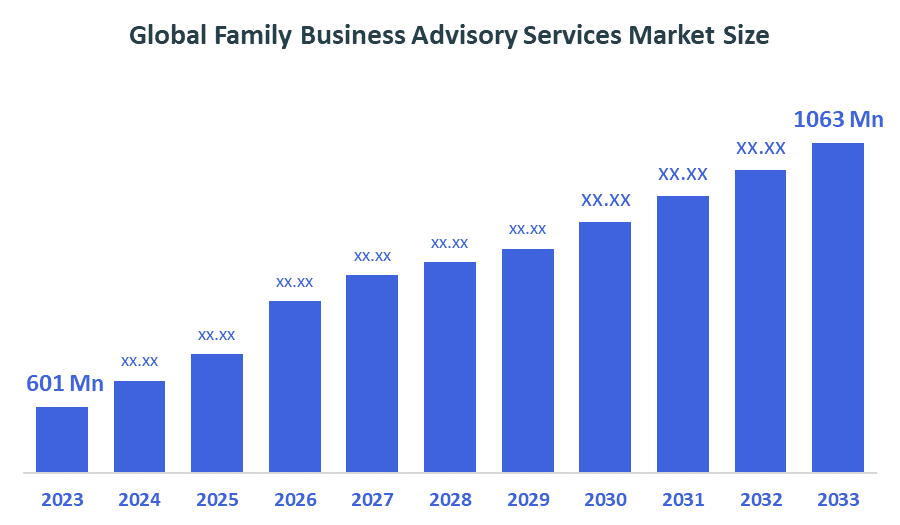

According to Decision Advisors, the Global Family Business Advisory Services Market Size is Expected to Grow from USD 601 Million in 2024 to USD 1063 Million by 2035, at a CAGR of 5.32% during the forecast period 2025-2035. A key driving factor of the Global family business advisory services market is the growing need for structured succession planning and governance as family-owned businesses face complex intergenerational transitions.

Key Market Insights

- North America is expected to account for the largest share in the family business advisory services market during the forecast period.

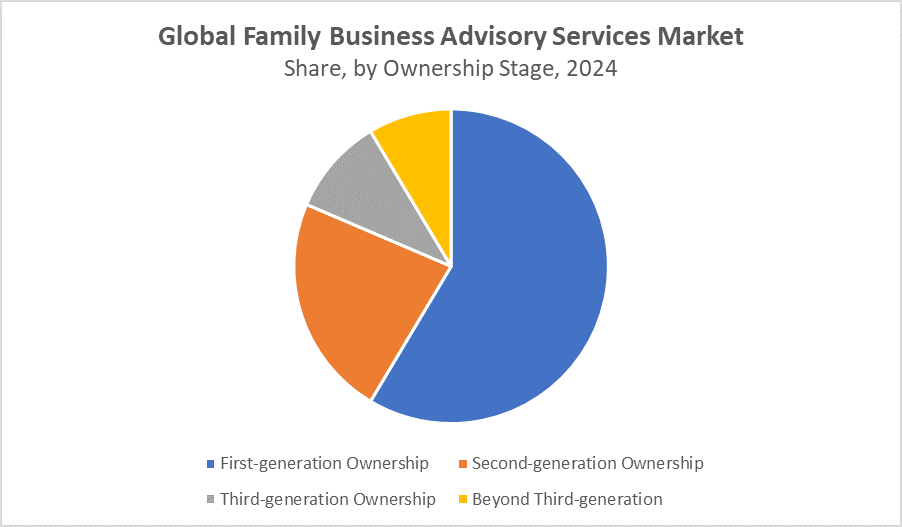

- In terms of ownership stage, the first-generation ownership segment accounted for the largest market share of the global family business advisory services market during the forecast period

- In terms of application area, the financial & tax advisory segment accounted for the major revenue share of the global family business advisory services market during the forecast period

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 601 Million

- 2035 Projected Market Size: USD 1063 Million

- CAGR (2025-2035): 5.32%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Family Business Advisory Services Market

The global family business advisory services market focuses on providing expert guidance to family-owned enterprises in areas such as succession planning, governance, estate planning, and professionalization. As family businesses form a vital part of the global economy, their long-term sustainability is essential. Advisory services help families navigate generational transitions, align business goals with family values, and implement effective governance structures. Governments support this sector through initiatives like mentorship programs, training workshops, and legal frameworks that promote continuity and growth. These efforts aim to ensure stability, job creation, and economic resilience. Increasing awareness of the importance of structured governance and wealth planning among family businesses is driving demand for these services. Leading global consulting firms, alongside niche advisors, offer tailored solutions to meet the evolving needs of these enterprises. As family businesses seek to balance tradition with innovation, the advisory services market continues to grow, playing a key role in their strategic evolution.

Family Business Advisory Services Market Trends

- As older generations retire, demand is rising for structured succession strategies to ensure smooth leadership transitions. Advisors focus on identifying next-gen leaders, mentoring, and aligning family and business goals.

- Family businesses are increasingly separating ownership from day-to-day operations. Advisors help implement formal governance structures, independent boards, and corporate-style management systems.

- Families are integrating Environmental, Social, and Governance (ESG) principles into business strategies. Advisory services support sustainable investment planning, ethical governance, and social impact initiatives.

- Advisors are guiding family firms through digital adoption modernizing operations, enhancing cybersecurity, and embracing data-driven decision-making to remain competitive in a tech-driven economy.

Family Business Advisory Services Market Dynamics

Driving Factors: Increasing generational transitions

Increasing generational transitions have created a strong need for succession planning and governance support. Rising complexity in family dynamics and business structures also fuels demand for expert advisory. Governments and financial institutions are promoting professionalization and long-term sustainability of family enterprises through supportive policies and training programs. Additionally, growing awareness of wealth preservation, estate planning, and corporate governance among business-owning families boosts the market. The push toward ESG compliance and digital transformation further encourages family businesses to seek strategic advisory services for long-term competitiveness and resilience.

Restrain Factors: Many family businesses are reluctant to seek external advice

Many family businesses are reluctant to seek external advice due to privacy concerns and a strong preference for internal decision-making. Resistance to change, especially in traditional or older generations, can hinder the adoption of formal governance structures and succession plans. High advisory costs may also limit access for smaller family enterprises. Additionally, a lack of awareness or understanding of the long-term benefits of professional advisory services can reduce demand. Cultural differences and complex family dynamics further complicate the implementation of standardized advisory solutions across diverse regions.

Opportunity: Growing emphasis on ESG

The family business advisory services market presents significant growth opportunities driven by evolving business needs and generational shifts. As younger family members take leadership roles, there is increasing openness to adopting formal governance, innovation, and strategic planning. The rising number of ultra-high-net-worth families creates demand for integrated services, including estate planning, philanthropy, and family office setup. Emerging markets, where family-owned businesses dominate the economy, offer untapped potential for advisory firms. Additionally, the growing emphasis on ESG, digital transformation, and global expansion provides opportunities for tailored advisory solutions. Collaborations between advisors, legal experts, and financial institutions can further enhance service offerings. As awareness grows, advisory services are becoming essential for long-term sustainability and legacy planning in family businesses.

Challenges: Aligning diverse generational perspectives

One major issue is the reluctance of families to involve external advisors due to trust and confidentiality concerns. Deep-rooted family conflicts and emotional dynamics can also hinder the implementation of professional advice. Additionally, aligning diverse generational perspectives and values often proves difficult. The lack of standardized advisory models across cultures and regions adds complexity. High service costs and limited access to expert advisors in rural or emerging areas further restrict market growth.

Global Family Business Advisory Services Market Ecosystem Analysis

The global family business advisory services ecosystem includes large consultancies (e.g., PwC, EY), boutique advisory firms, family offices, professional associations, and multidisciplinary networks. These stakeholders collaborate to offer services in succession planning, governance, wealth management, and digital transformation. Family offices act as central coordinators, while associations like the Family Firm Institute provide research and training. This interconnected ecosystem enables value co-creation, helping family businesses manage complexity, preserve legacy, and achieve long-term sustainability across generations and global markets.

Global Family Business Advisory Services Market, By Ownership Stage

The first-generation ownership segment accounted for the largest market share of the global family business advisory services market during the forecast period, primarily due to the growing need for foundational business structuring and future planning. First-generation business owners are often focused on establishing robust governance models, formalizing operations, and creating long-term succession strategies.

The second-generation ownership segment accounted for a significant revenue share of the worldwide family business advisory services market during the forecast period due to the complex transition and restructuring needs that arise when leadership passes from founders to their successors. At this stage, family businesses often face internal challenges such as aligning family values with business goals, managing sibling dynamics, and redefining governance structures.

Global Family Business Advisory Services Market, By Application Area

The financial & tax advisory segment accounted for the major revenue share of the global family business advisory services market during the forecast period, capturing over 40% of the total market share. This dominance is driven by the critical need for strategic financial planning, tax optimization, and wealth preservation among family-owned enterprises. Family businesses often face complex financial structures, cross-border investments, and intergenerational wealth transfers that require expert advisory. Services such as estate planning, business valuation, capital structuring, and tax-efficient succession strategies are essential, especially as families aim to protect their assets and ensure smooth transitions across generations.

The education & talent development segment accounted for the largest market share of the global family business advisory services market during the forecast period, capturing around 15% of the total market share. This growth is driven by the increasing need to prepare next-generation family members for leadership roles and long-term business sustainability. Family businesses are investing in leadership training, mentorship programs, and formal education to equip successors with the skills required for modern business challenges. Advisory firms offer tailored programs in areas such as governance, strategic decision-making, and emotional intelligence to strengthen both business acumen and family cohesion.

North America is expected to account for the largest share in the family business advisory services market during the forecast period, capturing approximately 35% of the total market share. This dominance is attributed to the high concentration of family-owned enterprises across the U.S. and Canada, many of which are multi-generational and have complex business and wealth structures. The region benefits from a mature advisory landscape, with a strong presence of global consulting firms and specialized family business advisors offering services in governance, succession, estate planning, and leadership development. Additionally, high awareness of the importance of structured succession planning and professional management contributes to strong demand for advisory services.

Canada is experiencing steady and significant growth in the family business advisory services market, capturing approximately 20% of the North American market share. This growth is fueled by a large number of small to mid-sized family-owned enterprises across industries such as agriculture, manufacturing, retail, and real estate. Many of these businesses are transitioning to second or third-generation ownership. Canadian family businesses are increasingly recognizing the need for structured succession planning, governance frameworks, and tax-efficient wealth transfer strategies. This has led to rising demand for advisory services focused on leadership development, estate planning, and family governance.

Asia Pacific is anticipated to register the highest CAGR of 7.1% in the family business advisory services market during the forecast period, driven by the region’s large concentration of first- and second-generation family-owned enterprises, many of which are now facing critical succession and governance challenges. As wealth continues to rise across countries like China, India, Indonesia, and Southeast Asia, there is increasing demand for professional guidance in estate planning, family governance, leadership development, and business continuity. Cultural shifts toward formalizing business structures and engaging external advisors are also accelerating market adoption.

India is the fastest-growing country in the Asia Pacific family business advisory services market, capturing approximately 30% of the regional market share, driven by a large number of family-owned businesses, many transitioning from the first to the second generation, creating a strong need for succession planning and governance advisory. The expanding middle class, rising entrepreneurship, and increasing awareness about professionalizing family businesses contribute to the demand for advisory services. Additionally, regulatory reforms, digital adoption, and government initiatives supporting SMEs bolster market expansion.

WORLDWIDE TOP KEY PLAYERS IN THE FAMILY BUSINESS ADVISORY SERVICES MARKET INCLUDE

- Deloitte

- EY (Ernst & Young)

- KPMG

- PwC (PricewaterhouseCoopers)

- Grant Thornton

- Mercer Capital

- The Family Business Consulting Group

- Baker Tilly US, LLP

- Bessemer Trust

- Citrin Cooperman

- Others

Product Launches in Family Business Advisory Services Market

- In January 2023, PKF O’Connor Davies, a leading U.S.-based accounting and advisory firm, launched its Family Advisory Services group to provide strategic, conflict-free advisory solutions tailored to ultra-high-net-worth families and private business owners. Services include wealth planning, governance consulting, family education, and strategic philanthropy.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the family business advisory services market based on the below-mentioned segments:

Global Family Business Advisory Services Market, By Ownership Stage

- First-generation Ownership

- Second-generation Ownership

- Third-generation Ownership

- Beyond Third-generation

Global Family Business Advisory Services Market, By Application Area

- Governance & Conflict Resolution

- Financial & Tax Advisory

- Strategic Planning & Business Growth

- Legal & Estate Structuring

- Education & Talent Development

Global Family Business Advisory Services Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

FAQs

Q: What are the key drivers of growth in the Family Business Advisory Services Market?

A: Key drivers include increasing generational transitions, rising demand for structured succession planning and governance, growing awareness of wealth preservation, and emphasis on ESG and digital transformation.

Q: What are the major challenges facing the Family Business Advisory Services Market?

A: Challenges include reluctance among family businesses to seek external advice due to privacy and trust concerns, resistance to change, high advisory costs, and complex family dynamics.

Q: What opportunities exist in the Family Business Advisory Services Market?

A: Growing emphasis on ESG, increasing openness to formal governance among younger generations, expanding ultra-high-net-worth families, and emerging markets offer significant opportunities.

Q: Which countries in Asia Pacific are leading market growth?

A: India is the fastest-growing country in the Asia Pacific family business advisory services market, driven by generational transitions and increasing professionalization.

Q: Who are the top players operating in the Global Family Business Advisory Services Market?

A: Key players include Deloitte, EY (Ernst & Young), KPMG, PwC, Grant Thornton, Mercer Capital, The Family Business Consulting Group, Baker Tilly US, LLP, Bessemer Trust, and Citrin Cooperman.

Q: What are the latest trends in the Family Business Advisory Services Market?

A: Trends include increasing demand for succession strategies, separation of ownership and management, integration of ESG principles, and adoption of digital technologies.

Q: How do North America and Asia Pacific compare in market dynamics?

A: North America leads in market share due to mature advisory infrastructure, while Asia Pacific shows faster growth driven by rising wealth and formalization of family businesses.

Q: What kinds of advisory services are included in the market?

A: Services include governance & conflict resolution, financial & tax advisory, strategic planning & business growth, legal & estate structuring, and education & talent development

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 240 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |