Global Fault Current Limiter Market

Global Fault Current Limiter Market Size, Share, and COVID-19 Impact Analysis, By Type (Superconducting, Non-Superconducting), By Voltage Range (High, Medium, Low), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Fault Current Limiter Market Summary

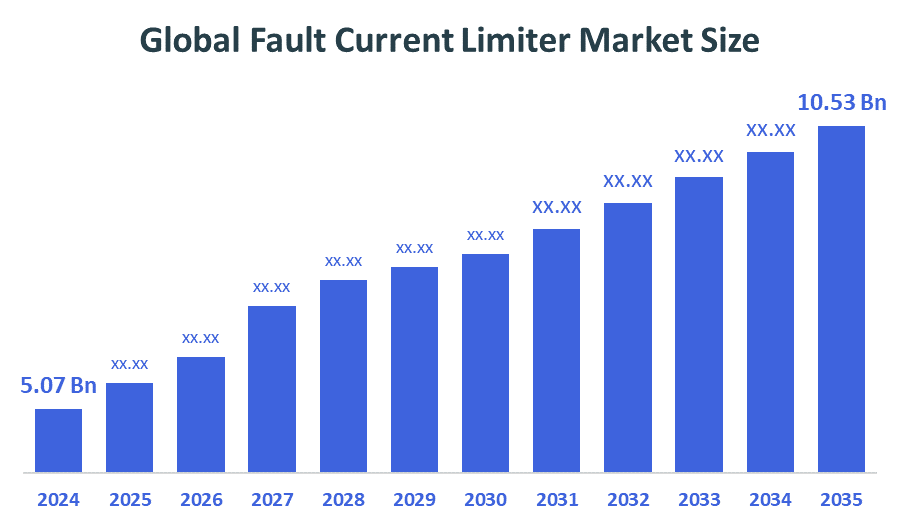

The Global Fault Current Limiter Market Size Was Estimated at USD 5.07 Billion in 2024 and is Projected to Reach USD 10.53 Billion by 2035, growing at a CAGR of 6.87% from 2025 to 2035. The market for fault current limiters is expanding due to the need to modernize outdated power infrastructure, integrate renewable energy sources, increase grid stability, and enforce stricter grid safety rules.

Key Regional and Segment-Wise Insights

- In 2024, the Asia Pacific held the largest revenue share and dominated the market globally.

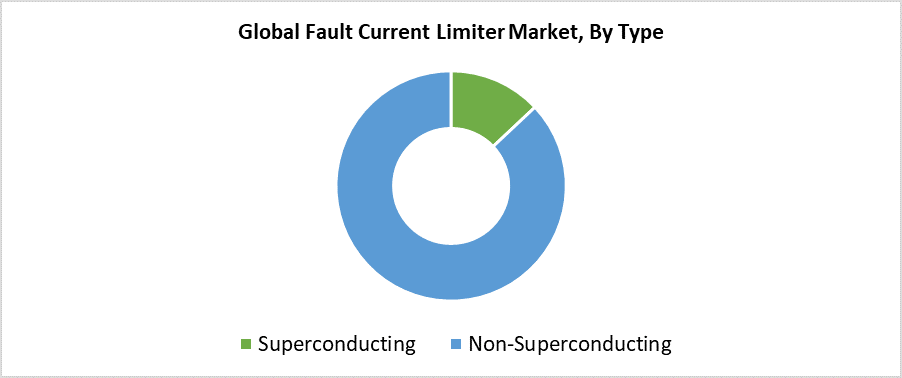

- In 2024, the non-superconducting segment had the highest market share by type, accounting for 87.3%.

- In 2024, the high-voltage segment had the biggest market share by voltage range.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 5.07 Billion

- 2035 Projected Market Size: USD 10.53 Billion

- CAGR (2025-2035): 6.87%

- Asia Pacific: Largest market in 2024

The fault current limiters (FCLs) market operates within the power systems industry to protect grid infrastructure and stabilize systems through current restriction during electrical faults. Modern power networks depend on these devices because they manage the complex integration of distributed energy resources such as wind and solar power. The market expansion results from increased smart grid infrastructure investment as well as rising requirements for dependable power delivery and heightened concerns about electrical equipment failure caused by fault currents or short circuits. The worldwide modernization of aging grid systems and the rapid increase of renewable energy installations fuel the advancement of FCL technology.

Technological advancements heavily influence the FCL market through various developments. The market adopts innovative designs, including solid-state fault current limiters and hybrid models and superconducting fault current limiters, which deliver advanced performance and faster response times, and reduced power dissipation. The implementation of these technologies expands within urban power distribution networks together with high-voltage transmission systems. Government programs supporting grid modernization and renewable energy integration, and infrastructure resilience create beneficial regulatory environments that promote the adoption of these technologies, especially across North America and Europe, and the Asia-Pacific. FCL adoption in developing and established economies speeds up because of public-private collaborations and enhanced support for smart grid research funding.

Type Insights

The non-superconducting segment held the largest revenue share of 87.3% and led the global fault current limiter (FCL) market during 2024. The technological maturity, along with its affordability and widespread adoption across different power grid voltage levels, makes this segment the market leader. Solid-state and inductive non-superconducting FCLs deliver reliable fault current limiting functions while avoiding the high costs and complex superconducting material requirements. The devices serve as common solutions for distribution networks and utility substations, and industrial power systems, because they need quick deployment and minimum maintenance. The majority of global utilities and industrial users select non-superconducting FCLs since they cost less to install while integrating easily with existing grid infrastructure.

During the forecast period, the fault current limiter (FCL) market's superconducting segment is expected to grow at the fastest CAGR. The fast-growing market demand for advanced protection systems that deliver maximum efficiency and quick response times with minimal power loss drives this rapid expansion. Modern power grids with high-capacity needs and renewable energy integration find optimal protection through superconducting FCLs (SFCLs) when traditional protection devices prove insufficient. The rising adoption of SFCLs by utilities stems from their capability to control high fault currents while maintaining grid stability as they transition toward modernizing older infrastructure and deploying smart grids. The worldwide adoption of SFCLs accelerates because of advancements in superconducting materials alongside government research investments and experimental pilot schemes.

Voltage Range Insights

The high-voltage segment held the highest revenue share of the global fault current limiter (FCL) market in 2024. The essential reason behind this is the expanding need to protect high-voltage transmission systems, which play a vital role in both grid reliability and extended power delivery. High-voltage system fault current risks have increased substantially because of rising power requirements alongside renewable energy integration into national grids. The FCL devices within this segment play an essential role in minimizing equipment damage while preventing power outages and enhancing overall system stability. The segment controls the market because utilities, together with transmission operators, select high-voltage FCLs more often to modernize their infrastructure and meet demanding safety and performance standards.

The fault current limiter (FCL) market's medium-voltage segment is anticipated to grow at the fastest CAGR throughout the forecast period. The rising demand for fault protection in industrial environments, together with urban power networks and medium-voltage integration of renewable energy resources, drives this market growth. The risk of fault current increases when medium-voltage distribution systems become more intricate because of the expanding use of wind and solar energy resources. The economical solution for grid protection and reliability during these scenarios is medium-voltage FCLs. The market growth potential stems from infrastructure modernization efforts and growing smart grid investments, which also drive adoption rates.

Regional Insights

The fault current limiter (FCL) market in North America is expected to grow significantly throughout the forecasted period because of growing investments in grid modernization, together with renewable energy integration and infrastructure resilience improvements. The declining condition of power grid infrastructure and rising demand for a stable electricity supply have pushed utilities to deploy advanced protection systems, including fault current limiters. Power systems become increasingly complex when distributed energy resources such as wind and solar are integrated, which requires enhanced fault current control measures. The US and Canada experience increased FCL adoption because of government funding initiatives and smart grid programs, and regulatory requirements, which establish North America as a leading growth market.

Europe Fault Current Limiter Market Trends

Europe's fault current limiter (FCL) market continues to grow at a steady rate because the continent advances its transition to renewable power generation while modernizing its outdated electrical networks. The increasing complexity of electrical networks happens because countries add more wind and solar power, which requires better fault current control solutions. The grid stability and equipment protection, and power supply reliability functions depend on FCLs for their implementation. Superconducting and non-superconducting FCL technologies experience accelerated adoption because government-supported pilot projects combine with strong European Union legislation that promotes clean energy and smart grid initiatives. The three main markets that lead the adoption of advanced power protection systems are Germany, together with the United Kingdom and France.

Asia Pacific Fault Current Limiter Market Trends

The Asia Pacific fault current limiter (FCL) market held the highest revenue share in 2024 and dominated globally. The strong market leadership of the Asia Pacific fault current limiter (FCL) comes from substantial urban growth and industrial expansion, and major power system investments in China, India, Japan, and South Korea. Modern grid protection systems require advanced solutions because of rising electrical stability and renewable energy source integration with solar and wind power. The adoption of FCLs continues to grow because they help manage escalating fault currents while protecting grid stability. The combination of government-led smart grid programs and extensive power network modernization projects has boosted FCL adoption rates in the area, making the Asia Pacific the leading global market.

Key Fault Current Limiter Companies:

The following are the leading companies in the fault current limiter market. These companies collectively hold the largest market share and dictate industry trends.

- Rongxin Power Electronic Co., Ltd.

- Zenergy Power Inc.

- Superconductor Technologies Inc.

- American Superconductor

- Nexans

- ABB

- Alsto

- Alstom SA

- Applied Materials, Inc.

- Siemens

- Others

Recent Developments

- In July 2024, Nexperia unveiled the NPS3102A and NPS3102B electronic fuses (eFuses), the newest additions to their line of power devices.

- In June 2024, Nexans and SNCF Réseau established a strategic partnership to implement the first superconducting fault current limiter in the rail industry.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the fault current limiter market based on the below-mentioned segments:

Global Fault Current Limiter Market, By Type

- Superconducting

- Non-Superconducting

Global Fault Current Limiter Market, By Voltage Range

- High

- Medium

- Low

Global Fault Current Limiter Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 216 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |