Global Feed Mycotoxin Detoxifiers Market

Global Feed Mycotoxin Detoxifiers Market Size, Share, and COVID-19 Impact Analysis, By Product (Mycotoxin Binders, Mycotoxin Modifiers), By Application (Poultry, Swine, Cattle, Aquaculture, Other Applications), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Feed Mycotoxin Detoxifiers Market Size Summary

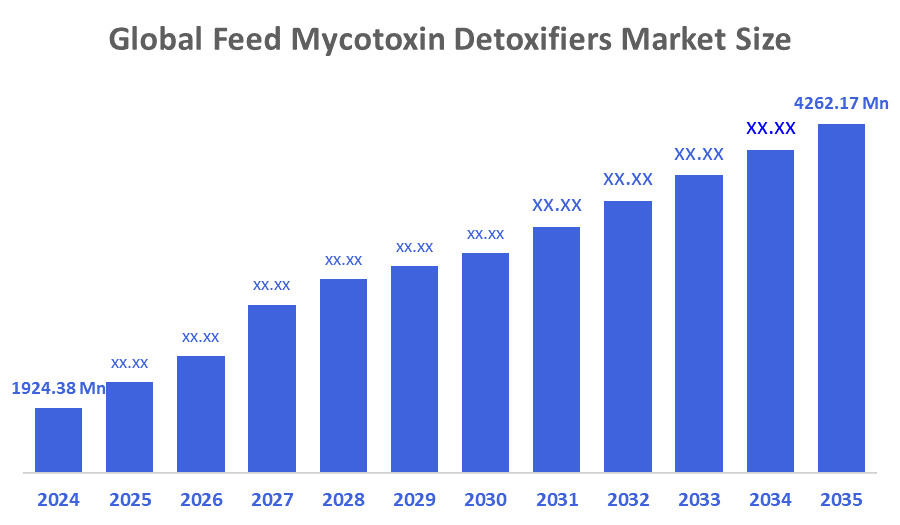

The Global Feed Mycotoxin Detoxifiers Market Size Was Estimated at USD 1924.38 Million in 2024 and is Projected to Reach USD 4262.17 Million by 2035, Growing at a CAGR of 7.5% from 2025 to 2035. The market for feed mycotoxin detoxifiers is expanding due to stricter regulations ensuring safe and toxin-free animal nutrition in international markets, increased demand for premium meat and dairy products, rising mycotoxin contamination in animal feed, and heightened awareness of livestock health.

Key Regional and Segment-Wise Insights

- With the largest revenue share of 36.7% in 2024, the Asia Pacific region dominated the global feed mycotoxin detoxifier market.

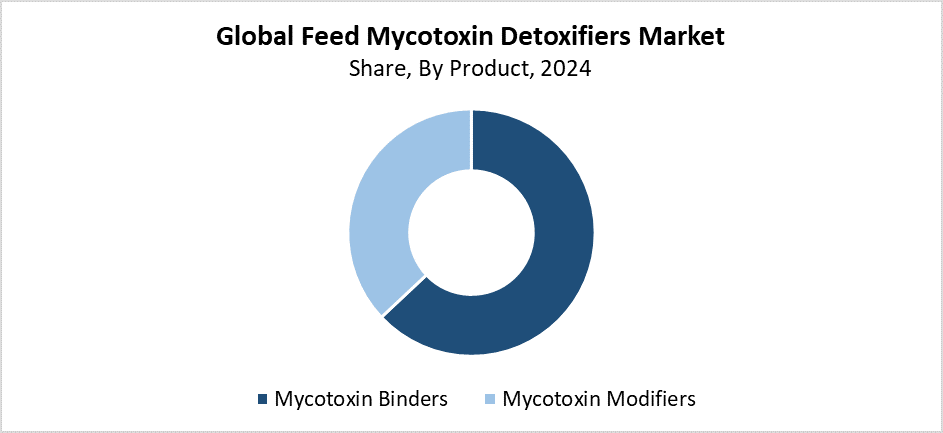

- In 2024, the mycotoxin binders segment had the biggest revenue share of 63.2% and led the market by product.

- In 2024, the poultry segment had the biggest revenue share of 39.4% and led the market by application.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 1924.38 Million

- 2035 Projected Market Size: USD 4262.17 Million

- CAGR (2025-2035): 7.5%

- Asia Pacific: Largest market in 2024

The feed mycotoxin detoxifiers market consists of products which bind or neutralise mycotoxins that fungi produce as harmful secondary metabolites. These enter animal feed. The three main types of mycotoxins which lead to major health issues in livestock include aflatoxin, fumonisin, and ochratoxin. These toxins lead to diminished productivity, health problems, and death in livestock. The market experiences growth because mycotoxin contamination occurs more frequently due to climate changes, improper feed storage, and rising animal production rates. The aquaculture industry, along with swine, poultry, and cattle sectors, requires mycotoxin detoxifiers because of new food safety regulations and rising consumer needs for high-quality, safe animal products and increasing farmer understanding of the issue. The market demand for toxin-free meat and dairy products drives manufacturers to invest in safer feed alternatives through efficient production systems.

Technological improvements in toxin-binding agents and enzyme-based detoxifiers have led to better product effectiveness, stability, and feed formulation compatibility. Multi-component detoxifiers and customised microbial treatments have enhanced toxin neutralisation. This leads to better animal health results. The FDA, together with the European Food Safety Authority (EFSA), have established new regulations which require feed producers to monitor and control mycotoxin concentrations in their products. The programs provide financial support to develop safer and advanced detoxification solutions. They also promote detoxifier application. The worldwide feed mycotoxin detoxifiers market will keep growing because of the collaboration between public institutions and private sector entities.

Product Insights

The mycotoxin binders segment held the largest revenue share of 63.2% and led the global feed mycotoxin detoxifiers market in 2024. The high efficiency of binders in adsorbing and neutralising a variety of mycotoxins in animal feed is what propels this supremacy. The products function by connecting to toxins inside the animal's digestive system. This prevents these harmful substances from entering the bloodstream. Mycotoxin binders, including activated carbon, and clay minerals such as bentonite, and zeolite, serve as common feed additives because they offer an inexpensive solution and easy incorporation into feed and proven safety. The segment holds a dominant market position because it serves multiple applications in the ruminant, swine, and poultry industries while meeting growing regulatory requirements for toxin-free feed.

The mycotoxin modifiers segment of the feed mycotoxin detoxifiers market is expected to grow at the fastest CAGR during the forecast period. The process of mycotoxin modification involves the conversion of harmful mycotoxins into safe or less toxic substances through biological or chemical means, which provides a more precise and efficient detoxification approach than binders. The segment grows because scientists need enzyme-based solutions, which can handle different mycotoxins that binders fail to neutralise. The research into species-specific detoxification methods, together with microbial and enzymatic detoxifier technology advances, leads to discoveries. Livestock producers adopt feed modifiers because of increasing regulations, which promote safer and more efficient feed additives. Thus, creating this market segment to drive future market growth.

Application Insights

The poultry segment held the largest revenue share of 39.4% and led the global feed mycotoxin detoxifiers in 2024. Mycotoxins present a major threat to poultry because they hinder growth and damage immune systems while reducing egg production and causing higher death rates. The intensive chicken farming operations, together with their substantial use of cereal-based feed, which becomes vulnerable to fungal contamination, drive the need for effective mycotoxin detoxification solutions. Farmers and producers use detoxifiers more frequently to maintain their production levels and comply with food safety standards, and protect the health of their animal populations. The worldwide demand for chicken meat and eggs continues to rise. This drives more investments into feed quality and safety improvements that support the growing poultry sector's market dominance in feed mycotoxin detoxifiers.

The aquaculture segment of the feed mycotoxin detoxifiers market is expected to grow at the fastest CAGR during the forecast period. The global aquaculture industry experiences rapid growth because scientists understand more about mycotoxins' effects on aquatic ecosystems. Fish and shrimp face the highest risk of feed contamination, which produces slow growth, weak immune systems, and deadly outcomes. The shift toward plant-based feed ingredients exposes the industry to increased mycotoxin contamination because these components have a higher chance of fungal infection. The demand for aquatic species detoxifiers continues to rise because of these conditions. The market expansion will accelerate because of new seafood safety regulations which work together. Improved mycotoxin detoxifiers protect specific species and operate in aquatic settings.

Regional Insights

The Asia Pacific feed mycotoxin detoxifiers market generated the highest revenue share of 36.7% and led the global market in 2024. The region's enormous and quickly expanding cattle and aquaculture industries, especially in nations like China, India, and Vietnam, are responsible for this domination. Warm and humid weather conditions lead to high mycotoxin contamination in animal feed. This creates a continuous need for detoxification treatments. The market shows growth because consumers want secure, high-quality meat, dairy, and seafood products and because farmers now understand the harmful effects of mycotoxins on animal welfare and productivity. The region-wide deployment of mycotoxin detoxifiers is also being reinforced by encouraging government laws and the growth of feed production facilities.

North American Feed Mycotoxin Detoxifiers Market Trends

The North American feed mycotoxin detoxifiers market experiences steady growth because of increasing knowledge about animal feed mycotoxin contamination risks and the need to maintain livestock productivity and health. The established cattle and poultry industries in the area require efficient detoxification methods to avoid the negative consequences of mycotoxins, like stunted growth and compromised immunity. The market experiences growth through technological progress in detoxifier formulations, which include microbial and enzyme-based solutions that enhance both performance and safety. The FDA and USDA maintain high feed safety standards through their strict regulations. These enable the widespread application of mycotoxin detoxifiers. Market growth receives support from the increasing number of customers who want high-quality meat and dairy products that do not contain any toxins. The region's market expansion through its research and development focus, and its collaboration between industry participants and regulatory bodies.

Europe Feed Mycotoxin Detoxifiers Market Trends

The European feed mycotoxin detoxifiers market is growing significantly because of strict regional laws and increasing public understanding about mycotoxin contamination hazards. The German, French, and Dutch cattle and poultry sectors need secure feed options to maintain their production levels and animal health standards. The need for detoxifiers increases because the moderate climate of the area promotes mycotoxin development in stored feed. The rapid adoption of new technology in enzyme-based and microbial detoxifying agents has led to better results in mycotoxin neutralisation. The European Union feed safety and quality standards require detoxifiers to be used as a mandatory practice. The European agricultural sector experiences growth because government programs support sustainable farming practices, and market demand for high-quality, toxin-free animal products continues to rise.

Key Feed Mycotoxin Detoxifiers Companies:

The following are the leading companies in the feed mycotoxin detoxifiers market. These companies collectively hold the largest market share and dictate industry trends.

- Biomin Holding GmbH

- Cenzone Tech Inc.

- Olmix Group

- Alltech Inc.

- Amlan International

- Special Nutrients, Inc.

- BASF SE

- Impextraco N.V.

- Perstorp Holding AB

- Kemin Industries, Inc.

- ADM

- Prince Agri Products

- Others

Recent Developments

- In April 2025, in Indonesia, Clariant established a new plant for producing feed additives, increasing its ability to produce mycotoxin binder using customised solutions.

- In January 2025, A new feed additive division called Nexus was introduced by SAM Nutrition to improve livestock performance by creative, scientifically supported solutions, such as testing novel feed detoxifiers. Nexus will concentrate on creating cutting-edge feed additives that enhance digestive health, immunity, growth optimisation, and feed efficiency for a range of livestock species.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the feed mycotoxin detoxifiers market based on the below-mentioned segments:

Global Feed Mycotoxin Detoxifiers Market, By Product

- Mycotoxin Binders

- Mycotoxin Modifiers

Global Feed Mycotoxin Detoxifiers Market, By Application

- Poultry

- Swine

- Cattle

- Aquaculture

- Other Applications

Global Feed Mycotoxin Detoxifiers Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 267 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |