Global Fertility Supplements Market

Global Fertility Supplements Market Size, Share, and COVID-19 Impact Analysis, By Ingredient (Natural, and Synthetic), By Form (Capsules, Tablets, Soft Gels, Powder, and Liquids), By Distribution Channel (Over-the-counter (OTC), and Prescribed), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

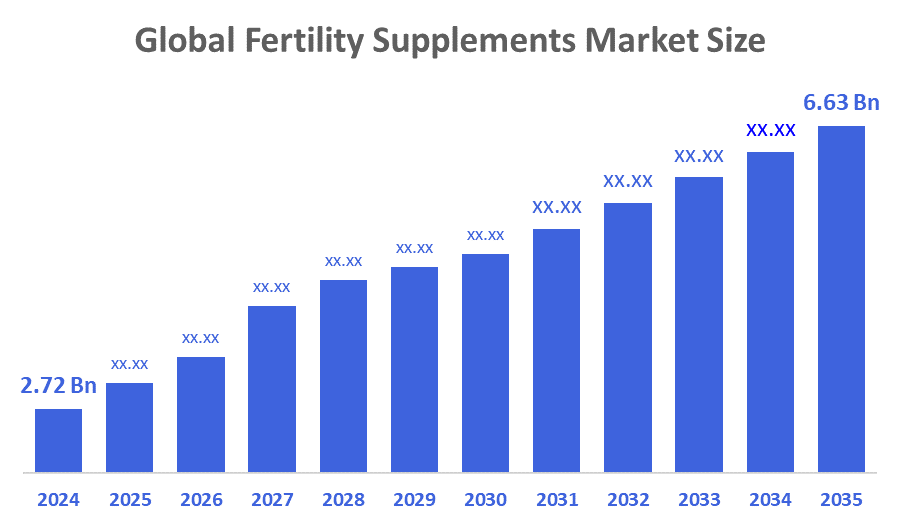

Global Fertility Supplements Market Size Insights Forecasts to 2035

- The Global Fertility Supplements Market Size Was Estimated at USD 2.72 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.44% from 2025 to 2035

- The Worldwide Fertility Supplements Market Size is Expected to Reach USD 6.63 Billion by 2035

- North America is expected to Grow the fastest during the forecast period.

According to a Research Report Published by Decisions Advisors and Consulting, The Global Fertility Supplements Market Size was worth around USD 2.72 Billion in 2024 and is predicted to Grow to around USD 6.63 Billion by 2035 with a compound annual growth rate (CAGR) of 8.44% from 2025 to 2035. The growing prevalence of lifestyle-related elements such as unhealthy dietary habits, stress, and delayed family planning, along with the heightened awareness of fertility issues, collectively constitute the major factors that are currently driving demand in the market. These factors have led to a surge in the number of individuals looking for natural and alternative methods of reproductive health care.

Market Overview

The fertility supplements market refers to the global industry focused on nutritional products designed to improve reproductive health and support conception in both men and women. Infertility is said to have risen due to various lifestyle habits like smoking, alcohol consumption, unhealthy eating, and mental stress. More stressed women tend to produce more alpha, amylase, and thereby find it difficult to get pregnant. These factors are likely to raise the infertility rate worldwide over the forecast period, thus boosting the demand for fertility supplements. The World Health Organisation reveals that various factors, such as the growing trend of smoking and alcohol use, the increasing number of obese people, and higher stress levels causing hormonal imbalance, among others, are to blame for the infertility epidemic seen today. Fertility issues have been blamed on factors such as ageing, excessive weight, polycystic ovarian syndrome (PCOS), and frequent miscarriages, which in turn affect the families and the community. Thereby stimulates the market for fertility supplements that aim to enhance fertility and general reproductive health.

Ova, a UK-based fertility supplement brand, has raised over US$1 million in a pre-seed funding round to expand its retail presence and scale innovation in reproductive wellness. The investment will help the company strengthen distribution in major retailers like Boots and Sainsbury’s, expand into Ireland, and enhance its partnership with Google’s High Growth Business Programme.

Perelel, a doctor-founded women’s health supplement brand, has secured $27 million in growth investment from Prelude Growth Partners to expand its clinically backed hormone support portfolio. The funding marks a major milestone as the company evolves from a prenatal-focused brand into a comprehensive women’s health provider.

Report Coverage

This research report categorises the fertility supplements market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the fertility supplements market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the fertility supplements market.

Driving Factors

The market for fertility supplements has grown mostly due to lifestyle changes, an increase in infertility cases, and increased knowledge of reproductive health. People's interest in fertility-related products has increased due to rising stress levels, bad eating habits, and delaying starting a family. Further, their contributions to increased acceptance include advancements in medicine and increased healthcare spending, while the trend of nutraceuticals boosts consumer confidence and opens up new market expansion ways. In addition, the availability of retail outlets and a developing network of epharmacies is making supplements more accessible, which is bolstering the market's global expansion. Research and innovation are receiving an increasing amount of funding, which is leading to new goods that are suitable for both men and women.

In June 2025, Phytaphix launched Fertility Phix, a unisex fertility supplement formulated with 27 clinically validated nutrients to support reproductive health for both men and women.

Restraining Factors

The infertility supplements market revenue is largely constrained by a lack of scientific evidence, among other things. Potential buyers might not want to spend money on such products unless there is strong scientific evidence to show that they are beneficial and safe, which thus restricts revenue growth in the reproductive supplements industry. The absence of scientific evidence for fertility supplements may also lead to doctors doubting their effectiveness. As a result, the situation becomes even more complicated for customers to get approval.

Market Segmentation

The fertility supplements market share is classified into ingredient, form, and distribution channel.

- The synthetic segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the ingredient, the fertility supplements market is segmented into natural, and synthetic. Among these, the synthetic segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The increasing rate of fertility, related issues and the need for fast results are the main reasons. Synthetic supplements are made with precise and potent doses of certain vitamins, minerals, and chemicals, thereby becoming an attractive option for those who want quick assistance with their reproductive problems.

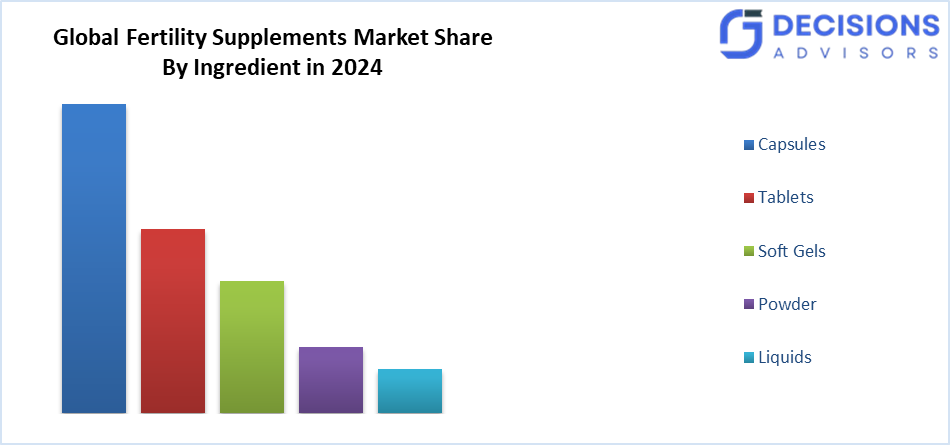

- The capsules segment accounted for the largest market share in 2024 and is projected to grow at a significant CAGR during the forecast period.

Based on the form, the fertility supplements market is classified into capsules, tablets, soft gels, powder, and liquids. Among these, the capsules segment accounted for the largest market share in 2024 and is projected to grow at a significant CAGR during the forecast period. Capsules are highly favoured because they do away with the requirement to measure and mix, thus being an easy and trouble-free way for fertility improvement. Besides that, capsules continue to be widely associated with higher product consistency, quality, and stability; therefore, customers looking for reliable and constant solutions to their reproductive health support are the ones who trust the products the most.

- The over-the-counter (OTC) segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the fertility supplements market is differentiated into over-the-counter (OTC), and prescribed. Among these, the over-the-counter (OTC) segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This is due to increased cases of reproductive disorders, coupled with the demand for accessible and convenient solutions. Couples struggling with reproductive problems often choose to take vitamins off the shelf, as they are available without a prescription and thus save them both time and money.

Regional Segment Analysis of the Fertility Supplements Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the fertility supplements market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the fertility supplements market over the predicted timeframe. Public and private industry players are conducting several other activities to spread the awareness of infertility; such efforts may be good for the fertility supplements market in the Asia Pacific. Asia Pacific Initiative on Reproduction (ASPIRE) is a group of clinicians and scientists who are fertility and ART enthusiasts. The goal of the organisation is to enlighten the public on issues of infertility and ART, among others, thus improving the APC market.

Manufacturers ensure the quality of their products through assertions and accountability so that the products are in accordance with the global health standards. As the demand for fertility supplements is going up, these Chinese manufacturers are likely to have a special position in the growing reproductive health industry. This is because their products are based on both tradition and scientific evidence, and thus they could fulfil the consumers' demand for natural products.

North America is expected to grow at a rapid CAGR in the fertility supplements market during the forecast period. Infertility rate has been going up while general health awareness has improved, and thus, North America is anticipated to record a steep growth during the forecast period. The area has the majority of people using fertility supplements since these are a good source of micronutrients and help fertility. Fertility supplements also contain vitamins and minerals that can increase sperm count and improve the menstrual cycle, and thus, the market in the area is pretty much male and female oriented.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the fertility supplements market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Active Bio Life Science GmbH

- Coast Science

- Exeltis USA, Inc.

- Fairhaven Health

- Fertility Nutraceuticals LLC

- Lenus Pharma GesmbH

- MegaFood

- Nutraceutical Corporation

- Orthomol

- PregPrep LLC

- Proxeed

- Theralogix

- Vitabiotics Ltd

- Zenith Nutrition

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2025, SwimClub launched as the first clinically-formulated male fertility supplement, designed to improve sperm health with evidence-based ingredients at clinically effective doses. It directly addresses the global male fertility crisis, often referred to as Spermageddon, where sperm counts have dropped nearly 60%.

- In July 2025, Carrot unveiled Sprints, the first clinically-backed metabolic-fertility program, designed to tackle infertility linked to metabolic dysfunction such as obesity, blood sugar dysregulation, and sperm damage. Thirty per cent of engaged Carrot members successfully conceive without IVF, and about sixty per cent select less costly and intrusive fertility treatments before IVF.

- In December 2024, Nestlé expanded its Materna brand with new products designed to support women’s fertility, pregnancy, and post-partum recovery, addressing critical nutritional gaps across all stages of motherhood. Moreover, to cater to underserved needs with science-based solutions, Nestlé introduced a new line of products. By introducing these goods and growing its Materna line, the multinational food and beverage behemoth.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the fertility supplements market based on the below-mentioned segments:

Global Fertility Supplements Market, By Ingredient

- Natural

- Synthetic

Global Fertility Supplements Market, By Form

- Capsules

- Tablets

- Soft Gels

- Powder

- Liquids

Global Fertility Supplements Market, By Distribution Channel

- Over-the-counter (OTC)

- Prescribed

Global Fertility Supplements Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

1. What is the current size of the global fertility supplements market?

The market was valued at USD 2.72 billion in 2024.

2. What is the projected market size by 2035 and the CAGR?

It is expected to reach USD 6.63 billion by 2035, growing at a CAGR of 8.44% from 2025 to 2035.

3. What are the main drivers of market growth?

Key drivers include rising infertility due to lifestyle factors like stress, unhealthy diets, delayed family planning, obesity, and increasing awareness of reproductive health.

4. Which segment held the largest share in 2024 by ingredient?

The synthetic ingredients segment accounted for the largest share in 2024 and is expected to grow significantly.

5. What is the leading form of fertility supplements?

Capsules held the largest market share in 2024 due to their convenience, consistency, and ease of use.

6. Which distribution channel dominates the market?

The over-the-counter (OTC) segment generated the highest revenue in 2024, driven by accessibility and convenience.

7. Which region is expected to grow the fastest?

North America is projected to grow at the fastest CAGR, fueled by high infertility rates and health awareness, while Asia-Pacific holds the largest overall share.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 265 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |