Global Fine Blanking Tools Market

Global Fine Blanking Tools Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Tool Type (Dies, Punches, Strippers, Guides, and Others), By Material (Steel, Carbide, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Fine Blanking Tools Market Summary, Size & Emerging Trends

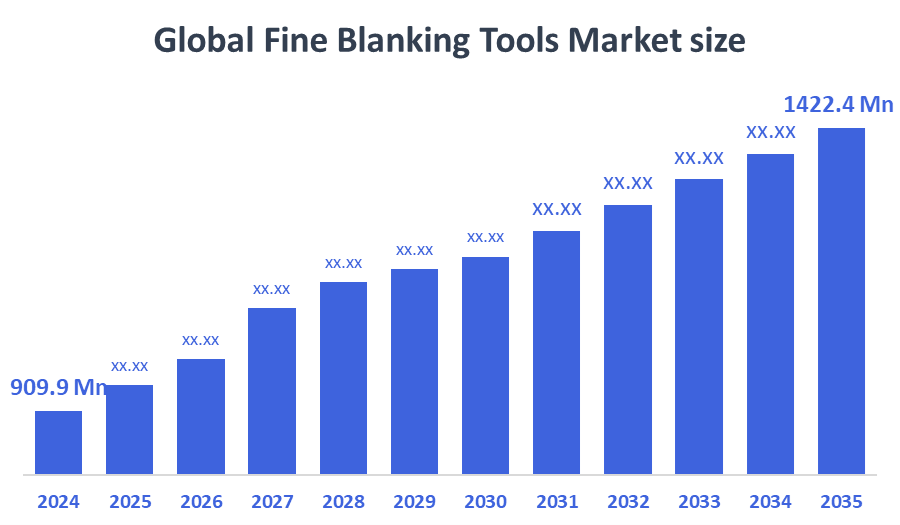

According to Decision Advisor, The Global Fine Blanking Tools Market Size is Expected to Grow from USD 909.9 Million in 2024 to USD 1422.4 Million by 2035, at a CAGR of 4.15% during the forecast period 2025-2035. Increasing demand for precision-engineered components in automotive, electronics, and aerospace industries is a key driving factor for the fine blanking tools market.

Key Market Insights

- Asia Pacific is expected to account for the largest share in the fine blanking tools market during the forecast period.

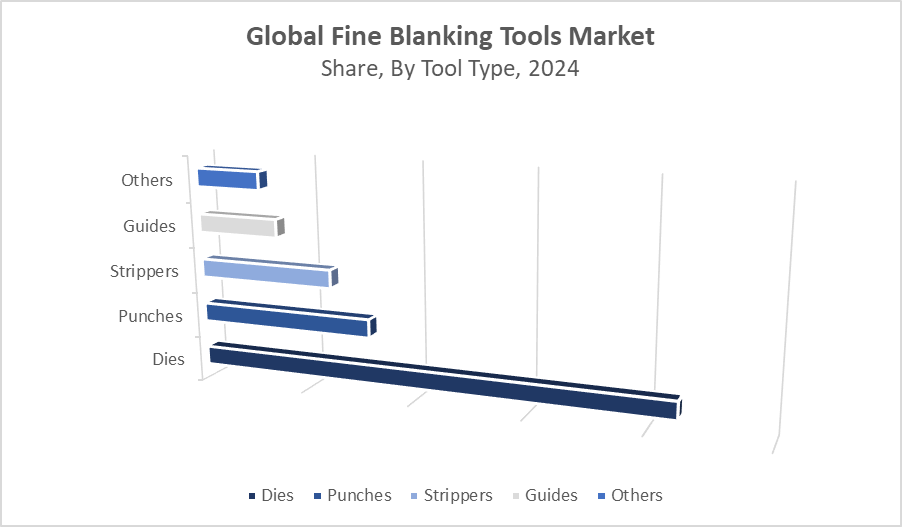

- In terms of tool type, the dies segment dominated in terms of revenue during the forecast period.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 909.9 Million

- 2035 Projected Market Size: USD 1422.4 Million

- CAGR (2025-2035): 4.15%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Fine Blanking Tools Market

The fine blanking tools market centers on the production of high-precision tooling systems essential in fine blanking processes used to manufacture components with smooth edges, tight tolerances, and superior flatness. These tools include dies, punches, strippers, and guides, and are widely used in industries such as automotive, electronics, and medical devices. Fine blanking enables high-volume production of complex parts with exceptional accuracy, making it vital for advanced manufacturing. Governments and industry players are investing in technological upgrades to enhance tooling performance and extend tool life, while also supporting sustainable and energy-efficient production methods. As demand for lightweight and high-performance components continues to rise, fine blanking tools are expected to play an increasingly critical role in global manufacturing systems.

Fine Blanking Tools Market Trends

- Demand for smart and automated tooling systems is growing to improve efficiency and reduce downtime.

- Material innovations, such as advanced tool steels and carbide composites, are enhancing tool durability and precision.

- Expansion of electric vehicle production is creating new opportunities for high-precision components.

- Companies are entering strategic partnerships and acquisitions to strengthen their tooling capabilities and global presence.

Fine Blanking Tools Market Dynamics

Driving Factors: Rising demand from the automotive and electronics industries

The growing need for lightweight and high-precision components in automotive and electronics sectors is driving the adoption of fine blanking tools. Increasing production of electric vehicles, consumer electronics, and medical devices demands components manufactured to exacting specifications. Technological advancements in tool design and materials are enhancing tool longevity and performance. Additionally, the shift toward automation and digital manufacturing processes is further fueling demand for high-precision tooling systems.

Restrain Factors: High cost of materials and skilled labor

The fine blanking tools market faces restraints due to the high cost of tool materials such as carbide and specialized steels. Skilled labor is essential for tool design, setup, and maintenance, but talent shortages in key regions can hinder production efficiency. Additionally, fluctuations in raw material prices and the complexity of tool manufacturing contribute to higher operational costs, limiting accessibility for smaller manufacturers.

Opportunity: Growth in emerging markets and high-precision industries

The expansion of industrial manufacturing in emerging economies presents a strong opportunity for the fine blanking tools market. Rising investment in automotive, aerospace, and medical industries is increasing the need for fine blanked components. Continuous advancements in additive manufacturing, surface coatings, and smart tooling are opening new avenues for toolmakers to innovate. Moreover, demand for eco-friendly and energy-efficient tooling systems aligns with global sustainability goals.

Challenges: Tool wear, maintenance, and supply chain disruptions

Challenges in the fine blanking tools market include rapid tool wear under high-volume production, necessitating frequent maintenance and replacement. This increases downtime and total cost of ownership. Global supply chain disruptions and trade restrictions can also affect the availability of raw materials and components, impacting production timelines and costs. Ensuring consistent quality and dimensional accuracy across global operations remains a complex challenge for manufacturers.

Global Fine Blanking Tools Market Ecosystem Analysis

The global fine blanking tools market ecosystem includes raw material suppliers, tool manufacturers, technology providers, OEMs, and end-user industries. Toolmakers depend on high-quality steel, carbide, and coatings to produce durable and precise tooling systems. End-users across automotive, aerospace, medical, and electronics sectors drive demand for high-performance components. Technology providers play a critical role in simulation, design, and production automation. Regulatory compliance, sustainability goals, and innovation in materials and tool design are shaping the ecosystem and supporting market expansion worldwide.

Global Fine Blanking Tools Market, By Tool Type

The dies segment dominated the global fine blanking tools market, accounting for approximately 52% of the total revenue share in 2024. Dies are essential components in the fine blanking process, responsible for shaping parts with exceptional edge quality, flatness, and dimensional accuracy. Their capability to handle complex part geometries at high production volumes makes them the most preferred tool type across industries such as automotive, aerospace, and electronics. Technological advancements in die materials particularly the use of hardened tool steels and advanced coatings are further enhancing wear resistance, minimizing tool replacement frequency, and reducing operational costs. As demand for precision metal parts continues to increase, the role of dies remains central in delivering consistent and high-quality output in fine blanking operations.

The punches segment accounted for approximately 28% of the global revenue share in 2024. Punches play a crucial role in the fine blanking process by executing clean, accurate cuts and forming detailed part contours. As industries demand more compact, complex, and lightweight components, particularly in automotive safety systems and electronic connectors, the need for precision-engineered punches has intensified. Punches must withstand extreme mechanical stress while maintaining tight tolerances, making material quality and design innovation key differentiators in this segment. The growing trend toward electrification and miniaturization in end-use industries continues to support the expansion of the punches segment globally.

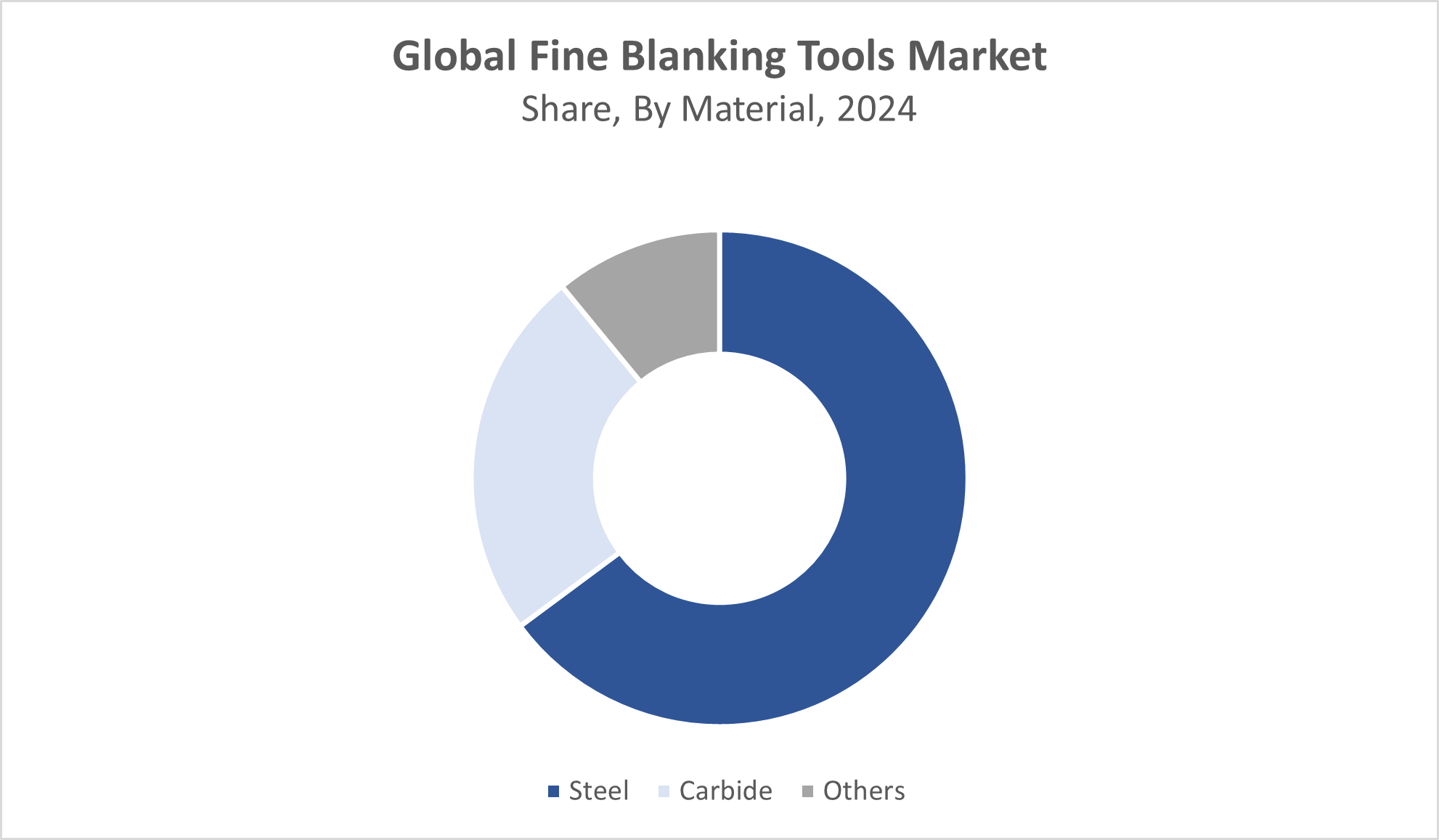

Global Fine Blanking Tools Market, By Material

The steel segment accounted for the largest revenue share, approximately 61% of the global fine blanking tools market in 2024. Tool steels are the most commonly used material in fine blanking tools due to their excellent strength, toughness, and wear resistance. These materials are well-suited to withstand the high mechanical stresses and elevated temperatures involved in fine blanking operations. Steel tools are also favored for their ease of machining and regrinding, making them highly cost-effective for repetitive use across high-volume production lines. Their adaptability and durability position them as the preferred choice for tool manufacturers and end-users in automotive, industrial, and electronics sectors.

The carbide segment is projected to grow at a strong CAGR and held approximately 26% of the revenue share in 2024. Carbide-based fine blanking tools offer superior hardness, thermal stability, and resistance to abrasion, making them ideal for applications where extended tool life and high part precision are critical. These tools are particularly beneficial in continuous, high-speed production environments where downtime must be minimized. As the demand for precision parts in EVs, electronics, and medical devices rises, carbide tools are gaining popularity for their ability to maintain dimensional accuracy over longer production cycles with minimal wear.

Asia Pacific is expected to account for the largest share, holding approximately 43% of the global fine blanking tools market revenue in 2024.

The region’s dominance is primarily driven by its robust automotive and electronics manufacturing sectors, especially in key countries such as China, India, and Japan. These economies are witnessing rapid industrial growth, supported by expanding infrastructure and rising domestic demand for precision-engineered components. Favorable government policies, increased foreign investments, and the presence of established toolmakers are further strengthening Asia Pacific’s leadership position. Continuous upgrades in manufacturing technologies and skilled labor availability contribute to the region’s competitiveness in the global market.

India is experiencing notable growth in the fine blanking tools market, with a projected CAGR of approximately 10.5%.

This growth is fueled by the country’s expanding automotive industry, infrastructure development, and strategic focus on "Make in India" initiatives. As manufacturing hubs continue to rise across regions like Tamil Nadu and Maharashtra, the demand for high-precision tools in automotive, electrical, and consumer goods sectors is increasing rapidly. Government incentives for industrialization and import substitution are positioning India as a key emerging player in the global fine blanking tools market.

North America is projected to hold approximately 22% of the global market revenue in 2024 and is expected to register a steady CAGR during the forecast period.

The region benefits from a mature manufacturing base, with strong demand coming from the automotive, aerospace, and electronics industries in the United States and Canada. Increased investments in electric vehicle production and defense modernization are driving the need for fine blanking tools capable of producing high-precision parts. Technological leadership and a strong emphasis on quality and innovation continue to support North America’s market growth.

The United States is witnessing strong and consistent demand for fine blanking tools,

largely due to its advanced automotive, aerospace, defence, and electronics sectors. With leading manufacturers adopting precision manufacturing and automation technologies, the U.S. is becoming a critical market for high-performance tooling solutions. A growing focus on reshoring industrial capabilities and boosting domestic production is further driving the adoption of fine blanking tools in the country.

WORLDWIDE TOP KEY PLAYERS IN THE FINE BLANKING TOOLS MARKET INCLUDE

- Feintool International Holding AG

- TIDC India

- IFB Industries Limited

- Kenmode Precision Metal Stamping

- ART Group

- Petford Group

- Ferrari & Carena S.r.l.

- Quantum Manufacturing Limited

- Menear Engineering

- Others

Product Launches in Fine Blanking Tools Market

- In May 2023, a leading fine blanking tool manufacturer expanded its toolmaking facility, investing significantly in precision machining and automation technologies. This move was aimed at meeting the rising global demand for high-accuracy and high-efficiency tooling systems. The expansion reflects a broader market trend toward increased production capacity, automation, and digital integration, enabling faster turnaround times, improved tool consistency, and reduced operational costs.

- In March 2023, a key player in the Indian market introduced a new line of carbide-based fine blanking tools engineered for extended tool life and reduced maintenance requirements. These tools are designed to withstand high production volumes and deliver consistent performance in demanding applications such as automotive and electronics manufacturing. The launch highlights the shift toward advanced materials and innovation in tool design to enhance productivity, minimize downtime, and optimize lifecycle costs.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisor has segmented the fine blanking tools market based on the below-mentioned segments:

Global Fine Blanking Tools Market, By Tool Type

- Dies

- Punches

- Strippers

- Guides

- Others

Global Fine Blanking Tools Market, By Material

- Steel

- Carbide

- Others

Global Fine Blanking Tools Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

FAQs

Q. What is the projected market size of the global fine blanking tools market by 2035?

The global fine blanking tools market is expected to reach USD 1422.4 million by 2035, growing from USD 909.9 million in 2024, at a CAGR of 4.15% during the forecast period (2025–2035).

Q. What are fine blanking tools, and where are they used?

Fine blanking tools are precision-engineered tools such as dies, punches, strippers, and guides used in fine blanking processes to manufacture parts with smooth edges, close tolerances, and high dimensional accuracy. They are extensively used in automotive, electronics, aerospace, and medical industries.

Q. Which region dominates the global fine blanking tools market?

Asia Pacific holds the largest share of the global market in 2024, driven by strong automotive and electronics manufacturing in countries like China, India, and Japan.

Q. Which region is the fastest-growing in this market?

North America is the fastest-growing region, driven by increasing investments in electric vehicle production, aerospace, and automation technologies.

Q. Which tool type holds the largest market share?

The dies segment dominates, accounting for approximately 52% of the market share in 2024, due to their essential role in shaping parts with tight tolerances and clean edges.

Q. Which material is most commonly used in fine blanking tools?

Steel is the most widely used material, holding around 61% of the market share in 2024, due to its strength, machinability, and cost-effectiveness.

Q. What is the growth outlook for carbide-based tools?

Carbide tools are expected to grow at a strong pace due to their durability, heat resistance, and suitability for high-volume production, particularly in automotive and electronics sectors.

Q. How is India positioned in the fine blanking tools market?

India is emerging as a key growth market, driven by its expanding automotive sector, infrastructure development, and government-backed ‘Make in India’ initiatives. It is expected to grow at a CAGR of 10.5%.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 165 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |