Global Finish Foils Market

Global Finish Foils Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Material Type (Aluminum, Copper, and Stainless Steel), By Application (Packaging, Electronics, Automotive, and Construction), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Finish Foils Market Summary, Size & Emerging Trends

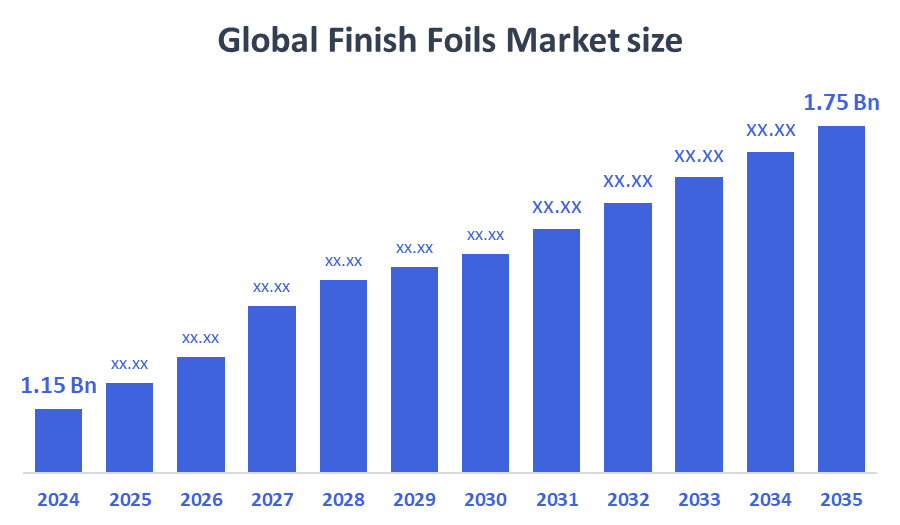

According to Decision Advisor, The Global Finish Foils Market Size is Expected to Grow from USD 1.15 Billion in 2024 to USD 1.75 Billion by 2035, at a CAGR of 3.89% during the forecast period 2025-2035. Increasing demand for lightweight, corrosion-resistant materials in packaging and electronics sectors is a key factor driving the finish foils market.

Key Market Insights

- Asia Pacific is expected to account for the largest share in the finish foils market during the forecast period.

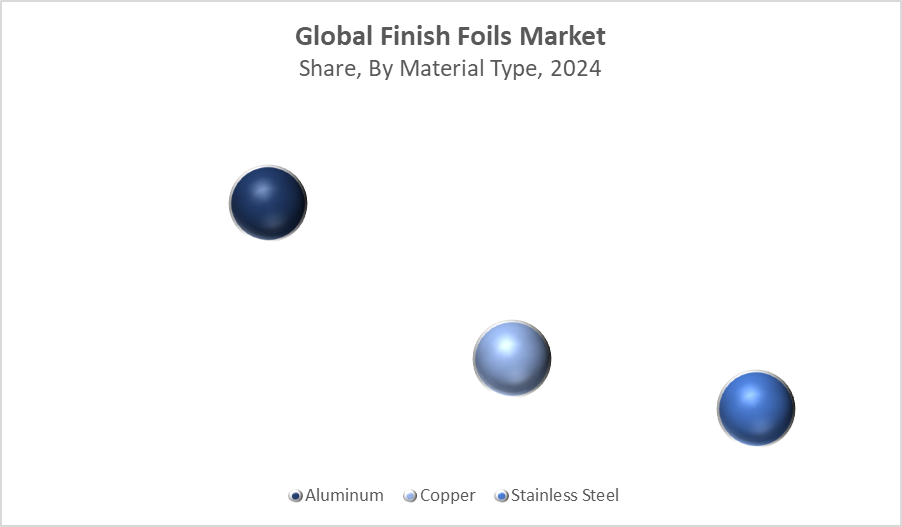

- In terms of material type, the aluminum foil segment dominated in terms of revenue during the forecast period.

- In terms of application, the packaging segment accounted for the largest revenue share in the global finish foils market during the forecast period.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 1.15 Billion

- 2035 Projected Market Size: USD 1.75 Billion

- CAGR (2025-2035): 3.89%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Finish Foils Market

The finish foils market focuses on the production of ultra-thin metal sheets used as protective or decorative layers across various industries. These foils enhance product aesthetics, improve corrosion resistance, and provide barrier properties in packaging. Commonly manufactured from aluminum, copper, and stainless steel, finish foils play a critical role in packaging, electronics, automotive, and construction industries. Growing consumer preference for sustainable and lightweight packaging materials alongside expanding electronics production is fueling market demand. Governments support this market by encouraging eco-friendly packaging and recycling initiatives. Technological advances in foil production processes are improving product quality and cost-efficiency. The market is poised for steady growth, driven by innovation, increasing industrial applications, and sustainability trends worldwide.

Finish Foils Market Trends

- Rising use of aluminum finish foils in flexible packaging due to their recyclability and barrier properties.

- Growing demand for decorative foils in automotive interiors and consumer electronics.

- Increasing collaborations between foil manufacturers and end-users to develop customized foil solutions.

Finish Foils Market Dynamics

Driving Factors: Growing demand for lightweight and sustainable packaging materials

The increasing global focus on sustainability is driving demand for lightweight, eco-friendly packaging solutions. Consumers today prefer products with reduced environmental impact, prompting manufacturers to switch from traditional heavy materials to lightweight foils that use less material and energy in production. Regulatory bodies worldwide are also enforcing stricter packaging waste guidelines, encouraging the use of recyclable and biodegradable materials like aluminium foil. In addition, the booming electronics sector needs protective foils that shield sensitive components from moisture and contaminants while maintaining a slim profile to fit compact devices. This sector’s rapid growth fuels demand for specialised foils with superior barrier properties. Finally, the rise of e-commerce and ready-to-eat convenience foods has increased demand for flexible packaging foils, which are ideal for protecting and extending shelf life during transport and storage.

Restrain Factors: High production costs and raw material price volatility

A significant challenge for the finish foils market is the fluctuating cost of raw materials like aluminum and copper. Price volatility impacts production costs, squeezing profit margins and leading to uncertain pricing for end-users. Moreover, alternative materials such as plastics, laminates, and paper-based packaging are often cheaper and easier to process, making them attractive substitutes that limit the growth of metal foils.

Opportunity: Expansion into emerging markets and technological innovations

Emerging economies in Asia, Latin America, and Africa are rapidly modernizing their packaging industries and expanding electronics manufacturing, creating fertile ground for finish foil market growth. These regions show increasing consumer spending and adoption of packaged goods, driving demand for advanced packaging solutions. Technological innovations present major opportunities — for instance, developing biodegradable and recyclable foil composites aligns with global sustainability goals and consumer preferences, opening new market segments. Additionally, expanding uses of finish foils in automotive lightweighting, construction insulation, and decorative applications further diversify potential revenue streams. Manufacturers who invest in R&D and local partnerships in these markets can capitalize on untapped demand.

Challenges: Environmental concerns and regulatory compliance

The market ecosystem comprises raw material suppliers (primarily aluminum and copper producers), foil manufacturers, coating and finishing companies, and end-users in packaging, electronics, automotive, and construction. Suppliers from Asia Pacific significantly influence raw material availability and pricing. Manufacturers focus on technological upgrades and sustainable production. Regulatory bodies enforce standards related to environmental impact and recycling, driving innovation and compliance.

Global Finish Foils Market Ecosystem Analysis

The global finish foils market ecosystem comprises semiconductor manufacturers, material suppliers, design houses, and system integrators collaborating to develop advanced, modular chip architectures. Key players focus on innovative microfluidic cooling solutions and heterogeneous integration technologies. Research institutions and startups drive R&D for improved reliability and performance. End-users span consumer electronics, wearables, automotive, and medical sectors. Strong partnerships between technology providers and equipment manufacturers support scalable production. Growing demand for miniaturized, energy-efficient devices fuels ecosystem expansion, while regulatory bodies work toward standardization and safety compliance.

Global Finish Foils Market, By Material Type

The aluminium foil segment dominated the market, accounting for approximately 50% of global revenue in 2024, due to its versatile properties that make it highly sought after across multiple industries. Its lightweight nature helps reduce overall packaging weight, lowering transportation costs and environmental impact. The excellent corrosion resistance of aluminium foil protects products from moisture, oxygen, and contaminants, which is critical for food packaging to preserve freshness and shelf life. Additionally, aluminium’s superior barrier properties make it ideal for electronics packaging, where it shields sensitive components from electromagnetic interference and physical damage. The combination of these factors ensures that aluminium foil remains the preferred choice for packaging applications, including flexible food wraps, pharmaceutical blister packs, and industrial laminates.

The copper foil segment held about 25% share, driven by demand in electronics, particularly printed circuit boards (PCBs) and battery applications. Copper foil commands a significant quarter of the market primarily due to its critical role in the electronics industry. Copper’s excellent electrical conductivity makes it indispensable in printed circuit boards, which are fundamental components of virtually all electronic devices. The increasing production of smartphones, computers, and consumer electronics drives consistent demand for high-quality copper foils. Moreover, the rapid growth of the electric vehicle (EV) market and renewable energy storage systems has heightened the need for copper foil in lithium-ion batteries. Copper foil serves as a key current collector in battery cells, enhancing efficiency, energy density, and overall performance.

Global Finish Foils Market, By Application

The packaging segment accounted for the largest revenue share of around 45% in 2024. Packaging dominates the finish foils market due to the increasing demand for flexible packaging solutions across various industries such as food, pharmaceuticals, and cosmetics. Consumers and manufacturers alike prioritize packaging that not only protects contents from moisture, oxygen, and contaminants but also offers an attractive appearance to enhance product appeal on shelves. Finish foils provide excellent barrier properties, extending shelf life and maintaining product quality, which is especially critical in the food and pharmaceutical sectors. The rise of convenience foods, ready-to-eat meals, and stringent safety regulations further boost the demand for foil-based packaging.

The electronics segment followed closely, with approximately 30% share. The electronics sector holds a substantial share due to its growing reliance on finish foils for conductive and protective purposes. Printed circuit boards (PCBs), batteries, and display panels require high-quality foils to ensure electrical conductivity, signal integrity, and mechanical protection. Rapid advancements in consumer electronics, electric vehicles, and renewable energy technologies are driving strong demand for copper and aluminum foils with specialized surface finishes and thicknesses tailored to these applications. The expansion of flexible electronics and wearable devices also contributes to this growth.

Asia Pacific is expected to hold the largest market share of about 42% during the forecast period.

This dominance is driven by rapid industrialization and economic growth in key countries such as China, India, Japan, and the nations of Southeast Asia. The region’s expanding packaging sector, fueled by rising consumer demand for packaged foods, pharmaceuticals, and personal care products, significantly contributes to this growth. Additionally, Asia Pacific is a global hub for electronics manufacturing, with major production centers for smartphones, consumer electronics, and automotive components relying heavily on finish foils for packaging and circuit applications. Government initiatives aimed at boosting manufacturing capabilities and infrastructure development further stimulate market expansion.

India is projected to grow at a CAGR of approximately 10%.

India’s impressive growth rate is attributed to accelerated infrastructure development, increasing investments in manufacturing, and supportive government programs like “Make in India” that encourage domestic production. Rising urbanization and a growing middle class also drive higher consumption of packaged goods, boosting demand for finish foils in packaging applications.

North America is expected to witness the fastest CAGR of around 7%.

Despite having a smaller overall market share compared to Asia Pacific, North America shows robust growth driven by technological innovations in foil manufacturing, including ultra-thin and high-performance foils tailored for advanced electronics and packaging needs. Stringent regulatory requirements on packaging safety, sustainability, and recyclability further push demand for high-quality finish foils. The region’s strong electronics sector, particularly in the U.S., with its focus on aerospace, defense, and life sciences, also fuels market growth.

WORLDWIDE TOP KEY PLAYERS IN THE FINISH FOILS MARKET INCLUDE

-

- Novelis Inc.

- UACJ Corporation

- American Packaging Corporation

- Assan Alüminyum

- Koninklijke Koninklijke Ten Cate

- Impala Platinum Holdings Limited

- Norsk Hydro ASA

- Others

Product Launches in Finish Foils Market

- In March 2024, Novelis Inc. introduced a new ultra-thin aluminum foil specifically engineered for high-barrier food packaging applications. This innovative product is designed to significantly enhance the shelf life of packaged foods by providing superior protection against moisture, oxygen, and other contaminants that can degrade product quality.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisor has segmented the finish foils market based on the below-mentioned segments:

Global Finish Foils Market, By Material Type

-

- Aluminum

- Copper

- Stainless Steel

Global Finish Foils Market, By Application

-

- Packaging

- Electronics

- Automotive

- Construction

Global Finish Foils Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

FAQs

Q1. What is the projected market size of the Global Finish Foils Market by 2035?

The Global Finish Foils Market size is expected to grow from USD 1.15 billion in 2024 to USD 1.75 billion by 2035, at a CAGR of 3.89% during the forecast period 2025-2035.

Q2. Which region holds the largest market share in the finish foils market?

Asia Pacific is expected to hold the largest market share, accounting for about 42% of the global finish foils market revenue in 2024.

Q3. What are the key material types in the finish foils market?

The primary material types are aluminum, copper, and stainless steel. Aluminum foil dominates the market, accounting for approximately 50% of the revenue in 2024.

Q4. Which application segment accounts for the largest share in the finish foils market?

The packaging segment holds the largest revenue share, around 45%, due to rising demand for flexible and sustainable packaging solutions.

Q5. What are the main factors driving growth in the finish foils market?

Key drivers include increasing demand for lightweight, corrosion-resistant materials, growth in packaging and electronics industries, sustainability trends, and government initiatives promoting eco-friendly packaging.

Q6. What challenges does the finish foils market face?

The market faces challenges such as high production costs, raw material price volatility, competition from cheaper alternatives like plastics, and stringent environmental and regulatory compliance requirements.

Q7. Which region is expected to register the fastest growth in the finish foils market?

North America is projected to have the fastest CAGR of approximately 7%, driven by technological innovations and stringent regulations on packaging safety and sustainability.

Q8. How is the finish foils market evolving with respect to technology?

The market is seeing technological advances such as ultra-thin foils, high-barrier materials for food packaging, biodegradable and recyclable foil composites, and customized solutions for automotive and electronics sectors.

Q9. Who are the major players in the global finish foils market?

Key players include Novelis Inc., UACJ Corporation, American Packaging Corporation, Assan Alüminyum, Koninklijke Ten Cate, Impala Platinum Holdings Limited, and Norsk Hydro ASA, among others.

Q10. What recent product launches have occurred in the finish foils market?

In March 2024, Novelis Inc. introduced an ultra-thin aluminum foil engineered for high-barrier food packaging applications, enhancing shelf life by protecting against moisture and contaminants.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 232 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |