Global Flapper Caps Market

Global Flapper Caps Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Material (Polypropylene (PP), HDPE, LDPE, and PET), By Design (Single Flap, Dual Flap, Hinged, and Slotted), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Flapper Caps Market Summary, Size & Emerging Trends

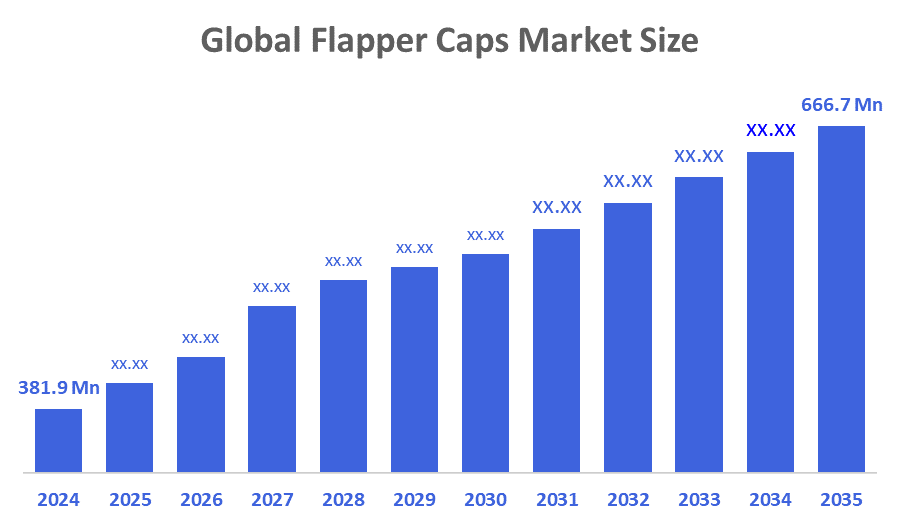

According to Decisions Advisors, The Global Flapper Caps Market Size is expected to Grow from USD 381.9 Million in 2024 to USD 666.7 Million by 2035, at a CAGR of 5.2% during the forecast period 2025-2035. The growing demand for convenient, hygienic, and reclosable packaging solutions in food, beverage, and personal care sectors is a key driving factor for the flapper caps market.

Key Market Insights

- Asia Pacific is expected to account for the largest share in the flapper caps market during the forecast period.

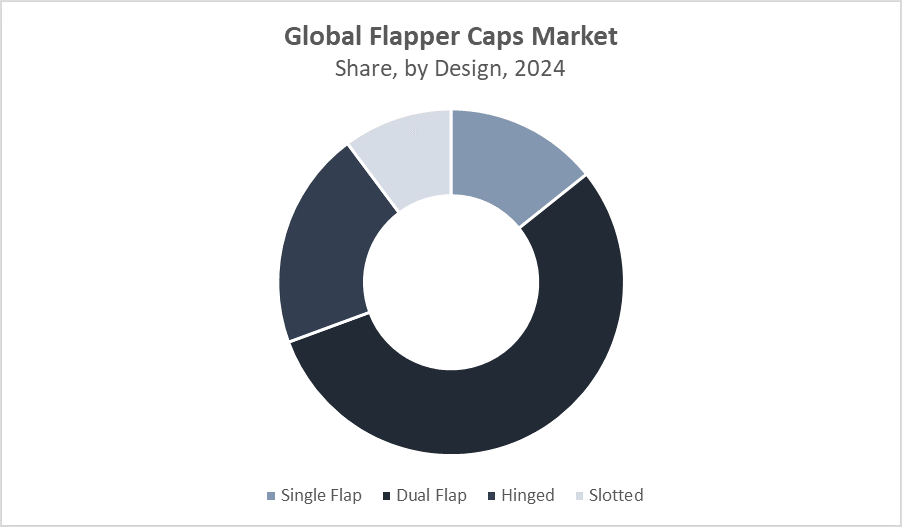

- In terms of design, the dual flap segment dominated in terms of revenue during the forecast period.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 381.9 Million

- 2035 Projected Market Size: USD 666.7 Million

- CAGR (2025-2035): 5.2%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Flapper Caps Market

The flapper caps market revolves around the production of dispensing closures commonly used in food, household, and personal care packaging. These caps are designed with hinged or slotted flaps for easy opening and resealing, ensuring product freshness and portion control. Their lightweight and cost-effective nature makes them ideal for plastic bottles and jars containing spices, powders, and granular products. The market is strongly supported by innovations in closure design, increasing hygiene awareness, and growing demand for reclosable and user-friendly packaging. In line with global sustainability trends, manufacturers are adopting recyclable materials and investing in lightweight cap structures to reduce plastic usage. Rising demand for premium packaging and consumer convenience is expected to further boost market expansion across all end-use industries.

Flapper Caps Market Trends

- There’s a growing push for recyclable and eco-friendly materials such as bio-based plastics and post-consumer resins.

- Advances in cap design and flap durability are creating more secure, leak-proof, and tamper-evident solutions for end-use industries.

- Manufacturers are forming strategic partnerships with packaging firms to improve product design, reduce weight, and enhance sustainability.

Flapper Caps Market Dynamics

Driving Factors:

Rising demand from food & beverage and personal care industries

Key growth factors for the flapper caps market include rising demand from food, beverage, and personal care sectors, where controlled dispensing and resealability are critical. Growing preference for packaged seasonings, spices, powders, and dry goods fuels the use of flapper closures. Increasing awareness regarding hygiene and contamination prevention has further driven demand for flap-based dispensing. Packaging manufacturers are innovating with dual flap and hinged options that improve consumer convenience. Moreover, government initiatives to encourage recyclable packaging and ban single-use plastics are influencing the use of sustainable cap materials, thereby shaping the future of the flapper caps market.

Restrain Factors:

Stringent plastic regulations and rising raw material costs

Major restraining factors include fluctuating polymer prices and increasing scrutiny over the environmental impact of plastic closures. Flapper caps, primarily made from polypropylene or polyethylene, are affected by volatile oil-based resin costs. Environmental regulations, especially in Europe and North America, are pushing companies to adopt recyclable materials or lightweight alternatives, increasing production complexity and costs. Competition from alternative closure systems such as flip-tops, screw caps, and valve dispensers also limits market expansion. Additionally, limited recycling infrastructure in developing countries slows the adoption of sustainable cap designs.

Opportunity:

Emerging demand for dual-purpose and customizable closure designs

The flapper caps market presents strong growth opportunities through the development of multi-functional cap designs. Dual-opening mechanisms that allow both sprinkling and pouring functions are gaining traction across the spice and food industries. Customization in flap hole patterns, color coding, and neck compatibility presents unique branding and design opportunities for manufacturers. Rising consumption of packaged foods in emerging economies, paired with increasing awareness of sustainable packaging, offers a profitable avenue for global players. Technological innovations in injection molding and material efficiency are further expected to drive cost-effective solutions in high-demand regions.

Challenges:

Environmental compliance and global supply chain constraints

Key challenges in the flapper caps market include navigating environmental legislation and maintaining consistent quality under global supply chain pressures. With rising demand for recyclable caps, manufacturers face the dual challenge of adhering to material regulations and minimizing plastic waste. Complex flap mechanisms require precision molding, which can be costly in regions lacking advanced manufacturing infrastructure. Supply chain disruptions and geopolitical tensions may further impact resin availability, logistics, and pricing. The need to balance cost-efficiency, sustainability, and high-volume production poses significant challenges for market players.

Global Flapper Caps Market Ecosystem Analysis

The global flapper caps market ecosystem comprises raw material suppliers (resin manufacturers like polypropylene and polyethylene producers), closure manufacturers, packaging firms, and end-users in food & beverage, cosmetics, and personal care industries. Key market participants operate across molding, flap design, liner application, and integration with bottle manufacturers. Regulatory bodies are actively shaping the ecosystem with mandates on recyclability and reduced plastic usage. The market’s health is dependent on innovation in design, efficiency in production, and compliance with global sustainability goals.

Global Flapper Caps Market, By Design

The dual flap segment accounted for the largest revenue share of approximately 42% in the global flapper caps market during the forecast period. This design offers versatile dispensing options, typically a sprinkle side and a pour side, making it ideal for packaging dry goods such as spices, seasonings, powdered supplements, and food powders. The flap mechanism allows for more precise control over the quantity dispensed, which improves portion control, minimizes waste, and preserves product freshness. Dual flap caps are increasingly favored by food manufacturers and personal care brands for their user-friendly design, reusability, and ability to enhance product aesthetics and safety through tamper-evident sealing.

The hinged segment held the second-largest revenue share, estimated at approximately 28%. These caps are widely used in household cleaning agents, cosmetic powders, and body care products. The simplicity of the hinged mechanism allows for one-handed operation, which enhances convenience in high-frequency use applications. Their ability to reseal effectively and maintain product hygiene makes them a popular choice in both home and commercial settings.

Global Flapper Caps Market, By Material

The polypropylene (PP) segment accounted for the largest revenue share of approximately 46% in the global flapper caps market during the forecast period. PP is the preferred material for flapper caps due to its excellent balance of chemical resistance, durability, moldability, and cost-effectiveness. It offers superior rigidity, which is essential for the repeated opening and closing action of flap mechanisms. Its compatibility with food-grade applications also makes it ideal for spice, seasoning, and condiment packaging. Additionally, PP is lightweight and recyclable, aligning well with global sustainability trends. Many manufacturers favor PP for its adaptability to both standard and custom cap designs, making it the dominant material in the market.

The high-density polyethylene (HDPE) segment held the second-largest revenue share at approximately 26%. HDPE is widely used in flapper caps for applications that require enhanced impact resistance, flexibility, and moisture barrier properties. It is particularly suitable for household cleaning products, personal care powders, and certain pharmaceutical uses where chemical compatibility and stress crack resistance are crucial. HDPE's ability to withstand harsh contents (e.g., detergents or disinfectants) and extreme temperatures further supports its application across non-food industries.

Asia Pacific is expected to account for the largest share of the flapper caps market during the forecast period, holding approximately 43% of the global market revenue.

This is largely driven by rapid industrialization, growth in the fast-moving consumer goods (FMCG) sector, and rising disposable incomes in key countries such as China, India, and Japan. India, in particular, is projected to grow at a robust CAGR of approximately 9.5%, supported by strong FMCG demand, an expanding middle class, and significant investments in sustainable plastic technologies and customization by local packaging manufacturers.

China continues to dominate the region

with its vast manufacturing base and increasing consumer demand for convenient and innovative packaging solutions. Japan’s mature market focuses on premium packaging innovations catering to high-end cosmetic and food brands, further supporting flapper cap adoption.

North America is anticipated to register significant growth in the flapper caps market, accounting for approximately 24% of the global revenue.

The United States leads the market within the region, with steady growth driven by increasing demand for portion-controlled spice dispensers, eco-friendly packaging, and tamper-evident closures. Major food and personal care brands, along with private-label manufacturers, are actively integrating dual flap closures to enhance convenience and safety.

Canada also contributes to regional growth, with a focus on sustainable packaging solutions influenced by strong environmental regulations and consumer preferences. Mexico is witnessing growth due to expanding FMCG production and increasing adoption of modern packaging technologies.

WORLDWIDE TOP KEY PLAYERS IN THE FLAPPER CAPS MARKET INCLUDE

- Berry Global, Inc.

- AptarGroup, Inc.

- Silgan Holdings Inc.

- RPC Group Plc (now part of Berry Global)

- WestRock Company

- Mold-Rite Plastics

- Coveris Holdings S.A.

- Greiner Packaging International GmbH

- Amcor Limited

- Alpla Werke Alwin Lehner GmbH & Co KG

- Others

Product Launches in Flapper Caps Market

- In May 2023, Moulded Packaging Solutions launched a 63mm dual flapper cap equipped with an Induction Heat Seal Wad (IHS Wad). This cap features two lift-open tabs: one for sprinkling and the other for spooning out the content. The cap can also be removed to offer conventional dispensing. This versatile design caters to various applications, including dry foods, confectioneries, herbs, spices, and seasonings.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the flapper caps market based on the below-mentioned segments:

Global Flapper Caps Market, By Material

- Polypropylene (PP)

- HDPE

- LDPE

- PET

Global Flapper Caps Market, By Design

- Single Flap

- Dual Flap

- Hinged

- Slotted

Global Flapper Caps Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 175 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |