Global Flavored Water Market

Global Flavored Water Market Size, Share, and COVID-19 Impact Analysis, By Product (Still, Sparkling), By Distribution Channel (Supermarkets & Hypermarkets, Convenience Stores, Online, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Flavored Water Market Summary

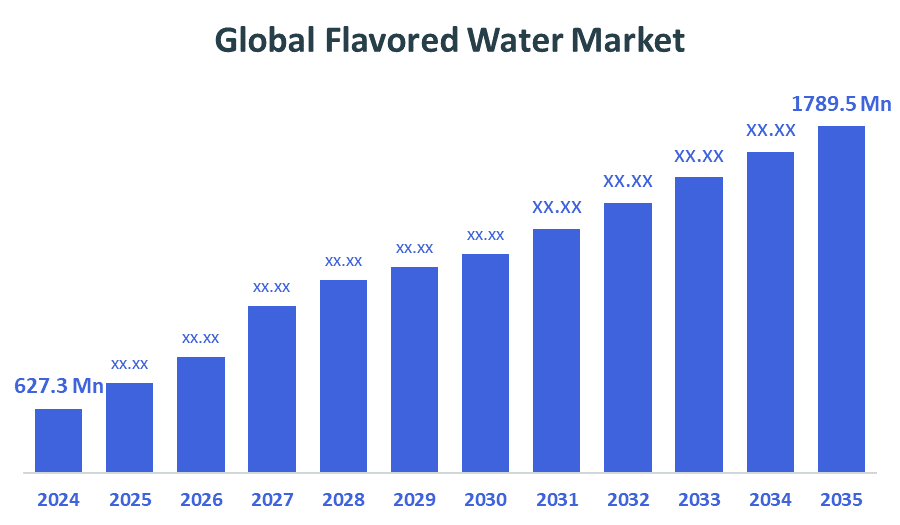

The Global Flavored Water Market Size Was Estimated at USD 627.3 Million in 2024 and is Projected to Reach USD 1789.5 Million by 2035, Growing at a CAGR of 10% from 2025 to 2035. A greater range of flavors, growing disposable incomes, and growing health consciousness are some of the factors driving the growth of the flavored water market.

Key Regional and Segment-Wise Insights

- Europe accounted for the greatest revenue share of 29.6% in 2024, and dominated the market globally.

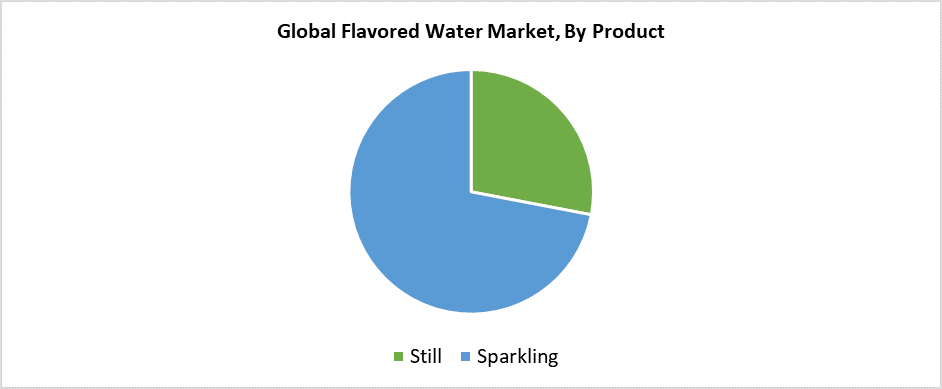

- In 2024, the sparkling segment had the largest revenue share, accounting for 72.5% of revenue share based on product.

- In 2024, the supermarket segment had the biggest revenue share by distribution channel, accounting for over 55.4%.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 627.3 Million

- 2035 Projected Market Size: USD 1789.5 Million

- CAGR (2025-2035): 10%

- Europe: Largest market in 2024

The flavored water market encompasses the production, distribution, and consumption of mainly water-based beverages that contain either natural or artificial flavors to enhance their taste. The industry grows because consumers become more health-conscious while seeking hydration options that lack added sugars or calories. The worldwide consumption of flavored water continues to grow because people want portable and convenient drinks while gaining awareness about proper hydration. The combination of delicious taste and supposed health benefits makes flavored water the preferred choice of Gen Z and Millennial customers. Market expansion owes its growth to two main factors: the rise of fitness and wellness activities and the decreasing popularity of sugary soft drinks.

The market for flavored water benefits from technological advancements, which improve product quality and expand product variety while extending shelf life. Modern innovations enhance taste together with health benefits through vitamin fortification and advanced filtration techniques, and natural flavor extraction methods. Sustainable packaging solutions, such as biodegradable bottles together with environmentally friendly caps, address environmental issues while attracting consumers who support environmental causes. The growth of the flavored water market receives support from government programs, which promote healthy beverage consumption and implement beverage sugar regulations. The global expansion of the flavored water business depends on labeling regulations, together with food safety standards, which establish customer trust through product transparency.

Product Insights

The sparkling product segment of the global flavored water market held the largest revenue share of 72.5% during 2024 because consumers seek healthier alternatives to carbonated soft drinks. Health-conscious consumers choose sparkling flavored water as a soda alternative because it delivers soda bubbles without added sugar or calories. The market benefits from the increasing demand of Gen Z and younger consumers who seek refreshing drinks with added flavors and functional benefits. Major businesses maintain their effervescent product lines through continuous addition of new products, which include fruit infusions and botanical extracts along with natural sweeteners. The sparkling segment achieved strong market performance because of its attractive packaging and its availability through retail stores and online platforms, combined with its user-friendly design.

During the forecast period, the still segment within the flavored water market will show substantial growth as consumers seek naturally flavored beverages that do not contain carbonation. Health-conscious people, particularly those with digestive sensitivity and older persons, choose still-flavored water because it serves as a healthier alternative to sugar-laden drinks and carbonated sodas. This market continues to grow because more consumers want products that maintain their natural ingredients and avoid artificial components. The rising popularity of still-flavored water will continue worldwide because supermarkets and convenience stores, and online platforms provide more product availability while companies develop new flavor combinations with vitamin and electrolyte additions.

Distribution Channel Insights

The supermarket segment maintained the highest revenue share in the global flavored water market, accounting for 55.4% during 2024 because of its large product range, strong customer base, and high store traffic. The one-stop shopping experience of supermarkets makes them a popular location for purchasing flavored water along with other household products. Through this channel, higher sales result from customers being able to compare different products, benefit from promotional offers, and buy in bulk. The combination of product sampling with in-store promotion and prominent shelf placement enhances consumer awareness while driving impulsive purchases. Leading manufacturers prioritize supermarket distribution because it enables them to achieve maximum exposure and customer reach.

The online segment of the flavored water market will experience the fastest CAGR during the forecast period because of increasing internet access, smartphone popularity, alongside e-commerce platform acceptance. More customers are switching to online ordering because it provides easy access to a diverse range of flavored water products through subscription options and home delivery services. Direct-to-consumer brand strategies and health-focused internet shops have enhanced both sales and visibility of products. Customers receive better online purchasing experiences through product reviews and personalized product suggestions, as well as precise digital marketing efforts. Consumer trends toward digital channels will drive substantial online segment growth in the flavored water market, specifically among younger populations.

Regional Insights

The North American flavored water market generated substantial revenue in 2024 because consumers sought reduced-calorie beverage choices along with healthier drink alternatives. North America transitioned from soda consumption toward flavored water products because of increasing public awareness about hydration benefits alongside rising concerns regarding sugar consumption and obesity issues. The United States led the acceptance of flavored water because people lead busy lives, while health trends remain popular, and people prefer convenient, portable beverages. Leading brands continuously release new flavor pairings alongside different functional variants to match shifting consumer preferences. The area maintains its top market position because consumers can easily purchase flavored water at supermarkets and convenience stores as well as through online retail platforms.

Europe Flavored Water Market Trends

Europe led the worldwide flavored water market with 29.6% revenue share during 2024 because of rising health awareness, decreasing sugar consumption, and widespread acceptance of healthy hydration habits. The important markets of Germany and the UK, along with France, experience a strong shift of customers from soft drinks to flavored water options, which provide taste without extra calories or artificial additives. The strong regulatory environment supporting natural and clean-label products in this region drives brands to explore organic flavors and functional additives. The growing acceptance of eco-friendly methods and sustainable packaging by European consumers drives market growth through their core values. The industry leader position of Europe in 2024 emerged from its solid retail network, combined with expanding digital platforms.

Asia Pacific Flavored Water Market Trends

The flavored water industry is predicted to experience significant growth in the Asia Pacific region because of increasing health awareness and changing dietary habits, together with rising consumer spending. Consumers across China, India, Japan, and South Korea pursue better alternatives to sugar-laden beverages during the rapid urbanization process and fast-paced modern lifestyles. The health-aware Gen Z and millennial demographic shows rising preference for flavored water, which includes functional additives such as vitamins, electrolytes, and herbal components. The rapid development of e-commerce platforms, together with rising domestic and foreign business participation, has enhanced market accessibility for consumers. The worldwide flavored water market sees Asia Pacific as its primary growth driver because of its distinctive market attributes alongside active product development and marketing strategies.

Key Flavored Water Companies:

The following are the leading companies in the flavored water market. These companies collectively hold the largest market share and dictate industry trends.

- Nestle

- Saratoga Spring Water Company

- Talking Rain

- National Beverage Corp.

- Spindrift Beverage Co.

- PepsiCo

- Sanpellegrino S.p.A.

- Hint Inc.

- KeurigDr Pepper, Inc.

- The Coca?Cola Company

- Others

Recent Developments

- In February 2025, National Beverage Corp.'s LaCroix Sparkling Water debuted a new flavor called "Sunshine," which combines tropical and citrus freshness.

- In February 2025, two new flavors were introduced by Waterloo Sparkling Water: Ruby Red Tangerine and Guava Berry. All year long, both varieties will be accessible and are free of calories, sugar, and sweetness.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the flavored water market based on the below-mentioned segments:

Global Flavored Water Market, By Product

- Still

- Sparkling

Global Flavored Water Market, By Distribution Channel

- Supermarkets

- Convenience Stores

- Online

- Others

Global Flavored Water Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 217 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Aug 2025 |

| Access | Download from this page |