Global Flexographic Ink Market

Global Flexographic Ink Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Resin Type (Polyurethanes, Acrylics, Polyamides, and Nitrocellulose), By Technology (Water-based Inks and UV-curable Inks), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Flexographic Ink Market Summary, Size & Emerging Trends

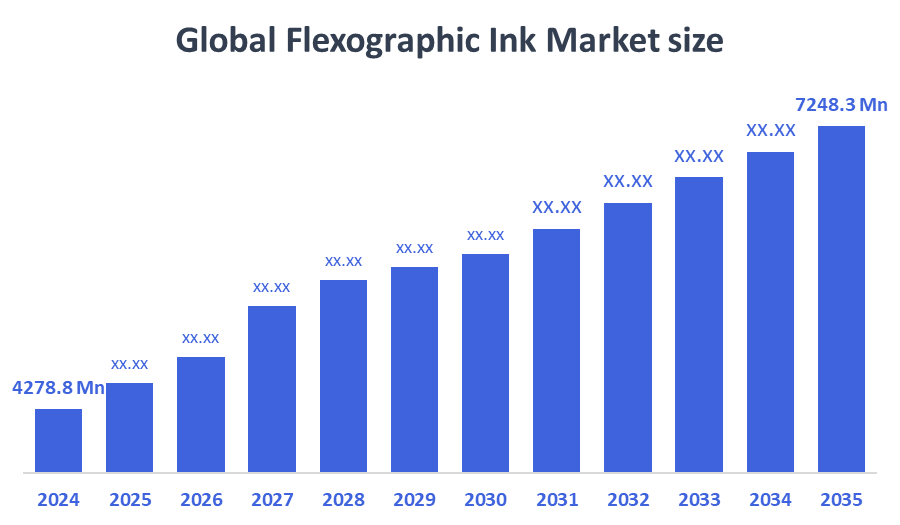

According to Decision Advisor, The Global Flexographic Ink Market Size is Expected to Grow from USD 4,278.8 Million in 2024 to USD 7,284.3 Million by 2035, at a CAGR of 4.96% during the forecast period 2025-2035. The increasing demand for flexible packaging, rising environmental regulations promoting sustainable printing, and rapid growth in e-commerce sectors are the primary factors driving the flexographic ink market.

Key Market Insights

- Asia Pacific is expected to account for the largest share in the flexographic ink market during the forecast period.

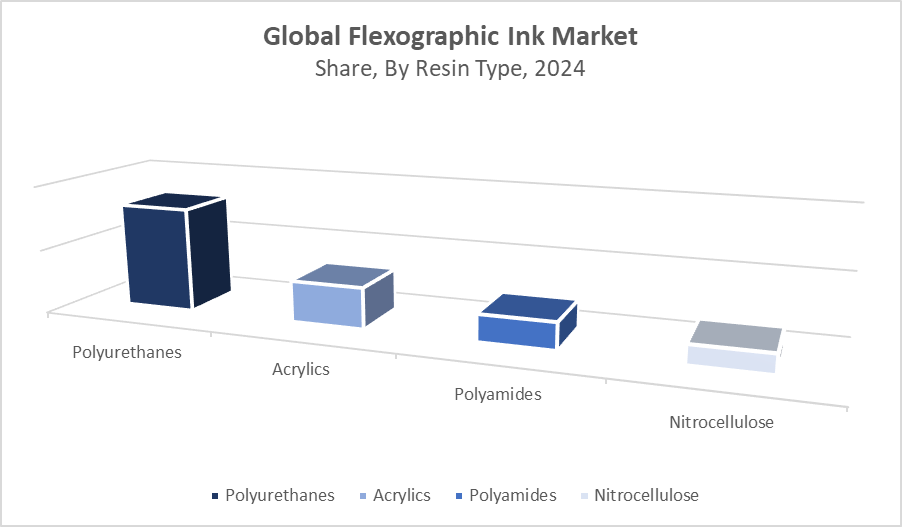

- In terms of resin type, the polyurethanes segment is expected to dominate in revenue during the forecast period.

- In terms of technology, the water-based inks segment accounted for the largest revenue share in the global flexographic ink market during the forecast period.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 4,278.8 Million

- 2035 Projected Market Size: USD 7,284.3 Million

- CAGR (2025-2035): 4.96%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Flexographic Ink Market

The flexographic ink market focuses on the production of specialized inks utilized in flexographic printing, a dominant technology in packaging, labeling, and corrugated materials. These inks are preferred for their fast-drying times, high print quality, and compatibility with diverse substrates such as plastic films, paper, and metal foils. Governments worldwide promote the use of eco-friendly printing technologies, encouraging innovation in water-based and UV-curable inks that reduce volatile organic compounds (VOCs) and minimize environmental impact. The demand for flexographic inks is propelled by rising packaged goods consumption, expanding e-commerce activities, and growing consumer preference for sustainable packaging solutions. Continuous advances in ink chemistry and formulation further enhance the application scope, providing the market with steady growth prospects.

Flexographic Ink Market Trends

- Increasing shift toward water-based and UV-curable inks due to stringent environmental regulations and sustainability goals.

- Development of advanced resin types such as polyurethanes and acrylics to improve adhesion, durability, and color vibrancy.

- Strategic collaborations and mergers among manufacturers to expand product portfolios and strengthen global market presence.

- Growing adoption of digital flexographic printing techniques, driving demand for specialized ink formulations.

- Rising interest in recyclable and compostable packaging materials, pushing ink manufacturers to innovate sustainable ink solutions.

Flexographic Ink Market Dynamics

Driving Factors: Rising demand for flexible packaging and sustainable printing technologies

The flexographic ink market is growing due to rising demand for flexible packaging, especially from food & beverage, pharmaceuticals, and consumer goods sectors. Increasing focus on eco-friendly printing methods has boosted the use of water-based and UV-curable inks. Advances in resin chemistry enhance ink performance, making them compatible with various materials and faster printing. Additionally, the surge in e-commerce and retail industries worldwide is driving the need for efficient, high-quality packaging solutions, fueling market growth.

Restrain Factors: Raw material price fluctuations and alternative printing technologies

Market growth is challenged by fluctuating prices of raw materials used in resin production, affecting overall costs and profits. Alternative printing technologies like digital and gravure printing create strong competition, limiting flexographic ink market expansion. Moreover, strict environmental regulations increase compliance and production costs. In some regions, limited infrastructure and lack of expertise in using UV-curable inks hinder adoption, restricting the penetration and growth of these advanced ink technologies.

Opportunity: Innovation in resin and ink technology

Innovations in resin and ink chemistry provide opportunities to develop high-performance, environmentally friendly inks, meeting sustainability demands. Rapid industrialization and expansion of the packaging sector in emerging economies open new markets for flexographic inks. The growing trend toward sustainable and biodegradable packaging materials encourages development of low-VOC and eco-conscious ink formulations. Strategic collaborations between ink manufacturers and packaging companies can create integrated solutions, boosting product offerings and driving future market growth.

Challenges: Supply chain disruptions and environmental regulations

Supply chain disruptions, especially for key raw materials amid geopolitical tensions, create production instability and affect the market. Transitioning to advanced technologies like UV-curable inks requires significant capital investment, posing barriers for small and mid-sized manufacturers. Intense competition and shifting consumer preferences demand constant innovation in ink formulations and cost management to maintain market share. Manufacturers must balance quality improvements with affordability while adapting to fast-evolving industry trends and regulations.

Global Flexographic Ink Market Ecosystem Analysis

The ecosystem comprises raw material suppliers (resin and pigment manufacturers), ink producers, printing service providers, packaging companies, and end-users across food & beverage, healthcare, personal care, and retail sectors. Regulatory bodies govern environmental standards and promote sustainability initiatives. Leading players invest heavily in R&D to enhance ink formulations and production efficiency. The balance between supply stability, technological innovation, and environmental compliance drives market growth and ecosystem health.

Global Flexographic Ink Market, By Resin Type

What key advantages helped polyurethanes outperform other ink types in the flexographic ink market in 2024?

Polyurethanes dominated the flexographic ink market in 2024, holding approximately 45% share, due to their excellent adhesion properties, chemical resistance, and versatility across various substrates. Their ability to deliver high-quality print results with durability and fast drying times made them highly favored by manufacturers. Additionally, polyurethane-based inks offer enhanced flexibility and environmental benefits, aligning with industry trends toward sustainable and efficient printing solutions. These combined advantages positioned polyurethanes as the leading choice in the flexographic ink market during the forecast period.

How did the acrylic segment sustain its market presence in the flexographic ink market in 2024?

Acrylics captured a significant share of around 30% in the flexographic ink market in 2024 due to their excellent color vibrancy, durability, and strong adhesion to a variety of substrates. Their versatility in application and compatibility with both water-based and solvent-based formulations made them popular among manufacturers seeking high-performance and cost-effective printing solutions. Additionally, the environmental friendliness of acrylic-based inks, combined with ongoing innovations in their formulations, supported their sustained market presence and competitiveness during the forecast period.

Global Flexographic Ink Market, By Technology

Why were water-based inks preferred over other ink types in the flexographic ink market in 2024?

Water-based inks accounted for the largest revenue share, estimated at around 50% in the flexographic ink market in 2024, primarily due to their environmentally friendly nature and compliance with increasingly stringent regulations on volatile organic compounds (VOCs). These inks offer excellent print quality, fast drying times, and strong adhesion to a variety of substrates, making them highly versatile and preferred across multiple applications. Additionally, growing demand for sustainable and safer printing solutions in packaging and labels has driven widespread adoption of water-based inks, securing their position as the top revenue-generating segment in the market.

What made UV-curable inks a preferred choice in the flexographic ink market in 2024?

UV-curable inks gained significant market traction in the flexographic ink market in 2024, holding approximately 35% of the revenue share, due to their rapid curing times, superior durability, and environmental benefits. These inks cure instantly under UV light, enabling faster production speeds and reducing energy consumption compared to traditional inks. Moreover, UV-curable inks offer excellent adhesion on a wide range of substrates and provide high-quality, vibrant prints that resist fading and abrasion. The growing demand for efficient, sustainable, and high-performance printing solutions has driven the increased adoption of UV-curable inks, making them a key revenue contributor in the market.

Asia Pacific holds the largest market share in the flexographic ink market, estimated at around 40%,

fueled by rapid industrialization and expanding packaging industries across key countries like China, India, and Japan. Strong government initiatives promoting eco-friendly and sustainable printing technologies further support market growth. The region’s large manufacturing base, rising consumer demand, and growing exports contribute to sustained demand for flexographic inks, making Asia Pacific the dominant player in the global market.

North America is the fastest-growing region, with a CAGR outpacing other areas, holding approximately 25% market share.

Growth is driven by increasing adoption of sustainable inks in packaging, accelerated e-commerce activities, and a robust printing infrastructure. Advanced manufacturing capabilities and stringent environmental regulations encourage the shift towards eco-friendly water-based and UV-curable inks. The presence of major printing and packaging companies further boosts the market expansion in North America.

WORLDWIDE TOP KEY PLAYERS IN THE FLEXOGRAPHIC INK MARKET INCLUDE

- Flint Group

- Sun Chemical

- Siegwerk Druckfarben AG & Co. KGaA

- Toyo Ink Group

- DIC Corporation

- Huber Group

- Sakata INX Corporation

- CCL Industries

- Allured Business Media

- Others

Product Launches in Flexographic Ink Market

- In March 2024, Flint Group launched a new eco-friendly polyurethane-based flexographic ink that offers enhanced adhesion and low volatile organic compound (VOC) emissions. This innovation specifically targets food packaging applications, addressing the increasing demand for sustainable and safe printing solutions in Europe and North America. The new product aligns with stricter environmental regulations and consumer preference for greener packaging, strengthening Flint Group’s position in these key markets.

- In November 2023, Siegwerk introduced an advanced UV-curable ink series designed to provide superior print durability and significantly faster curing times. This product is tailored for high-speed packaging lines, especially in the Asia Pacific region, where demand for efficient and high-quality printing solutions is growing rapidly. The new ink series enhances production efficiency and print quality, supporting Siegwerk’s strategy to cater to the evolving needs of fast-paced industrial packaging environments.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisor has segmented the flexographic ink market based on the below-mentioned segments:

Global Flexographic Ink Market, By Resin Type

- Polyurethanes

- Acrylics

- Polyamides

- Nitrocellulose

Global Flexographic Ink Market, By Technology

- Water-based Inks

- UV-curable Inks

Global Flexographic Ink Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

FAQs

Q: What is the market size of the Global Flexographic Ink Market in 2024?

A: The Global Flexographic Ink Market size was estimated at USD 4,278.8 million in 2024.

Q: What is the forecasted CAGR of the Global Flexographic Ink Market from 2025 to 2035?

A: The market is expected to grow at a CAGR of around 4.96% during the period 2025–2035.

Q: What is the projected market size of the Global Flexographic Ink Market by 2035?

A: The market is projected to reach USD 7,284.3 million by 2035.

Q: Which region holds the largest share in the Global Flexographic Ink Market?

A: Asia Pacific is expected to account for the largest market share, estimated at around 40% in 2024.

Q: Which region is the fastest-growing in the Global Flexographic Ink Market?

A: North America is the fastest-growing region, holding approximately 25% market share with a higher CAGR compared to other regions.

Q: Which resin type dominated the Global Flexographic Ink Market in 2024?

A: Polyurethanes dominated the market with approximately 45% share due to excellent adhesion, chemical resistance, and versatility.

Q: How did the acrylic resin segment perform in the Global Flexographic Ink Market in 2024?

A: Acrylics held around 30% market share owing to their color vibrancy, durability, and compatibility with various formulations.

Q: Which ink technology generated the highest revenue in 2024?

A: Water-based inks accounted for the largest revenue share, estimated at around 50%, driven by their eco-friendly nature and regulatory compliance.

Q: What advantages make UV-curable inks important in the market?

A: UV-curable inks held approximately 35% revenue share due to rapid curing times, superior durability, environmental benefits, and high print quality.

Q: Who are the top key players operating in the Global Flexographic Ink Market?

A: Leading companies include Flint Group, Sun Chemical, Siegwerk Druckfarben AG & Co. KGaA, Toyo Ink Group, DIC Corporation, Huber Group, Sakata INX Corporation, CCL Industries, and Allured Business Media.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 165 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |