Global Floating Power Plant Market

Global Floating Power Plant Market Size, Share, and COVID-19 Impact Analysis, By Power Source (Non-renewable, Renewable), By Power Rating (Low (Less than 20 MW), Medium (20 MW to 100 MW), High (Greater than 100 MW)), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 ? 2035

Report Overview

Table of Contents

Floating Power Plant Market Summary

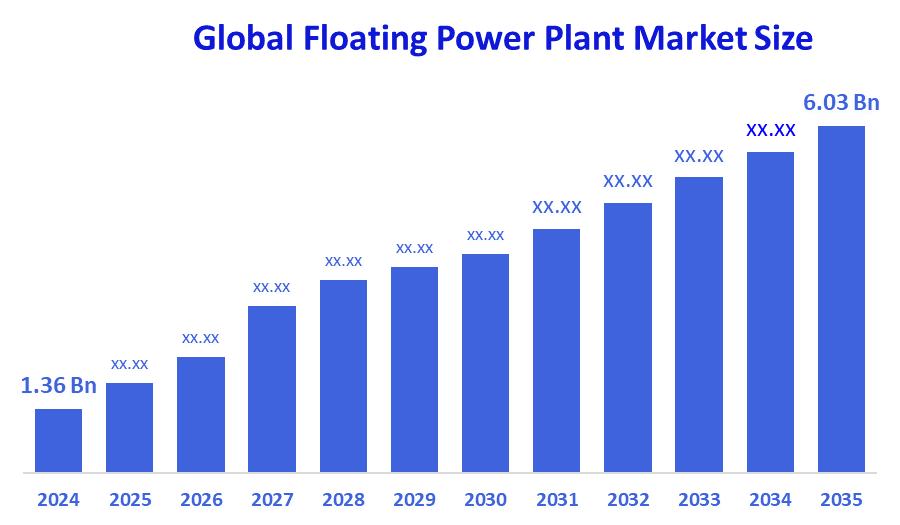

The Global Floating Power Plant Market Size Was Estimated at USD 1.36 Billion in 2024 and is Projected to Reach USD 6.03 Billion by 2035, Growing at a CAGR of 14.5% from 2025 to 2035. The market for floating power plants is expanding as a result of growing demands for quick and flexible power generation, growing energy requirements in isolated coastal regions, the incorporation of renewable energy sources like wind and solar, and technological developments that make offshore power generation and deployment more efficient.

Key Regional and Segment-Wise Insights

- In 2024, the Asia Pacific held the largest revenue share of over 39.4% and dominated the market globally.

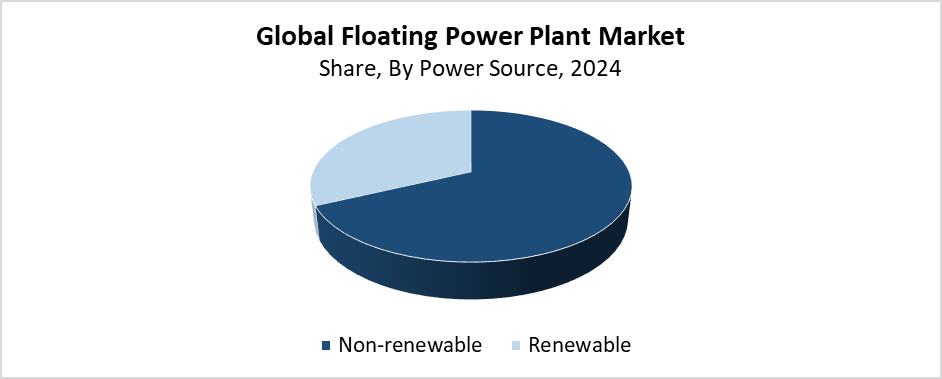

- In 2024, the non-renewable segment had the highest market share by power source, accounting for 68.3%.

- In 2024, the High (Greater than 100 MW) segment had the biggest market share by power rating.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 1.36 Billion

- 2035 Projected Market Size: USD 6.03 Billion

- CAGR (2025-2035): 14.5%

- Asia Pacific: Largest market in 2024

The floating power plant market consists of power generation facilities that float on ships or barges, or floating platforms, and produce electricity through solar, wind, nuclear, diesel engines, and gas turbines. The power plants deliver swift, flexible power generation capabilities to remote locations and island communities, and disaster-affected areas that lack conventional grid infrastructure. The primary drivers behind floating power plant adoption include increased offshore and coastal energy requirements, along with worldwide power supply stability needs, and the growing trend of distributed energy production. The major advantages of floating power plants for public and commercial sectors include facility relocation capabilities, minimal land footprint, and fast construction times.

Technological advancements play an essential role in developing power plants that float on water surfaces. Modular platforms have grown more practical and extensive because engineers have developed offshore wind turbines alongside floating solar PV systems and multi-source hybrid power solutions. Multiple nations have started initiatives to support floating power plants through their programs, which target underserved communities for electricity access and renewable offshore energy investments and supportive legislative frameworks. Worldwide programs that focus on reducing carbon emissions and expanding renewable energy capacity support the development of clean floating power technology. The floating power plant market will expand substantially because of technological progress, combined with supportive regulations and rising corporate interest in energy solutions.

Power Source Insights

The non-renewable segment held the largest revenue share of 68.3% and dominated the global floating power plant industry during 2024. Floating power plants maintain their dominant position because gas turbines and diesel engines deliver consistent high-capacity power generation. Non-renewable floating power plants get selected to provide quick and reliable power to areas beyond grid access, including remote locations and disaster zones. These power plants stand as suitable solutions for fast power delivery because they combine established technology with their portable design and efficient installation processes. The worldwide infrastructure network, along with its affordable initial costs, sustains fossil fuel requirements, which positions the non-renewable sector as the leading segment in the floating power plant industry.

The floating power plant market's renewable segment is anticipated to grow at a substantial CAGR during the forecast period. The main drivers for market growth include rising investments in offshore renewable technologies and worldwide attention on clean energy and carbon reduction targets. The limited availability of land in coastal and island regions makes floating renewable power plants an ideal solution for sustainable energy provision. The commercial viability of these systems increases through material advancements and anchoring method development, and energy storage improvements. The renewable segment leads the growth of the floating power plant market because of supportive government policies and subsidies and international climate obligations, which accelerate adoption.

Power Rating Insights

In 2024, the market for floating power plants was dominated by the high (greater than 100 MW) segment, which held the largest revenue share. This segment controls the market because of increasing requirements for large-scale power utilities that supply electricity to industrial zones and densely populated regions, and unserved territories. High-capacity floating power plants suit perfectly the needs of countries that require substantial power generation yet have minimal available land area. These facilities maintain electricity delivery through hybrid system integration along with non-renewable resource utilization using gas turbines. The worldwide adoption of high-power-rated floating plants is increasing due to technological advancements combined with rising investment in large-scale floating power development projects.

Over the course of the projected period, the medium (20 MW to 100 MW) segment is anticipated to grow at a significant CAGR. The increasing demand for versatile power generation solutions in coastal towns and island communities and industrial zones with intermediate energy requirements drives this market growth. Medium-sized floating power plants offer an ideal solution for deployment speed and budget efficiency because they strike the right balance between capacity needs and cost-effectiveness. Medium-sized floating plants achieve better reliability through modular design and hybrid technology integration, which combines solar and wind with conventional power sources for improved adaptability. Worldwide market growth will be driven by offshore infrastructure investments combined with government support for decentralized energy production.

Regional Insights

The Asia Pacific floating power plant market dominated globally with the largest revenue share of 39.4% in 2024. This leadership position has been fueled by the region's growing energy demands, together with rapid development and limited traditional power infrastructure space. Several nations, including Japan, South Korea, China, and India, invest heavily in floating power technology as they seek reliable, flexible, sustainable energy solutions. Southeast Asian coastal and island governments are currently establishing floating power plants to enhance energy accessibility in remote areas. The worldwide floating power plant market finds its main base in the Asia Pacific because of its leading position, which receives additional support from government initiatives and renewable energy policies, and high offshore infrastructure investments.

North America Floating Power Plant Market Trends

The North American floating power plant market generated a substantial revenue share within the global market during 2024 due to rising demand for reliable decentralized power generation systems. Floating power technology has gained attention in the region because of the need to combine renewable energy sources with grid resilience improvements and infrastructure modernization. The United States and Canada are evaluating floating solar and wind installations to maximize energy production within restricted space environments and environmentally sensitive areas. The industry growth receives support through renewable energy project investments and suitable regulatory frameworks alongside technological progress. The worldwide floating power plant market recognizes North America as a principal force because of its requirement for adaptable power generation systems and increasing climate change concerns.

Europe Floating Power Plant Market Trends

Europe's floating power plant market is growing significantly because the region has strong renewable energy targets and is developing offshore energy technology. The Netherlands, together with Norway and the UK, and Germany, invests in floating wind and solar projects to optimize energy generation in coastal and deepwater zones, which traditional infrastructure cannot reach. The region's advanced maritime industry, along with supportive regulations and sustainable energy funding, accelerates the market adoption of these technologies. Floating power plants present a solution to power grid instability, which arises from unpredictable renewable energy supply. The transition of Europe towards sustainable energy systems requires floating power plants to fulfill both energy demands and environmental objectives.

Key Floating Power Plant Companies:

The following are the leading companies in the floating power plant market. These companies collectively hold the largest market share and dictate industry trends.

- Wärtsilä

- CHN ENERGY Investment Group Co. LTD

- Ciel et Terre International, SAS

- Siemens Energy

- Floating Power Plant A/S

- Karadeniz Holding

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- GE Vernova

- Kawasaki Heavy Industries, Ltd.

- Swimsol

- Others

Recent Developments

- In June 2024, Floating Power Plant declared that Siemens Gamesa Renewable Energy had delivered a 4.3-megawatt SWT-DD-120 wind turbine generator to it. Off the Spanish coast of Gran Canaria, this development allows the business to move forward with its main demonstrator project. An essential aspect of this project is the generator's integration of wind and wave power, as well as hydrogen storage technologies. The initiative had already been awarded a grant of more than USD 27 million from the EU Innovation Fund, demonstrating its significance in advancing the EU's sustainable energy goals.

- In February 2024, HEXA Renewables, an Asian renewable energy firm, and Ciel & Terre Taiwan, a developer of floating solar PV products, announced the completion of a near-shore floating solar project in Taiwan. The Changbin Industrial Park in Changhua County is home to the project, which has a 440MWp capacity. Of that, 280MWp of floating photovoltaic (FPV) is provided by Ciel & Terre Taiwan. In order to reduce the FPV's movement under any circumstances, Ciel and Terre have also developed the New Pillar anchoring system.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the floating power plant market based on the below-mentioned segments:

Global Floating Power Plant Market, By Power Source

- Non-renewable

- Renewable

Global Floating Power Plant Market, By Power Rating

- Low (Less than 20 MW)

- Medium (20 MW to 100 MW)

- High (Greater than 100 MW)

Global Floating Power Plant Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 225 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |