Global Fluorinated Compounds Market

Global Fluorinated Compounds Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Product Type (Fluorocarbons, Fluoropolymers, Inorganics, and Fluoroelastomers), By Application (Refrigerants, Electronics, Aluminum Production, Automotive, and Pharmaceuticals), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Fluorinated Compounds Market Summary, Size & Emerging Trends

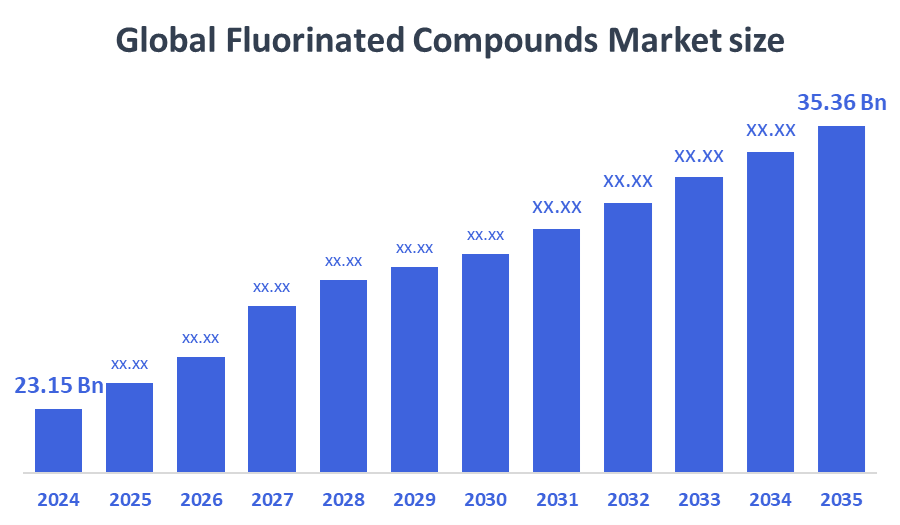

According to Decision Advisor, The Global Fluorinated Compounds Market Size is Expected to Grow from USD 23.15 Billion in 2024 to USD 35.36 Billion by 2035, at a CAGR of 3.93% during the forecast period 2025-2035. Increasing demand across refrigeration, electronics, and automotive industries is a key driving factor for the fluorinated compounds market.

Key Market Insights

- Asia Pacific is expected to account for the largest share in the fluorinated compounds market during the forecast period.

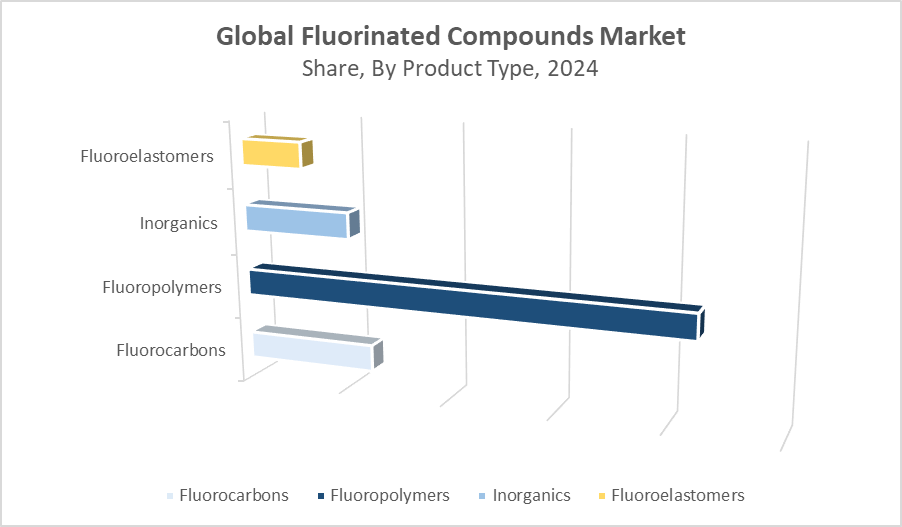

- In terms of product type, the fluoropolymers segment dominated in terms of revenue during the forecast period.

- In terms of application, the refrigerants segment accounted for the largest revenue share in the global fluorinated compounds market during the forecast period.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 23.15 Billion

- 2035 Projected Market Size: USD 35.36 Billion

- CAGR (2025-2035): 3.93%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Fluorinated Compounds Market

The fluorinated compounds market centers on the production of compounds containing fluorine, which are critical in diverse applications such as refrigeration, electronics manufacturing, aluminum production, and pharmaceuticals. These compounds are valued for their chemical stability, resistance to heat, and unique electrical properties. Global industrial growth and technological advances are driving increased demand for specialized fluorinated compounds. Governments worldwide are promoting environmentally friendly alternatives in refrigerants and manufacturing, influencing market dynamics. The push for sustainable production and stringent environmental regulations shapes ongoing product innovation and adoption. The market’s expansion is fueled by the growing need for advanced materials in automotive, electronics, and pharmaceutical sectors.

Fluorinated Compounds Market Trends

- Increasing shift towards eco-friendly and low-global warming potential (GWP) refrigerants.

- Innovations in fluoropolymers enhancing durability and application scope in electronics and automotive sectors.

- Strategic partnerships and mergers to broaden product portfolios and geographical reach.

Fluorinated Compounds Market Dynamics

Driving Factors: Rising demand from refrigeration, electronics, and automotive industries

Key growth factors for the fluorinated compounds market include rising demand from the refrigeration, electronics, and automotive sectors, where these compounds are essential for enhancing performance, efficiency, and durability. The growing aluminum production industry also contributes to demand for inorganic fluorides. Government incentives promoting the use of low-global warming potential (GWP) refrigerants and advanced fluoropolymers further drive market expansion. Technological improvements in fluorinated compound synthesis and processing enhance product performance and production efficiency, attracting broader industrial adoption. These factors collectively support sustained market growth across developed and emerging economies.

Restrain Factors: Environmental regulations and fluctuating raw material prices may limit market growth

Restraining factors in the fluorinated compounds market include stringent environmental regulations aimed at limiting the use of high-GWP compounds, particularly in refrigerants. These policies can lead to phase-outs or restrictions that impact market dynamics. Additionally, the availability of alternative materials and substitutes reduces dependence on fluorinated compounds in certain applications. Fluctuating prices of raw materials such as fluorspar add financial pressure, while the complexity and cost of production hinder scalability for smaller players. Together, these factors may restrain market expansion and demand more innovation in sustainable production methods.

Opportunity: Adoption of eco-friendly fluorinated compounds and pharmaceutical applications creates new growth avenues

The fluorinated compounds market presents several promising opportunities. The growing adoption of eco-friendly refrigerants, especially in line with Kigali Amendment targets and carbon neutrality goals, creates substantial demand. Expansion of the pharmaceutical industry is also a key opportunity, as fluorinated compounds are increasingly used in drug formulation to enhance efficacy and stability. Furthermore, technological innovations in recycling, production optimization, and green chemistry open new paths for sustainable growth. Emerging markets investing in advanced manufacturing offer untapped potential, while strategic collaborations can broaden product portfolios and application areas in electronics, healthcare, and renewable energy.

Challenges: Supply chain constraints, regulatory complexity, and geopolitical risks

Challenges in the fluorinated compounds market include supply chain disruptions due to geopolitical tensions and dependence on a limited number of raw material suppliers, especially for fluorspar and other critical inputs. Regulatory hurdles surrounding the approval of new fluorinated chemicals can be complex and time-consuming, delaying product launches and innovation. Environmental compliance costs are rising, impacting profitability, particularly for companies in regions with stricter emissions controls. The highly technical nature of production also requires significant capital investment and expertise, making it difficult for new entrants and smaller players to compete effectively in the global market.

Global Fluorinated Compounds Market Ecosystem Analysis

The fluorinated compounds market ecosystem consists of raw material suppliers, primarily fluorine and fluorspar producers, manufacturers, and diverse end-users across refrigeration, electronics, aluminum, automotive, and pharmaceutical sectors. Manufacturers rely on stable raw material sourcing and focus on technological innovation to improve product performance. Regulatory compliance, especially concerning environmental standards, plays a crucial role. Companies are also adopting sustainable production practices to meet global climate goals. Strategic partnerships and vertical integration help strengthen supply chains and ensure competitiveness in a rapidly evolving market landscape.

Global Fluorinated Compounds Market, By Product Type

The fluoropolymers segment accounted for the largest revenue share of approximately 42% in the global fluorinated compounds market in 2024. This dominance is attributed to their widespread use in high-performance applications such as electronics insulation, wire coatings, fuel hoses, and automotive seals. Their exceptional thermal stability, chemical resistance, and electrical properties make them indispensable in harsh environments. The growing adoption of electric vehicles and advanced electronic devices continues to drive demand, reinforcing the segment’s strong revenue position during the forecast period.

The fluorocarbons segment held a notable share of around 28% in the global market in 2024, primarily driven by their extensive use as refrigerants in HVAC systems and cooling applications. However, this segment faces increasing regulatory pressure due to their high global warming potential (GWP), particularly under frameworks like the Kigali Amendment and F-Gas regulations. As a result, demand is gradually shifting toward low-GWP alternatives, affecting long-term growth. Despite this, fluorocarbons remain crucial in several industrial cooling processes where alternatives are still emerging.

Global Fluorinated Compounds Market, By Application

The refrigerants segment accounted for the largest revenue share of approximately 46% in the global fluorinated compounds market in 2024. This growth is driven by increasing demand for energy-efficient cooling systems and the global transition to low-global warming potential (GWP) refrigerants. Fluorinated compounds such as HFOs and HCFCs are widely used in HVAC, refrigeration, and air conditioning systems. Regulatory support for sustainable cooling technologies under agreements like the Kigali Amendment further accelerates demand, securing this segment’s leadership in the market.

The electronics segment held a significant revenue share of around 22% in 2024, fueled by growing global demand for semiconductors, circuit boards, and high-performance electronic components. Fluorinated compounds are essential for insulation, dielectric layers, etching gases, and heat resistance in advanced electronics. Their stability under extreme temperatures and chemical exposure makes them ideal for precision manufacturing. As 5G deployment, data centers, and consumer electronics expand globally, this segment continues to gain momentum, making it one of the fastest-growing application areas for fluorinated compounds.

Asia Pacific held the largest share of approximately 44% in the global fluorinated compounds market in 2024.

This dominance is fueled by robust growth in electronics, automotive, and refrigeration industries, particularly in China, Japan, South Korea, and India. The region’s strong manufacturing base, rising middle-class population, and increasing demand for consumer electronics and cooling systems support market expansion. Additionally, government initiatives promoting energy efficiency and environmental sustainability further enhance adoption of low-GWP fluorinated products in this high-growth region.

North America accounted for a market share of around 24% in 2024,

driven by strict environmental regulations and growing demand for low-GWP refrigerants. The U.S. and Canada are leading adopters of next-generation fluorinated compounds, particularly in HVAC, automotive, and semiconductor industries. Strong R&D infrastructure and presence of key manufacturers like Chemours and Honeywell support innovation and product development. Additionally, increasing investments in electric vehicles and smart infrastructure continue to drive regional demand for high-performance fluoropolymers and specialty gases.

Europe held a significant share of approximately 20% in the global market,

supported by strong environmental policies and industrial adoption of sustainable technologies. The region’s push to phase out high-GWP fluorocarbons under the EU F-Gas Regulation has accelerated the shift toward low-emission refrigerants and eco-friendly fluorinated materials. Countries like Germany, France, and the UK are at the forefront of adopting green technologies in refrigeration, automotive, and pharmaceuticals. Strong focus on circular economy and innovation makes Europe a key market for sustainable fluorinated solutions.

WORLDWIDE TOP KEY PLAYERS IN THE FLUORINATED COMPOUNDS MARKET INCLUDE

-

- The Chemours Company

- Daikin Industries, Ltd.

- Honeywell International Inc.

- Solvay S.A.

- 3M Company

- Arkema S.A.

- Gujarat Fluorochemicals Ltd.

- Mexichem S.A.B. de C.V.

- Sinochem Group

- Dongyue Group

- Others

Product Launches in Fluorinated Compounds Market

- In March 2024, Chemours launched a next-generation low-global warming potential (GWP) refrigerant specifically designed for commercial cooling applications. This innovation aligns with evolving environmental regulations in North America and Europe, which are phasing down high-GWP substances under the Kigali Amendment and regional F-Gas rules. The new refrigerant offers improved energy efficiency and lower climate impact, supporting Chemours’ sustainability goals. This launch strengthens the company’s position in the eco-friendly refrigerant market and addresses rising demand for compliant, high-performance cooling solutions.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisor has segmented the fluorinated compounds market based on the below-mentioned segments:

Global Fluorinated Compounds Market, By Product Type

-

- Fluorocarbons

- Fluoropolymers

- Inorganics

- Fluoroelastomers

Global Fluorinated Compounds Market, By Application

-

- Refrigerants

- Electronics

- Aluminum Production

- Automotive

- Pharmaceuticals

Global Fluorinated Compounds Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

FAQs

Q: What is the market size of the Global Fluorinated Compounds Market in 2025?

A: The Global Fluorinated Compounds Market size is projected to reach approximately USD 24.05 billion in 2025, growing from USD 23.15 billion in 2024.

Q: What is the forecasted CAGR of the Global Fluorinated Compounds Market from 2025 to 2035?

A: The market is expected to grow at a CAGR of 3.93% during the period 2025–2035.

Q: What is the revenue potential of fluorinated compounds in the Asia–Pacific region by 2035?

A: The Asia–Pacific region is projected to generate over USD 15 billion in revenue by 2035, maintaining its position as the largest regional market.

Q: Who are the top 10 companies operating in the Global Fluorinated Compounds Market?

A: Key players include The Chemours Company, Daikin Industries, Honeywell International, Solvay S.A., 3M Company, Arkema S.A., Gujarat Fluorochemicals, Mexichem, Sinochem Group, and Dongyue Group.

Q: Which startups or regional players are disrupting the fluorinated compounds market?

A: Regional innovators in Asia and Europe, such as Dongyue Group (China) and Arkema (France), are expanding capabilities in low-GWP refrigerants and advanced fluoropolymers, contributing to market disruption.

Q: Can you provide company profiles for leading fluorinated compound manufacturers?

A: Yes. For example, Chemours focuses on sustainable refrigerants and high-performance fluoropolymers, while Daikin offers a broad portfolio of HVAC-compatible fluorinated solutions and holds strong patents in low-GWP technologies.

Q: What are the main drivers of growth in the fluorinated compounds market?

A: Rising demand from refrigeration, electronics, automotive, and pharmaceuticals, along with technological innovation and government incentives for low-GWP refrigerants, are key market drivers.

Q: What challenges are limiting the adoption of fluorinated compounds?

A: Major challenges include strict environmental regulations, high raw material costs, supply chain disruptions, and the availability of alternative materials.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 234 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |