Global Foam Concrete Market

Global Foam Concrete Market Size, Share, and COVID-19 Impact Analysis, By Concrete Type (Precast Foam Concrete Elements, Ready-mix Foam Concrete, On-site Produced Foam Concrete, Others), By End-use (Residential Construction, Commercial Construction, Infrastructure & Industrial, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Foam Concrete Market Summary

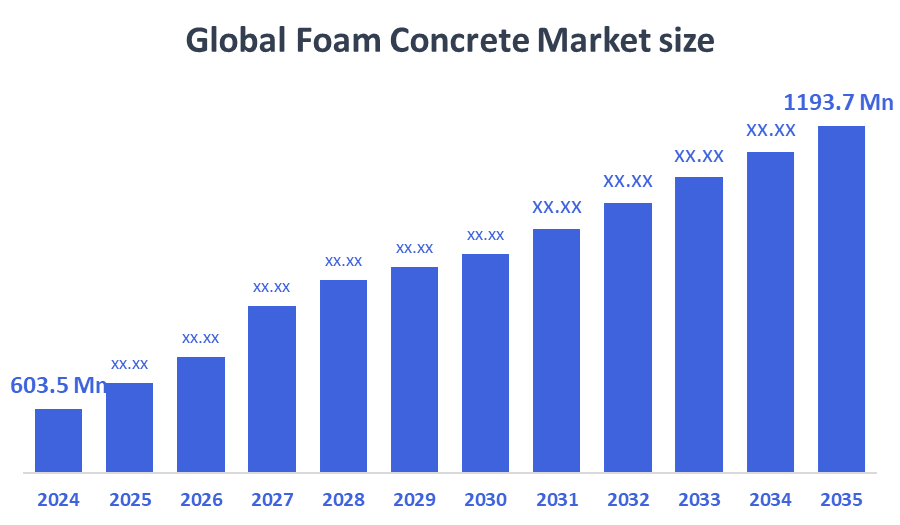

The Global Foam Concrete Market Size Was Estimated at USD 603.5 Million in 2024 and is Expected to Reach USD 1193.7 Million by 2035, Registering a CAGR of 6.4% from 2025 to 2035. The market for foam concrete is expanding due to factors like cost-effectiveness, increased infrastructure development, enhanced thermal and sound insulation qualities, and growing demand for lightweight building materials, especially in emerging economies that prioritise sustainable and energy-efficient building solutions.

Key Regional and Segment-Wise Insights

- In 2024, the Asia Pacific foam concrete market held the largest revenue share of 38.3% and dominated the global market.

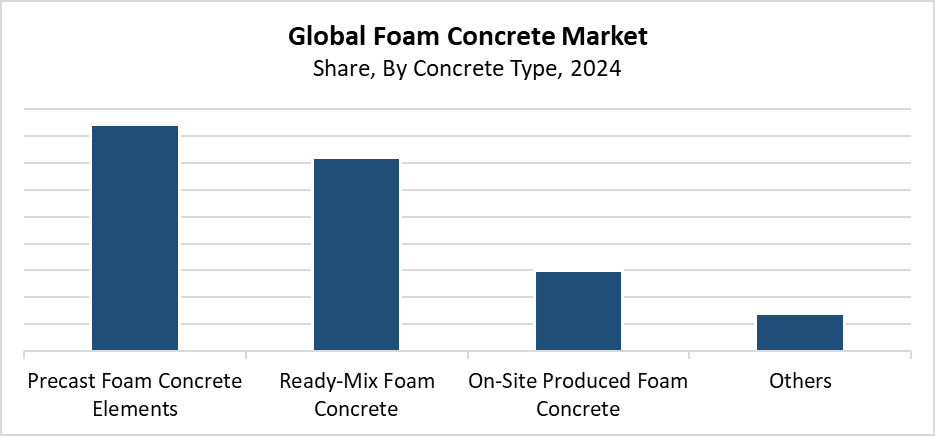

- In 2024, the precast foam concrete elements segment held the highest revenue share of 42.4% and dominated the global market by concrete type.

- With the biggest revenue share of 41.2% in 2024, the residential construction segment led the worldwide foam concrete market by end use.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 603.5 Million

- 2035 Projected Market Size: USD 1193.7 Million

- CAGR (2025-2035): 6.4%

- Asia Pacific: Largest market in 2024

The foam concrete market produces lightweight concrete through the process of mixing foam into cement-based slurry, which results in its application. The construction industry employs foam concrete for various applications, including void filling, roof insulation, road sub-base, and precast blocks, because of its lightweight properties, thermal insulation, and fire-resistant capabilities. The need for cost-effective, sustainable, lightweight building materials has driven the rising demand for this product. Established and emerging economies experience major growth through infrastructure development and fast urban expansion, and sustainable construction practices. The construction industry chooses foam concrete because it provides the benefits of reduced structural weight and shorter construction periods.

Technological advancements have played a major role in the expansion of the foam concrete market. The development of pumpable formulations, automated mixing systems, and foaming agents has resulted in better material performance and faster production operations. The development of fibre-reinforced and high-strength foam concrete materials has expanded the application possibilities for foam concrete products. Green building regulations and eco-friendly material subsidies, and infrastructure spending programs function as key tools which governments worldwide use to promote sustainable construction practices in developing nations. The programs function as a catalyst to drive sustainable market growth. They do so through their support of foam concrete usage in residential and public infrastructure construction.

Concrete Type Insights

The precast foam concrete elements segment leads the foam concrete market with the largest revenue share of 42.4% in 2024. The segment's effectiveness, reliable quality, and simplicity of installation are the main reasons for its supremacy. The infrastructure and commercial and residential construction sectors use precast elements, including blocks, panels, and slabs, because these components provide fire resistance and thermal insulation while being lightweight. The manufacturing process under controlled conditions produces products with uniform strength and durability. This helps decrease construction site work and time. The market growth for adoption receives support from two main factors, which include sustainable building practices and modular construction systems. The market leadership of precast foam concrete continues because it supports construction projects that are both quick, economical, and environmentally conscious.

The ready-mix foam concrete segment of the foam concrete market is expected to grow at a significant rate over the forecast period because it delivers on-site flexibility, fast construction times, and affordable building costs. Ready-mix foam concrete batching plants produce the material at a consistent quality level while minimising waste during delivery to construction sites. The material functions as a pumpable substance, which makes it ideal for applications such as trench restoration and void filling, and floor levelling in both new construction and renovation projects. The market receives additional support from expanding urban infrastructure development. This mainly takes place in areas with high population density. The construction industry has adopted ready-mix foam concrete as its preferred choice for large-scale projects because of enhanced performance and workability, which stem from new mixing technology and foaming agent developments.

End-use Insights

The residential construction segment led the foam concrete market with the largest revenue share of 41.2% in 2024. The housing sector needs affordable lightweight energy-efficient construction materials, which drives this leadership position. Foam concrete finds residential applications through its thermal insulation properties and fire resistance, and easy handling characteristics in soundproofing, wall panels, and blocks, and floor and roof insulation. Foam concrete usage in residential buildings has grown rapidly because governments now support cost-effective housing projects, and urban areas are expanding quickly throughout developing countries. The solution functions as the ideal answer to current housing requirements because it decreases structural loads and construction expenses. It supports environmentally friendly building practices.

The commercial construction segment of the foam concrete market is expected to grow at the fastest CAGR during the forecast period. Increased investments in commercial infrastructure, such as offices, shops, hotels, and educational facilities, especially in urban regions, are the main driver of this expansion. Foam concrete gains popularity in commercial construction projects because of its lightweight properties and thermal and acoustic insulation abilities, and its ability to speed up construction work. The promotion of sustainable construction practices and green building certifications supports the use of environmentally friendly materials. This includes foam concrete. The commercial applications of foam concrete continue to grow because of technological advancements which enhance its strength and adaptability for use in modern, cost-effective, and energy-efficient building designs.

Regional Insights

The North American foam concrete market experiences substantial growth because the construction industry needs sustainable building materials that provide energy efficiency. The region supports foam concrete through its green building regulations, increasing residential construction and infrastructure maintenance projects. The material works well for different construction projects because it delivers economical value, fire protection, and thermal insulation, and it weighs less than traditional materials. The construction industry in the United States and Canada uses foam concrete for prefabricated elements, void filling, and road construction projects. The market growth receives additional support from modern construction technology and the expanding popularity of modular building systems and off-site construction methods. The market growth receives support from government financial backing. This promotes environmentally friendly construction methods.

Asia Pacific Foam Concrete Market Trends

Asia Pacific leads the worldwide foam concrete market with the largest revenue share of 38.3% in 2024. The primary factors that drive this leadership position include rapid urban growth, infrastructure development, and expanding construction activities in China, India, and Southeast Asian countries. The region's demand for foam concrete materials has risen because of government programs that support sustainable building materials, energy efficiency, and the increasing focus on affordable housing development. The material serves as an excellent solution for constructing large-scale residential and commercial structures because it provides lightweight construction at affordable costs while offering thermal insulation properties. The Asia Pacific foam concrete market benefits from two main factors, which include the rising use of modular and prefabricated building methods. The market also benefits from the expanding knowledge of environmentally friendly construction techniques.

Europe Foam Concrete Market Trends

The European foam concrete market experiences steady growth because the continent dedicates itself to sustainable construction methods and energy-saving products. European countries now prefer foam concrete as their lightweight, eco-friendly building material choice for all infrastructure, commercial, and residential construction projects. The building material meets both green construction requirements and European Union regulations through its fire safety properties and weight reduction, and thermal insulation performance. The market experiences growth because of infrastructure renewal activities and rising demand for prefabricated and modular building solutions. The German, UK, and French governments support foam concrete adoption through their carbon reduction programs and research initiatives. The foam concrete industry benefits from an optimistic outlook because the area maintains strong environmental conservation initiatives.

Key Foam Concrete Companies:

The following are the leading companies in the foam concrete market. These companies collectively hold the largest market share and dictate industry trends.

- JB International

- CLC Foam Concrete

- Guangzhou Hengde Construction Technology Co., Ltd.

- THT International

- EasyMix Concrete

- Namra Tech

- Tarmac

- Total Concrete Ltd

- Heidelberg Materials AG

- Others

Recent Developments

- In July 2024, Heidelberg Materials AG established a selective separation recycling plant close to Katowice, Poland, to replace virgin materials in the manufacturing of concrete and more thoroughly recycle demolition debris (gravel, sand).

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the foam concrete market based on the below-mentioned segments:

Global Foam Concrete Market, By Concrete Type

- Precast Foam Concrete Elements

- Ready-Mix Foam Concrete

- On-Site Produced Foam Concrete

- Others

Global Foam Concrete Market, By End Use

- Residential Construction

- Commercial Construction

- Infrastructure & Industrial

- Others

Global Foam Concrete Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 234 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |