Global Food Cold Chain Market

Global Food Cold Chain Market Size, Share, and COVID-19 Impact Analysis, By Type (Storage, Transportation, Monitoring Components), By Construction Type (Grocery Stores, Restaurants, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Food Cold Chain Market Size Summary

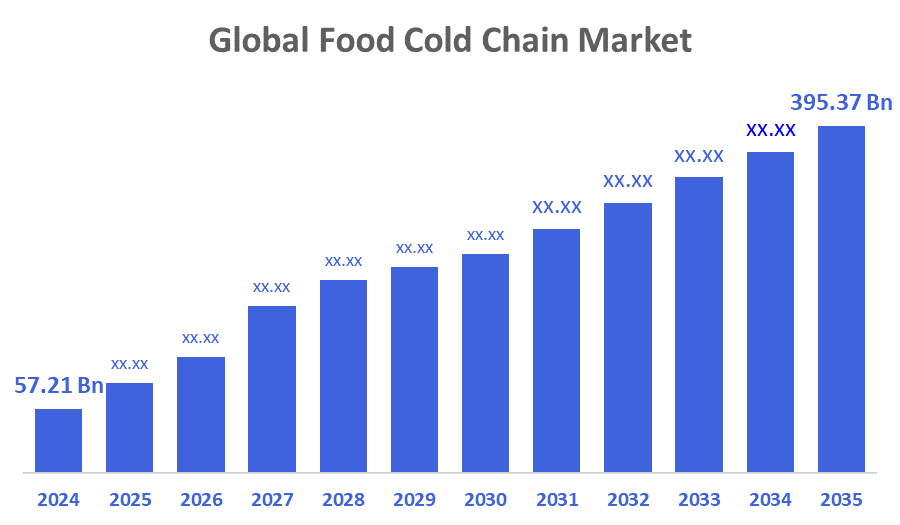

The Global Food Cold Chain Market Size Was Estimated at USD 57.21 Billion in 2024 and is Projected to Reach USD 395.37 Billion by 2035, Growing at a CAGR of 19.21% from 2025 to 2035. Stricter food safety laws, increased international trade in temperature-sensitive goods, greater demand for perishable food, increased e-commerce for fresh and frozen foods, and improvements in refrigeration and logistics technology are all driving growth in the food cold chain market.

Key Regional and Segment-Wise Insights

- In 2024, the North American food cold chain market led globally by holding the largest revenue share of 30.5%.

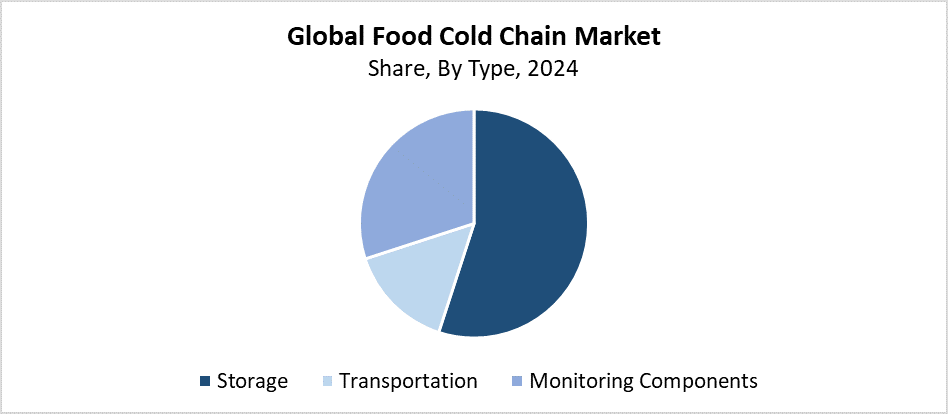

- In 2024, the storage segment had the highest revenue share by type, accounting for 55.7%.

- In 2024, the restaurants segment had the highest revenue share of 45.3% and led the market based on construction type.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 57.21 Billion

- 2035 Projected Market Size: USD 395.37 Billion

- CAGR (2025-2035): 19.21%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The food cold chain market represents a temperature-controlled supply chain system that handles the storage and distribution of perishable food products such as dairy, meat, fish, and vegetables. The system ensures perfect temperature control throughout production-to-consumption stages, which protects food quality and safety and extends shelf life. Several key drivers fuel the expanding worldwide demand for frozen and perishable goods, including increased consumer food safety awareness as well as rapid urbanization and the expansion of organized retail and e-commerce platforms. The growing international food trade alongside rising temperature-sensitive product exports has led to an increased demand for efficient cold chain logistics, primarily in developing countries.

The food cold chain industry undergoes a fundamental transformation because of technological progress. Automated warehousing systems, together with GPS tracking and real-time temperature monitoring and refrigeration technology, enable better cold chain operations and reduce product spoilage. Blockchain technology, together with data analytics and IoT networks, enable complete visibility and traceability while ensuring food safety rule compliance. Worldwide governments support the market by launching programs that include infrastructure development alongside cold storage facility subsidies and strict food safety rules. These initiatives, together with private sector investments, have created a new advanced cold chain system that operates globally.

Type Insights

The storage segment dominated the food cold chain market by generating the largest revenue share of 55.7% in 2024. The large market exists because companies must maintain freshness while following safety protocols through proper storage of dairy products, meat, seafood, and fresh fruits and vegetables at specified temperature ranges. The rise in frozen and chilled food demand and supermarket and food processing industry expansion has led to a substantial increase in cold storage facilities. The storage sector saw growth because of advancements in energy-efficient cooling systems, together with refrigeration technology enhancements and warehouse management automation. The rising focus on reducing food waste alongside shelf-life extension drives the requirement for reliable cold storage systems.

The food cold chain market's monitoring components segment is expected to grow at the fastest CAGR during the forecast period because of rising requirements for real-time tracking and temperature control of perishable food products. Businesses invest in advanced monitoring systems to meet compliance standards while preventing food contamination and spoilage during storage and transportation because food safety regulations across different countries are becoming more stringent. Through these elements, the entire cold chain gains total visibility along with traceability, which includes RFID tags, cloud-based data platforms, GPS tracking systems, and Internet of Things sensors. The market experiences growth because automation adoption alongside smart logistics implementation expands, and consumer demand for food quality transparency and sourcing traceability continues to rise.

Construction Type Insights

The restaurants segment led the food cold chain market by holding the largest revenue share of 45.3% in 2024. The foodservice industry growth, together with customer preference for dining out and expanding takeaway and delivery businesses, explains this large market share. Restaurants depend heavily on cold chain infrastructure to maintain food safety standards and quality while following health regulations in their storage and management of perishable products, which include meat, fish, dairy, and fresh produce. The rising demand for dependable cold storage and temperature monitoring solutions has grown because of cloud kitchens alongside quick-service restaurants (QSRs) and fast-casual dining establishments. The increased focus on food waste reduction leads to more investment in cold chain solutions.

The food cold chain market's grocery stores segment is expected to grow at the fastest CAGR throughout the forecast period. The increase stems primarily from rising customer demand for frozen, fresh, and perishable food products and the rapid expansion of modern retail chains and supermarkets, especially in developing markets. Grocery retailers require reliable cold chain infrastructure to maintain food quality while reducing spoilage and meeting strict food safety standards. The rise of online grocery shopping combined with last-mile delivery services has created increased demand for effective temperature-controlled storage and transportation solutions. The segment achieves accelerated growth alongside operational success because of technological advancements that integrate energy-efficient cooling systems with real-time monitoring capabilities and smart refrigeration technologies.

Regional Insights

The global food cold chain market is dominated by the North America region with the largest revenue share of 30.5% in 2024. The leadership position of this market segment stems from strict food safety regulations and quality standards, and the established food industry and advanced logistics systems. The high consumption of perishable goods in this region demands comprehensive cold chain systems throughout all stages from production to consumer delivery. The fast growth of meal delivery services, together with online grocery stores, has driven increased requirements for temperature-controlled storage and transport solutions. The industry gains strength through investments in smart cold chain technology, which includes automated warehousing and energy-efficient refrigeration and IoT-enabled monitoring systems. Market supremacy remains intact due to the presence of substantial cold chain service providers.

Europe Food Cold Chain Market Trends

The food cold chain market recognized Europe as a lucrative business location in 2024 because of the European Union's strict food safety requirements, together with increasing demand for high-quality perishable food items. The region's strict food waste reduction policies, supply chain transparency requirements, and cold chain preservation standards have led to increased adoption of advanced refrigeration and monitoring systems throughout Europe. The United Kingdom, together with France and Germany, leads the development of cold chain infrastructure, especially for the culinary and retail sectors and the pharmaceutical industries. The increasing need for efficient cold storage and transportation solutions stems from the growth of online grocery shopping, together with international food trading activities. The European market potential expands through investments made in sustainable cold chain technologies that focus on energy efficiency and environmental responsibility.

Asia Pacific Food Cold Chain Market Trends

The Asia Pacific food cold chain market is expected to grow at the fastest CAGR through the projected period because of fast urban development, rising disposable incomes, and increased demand for fresh and frozen foods. The rapid development of organized retail and e-commerce sectors and foodservice industries in China, India, Japan, and Southeast Asian countries creates growing demand for efficient cold chain logistics solutions. The expanding population base and mounting awareness about food safety standards together push higher demand growth in the region. The industry growth benefits from government initiatives, which modernize supply chains and develop better cold storage infrastructure. Technological advancements such as energy-efficient refrigeration and IoT-based temperature monitoring systems help improve cold chain efficiency throughout the Asia Pacific region.

Key Food Cold Chain Companies:

The following are the leading companies in the food cold chain market. These companies collectively hold the largest market share and dictate industry trends.

- Americold Logistics LLC

- Cold Chain Technologies, Inc.

- Lineage Logistics, LLC

- Agro Merchant Group

- Preferred Freezer

- Wabash National

- Henningsen Cold Storage Company

- Nordic Logistics

- Burris Logistics, Inc.

- Cryopak Industries Inc.

- Others

Recent Developments

- In May 2024, Candor Expedite established Candor Food Chain, a new cold chain division. It uses a cutting-edge reusable cold packaging technology in conjunction with its nationwide shipping services to keep frozen and chilled cargo at regulated temperatures for up to nine days while being transported normally. This technology, which was unveiled in collaboration with the European company Cool Chain, enables the combination of dry and perishable goods in a single truck that supports three temperature zones: freeze, refrigerated, and ambient, reducing the need for multiple deliveries and lowering expenses for food producers, distributors, and retailers throughout the United States.

- In December 2023, Americold Realty Trust and its joint venture, RSA Cold Chain in Dubai, revealed plans to build and run a state-of-the-art cold storage facility in the Port of Jebel Ali, Dubai's Jebel Ali Free Zone (Jafza), that will cost USD 35 million. Temperature-sensitive food products' cold chain requirements will be supported by the facility's 40,000 pallet locations and multi-temperature storage options. This project aims to improve the operational efficiency and resilience of the food and beverage supply chain throughout the United Arab Emirates and the larger Middle East by fortifying the strategic partnership between Americold and DP World, a world leader in port operations and supply chain logistics.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the food cold chain market based on the below-mentioned segments:

Global Food Cold Chain Market, By Type

- Storage

- Transportation

- Monitoring Components

Global Food Cold Chain Market, By Construction Type

- Grocery Stores

- Restaurants

- Others

Global Food Cold Chain Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 175 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |