Global Foot and Ankle Devices Market

Global Foot and Ankle Devices Market Size, Share, and COVID-19 Impact Analysis, By Product (Orthopedic Implant and Devices, Prostheses, Bracing and Support Devices, and Others), By Application (Trauma and Hairline Fracture, Rheumatoid Arthritis & Osteoarthritis, Diabetic Foot Diseases, Hammertoe, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

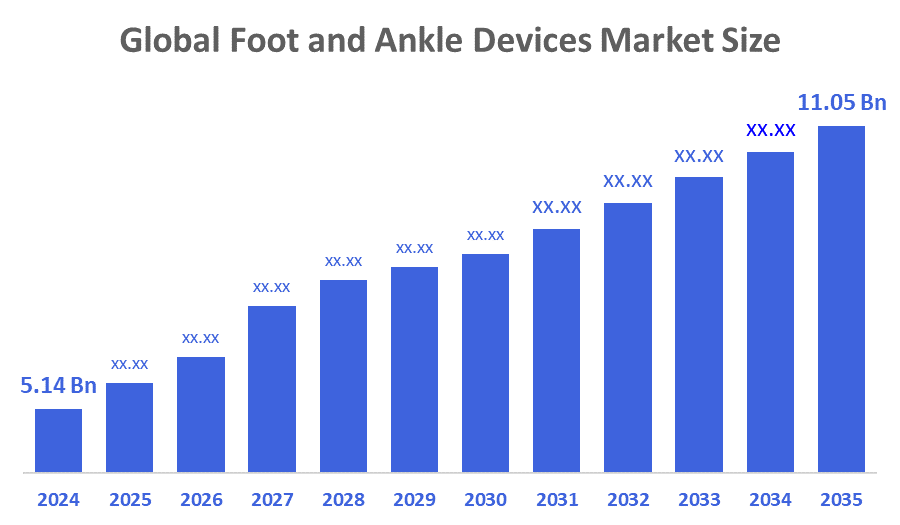

Global Foot and Ankle Devices Market Size Insights Forecasts to 2035

- The Global Foot and Ankle Devices Market Size Was Estimated at USD 5.14 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.21% from 2025 to 2035

- The Worldwide Foot and Ankle Devices Market Size is Expected to Reach USD 11.05 Billion by 2035

- North America is expected to Grow the fastest during the forecast period.

According to a Research Report Published by Decisions Advisors and Consulting, The Global Foot and Ankle Devices Market Size was worth around USD 5.14 Billion in 2024 and is predicted to Grow to around USD 11.05 Billion by 2035 with a compound annual growth rate (CAGR) of 7.21% from 2025 to 2035. The rise in sports injuries, the trend toward minimally invasive and outpatient procedures, technological developments in foot and ankle devices, and the rising incidence of orthopaedic illnesses are some of the main causes of the market's strong growth. Some of the main drivers propelling the market are the growing number of foot and ankle injuries, the ageing population, and the use of three-dimensional (3D) printing.

Market Overview

The foot and ankle devices market includes products that make segment in the medical device market for podiatry, which consists of orthopaedic implants, joint/soft tissue repair implants, prosthetics, bracing/support, and devices to treat arthritis, trauma, diabetic foot conditions, and deformities (such as combative toes) via surgery and rehabilitation. They are used by hospitals, hospitals for outpatient care, aka ambulatory surgical centres, orthopaedic doctors' offices and rehabilitation centres. Foot and ankle devices may include ankle bracing, heel cups, splints for at night, plates, screws, fusion nails, biologics, fixator systems, and artificial ligaments and tendons. The device provides cushioning and support for the injured area to relieve pain, enhance mobility and stability, improve functional capacity, and reduce the risk of developing future complications. Foot/ankle devices also accelerate the healing process, improve rehabilitation potential, and correct deformities caused by injuries.

The American Orthopaedic Foot & Ankle Society (AOFAS) awarded more than $258,000 in grants, funding 12 innovative research projects in foot and ankle orthopaedics. The grants include Resident Awards, Early Career Awards, and support for first-time applicants, aiming to advance patient care and treatment innovation.

Zimmer Biometlaunched two new foot and ankle trauma devices, the Gorilla Pilon Fusion Plating System and the Phantom TTC Trauma Nail, following its $1.1 billion acquisition of Paragon in April 2025. These devices target complex shinbone fractures and hindfoot injuries, reinforcing Zimmer’s strategy to maintain Paragon’s double-digit growth trajectory.

Report Coverage

This research report categorises the Foot and Ankle Devices market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Foot and Ankle Devices market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the Foot and Ankle Devices market.

Driving Factors

The increasing incidence of foot and ankle ailments, combined with an ageing population, is believed to be driving the demand for an assortment of orthopaedic products. As healthcare systems globally continue to focus on rehabilitation and smart mobility, the foot and ankle device market is likely to experience a significant increase in both surgical and non-surgical devices. The use of digital health technology in the foot & ankle device marketplace is growing, as TeleMed and remote monitoring products are changing the way users receive and manage treatment options, making it much easier for users to manage their care. There is also a growing trend toward the development of online E-commerce sites as a means of distributing the vast selection of products available in the foot and ankle device marketplace, making it easier for users to access all of the products they need.

Restraining Factors

One of the most important limitations in the foot and ankle devices industry is that there are not enough surgeons to perform complicated foot and ankle procedures that require extensive or high-tech training. New designs of advanced implants, minimally invasive systems, and customizable products require additional training for surgeons to be used correctly. In addition to limited access to highly skilled orthopaedic specialists in many developing nations, there are also limitations in the speed of adoption and effective deployment of these new types of foot and ankle devices.

Market Segmentation

The foot and ankle devices market share is classified into product, and application.

- The orthopaedic implant segment accounted for the largest market share in 2024 and is projected to grow at a substantial CAGR over the forecast period.

Based on the product, the foot and ankle devices market is segmented into orthopaedic implants, prostheses, bracing and support devices, and others. Among these, the orthopaedic implant segment accounted for the largest market share in 2024 and is projected to grow at a substantial CAGR over the forecast period. Orthopaedic devices and implants are the leading product type in the foot & ankle device market and continue to capture a significant market share as a result of product innovation (advances in design, improved materials). It continues to drive better patient outcomes, as well as their use in surgical procedures such as screws, plates and fixation devices.

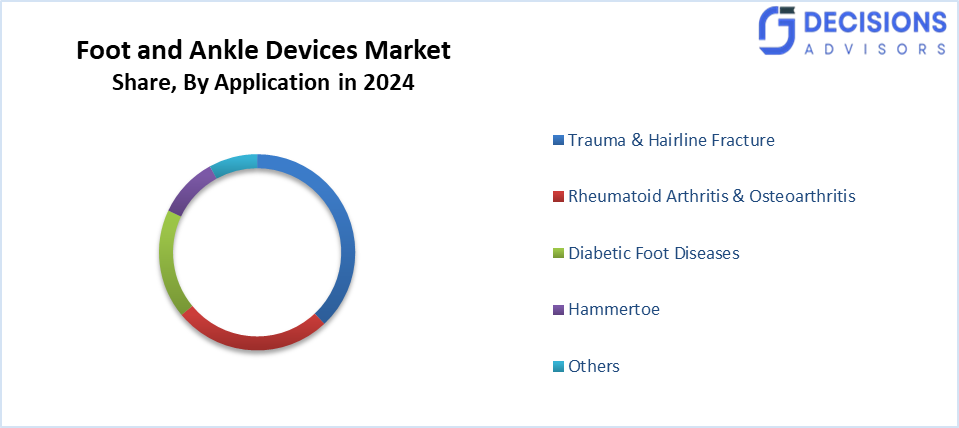

- The trauma and hairline fracture segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the foot and ankle devices market is divided into trauma and hairline fracture, rheumatoid arthritis & osteoarthritis, diabetic foot diseases, hammertoe, and others. Among these, the trauma and hairline fracture segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This growth is primarily linked to an increase in traumatic injuries and stress fractures at workplaces among the workers engaged in logistics, manufacturing and the service sectors. As a result, the clinical detection of hairline fractures has increased significantly, and the market demand for the early-stage, application-specific foot and ankle stabilisation solutions has become greater.

Regional Segment Analysis of the Foot and Ankle Devices Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the foot and ankle devices market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the foot and ankle devices market over the predicted timeframe. In recent years, foot and ankle device manufacturers have localised their production very rapidly as a consequence of the collaboration between hospitals and manufacturers within their respective countries (most notably in China, Japan, and South Korea). By localising their production, these manufacturers can shorten the time it takes to gain regulatory approval and deliver products that can be customised quickly based on the regional anatomical requirements of an individual's feet, eliminating the need for importing products and ultimately enabling them to be adopted by both public and private healthcare systems in a more timely manner.

Along with that, the growing popularity of TAA vs. arthrodesis among surgeons is contributing to the significant increase in Japan's total ankle arthroplasty (TAA) market. The current data from the Japanese national surgical registry indicates a significant increase in TAA procedures over the last few years, primarily due to the ability of these procedures to maintain both joint mobility and enhance the quality of life post-operatively.

North America is expected to grow at a rapid CAGR in the foot and ankle devices market during the forecast period. In the U.S., many hospitals have voluntarily involved themselves with bundled payments for care improvement (BPCI) and other incentive programs, primarily to improve hospital efficiency while providing quality care and cost-effectiveness to the consumer. The incentive structure associated with BPCI Foster hospitals' investments in durable implants and advanced surgical fixation systems, and support for these innovative products, drives down the cost of service associated with re-hospitalisation and long-term care.

There has been a dramatic increase in the provincial public funding of custom orthotics and orthosis support programs throughout Canada. The large provinces have made extensive investments in these programs through their provincial governments, thereby providing their resident population with increased access to custom-fit orthotics to reduce complications related to diabetic foot.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the foot and ankle devices market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Acumed LLC

- Arthrex, Inc.

- CONMED Corporation

- DJO Global

- Exactech, Inc.

- Integra LifeSciences Holdings Corporation

- Johnson & Johnson

- Orthofix Medical Inc.

- Össur hf.

- OsteoMed LLC

- Paragon 28, Inc.

- Smith & Nephew plc

- Stryker Corporation

- Zimmer Biomet Holdings, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2025, MedCAD received 510(k) FDA clearance (Nov 6, 2025) for its AccuStride Fixation Plates, completing its patient-specific foot and ankle system. This marks the first and only FDA-cleared, truly patient-specific 3D?printed titanium implant and cutting guide system in the U.S.

- In October 2025, Zimmer Biomet, together with its subsidiary Paragon 28, launched two new foot and ankle trauma solutions—the Gorilla Pilon Fusion Plating System and the Phantom TTC Trauma Nail to address complex pilon fractures and hindfoot injuries. These products were officially introduced and expanded the company’s trauma portfolio with advanced fixation options.

- In September 2025, Stryker officially launched its FDA-cleared Incompass Total Ankle System at the American Orthopaedic Foot & Ankle Society (AOFAS) 2025 Annual Meeting in Savannah, Georgia. The system is designed for patients with end-stage ankle arthritis and introduces a next-generation implant with enhanced instrumentation to simplify procedures and improve long?term outcomes.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the foot and ankle devices market based on the below-mentioned segments:

Global Foot and Ankle Devices Market, By Product

- Orthopaedic Implant and Devices

- Prostheses

- Bracing and Support Devices

- Others

Global Foot and Ankle Devices Market, By Application

- Trauma and Hairline Fracture

- Rheumatoid Arthritis & Osteoarthritis

- Diabetic Foot Diseases

- Hammertoe

- Others

Global Foot and Ankle Devices Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

- What is the current size of the global foot and ankle devices market?

The market was valued at USD 5.14 billion in 2024.

- What is the projected market size by 2035?

It is expected to reach USD 11.05 billion by 2035.

- What is the CAGR for the forecast period?

The market is projected to grow at a CAGR of 7.21% from 2025 to 2035.

- Which product segment leads the market?

Orthopaedic implants and devices held the largest share in 2024 and are expected to grow substantially.

- Which application segment generates the highest revenue?

Trauma and hairline fractures accounted for the highest revenue in 2024.

- Which region will dominate the market?

Asia-Pacific is anticipated to hold the largest share over the forecast period.

- What are the main growth drivers?

Rising sports injuries, ageing population, minimally invasive procedures, and 3D printing advancements fuel growth.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 252 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Feb 2026 |

| Access | Download from this page |