Global Forklift Rental Market

Global Forklift Rental Market Size, Share, and COVID-19 Impact Analysis, By Ton Capacity (Below 5 Ton, 6-30 Ton, Above 30 Ton), By End Use (Construction, Automotive, Aerospace & Defense, Warehouse and Logistics, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 ? 2035

Report Overview

Table of Contents

Forklift Rental Market Summary

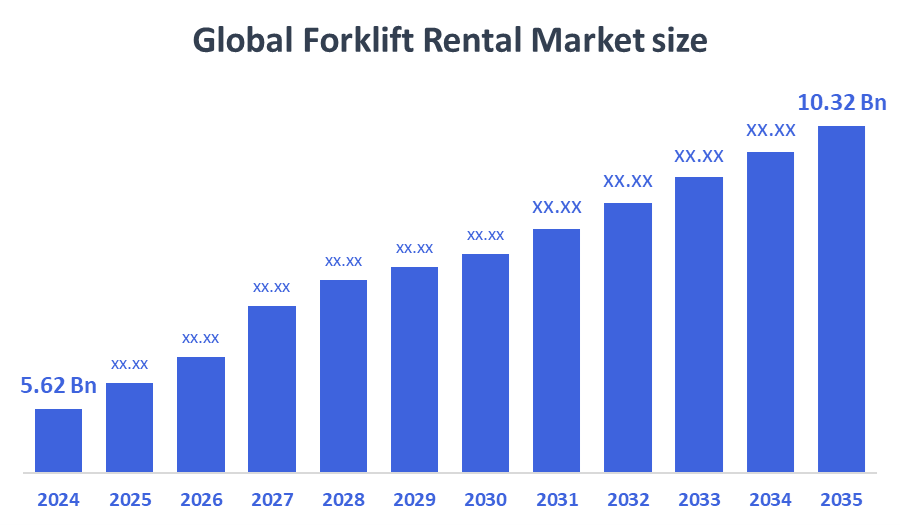

The Global Forklift Rental Market Size Was Estimated at USD 5.62 Billion in 2024 and is Projected to Reach USD 10.32 Billion by 2035, Growing at a CAGR of 5.68% from 2025 to 2035. The market for forklift rentals is expanding because of the growing need for affordable material handling solutions, the automation of warehouses, the need for short-term and seasonal projects, the growth of the e-commerce and logistics industries, and the preference for flexible rental over purchase in order to lower maintenance and capital expenditure costs.

Key Regional and Segment-Wise Insights

- In 2024, Asia-Pacific held the greatest revenue share of 33.6%, dominating the forklift rental industry.

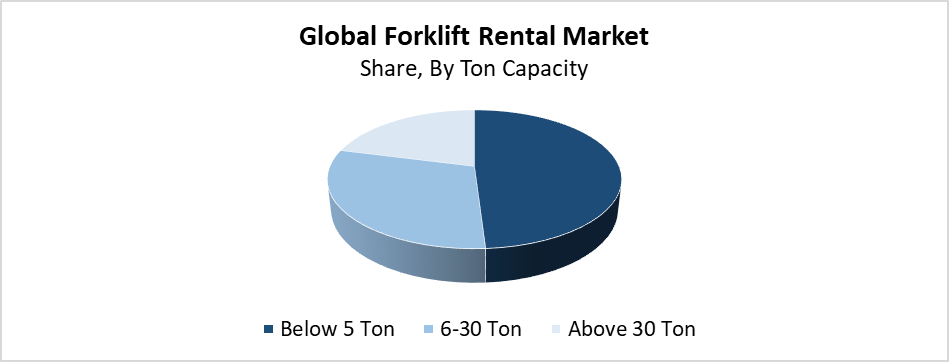

- With the biggest revenue share of 49.8% in 2024, the below-5-ton capacity segment dominated the market by ton capacity.

- In 2024, the warehouse and logistics segment had the biggest market revenue share and dominated the market by end-use.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 5.62 Billion

- 2035 Projected Market Size: USD 10.32 Billion

- CAGR (2025-2035): 5.68%

- Asia-Pacific: Largest market in 2024

The forklift rental market exists to provide short-term and long-term leasing solutions for material handling equipment to companies. Through this arrangement, businesses can efficiently move, lift, and store items without needing to purchase equipment. The market serves multiple industrial sectors that include manufacturing operations, along with logistics services, construction sites, and warehousing operations. The rapid expansion of retail and e-commerce businesses, combined with warehouse automation growth, along with brief project and seasonal demand fluctuations, represent the primary drivers behind its development. Small and medium-sized businesses choose leasing services because they can avoid spending large upfront costs and maintenance fees, as well as equipment depreciation costs. The market grows because customers gain access to modern forklift models while also enjoying flexible and scalable solutions.

Technological progress through electric and automated forklifts transforms the forklift rental industry while delivering better environmental performance, operational safety and efficiency. The implementation of IoT-enabled forklifts with predictive maintenance and real-time monitoring systems reduces expenses and downtime. Government initiatives supporting infrastructure growth and industrial expansion, combined with environmental regulations, promote electric forklift adoption, which drives both innovation and market expansion.

Ton Capacity Insights

Why did the Below 5 Tons Segment Hold the Largest Share of 49.8% in the Forklift Rental Market During 2024?

The below 5 tons segment held the largest revenue share of 49.8% and led the forklift rental market during 2024. The wide-ranging applications of this category throughout various industries, including manufacturing, retail, logistics, and warehousing, make it the leading segment because lighter material handling equipment meets daily operational needs. Forklifts that weigh less than five tons earn preference because they offer cost-effective solutions and easy maneuverability within confined spaces, and convenient operation. The market growth stems from electric and battery-powered forklifts in this capacity range, which demonstrate low maintenance needs and environmentally friendly features. The below 5-ton forklifts serve as the most common rental choice because they offer adaptable functionality to small and medium-sized businesses that need operational efficiency without paying high costs.

The 6-30 Ton segment of the forklift rental market is expected to grow at the fastest CAGR throughout the forecast period because heavy-duty industries such as construction, mining, shipping, and large-scale manufacturing are increasing their requirements. Large heavy objects require high-capacity forklifts for safe and effective transportation in these industrial sectors. Businesses can meet their specific project requirements through forklift rental services while avoiding both initial purchase costs and ongoing maintenance expenses for such heavy-duty equipment. The rising industrial development, together with expanding infrastructure, mainly in developing economies, creates additional market demand. The segment's popularity continues to grow because of technological advancements in fuel efficiency and safety features, as well as electric-powered forklifts, which have boosted its rapid worldwide forklift rental market expansion.

End Use Insights

How Did the Warehouse and Logistics Segment Lead the Forklift Rental Market in 2024?

The warehouse and logistics segment led the forklift rental market and accounted for the largest revenue share in 2024. The rapid expansion of e-commerce, together with rising international trade and increasing requirements for efficient inventory control, drives this sector to lead the market. Facilities handling massive goods volumes need flexible and cost-effective material handling equipment, particularly during peak seasons. Businesses can grow their operations quickly without concern for maintenance expenses or capital investment by utilizing forklift rental services. Warehouse automation, along with real-time logistics systems, has created an increased need for reliable and flexible equipment, which makes renting forklifts a desirable solution. This pattern is expected to persist because supply chain operations evolve toward dynamic and demand-based approaches.

The construction segment within the forklift rental market is expected to grow at the fastest rate during the forecast period because of expanding global infrastructure development, urbanization, and large-scale commercial and residential projects. Construction sites require high-capacity forklifts to handle equipment, pallets, and steel beams as their primary lifting and transportation needs. Project-based and short-term users find forklift rentals beneficial because the service offers flexible usage combined with reduced upfront costs and simplified maintenance requirements. Contractors and small construction organizations, along with other customers, now prefer rental services instead of purchasing equipment, which drives market demand. The market expansion receives significant momentum from the sector because of ongoing improvements in rough-terrain forklifts and telematics systems that enhance safety and operational performance.

Regional Insights

The North American forklift rental industry is expected to experience a substantial CAGR because of the fast-growing warehousing operations, logistics, and e-commerce activities throughout the United States and Canada between now and the forecast period. Organizations select rental alternatives because they require access to current forklift technology and operational versatility, and need to minimize initial costs. The growing number of short-term projects across manufacturing and distribution, and construction industries continues to increase rental demand. The rising popularity of electric forklifts, as well as fleet management and telematics developments, is making rental services more attractive and efficient for customers. The region's forklift rental industry sustains strong growth because of both major rental service providers and government infrastructure programs.

Asia Pacific Forklift Rental Market Trends

The Asia-Pacific region led the forklift rental market with the largest revenue share of 33.6% in 2024. The supremacy of the region is attributed to rapid industrialization, together with e-commerce growth and manufacturing and logistics industry development in China, India, Japan, and South Korea. Local businesses increasingly choose forklift rentals because this method helps them manage changing demand while reducing capital costs and maintaining flexible operations. The rise of warehouse expansion alongside construction projects and infrastructure development has driven an increased need for temporary and project-based forklift rentals. The market expansion receives support from both advancements in electric and fuel-efficient forklifts and increasing recognition of cost-efficient fleet management practices. The leading market position of Asia-Pacific stems from industrial development initiatives that government agencies support.

Europe Forklift Rental Market Trends

The European forklift rental market continues to grow significantly in 2024 because of increasing demand for versatile, cost-effective material handling solutions in manufacturing and automotive, as well as transportation and construction sectors. Businesses now prefer to rent instead of owning equipment because they want to reduce capital costs while boosting efficiency and maintaining rapid flexibility for changing operational needs. Warehouse automation alongside e-commerce expansion drives an increase in forklift rental usage. Europe's environmental focus drives the increasing adoption of electric and eco-friendly forklifts in rental fleets. The market expansion across the region continues because of established rental providers and government rules that support sustainable logistics operations.

Key Fortlift Rental Companies:

The following are the leading companies in the forklift rental market. These companies collectively hold the largest market share and dictate industry trends.

- United Rentals, Inc

- Caterpillar

- Crown Equipment Corporation

- Sunbelt Rentals, Inc.

- Toyota

- Boels Rental

- Nishio Rent All (M) Sdn Bhd

- Herc Rentals Inc.

- KION GROUP AG

- Komatsu

- Others

Recent Developments

- In February 2023, Ahern Rentals was acquired by United Rentals, Inc. for USD 2 billion (announced Dec 2022, concluded Feb 2023), adding 106 locations and 60,000 rental assets. The company also reported record quarterly revenues. United Rentals, Inc.'s inventory and clientele were further increased by Ahern's specialist rental company, which included forklifts, aerial lifts, and cranes.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the forklift rental market based on the below-mentioned segments:

Global Forklift Rental Market, By Ton Capacity

- Below 5 Ton

- 6-30 Ton

- Above 30 Ton

Global Forklift Rental Market, By End Use

- Construction

- Automotive

- Aerospace & Defense

- Warehouse and Logistics

- Others

Global Forklift Rental Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 165 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |