France Accident Insurance Market

France Accident Insurance Market Size, Share, and COVID-19 Impact Analysis, By Type of Accident Insurance (Personal Accident Insurance, Workplace Accident Insurance, Travel Accident Insurance, and Auto Accident Insurance), By Policy Coverage (Accidental Death Coverage, Permanent Disability Coverage, Temporary Disability Coverage, and Critical Illness & Accident Coverage), and France Accident Insurance Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

France Accident Insurance Market Size Insights Forecasts to 2035

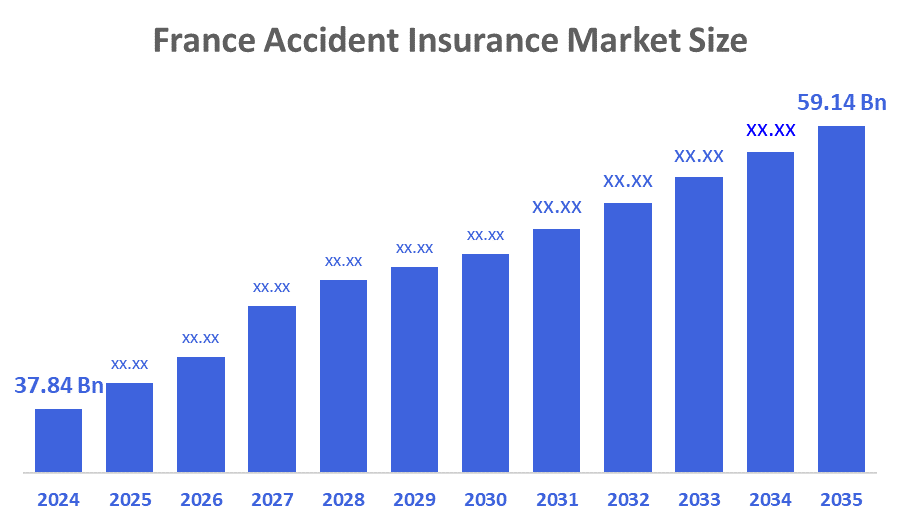

- The Market Size for Accident Insurance was estimated to be worth USD 37.84 Billion in 2024.

- The Market Size is Going to expand at a CAGR of 4.14 % between 2025 and 2035.

- The France Accident Insurance Market Size is anticipated to Reach USD 59.14 Billion by 2035.

According to a Research Report Published by Decisions Advisors & Consulting, The France Accident Insurance Market Size is anticipated to Hold USD 59.14 Billion by 2035, Growing at a CAGR of 4.14 % from 2025 to 2035. The France accident insurance market has strong future opportunities driven by rising disposable incomes, increasing employer-provided benefit packages, growing demand for personalized policies, digital claims processing, and enhanced risk awareness.

Market Overview

The France accident insurance market is witnessing steady growth as individuals and employers increasingly prioritize financial protection against unforeseen injuries and medical emergencies. Rising awareness about the limitations of basic public coverage is encouraging more people to adopt supplementary private accident insurance. Employers are also expanding workplace benefit packages to include accident protection, supporting broader market adoption. Digitalization is transforming the sector, with online policy purchases, faster claim processing, and AI-enabled risk assessment improving customer experience. Growing participation in sports, outdoor activities, and daily mobility further drives demand for comprehensive and flexible accident insurance solutions. Overall, the market is evolving toward more personalized, technology-enabled, and customer-centric offerings.

Report Coverage

This research report categorizes the market for the France accident insurance market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France accident insurance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France accident insurance market.

Driving Factors

Key driving factors for the France accident insurance market include rising public awareness about financial protection against unexpected injuries, medical costs, and income loss. Growing participation in sports, outdoor activities, and increased daily mobility has heightened the need for accident coverage. Employers are also expanding employee benefit packages, boosting group accident policy adoption. Additionally, gaps in public health coverage encourage individuals to choose supplementary private insurance. The rapid digitalization of insurance services, including online policy issuance and faster claim processing, further accelerates market growth.

Restraining Factors

The France accident insurance market faces restraints such as limited consumer awareness about policy benefits, perceived complexity in terms and coverage, and overlap with existing public health protections. High premiums for comprehensive plans and lengthy claim procedures can also discourage wider adoption.

Market Segmentation

The France accident insurance market share is classified into type of accident insurance and policy coverage.

- The personal accident insurance segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France accident insurance market is segmented by type of accident insurance into personal accident insurance, workplace accident insurance, travel accident insurance, and auto accident insurance. Among these, the Personal accident insurance segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This segment leads due to rising consumer awareness of financial protection against unexpected injuries, increasing participation in sports and outdoor activities, and the need for coverage beyond what public healthcare offers. Its flexibility, wide coverage options, and suitability for individuals and families make it the most widely adopted category, driving continued growth.

- The accidental death coverage segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France accident insurance market is segmented by policy coverage into accidental death coverage, permanent disability coverage, temporary disability coverage, and critical illness & accident coverage. Among these, the accidental death coverage segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This segment remains dominant because it provides essential financial protection for families in the event of fatal accidents, making it a widely chosen base component of most accident insurance policies. Its affordability, straightforward coverage structure, and inclusion in many employer-provided benefit packages further strengthen its uptake. Rising awareness of long-term financial security among individuals continues to support its strong growth outlook.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France accident insurance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Allianz France

- Generali France

- AXA

- Covea

- Credit Agricole

- Groupama-Gan

- Crédit Mutuel

- Mutuelle d'Assurances des Artisans de France (MAAF)

- La Maif

- Mutuelle Verte

- CNP Assurances

- Mutualité Française

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at France, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the France accident insurance market based on the following segments:

France Accident Insurance Market, By Type of Accident Insurance

- Personal Accident Insurance

- Workplace Accident Insurance

- Travel Accident Insurance

- Auto Accident Insurance

France Accident Insurance Market, By Policy Coverage

- Accidental Death Coverage

- Permanent Disability Coverage

- Temporary Disability Coverage

- Critical Illness & Accident Coverage

FAQ’s

Q: What is the France accident insurance market size?

A: France accident insurance market size is expected to grow from USD 37.84 Billion in 2024 to USD 59.14 Billion by 2035, growing at a CAGR of 4.14 % during the forecast period 2025-2035.

Q: What are the key growth drivers of the market?

A: Key driving factors for the France accident insurance market include rising public awareness about financial protection against unexpected injuries, medical costs, and income loss.

Q: What factors restrain the France accident insurance market?

A: High premiums for comprehensive plans and lengthy claim procedures can also discourage wider adoption.

Q: How is the market segmented by Type of accident insurance?

A: The market is segmented into personal accident insurance, workplace accident insurance, travel accident insurance, and auto accident insurance.

Q: Who are the key players in the France accident insurance market?

A: Key companies include 3M, BIC, Hamelin, Newell Brands, Crayola, Pentel Co. Ltd. (Pentel Stationery (France) Pvt Ltd), Faber-Castell, ACCO Brands, Staples, Inc., Kokuyo Co., Ltd.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 264 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Nov 2025 |

| Access | Download from this page |