France Advertising Market

France Advertising Market Size, Share, and COVID-19 Impact Analysis, By Platform (Traditional Advertising and Digital Advertising), By Medium (Television, Radio, Print (Newspapers & Magazines), Outdoor/Out-of-Home (OOH), Cinema, Social Media, Search Advertising, Display Advertising, Mobile Advertising, and Video Advertising), and France Advertising Market Insights, Industry Trend, Forecasts to 2035.

Report Overview

Table of Contents

France Advertising Market Insights Forecasts to 2035

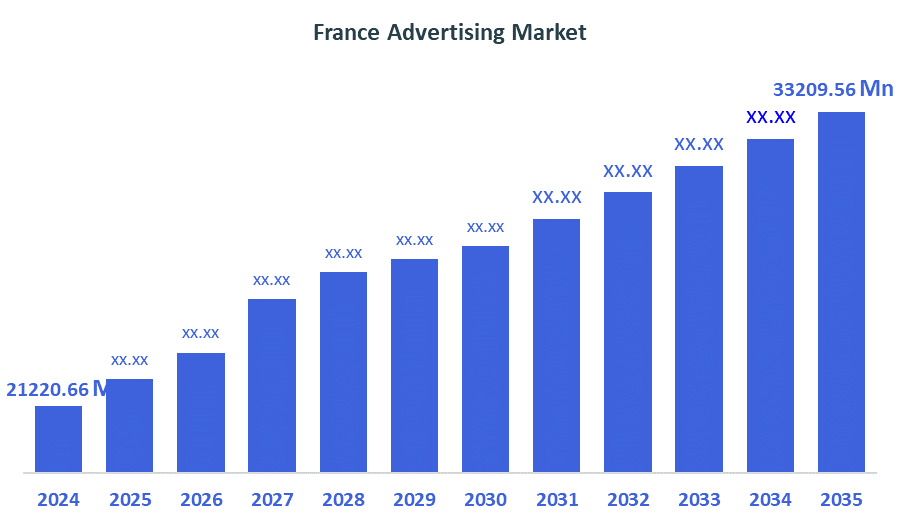

- The France Advertising Market Size was estimated at USD 21220.66 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.16% from 2025 to 2035

- The France Advertising Market Size is Expected to Reach USD 33209.56 Million by 2035

According to a Research Report Published by Decision Advisiors & Consulting, The France Advertising Market Size is anticipated to reach USD 33209.56 Million by 2035, Growing at a CAGR of 4.16% from 2025 to 2035. As digital platforms rise in popularity alongside traditional media, the market is undergoing dynamic changes. Advertisers are using multi-channel strategies and data-driven insights to better reach a variety of audiences. While digital tools like social media and programmatic advertising are driving change and growth, TV, print, and outdoor advertisements still serve a purpose.

Market Overview

The advertisement market in France represents all forms of promotional and communication activity that are conducted in France, using a variety of media to influence consumer responses, develop brand recognition, and generate revenue for businesses. The development and implementation of advertisement campaigns is conducted by media companies, agencies, or technology suppliers, covering a variety of business sectors including retail, automotive, luxury goods, healthcare, and technology, among others. Additionally, the first set of guidelines for the creation of AI systems in accordance with the GDPR was released by France's data protection authority, the CNIL. From defining system purpose and legal responsibility to restricting data collection and carrying out impact assessments, these guidelines outline seven crucial steps. The suggestions address the difficulties presented by generative AI and behavioral targeting models and are intended to assist technologists and advertisers in navigating AI responsibly. Transparency and user rights are prioritized; people must be made aware if their data is being used for AI training, and they must have the ability to exercise their rights to access, rectification, and deletion. These actions promote the creation of moral and privacy-conscious advertising tools by bringing digital creativity into compliance with legal requirements. Following these guidelines is now essential, particularly in areas like programmatic advertising and content creation, as AI-driven personalization becomes commonplace in campaign strategies. In the end, a larger trend toward accountability in digital campaigns is reflected in this shift toward audited AI use.

Report Coverage

This research report categorizes the market for the France advertising market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France advertising market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France advertising market.

Driving Factors

The slowdown in growth for French online advertising comes at a time when advertisers became increasingly cautious with respect to the allocation of their advertising budgets due to a volatile, uncertain economic climate. Digital media, although still growing at a faster rate than traditional media, experienced decreases in their growth rates when compared to previous year's growth in this area. Search advertising remains the leading type of digital advertising for advertisers today because advertisers place the highest priority on being able to measure and hold accountable for their advertising strategies. Increasingly, social media and display advertisements are feeling the pressure and must now compete with each other to justify their expense through returns on investment. The slowdown in growth for French online advertising comes at a time when advertisers became increasingly cautious with respect to the allocation of their advertising budgets due to a volatile, uncertain economic climate. Digital media, although still growing at a faster rate than traditional media, experienced decreases in their growth rates when compared to previous year's growth in this area. Search advertising remains the leading type of digital advertising for advertisers today because advertisers place the highest priority on being able to measure and hold accountable for their advertising strategies. Increasingly, social media and display advertisements are feeling the pressure and must now compete with each other to justify their expense through returns on investment.

Restraining Factors

The decline in traditional media consumption as audiences move more and more toward digital platforms, which lowers the efficacy of television, print, and radio campaigns, is one of the key factors limiting the French advertising market. Digital ad reach is limited by growing ad-block usage and consumer annoyance with repetitive or intrusive formats, and strict regulations like GDPR impose strict compliance requirements that increase advertisers' operating costs.

Market Segmentation

The France advertising market share is classified into platform and medium.

- The digital advertising segment dominated the market in 2024, approximately 65% and is projected to grow at a substantial CAGR during the forecast period.

The France advertising market is segmented by platform into traditional advertising and digital advertising. Among these, the digital advertising segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period. Growing internet connectivity and smartphone penetration make online channels more accessible to consumers. By making highly targeted and quantifiable campaigns possible, developments in influencer marketing, social media integration, and programmatic advertising are also increasing adoption. The transition from traditional media to digital platforms is also being accelerated by the growing popularity of video and mobile-based formats as well as regulatory support for open and sustainable advertising practices.

- The social media segment dominated the market in 2024, approximately 22% and is projected to grow at a substantial CAGR during the forecast period.

The France advertising market is segmented by medium into television, radio, print (newspapers & magazines), outdoor/out-of-Home (OOH), cinema, social media, search advertising, display advertising, mobile advertising, and video advertising. Among these, the social media segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth due to the quick uptake of social media sites like Facebook, Instagram, TikTok, and LinkedIn, which are now essential for customer interaction and brand awareness. Influencer marketing and interactive ad formats boost conversion rates and brand loyalty, while growing smartphone penetration and internet access have increased user bases. Additionally, advertisers can deliver tailored campaigns with quantifiable results thanks to sophisticated targeting tools, AI-driven analytics, and integration with e-commerce platforms.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France advertising market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Publicis Groupe SA

- JCDecaux SA

- Ipsos SA

- Criteo SA

- Artefact SA

- Havas Group

- Others

Recent Developments:

- In July 2025, Publicis Groupe, a leading French advertising firm, raised its growth outlook as it addressed the rising influence of AI in the marketing sector. Despite new AI tools from tech giants like Meta, Publicis remained confident in its proprietary platform and client-centric approach. The company emphasized that brands preferred transparent, multi-platform strategies over closed ecosystems. By leveraging its own AI capabilities and strengthening global partnerships, Publicis aimed to maintain its leadership in France’s evolving advertising landscape.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at France, regional, and country levels from 2020 to 2035. Decision Advisiors has segmented the France Advertising Market based on the below-mentioned segments:

France Advertising Market, By Platform

- Traditional Advertising

- Digital Advertising

France Advertising Market, By Medium

- Television

- Radio

- Print (Newspapers & Magazines)

- Outdoor/Out-of-Home (OOH)

- Cinema

- Social Media

- Search Advertising

- Display Advertising

- Mobile Advertising

- Video Advertising

FAQ’s

Q: What is the France advertising market size?

A: France Advertising Market is expected to grow from USD 21220.66 million in 2024 to USD 33209.56 million by 2035, growing at a CAGR of 4.16% during the forecast period 2025-2035

Q: What are the key growth drivers of the market?

A: Digital transformation, growing e-commerce, mobile penetration, programmatic advertising, regulatory support, and the growing need for open, sustainable, and customer-focused communication strategies are the main factors propelling the French advertising market's expansion.

Q: What factors restrain the France advertising market?

A: Declining traditional media consumption, growing ad-block usage, strict regulatory frameworks, data privacy concerns, and growing competition from international digital platforms that affect local market share are all factors limiting the French advertising market.

Q: Who are the key players in the France advertising market?

A: Publicis Groupe SA, JCDecaux SA, Ipsos SA, Criteo SA, Artefact SA, Havas Group, Others.

Q: Who are the target audiences for this market report?

A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs)

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 170 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Dec 2025 |

| Access | Download from this page |